Answered step by step

Verified Expert Solution

Question

1 Approved Answer

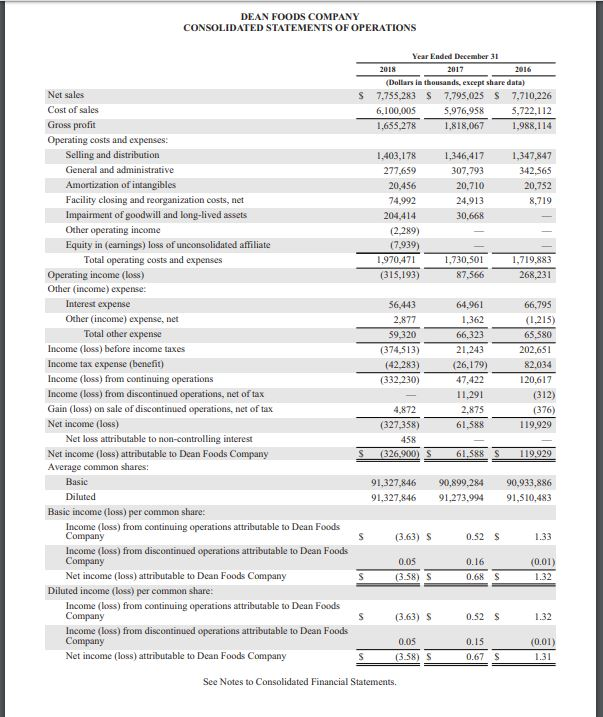

only for a year. we can do 2018 or 2017. can find annual report on google for dean foods company. DEAN FOODS COMPANY CONSOLIDATED STATEMENTS

only for a year. we can do 2018 or 2017. can find annual report on google for dean foods company.

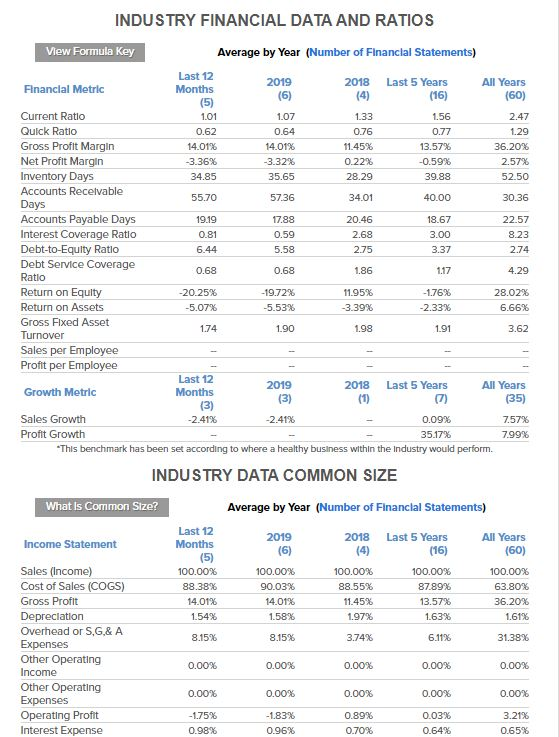

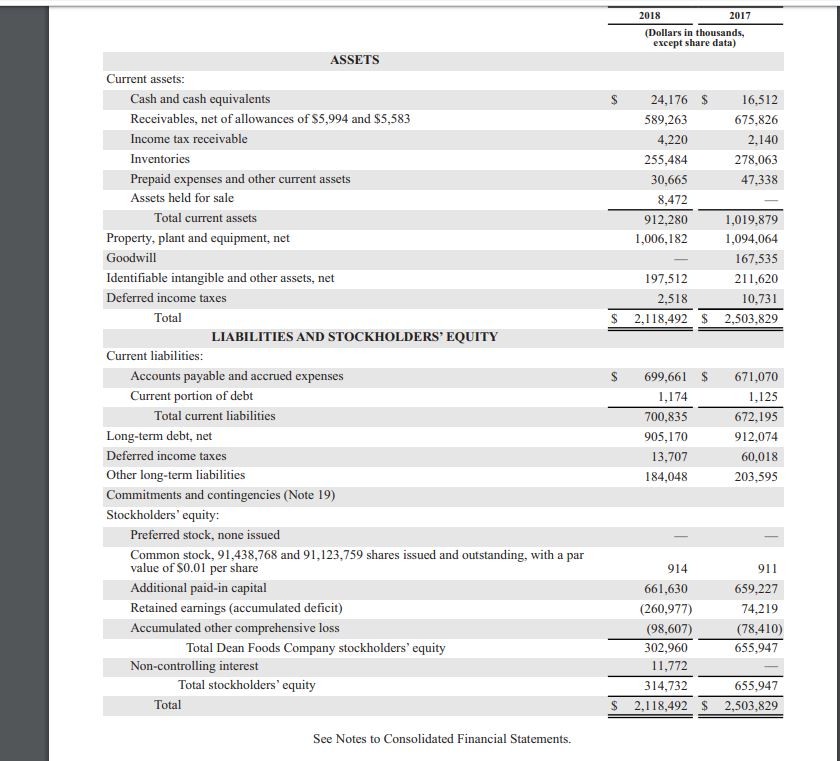

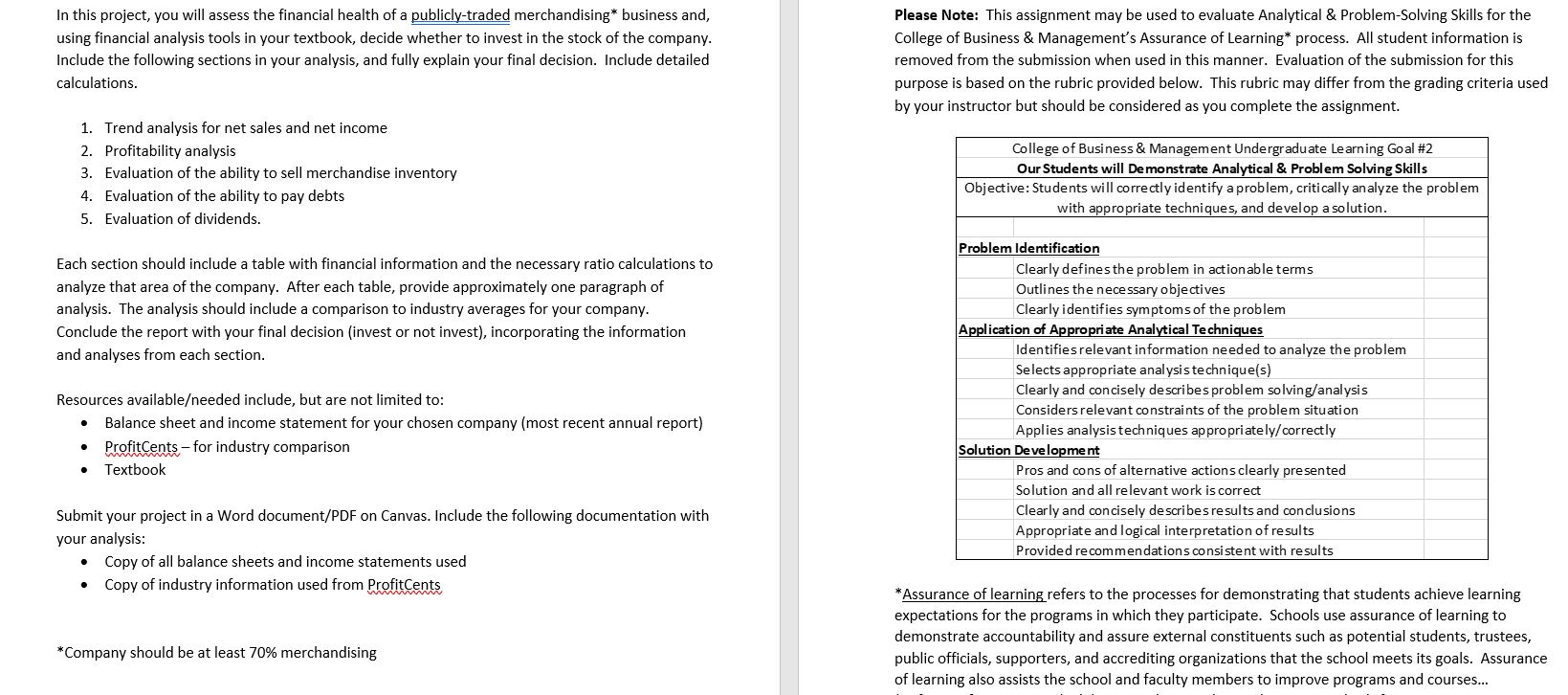

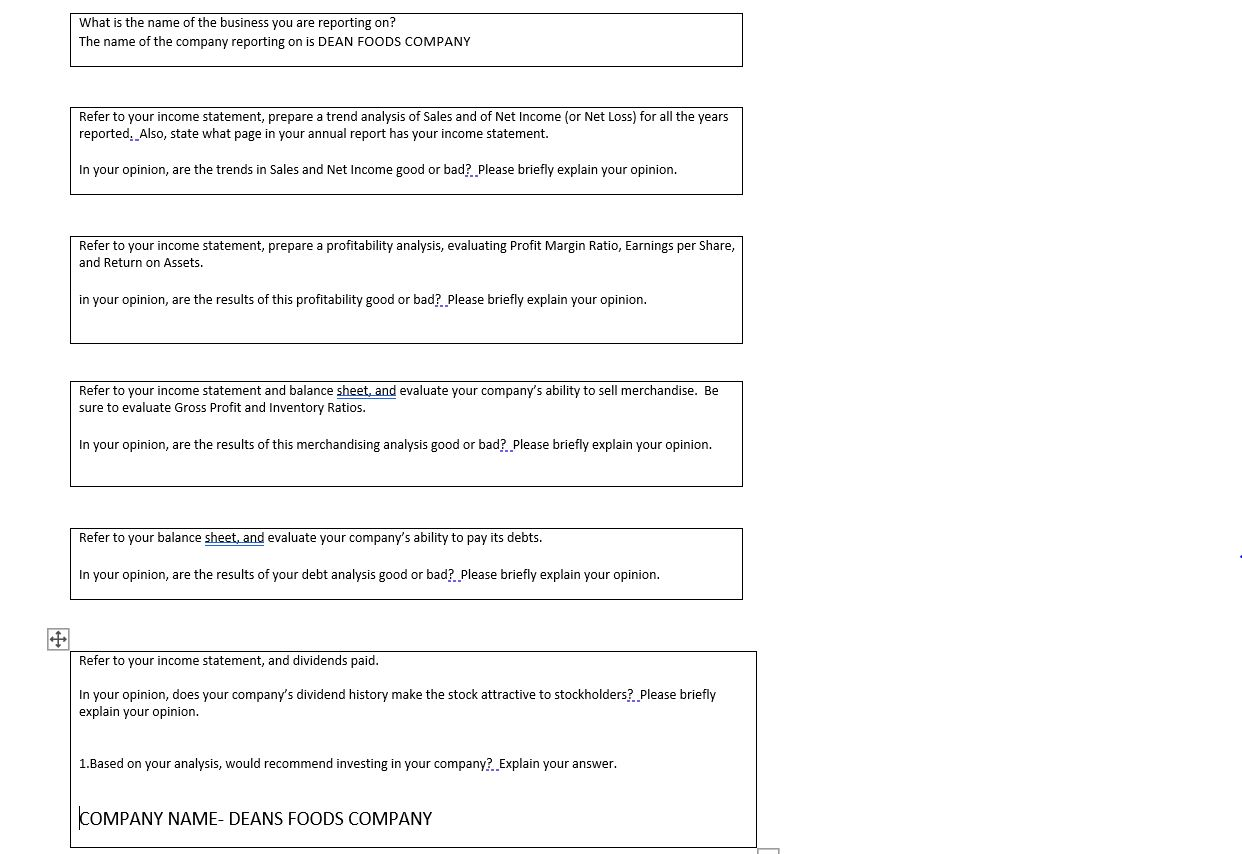

DEAN FOODS COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31 2018 2017 2016 (Dollars in thousands, except share data) 7,755,283 $ 7,795,025 $ 7,710,226 6,100,005 5,976,958 5,722,112 1.635,278 1.818,067 1,988,114 1 1.403,178 277,659 20,456 74,992 204,414 (2.289) (7,939) 1.970,471 (315,193) 1,346,417 307,793 20,710 24.913 30.668 ,347,847 342,565 20,752 8,719 1,730,501 87,566 1,719,883 268,231 Net sales Cost of sales Gross profit Operating costs and expenses Selling and distribution General and administrative Amortization of intangibles Facility closing and reorganization costs, net Impairment of goodwill and long-lived assets Other operating income Equity in (earnings) loss of unconsolidated affiliate Total operating costs and expenses Operating income (loss) Other (income) expense: Interest expense Other (income) expense, Det Total other expense Income (loss) before income taxes Income tax expense (benefit) Income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Gain (loss) on sale of discontinued operations, net of tax Net income (loss) Net loss attributable to non-controlling interest Net income (loss) attributable to Dean Foods Company Average common shares: Basic Diluted Basic income (loss) per common share: Income (loss) from continuing operations attributable to Dean Foods Company Income (loss) from discontinued operations attributable to Dean Foods Company Net income (loss) attributable to Dean Foods Company Diluted income (loss) per common share: Income (loss) from continuing operations attributable to Dean Foods Company Income (loss) from discontinued operations attributable to Dean Foods Company Net income (loss) attributable to Dean Foods Company 56,443 2,877 59,320 (374,513) (42.283) (332,230) 64,961 1,362 66,323 21.243 (26.179) 47.422 11.291 2.875 61,588 66,795 (1.215) 65.580 202,651 82.034 120.617 (312) (376) 119.929 4,872 (327,358) 458 (326,900) S S 61.588 S 119.929 91,327,846 91,327,846 90,899,284 91,273.994 90,933,886 9 1,510,483 S (3.63) S 0.52 S 1.33 0.05 (3.58) S 0.16 0.68 $ (0.01) 1.32 S S (3.63) S 0.52 S 1.32 0.05 (3.58) S 0.15 0.67 (0.01 1.31 S $ See Notes to Consolidated Financial Statements. INDUSTRY FINANCIAL DATA AND RATIOS View Formula Key Average by Year (Number of Financial Statements) (4) 1.01 Last 12 2018 2019 Last 5 Years All Years Financial Metric Months (6) (16) (60) (5) Current Ratio 1.07 1.33 1.56 2.47 Quick Ratio 0.62 0.64 0.76 0.77 1.29 Gross Profit Margin 14.01% 14.01% 11.45% 13.57% 36.20% Net Profit Margin -3.36% -3.32% 0.22% -0.59% 2.57% Inventory Days 34.85 35.65 28.29 39.88 52.50 Accounts Receivable 55.70 57.36 34.01 40.00 30.36 Days Accounts Payable Days 19.19 17.88 20.46 18.67 22.57 Interest Coverage Ratio 0.81 0.59 2.68 3.00 8.23 Debt-to-Equity Ratio 6.44 5.58 2.75 3.37 2.74 Debt Service Coverage 0.68 0.68 1.86 1.17 4.29 Ratio Return on Equity -20.25% -19.72% 11.95% -1.76% 28.02% Return on Assets -5.07% -5.53% -3.39% -2.33% 6.66% Gross Fixed Asset 1.74 1.90 1.98 1.91 Turnover Sales per Employee Profit per Employee Last 12 2019 2040 5 Years All Years Growth Metric Months (3) (35) (3) Sales Growth -2.41% -2.41% 0.09% 7.57% Profit Growth 35.17% 7.99% *This benchmark has been set according to where a healthy business within the industry would perform INDUSTRY DATA COMMON SIZE What Is Common Size? Average by Year (Number of Financial Statements) 2018 Income Statement 2019 (6) Last 5 Years (16) (4) Last 12 Months (5) 100.00% 88.38% 14.01% 1.54% 100.00% 90.03% 14.01% 1.58% 100.00% 88.55% 11.45% 1.97% 100.00% 87.89% 13.57% 1.63% All Years (60) 100.00% 63.80% 36.20% 1.61% 8.15% 8.15% 3.74% 6.11% 31.38% Sales (Income) Cost of Sales (COGS) Gross Profit Depreciation Overhead or S.G.& A Expenses Other Operating Income Other Operating Expenses Operating Profit Interest Expense 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% -1.75% 0.98% -1.83% 0.96% 0.00% 0.89% 0.70% 0.00% 0.03% 0.64% 0.00% 3.21% 0.65% 2018 2017 (Dollars in thousands, except share data) $ $ 24,176 589,263 4,220 255,484 30,665 8,472 912,280 1,006,182 16,512 675,826 2.140 278,063 47,338 1,019,879 1,094,064 167,535 211,620 10,731 2,503,829 197,512 2,518 2,118,492 $ $ ASSETS Current assets: Cash and cash equivalents Receivables, net of allowances of $5,994 and $5,583 Income tax receivable Inventories Prepaid expenses and other current assets Assets held for sale Total current assets Property, plant and equipment, net Goodwill Identifiable intangible and other assets, net Deferred income taxes Total LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and accrued expenses Current portion of debt Total current liabilities Long-term debt, net Deferred income taxes Other long-term liabilities Commitments and contingencies (Note 19) Stockholders' equity: Preferred stock, none issued Common stock, 91,438,768 and 91,123,759 shares issued and outstanding, with a par value of $0.01 per share Additional paid-in capital Retained earnings (accumulated deficit) Accumulated other comprehensive loss Total Dean Foods Company stockholders' equity Non-controlling interest Total stockholders' equity Total $ 699,661 $ 1,174 700,835 905,170 13,707 184,048 671,070 1,125 672,195 912,074 60,018 203,595 914 661,630 (260,977) (98,607) 302,960 11,772 314,732 2.118,492 $ 911 659,227 74,219 (78,410) 655,947 655,947 2,503,829 $ See Notes to Consolidated Financial Statements. In this project, you will assess the financial health of a publicly-traded merchandising* business and, using financial analysis tools in your textbook, decide whether to invest in the stock of the company. Include the following sections in your analysis, and fully explain your final decision. Include detailed calculations. Please Note: This assignment may be used to evaluate Analytical & Problem Solving Skills for the College of Business & Management's Assurance of Learning process. All student information is removed from the submission when used in this manner. Evaluation of the submission for this purpose is based on the rubric provided below. This rubric may differ from the grading criteria used by your instructor but should be considered as you complete the assignment. 1. Trend analysis for net sales and net income 2. Profitability analysis 3. Evaluation of the ability to sell merchandise inventory 4. Evaluation of the ability to pay debts 5. Evaluation of dividends. College of Business & Management Undergraduate Learning Goal #2 Our Students will Demonstrate Analytical & Problem Solving skills Objective: Students will correctly identify a problem, critically analyze the problem with appropriate techniques, and develop a solution. Each section should include a table with financial information and the necessary ratio calculations to analyze that area of the company. After each table, provide approximately one paragraph of analysis. The analysis should include a comparison to industry averages for your company. Conclude the report with your final decision (invest or not invest), incorporating the information and analyses from each section. Resources availableeeded include, but are not limited to: Balance sheet and income statement for your chosen company (most recent annual report) ProfitCents - for industry comparison Textbook Problem Identification Clearly defines the problem in action able terms Outlines the necessary objectives Clearly identifies symptoms of the problem Application of Appropriate Analytical Techniques Identifies relevant information needed to analyze the problem Selects appropriate analysis technique(s) Clearly and concisely describes problem solving/analysis Considers relevant constraints of the problem situation Applies analysis techniques appropriately/correctly Solution Development Pros and cons of alternative actions clearly presented Solution and all relevant work is correct Clearly and concisely describes results and conclusions Appropriate and logical interpretation of results Provided recommendations consistent with results Submit your project in a Word document/PDF on Canvas. Include the following documentation with your analysis: Copy of all balance sheets and income statements used Copy of industry information used from ProfitCents *Assurance of learning refers to the processes for demonstrating that students achieve learning expectations for the programs in which they participate. Schools use assurance of learning to demonstrate accountability and assure external constituents such as potential students, trustees, public officials, supporters, and accrediting organizations that the school meets its goals. Assurance of learning also assists the school and faculty members to improve programs and courses... *Company should be at least 70% merchandising What is the name of the business you are reporting on? The name of the company reporting on is DEAN FOODS COMPANY Refer to your income statement, prepare a trend analysis of Sales and of Net Income (or Net Loss) for all the years reported. Also, state what page in your annual report has your income statement. In your opinion, are the trends in Sales and Net Income good or bad? Please briefly explain your opinion. Refer to your income statement, prepare a profitability analysis, evaluating Profit Margin Ratio, Earnings per Share, and Return on Assets. in your opinion, are the results of this profitability good or bad? Please briefly explain your opinion. Refer to your income statement and balance sheet, and evaluate your company's ability to sell merchandise. Be sure to evaluate Gross Profit and Inventory Ratios. In your opinion, are the results of this merchandising analysis good or bad? Please briefly explain your opinion. Refer to your balance sheet, and evaluate your company's ability to pay its debts. In your opinion, are the results of your debt analysis good or bad? Please briefly explain your opinion. Refer to your income statement, and dividends paid. In your opinion, does your company's dividend history make the stock attractive to stockholders? Please briefly explain your opinion. 1.Based on your analysis, would recommend investing in your company? Explain your answer. COMPANY NAME-DEANS FOODS COMPANY DEAN FOODS COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended December 31 2018 2017 2016 (Dollars in thousands, except share data) 7,755,283 $ 7,795,025 $ 7,710,226 6,100,005 5,976,958 5,722,112 1.635,278 1.818,067 1,988,114 1 1.403,178 277,659 20,456 74,992 204,414 (2.289) (7,939) 1.970,471 (315,193) 1,346,417 307,793 20,710 24.913 30.668 ,347,847 342,565 20,752 8,719 1,730,501 87,566 1,719,883 268,231 Net sales Cost of sales Gross profit Operating costs and expenses Selling and distribution General and administrative Amortization of intangibles Facility closing and reorganization costs, net Impairment of goodwill and long-lived assets Other operating income Equity in (earnings) loss of unconsolidated affiliate Total operating costs and expenses Operating income (loss) Other (income) expense: Interest expense Other (income) expense, Det Total other expense Income (loss) before income taxes Income tax expense (benefit) Income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Gain (loss) on sale of discontinued operations, net of tax Net income (loss) Net loss attributable to non-controlling interest Net income (loss) attributable to Dean Foods Company Average common shares: Basic Diluted Basic income (loss) per common share: Income (loss) from continuing operations attributable to Dean Foods Company Income (loss) from discontinued operations attributable to Dean Foods Company Net income (loss) attributable to Dean Foods Company Diluted income (loss) per common share: Income (loss) from continuing operations attributable to Dean Foods Company Income (loss) from discontinued operations attributable to Dean Foods Company Net income (loss) attributable to Dean Foods Company 56,443 2,877 59,320 (374,513) (42.283) (332,230) 64,961 1,362 66,323 21.243 (26.179) 47.422 11.291 2.875 61,588 66,795 (1.215) 65.580 202,651 82.034 120.617 (312) (376) 119.929 4,872 (327,358) 458 (326,900) S S 61.588 S 119.929 91,327,846 91,327,846 90,899,284 91,273.994 90,933,886 9 1,510,483 S (3.63) S 0.52 S 1.33 0.05 (3.58) S 0.16 0.68 $ (0.01) 1.32 S S (3.63) S 0.52 S 1.32 0.05 (3.58) S 0.15 0.67 (0.01 1.31 S $ See Notes to Consolidated Financial Statements. INDUSTRY FINANCIAL DATA AND RATIOS View Formula Key Average by Year (Number of Financial Statements) (4) 1.01 Last 12 2018 2019 Last 5 Years All Years Financial Metric Months (6) (16) (60) (5) Current Ratio 1.07 1.33 1.56 2.47 Quick Ratio 0.62 0.64 0.76 0.77 1.29 Gross Profit Margin 14.01% 14.01% 11.45% 13.57% 36.20% Net Profit Margin -3.36% -3.32% 0.22% -0.59% 2.57% Inventory Days 34.85 35.65 28.29 39.88 52.50 Accounts Receivable 55.70 57.36 34.01 40.00 30.36 Days Accounts Payable Days 19.19 17.88 20.46 18.67 22.57 Interest Coverage Ratio 0.81 0.59 2.68 3.00 8.23 Debt-to-Equity Ratio 6.44 5.58 2.75 3.37 2.74 Debt Service Coverage 0.68 0.68 1.86 1.17 4.29 Ratio Return on Equity -20.25% -19.72% 11.95% -1.76% 28.02% Return on Assets -5.07% -5.53% -3.39% -2.33% 6.66% Gross Fixed Asset 1.74 1.90 1.98 1.91 Turnover Sales per Employee Profit per Employee Last 12 2019 2040 5 Years All Years Growth Metric Months (3) (35) (3) Sales Growth -2.41% -2.41% 0.09% 7.57% Profit Growth 35.17% 7.99% *This benchmark has been set according to where a healthy business within the industry would perform INDUSTRY DATA COMMON SIZE What Is Common Size? Average by Year (Number of Financial Statements) 2018 Income Statement 2019 (6) Last 5 Years (16) (4) Last 12 Months (5) 100.00% 88.38% 14.01% 1.54% 100.00% 90.03% 14.01% 1.58% 100.00% 88.55% 11.45% 1.97% 100.00% 87.89% 13.57% 1.63% All Years (60) 100.00% 63.80% 36.20% 1.61% 8.15% 8.15% 3.74% 6.11% 31.38% Sales (Income) Cost of Sales (COGS) Gross Profit Depreciation Overhead or S.G.& A Expenses Other Operating Income Other Operating Expenses Operating Profit Interest Expense 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% -1.75% 0.98% -1.83% 0.96% 0.00% 0.89% 0.70% 0.00% 0.03% 0.64% 0.00% 3.21% 0.65% 2018 2017 (Dollars in thousands, except share data) $ $ 24,176 589,263 4,220 255,484 30,665 8,472 912,280 1,006,182 16,512 675,826 2.140 278,063 47,338 1,019,879 1,094,064 167,535 211,620 10,731 2,503,829 197,512 2,518 2,118,492 $ $ ASSETS Current assets: Cash and cash equivalents Receivables, net of allowances of $5,994 and $5,583 Income tax receivable Inventories Prepaid expenses and other current assets Assets held for sale Total current assets Property, plant and equipment, net Goodwill Identifiable intangible and other assets, net Deferred income taxes Total LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and accrued expenses Current portion of debt Total current liabilities Long-term debt, net Deferred income taxes Other long-term liabilities Commitments and contingencies (Note 19) Stockholders' equity: Preferred stock, none issued Common stock, 91,438,768 and 91,123,759 shares issued and outstanding, with a par value of $0.01 per share Additional paid-in capital Retained earnings (accumulated deficit) Accumulated other comprehensive loss Total Dean Foods Company stockholders' equity Non-controlling interest Total stockholders' equity Total $ 699,661 $ 1,174 700,835 905,170 13,707 184,048 671,070 1,125 672,195 912,074 60,018 203,595 914 661,630 (260,977) (98,607) 302,960 11,772 314,732 2.118,492 $ 911 659,227 74,219 (78,410) 655,947 655,947 2,503,829 $ See Notes to Consolidated Financial Statements. In this project, you will assess the financial health of a publicly-traded merchandising* business and, using financial analysis tools in your textbook, decide whether to invest in the stock of the company. Include the following sections in your analysis, and fully explain your final decision. Include detailed calculations. Please Note: This assignment may be used to evaluate Analytical & Problem Solving Skills for the College of Business & Management's Assurance of Learning process. All student information is removed from the submission when used in this manner. Evaluation of the submission for this purpose is based on the rubric provided below. This rubric may differ from the grading criteria used by your instructor but should be considered as you complete the assignment. 1. Trend analysis for net sales and net income 2. Profitability analysis 3. Evaluation of the ability to sell merchandise inventory 4. Evaluation of the ability to pay debts 5. Evaluation of dividends. College of Business & Management Undergraduate Learning Goal #2 Our Students will Demonstrate Analytical & Problem Solving skills Objective: Students will correctly identify a problem, critically analyze the problem with appropriate techniques, and develop a solution. Each section should include a table with financial information and the necessary ratio calculations to analyze that area of the company. After each table, provide approximately one paragraph of analysis. The analysis should include a comparison to industry averages for your company. Conclude the report with your final decision (invest or not invest), incorporating the information and analyses from each section. Resources availableeeded include, but are not limited to: Balance sheet and income statement for your chosen company (most recent annual report) ProfitCents - for industry comparison Textbook Problem Identification Clearly defines the problem in action able terms Outlines the necessary objectives Clearly identifies symptoms of the problem Application of Appropriate Analytical Techniques Identifies relevant information needed to analyze the problem Selects appropriate analysis technique(s) Clearly and concisely describes problem solving/analysis Considers relevant constraints of the problem situation Applies analysis techniques appropriately/correctly Solution Development Pros and cons of alternative actions clearly presented Solution and all relevant work is correct Clearly and concisely describes results and conclusions Appropriate and logical interpretation of results Provided recommendations consistent with results Submit your project in a Word document/PDF on Canvas. Include the following documentation with your analysis: Copy of all balance sheets and income statements used Copy of industry information used from ProfitCents *Assurance of learning refers to the processes for demonstrating that students achieve learning expectations for the programs in which they participate. Schools use assurance of learning to demonstrate accountability and assure external constituents such as potential students, trustees, public officials, supporters, and accrediting organizations that the school meets its goals. Assurance of learning also assists the school and faculty members to improve programs and courses... *Company should be at least 70% merchandising What is the name of the business you are reporting on? The name of the company reporting on is DEAN FOODS COMPANY Refer to your income statement, prepare a trend analysis of Sales and of Net Income (or Net Loss) for all the years reported. Also, state what page in your annual report has your income statement. In your opinion, are the trends in Sales and Net Income good or bad? Please briefly explain your opinion. Refer to your income statement, prepare a profitability analysis, evaluating Profit Margin Ratio, Earnings per Share, and Return on Assets. in your opinion, are the results of this profitability good or bad? Please briefly explain your opinion. Refer to your income statement and balance sheet, and evaluate your company's ability to sell merchandise. Be sure to evaluate Gross Profit and Inventory Ratios. In your opinion, are the results of this merchandising analysis good or bad? Please briefly explain your opinion. Refer to your balance sheet, and evaluate your company's ability to pay its debts. In your opinion, are the results of your debt analysis good or bad? Please briefly explain your opinion. Refer to your income statement, and dividends paid. In your opinion, does your company's dividend history make the stock attractive to stockholders? Please briefly explain your opinion. 1.Based on your analysis, would recommend investing in your company? Explain your answer. COMPANY NAME-DEANS FOODS COMPANYStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started