Answered step by step

Verified Expert Solution

Question

1 Approved Answer

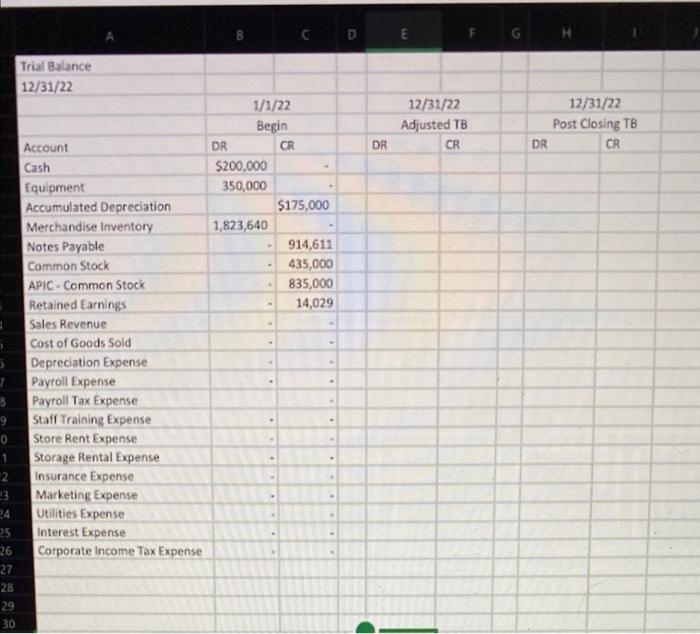

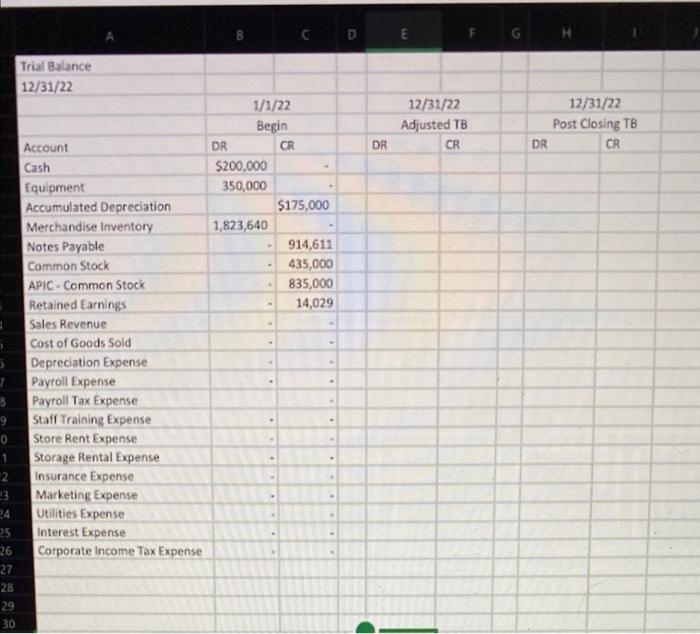

only need adjusted and posted trial balance these are the allocations only need adjusted and posted trial balance, below are the allocations 1 5 5

only need adjusted and posted trial balance

these are the allocations

only need adjusted and posted trial balance, below are the allocations

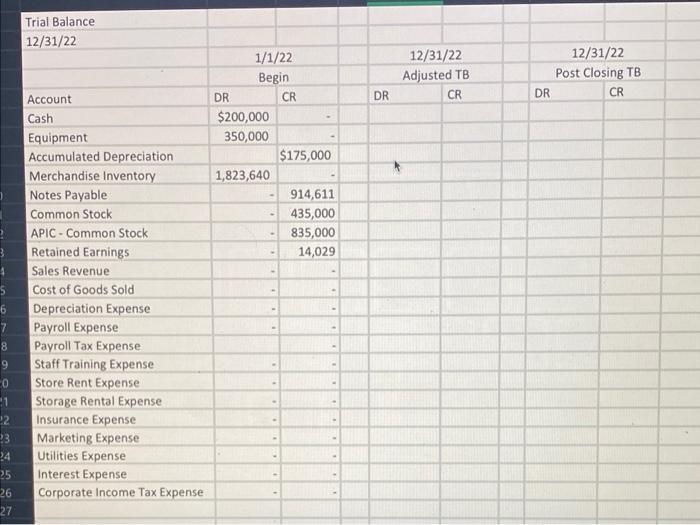

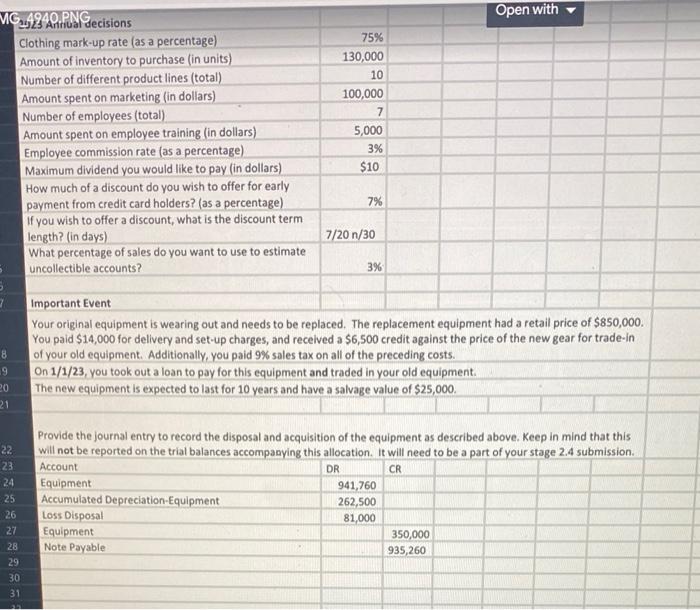

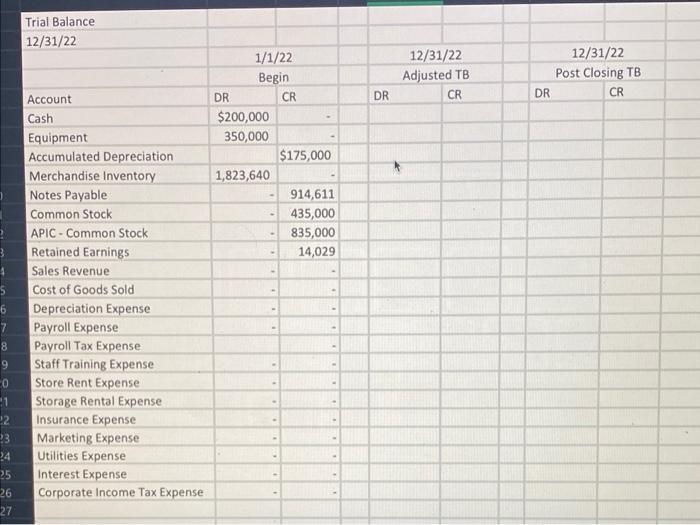

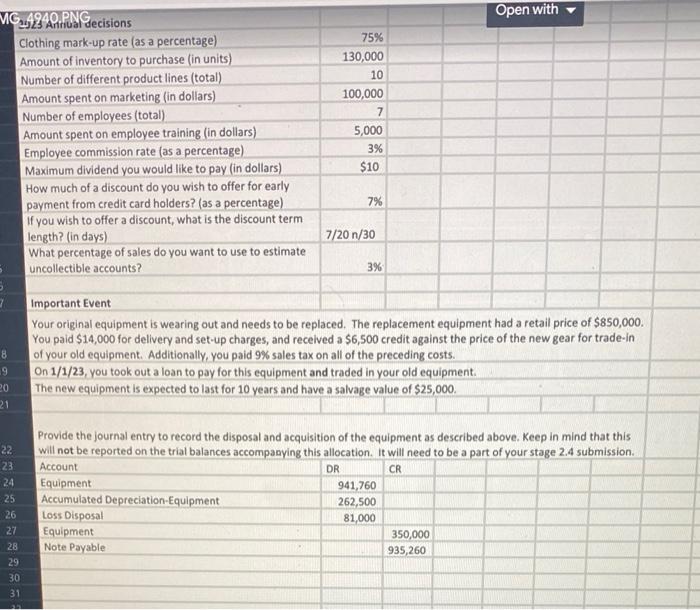

1 5 5 7 8 9 0 1 2 3 24 25 26 27 28 29 30 Trial Balance 12/31/22 Account Cash Equipment Accumulated Depreciation Merchandise Inventory Notes Payable Common Stock APIC-Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Depreciation Expense Payroll Expense Payroll Tax Expense Staff Training Expense Store Rent Expense Storage Rental Expense Insurance Expense Marketing Expense Utilities Expense Interest Expense Corporate Income Tax Expense 1/1/22 Begin DR $200,000 350,000 1,823,640 CR $175,000 914,611 435,000 835,000 14,029 DR E 12/31/22 Adjusted TB CR DR 12/31/22 Post Closing TB CR SI Se 2 Stage 2.4 Allocations 2023 Annual decisions 5 Clothing mark-up rate (as a percentage) 6 7 Amount of inventory to purchase (in units) Number of different product lines (total) Amount spent on marketing (in dollars) Number of employees (total) 9 10 11 12 Amount spent on employee training (in dollars) Employee commission rate (as a percentage) Maximum dividend you would like to pay (in dollars) How much of a discount do you wish to offer for early payment from credit card holders? (as a percentage) If you wish to offer a discount, what is the discount term length? (in days) 13 14 What percentage of sales do you want to use to estimate uncollectible accounts? 3% 15 16 17 Important Event Your original equipment is wearing out and needs to be replaced. The replacement equipment had a retail price of $850,000. You paid $14,000 for delivery and set-up charges, and received a $6,500 credit against the price of the new gear for trade-in of your old equipment. Additionally, you paid 9% sales tax on all of the preceding costs. 18 19 On 1/1/23, you took out a loan to pay for this equipment and traded in your old equipment. 20 The new equipment is expected to last for 10 years and have a salvage value of $25,000. 21 22 Provide the journal entry to record the disposal and acquisition of the equipment as described above. Keep in mind that this will not be reported on the trial balances accompanying this allocation. It will need to be a part of your stage 2.4 submission. Account 23 DR CR 24 Equipment 941,760 25 Accumulated Depreciation-Equipment 262,500 Loss Disposal 81,000 27 Equipment 28 Note Payable 29 30 31 32 33 34 35 36 Open with 75% 130,000 10 100,000 7 5,000 3% $10 7% 4 7/20/30 350,000 935,260 3 4 5 8 9 0 1 22 23 24 25 26 27 Trial Balance 12/31/22 Account Cash Equipment Accumulated Depreciation Merchandise Inventory Notes Payable Common Stock APIC- Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Depreciation Expense Payroll Expense Payroll Tax Expense Staff Training Expense Store Rent Expense Storage Rental Expense Insurance Expense Marketing Expense Utilities Expense Interest Expense Corporate Income Tax Expense 1/1/22 Begin DR $200,000 350,000 1,823,640 CR $175,000 914,611 435,000 835,000 14,029 DR 12/31/22 Adjusted TB CR DR 12/31/22 Post Closing TB CR MG 4240.PNG 2525 Annual decisions 75% 130,000 10 100,000 7 5,000 3% $10 5 5 7 Clothing mark-up rate (as a percentage) Amount of inventory to purchase (in units) Number of different product lines (total) Amount spent on marketing (in dollars) Number of employees (total) Amount spent on employee training (in dollars) Employee commission rate (as a percentage) Maximum dividend you would like to pay (in dollars) How much of a discount do you wish to offer for early payment from credit card holders? (as a percentage) If you wish to offer a discount, what is the discount term length? (in days) What percentage of sales do you want to use to estimate uncollectible accounts? 3% Important Event Your original equipment is wearing out and needs to be replaced. The replacement equipment had a retail price of $850,000. You paid $14,000 for delivery and set-up charges, and received a $6,500 credit against the price of the new gear for trade-in of your old equipment. Additionally, you paid 9% sales tax on all of the preceding costs. 8 9 On 1/1/23, you took out a loan to pay for this equipment and traded in your old equipment. 20 The new equipment is expected to last for 10 years and have a salvage value of $25,000. 21 22 Provide the journal entry to record the disposal and acquisition of the equipment as described above. Keep in mind that this will not be reported on the trial balances accompanying this allocation. It will need to be a part of your stage 2.4 submission. Account 23 DR CR 24 Equipment 941,760 25 Accumulated Depreciation-Equipment 262,500 26 Loss Disposal 81,000 27 Equipment 28 Note Payable 29 30 31 22. 7% 7/20 n/30 350,000 Open with 935,260 1 5 5 7 8 9 0 1 2 3 24 25 26 27 28 29 30 Trial Balance 12/31/22 Account Cash Equipment Accumulated Depreciation Merchandise Inventory Notes Payable Common Stock APIC-Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Depreciation Expense Payroll Expense Payroll Tax Expense Staff Training Expense Store Rent Expense Storage Rental Expense Insurance Expense Marketing Expense Utilities Expense Interest Expense Corporate Income Tax Expense 1/1/22 Begin DR $200,000 350,000 1,823,640 CR $175,000 914,611 435,000 835,000 14,029 DR E 12/31/22 Adjusted TB CR DR 12/31/22 Post Closing TB CR SI Se 2 Stage 2.4 Allocations 2023 Annual decisions 5 Clothing mark-up rate (as a percentage) 6 7 Amount of inventory to purchase (in units) Number of different product lines (total) Amount spent on marketing (in dollars) Number of employees (total) 9 10 11 12 Amount spent on employee training (in dollars) Employee commission rate (as a percentage) Maximum dividend you would like to pay (in dollars) How much of a discount do you wish to offer for early payment from credit card holders? (as a percentage) If you wish to offer a discount, what is the discount term length? (in days) 13 14 What percentage of sales do you want to use to estimate uncollectible accounts? 3% 15 16 17 Important Event Your original equipment is wearing out and needs to be replaced. The replacement equipment had a retail price of $850,000. You paid $14,000 for delivery and set-up charges, and received a $6,500 credit against the price of the new gear for trade-in of your old equipment. Additionally, you paid 9% sales tax on all of the preceding costs. 18 19 On 1/1/23, you took out a loan to pay for this equipment and traded in your old equipment. 20 The new equipment is expected to last for 10 years and have a salvage value of $25,000. 21 22 Provide the journal entry to record the disposal and acquisition of the equipment as described above. Keep in mind that this will not be reported on the trial balances accompanying this allocation. It will need to be a part of your stage 2.4 submission. Account 23 DR CR 24 Equipment 941,760 25 Accumulated Depreciation-Equipment 262,500 Loss Disposal 81,000 27 Equipment 28 Note Payable 29 30 31 32 33 34 35 36 Open with 75% 130,000 10 100,000 7 5,000 3% $10 7% 4 7/20/30 350,000 935,260 3 4 5 8 9 0 1 22 23 24 25 26 27 Trial Balance 12/31/22 Account Cash Equipment Accumulated Depreciation Merchandise Inventory Notes Payable Common Stock APIC- Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Depreciation Expense Payroll Expense Payroll Tax Expense Staff Training Expense Store Rent Expense Storage Rental Expense Insurance Expense Marketing Expense Utilities Expense Interest Expense Corporate Income Tax Expense 1/1/22 Begin DR $200,000 350,000 1,823,640 CR $175,000 914,611 435,000 835,000 14,029 DR 12/31/22 Adjusted TB CR DR 12/31/22 Post Closing TB CR MG 4240.PNG 2525 Annual decisions 75% 130,000 10 100,000 7 5,000 3% $10 5 5 7 Clothing mark-up rate (as a percentage) Amount of inventory to purchase (in units) Number of different product lines (total) Amount spent on marketing (in dollars) Number of employees (total) Amount spent on employee training (in dollars) Employee commission rate (as a percentage) Maximum dividend you would like to pay (in dollars) How much of a discount do you wish to offer for early payment from credit card holders? (as a percentage) If you wish to offer a discount, what is the discount term length? (in days) What percentage of sales do you want to use to estimate uncollectible accounts? 3% Important Event Your original equipment is wearing out and needs to be replaced. The replacement equipment had a retail price of $850,000. You paid $14,000 for delivery and set-up charges, and received a $6,500 credit against the price of the new gear for trade-in of your old equipment. Additionally, you paid 9% sales tax on all of the preceding costs. 8 9 On 1/1/23, you took out a loan to pay for this equipment and traded in your old equipment. 20 The new equipment is expected to last for 10 years and have a salvage value of $25,000. 21 22 Provide the journal entry to record the disposal and acquisition of the equipment as described above. Keep in mind that this will not be reported on the trial balances accompanying this allocation. It will need to be a part of your stage 2.4 submission. Account 23 DR CR 24 Equipment 941,760 25 Accumulated Depreciation-Equipment 262,500 26 Loss Disposal 81,000 27 Equipment 28 Note Payable 29 30 31 22. 7% 7/20 n/30 350,000 Open with 935,260

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started