Question

Only need answer to part C. Here is text. Samuel and Grace Paganelli want to replace their 2008 Ford F-150 pickup, which Samuel drives for

Only need answer to part C.

Only need answer to part C.

Here is text.

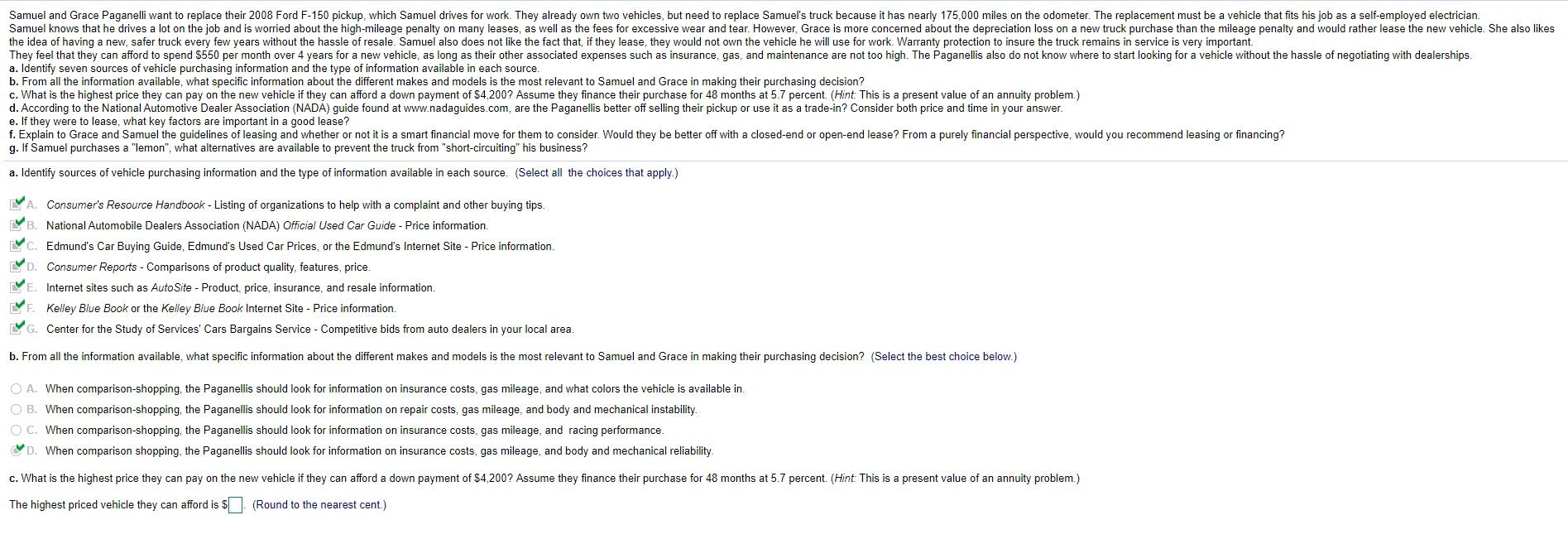

Samuel and Grace Paganelli want to replace their 2008 Ford F-150 pickup, which Samuel drives for work. They already own two vehicles, but need to replace Samuel's truck because it has nearly 175,000 miles on the odometer. The replacement must be a vehicle that fits his job as a self-employed electrician.

Samuel knows that he drives a lot on the job and is worried about the high-mileage penalty on many leases, as well as the fees for excessive wear and tear. However, Grace is more concerned about the depreciation loss on a new truck purchase than the mileage penalty and would rather lease the new vehicle. She also likes the idea of having a new, safer truck every few years without the hassle of resale. Samuel also does not like the fact that, if they lease, they would not own the vehicle he will use for work. Warranty protection to insure the truck remains in service is very important.

They feel that they can afford to spend

$550

per month over

4

years for a new vehicle, as long as their other associated expenses such as insurance, gas, and maintenance are not too high. The Paganellis also do not know where to start looking for a vehicle without the hassle of negotiating with dealerships.

a. Identify seven sources of vehicle purchasing information and the type of information available in each source.

b. From all the information available, what specific information about the different makes and models is the most relevant to Samuel and Grace in making their purchasing decision?

c. What is the highest price they can pay on the new vehicle if they can afford a down payment of

$4,200?

Assume they finance their purchase for

48

months at

5.7

percent.

(Hint:

This is a present value of an annuity problem.)

d. According to the National Automotive Dealer Association (NADA) guide found at www.nadaguides.com, are the Paganellis better off selling their pickup or use it as a trade-in? Consider both price and time in your answer.

e. If they were to lease, what key factors are important in a good lease?

f. Explain to Grace and Samuel the guidelines of leasing and whether or not it is a smart financial move for them to consider. Would they be better off with a closed-end or open-end lease? From a purely financial perspective, would you recommend leasing or financing?

g. If Samuel purchases a "lemon", what alternatives are available to prevent the truck from "short-circuiting" his business?

Samuel and Grace Paganelli want to replace their 2008 Ford F-150 pickup, which Samuel drives for work. They already own two vehicles, but need to replace Samuel's truck because it has nearly 175,000 miles on the odometer. The replacement must be a vehicle that fits his job as a self-employed electrician Samuel knows that he drives a lot on the job and is worried about the high-mileage penalty on many leases, as well as the fees for excessive wear and tear. However, Grace is more concerned about the depreciation loss on a new truck purchase than the mileage penalty and would rather lease the new vehicle. She also likes the idea of having a new, safer truck every few years without the hassle of resale. Samuel also does not like the fact that, if they lease, they would not own the vehicle he will use for work. Warranty protection to insure the truck remains in service is very important They feel that they can afford to spend 550 per month over 4 years for a new vehicle, as long as their other associated expenses such as insurance, gas, and maintenance are not too high. The Paganellis also do not know where to start looking for a vehicle without the hassle of negotiating with dealerships. a. Identify seven sources of vehicle purchasing information and the type of information available in each source. b. From all the information available, what specific information about the different makes and models is the most relevant to Samuel and Grace in making their purchasing decision? c. What is the highest price they can pay on the new vehicle if they can afford a down payment of $4,200? Assume they finance their purchase for 48 months at 5.7 percent. (Hint This is a present value of an annuity problem.) d. According to the National Automotive Dealer Association (NADA) guide found at www.nadaguides.com, are the Paganellis better off selling their pickup or use it as a trade-in? Consider both price and time in your answer. e. If they were to lease, what key factors are important in a good lease? f. Explain to Grace and Samuel the guidelines of leasing and whether or not it is a smart financial move for them to consider. Would they be better off with a closed-end or open-end lease? From a purely financial perspective, would you recommend leasing or financing? g. If Samuel purchases a "lemon", what alternatives are available to prevent the truck from "short-circuiting" his business? a. Identify sources of vehicle purchasing information and the type of information available in each source. (Select all the choices that apply.) A. Consumer's Resource Handbook - Listing of organizations to help with a complaint and other buying tips. B. National Automobile Dealers Association (NADA) Official Used Car Guide - Price information. C. Edmund's Car Buying Guide, Edmund's Used Car Prices, or the Edmund's Internet Site - Price information. LYD. Consumer Reports - Comparisons of product quality, features, price. E. Internet sites such as Auto Site - Product, price, insurance, and resale information. Kelley Blue Book or the Kelley Blue Book Internet Site - Price information. LG Center for the Study of Services' Cars Bargains Service - Competitive bids from auto dealers in your local area. YE b. From all the information available, what specific information about the different makes and models is the most relevant to Samuel and Grace in making their purchasing decision? (Select the best choice below.) O A. When comparison-shopping, the Paganellis should look for information on insurance costs, gas mileage, and what colors the vehicle is available in. OB. When comparison-shopping, the Paganellis should look for information on repair costs, gas mileage, and body and mechanical instability O C. When comparison-shopping, the Paganellis should look for information on insurance costs, gas mileage, and racing performance D. When comparison shopping, the Paganellis should look for information on insurance costs, gas mileage, and body and mechanical reliability c. What is the highest price they can pay on the new vehicle if they can afford a down payment of $4,200? Assume they finance their purchase for 48 months at 5.7 percent. (Hint: This is a present value of an annuity problem.) The highest priced vehicle they can afford is $1(Round to the nearest cent.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started