only need answers for C down.

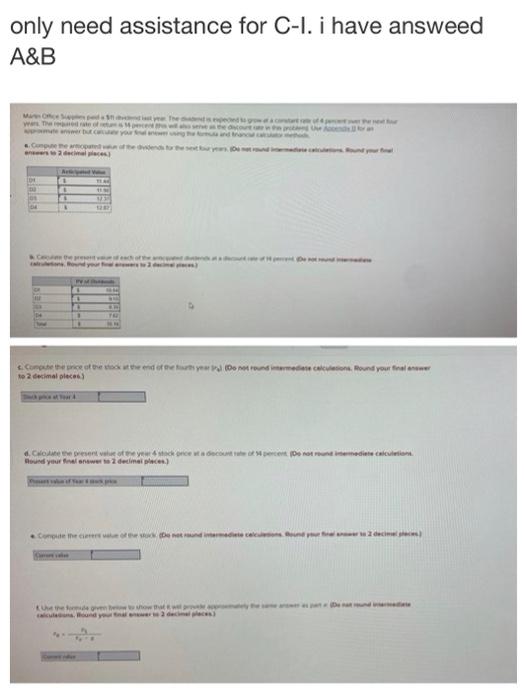

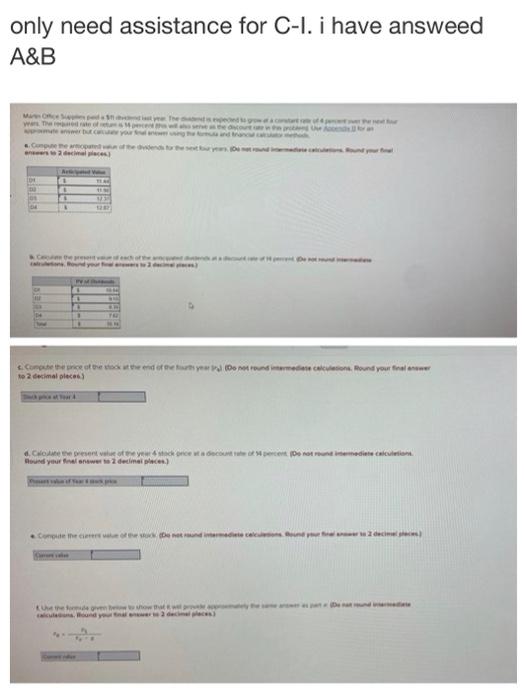

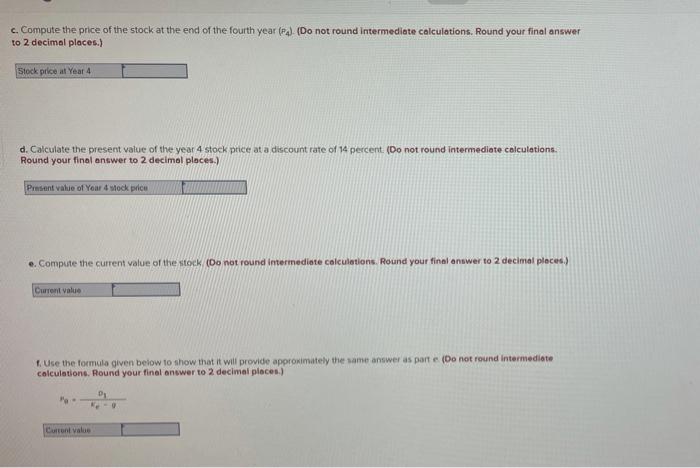

only need assistance for C-I. i have answeed A&B Mare Office Spa Sast year. The depend so years. The reared rate of net 14 percent tha was serve Compute the atopate van of the dividends for en to 2 decimal places) Arte V DI 0 01 04 1 14 Ce the present v cautions Round your flere 1 1282 Compute the price of the stock at the end of the fourth year ) (Do not round intermediate calculations, Round your final answer to 2 decimal pieces) 6. Calculate the present value of the year 4 stack price at a decounts Round your final answer to 2 decimal places) of Yea Compute the cerere value of the stock De her Use the forme given be to show 1 calculations, Round your final e viations decimals) c. Compute the price of the stock at the end of the fourth year (P4). (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock price at Year 4 d. Calculate the present value of the year 4 stock price at a discount rate of 14 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value of Year 4 stock price e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Current value f. Use the formula given below to show that it will provide approximately the same answer as part e (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Pa DI Ke 9 Current value Martin Office Supplies paid a $11 dividend last year. The dividend is expected to grow at a constant rate of 4 percent over the next four years. The required rate of return is 14 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) D1 02 03 04 Anticipated Value 11:44 11.90 12.37 12.87 D1 02 03 04 Total $ $ $ S b. Calculate the present value of each of the anticipated dividends at a discount rate of 14 percent. (Do not round intermediate calculations. Round your final answers to 2 decimel places.) PV of Dividends S S S $ $ 10.04 9.15 0,35 7.62 35.16 only need assistance for C-I. i have answeed A&B Mare Office Spa Sast year. The depend so years. The reared rate of net 14 percent tha was serve Compute the atopate van of the dividends for en to 2 decimal places) Arte V DI 0 01 04 1 14 Ce the present v cautions Round your flere 1 1282 Compute the price of the stock at the end of the fourth year ) (Do not round intermediate calculations, Round your final answer to 2 decimal pieces) 6. Calculate the present value of the year 4 stack price at a decounts Round your final answer to 2 decimal places) of Yea Compute the cerere value of the stock De her Use the forme given be to show 1 calculations, Round your final e viations decimals) c. Compute the price of the stock at the end of the fourth year (P4). (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock price at Year 4 d. Calculate the present value of the year 4 stock price at a discount rate of 14 percent. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Present value of Year 4 stock price e. Compute the current value of the stock. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Current value f. Use the formula given below to show that it will provide approximately the same answer as part e (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Pa DI Ke 9 Current value Martin Office Supplies paid a $11 dividend last year. The dividend is expected to grow at a constant rate of 4 percent over the next four years. The required rate of return is 14 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) D1 02 03 04 Anticipated Value 11:44 11.90 12.37 12.87 D1 02 03 04 Total $ $ $ S b. Calculate the present value of each of the anticipated dividends at a discount rate of 14 percent. (Do not round intermediate calculations. Round your final answers to 2 decimel places.) PV of Dividends S S S $ $ 10.04 9.15 0,35 7.62 35.16