Question

Only need answers for question 7!!! Jena has been so excited about what she has learned in her personal finance management class that she has

Only need answers for question 7!!!

Jena has been so excited about what she has learned in her personal finance management class that she has been telling everyone, "You should take this class." Now her dormitory hall monitor has asked her to prepare a talk on "credit and the young professional." She has decided to use a question-and-answer format. Help her answer the following questions.

Questions

1. Why is it easy for college students to get and use credit cards? Aside from the obvious impact of "forgoing future consumption" to repay the debt, how can students' credit practices affect their financial future?

2. What are three debt and credit trends that suggest few people are practicing frugality?

3. What does it mean to determine your own borrowing capacity and stick to it? Why is this strategy necessary when "choosing wealth"?

4. What is the relationship between borrowing capacity and an emergency account? What is the advantage or disadvantage of using less liquid accounts for emergency savings and, in the event of an emergency, immediately relying on credit?

5. What financial ratios are useful in monitoring your borrowing capacity? How are these ratios calculated and interpreted?

6. Review the 12 "keys to success." Which strategies could you utilize to avoid bad debt?

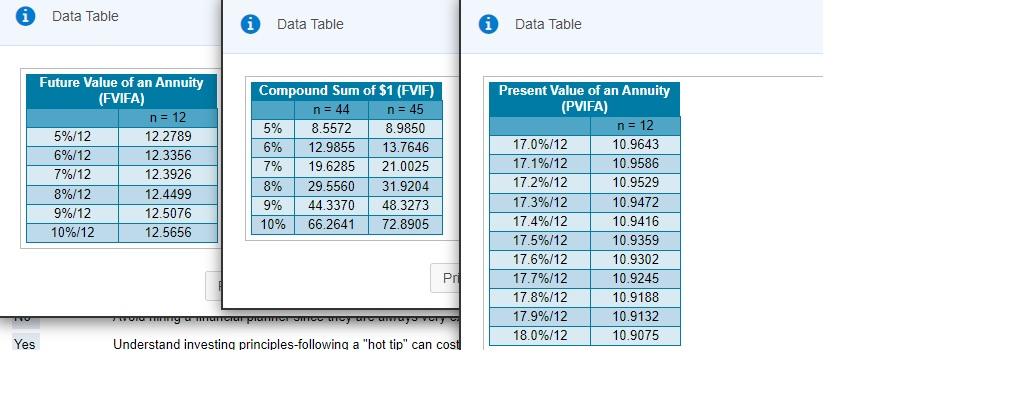

7. Jena decided to use the time value of money tools from Chapter 3 to calculate the size of the monthly payments that a typical undergraduate would need to pay the average credit card debt of

$2,984

over

1

year

(12

monthly payments), assuming an annual interest rate of

17.7

percent. If, instead of having to make that credit card payment, a new college graduate invested that same amount monthly in a mutual fund earning

9

percent on average, how much would he or she have for retirement in

45

years?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started