Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need correct answers! I will appreciate that! QUESTION 1 As of January 1, Year 1, Farley Co. had a credit balance of $534,000 in

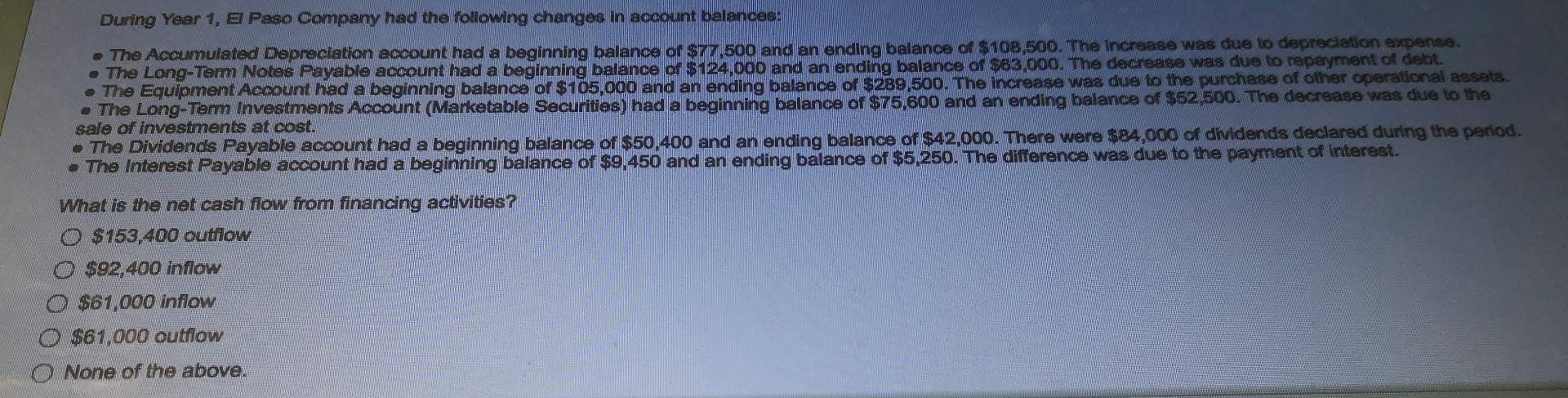

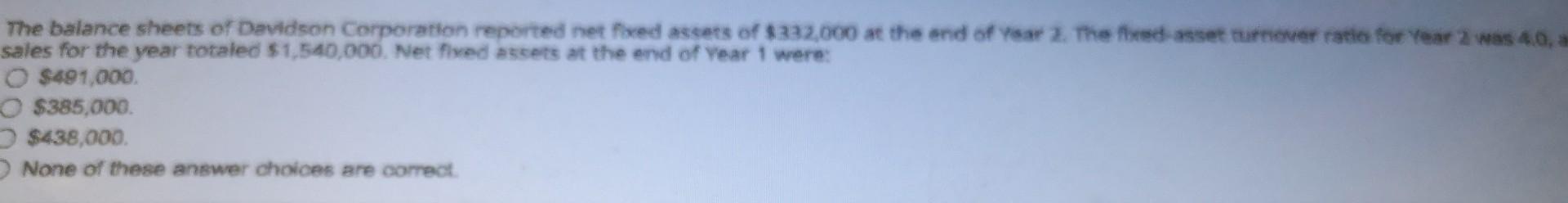

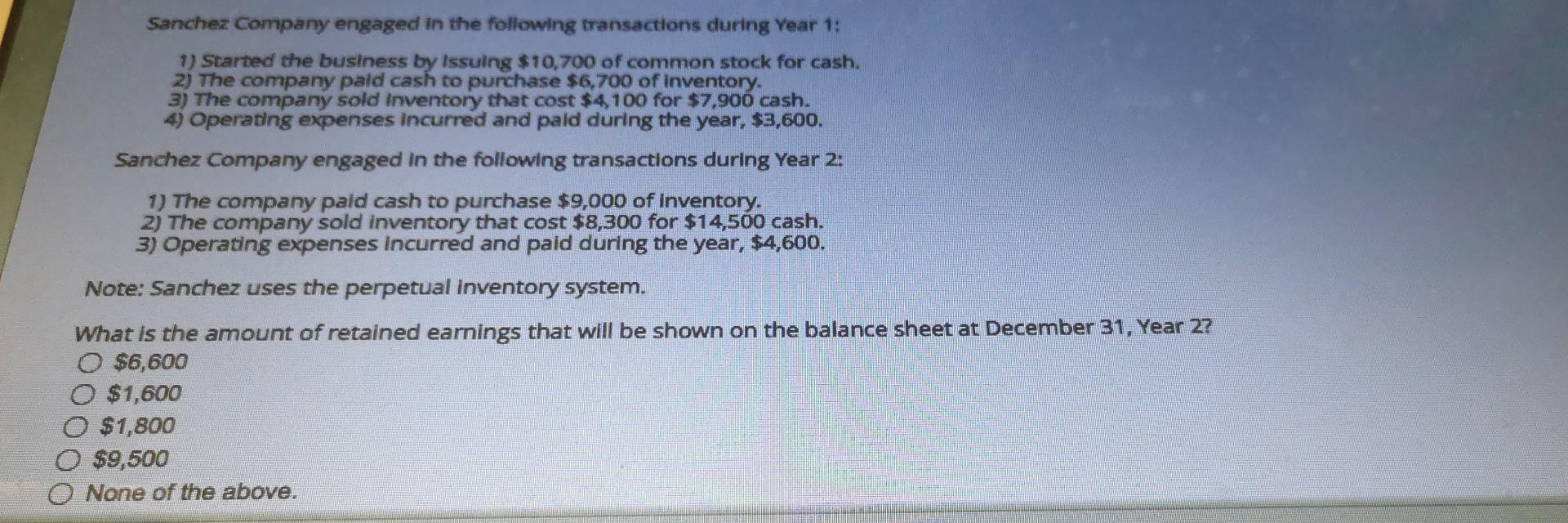

Only need correct answers! I will appreciate that!

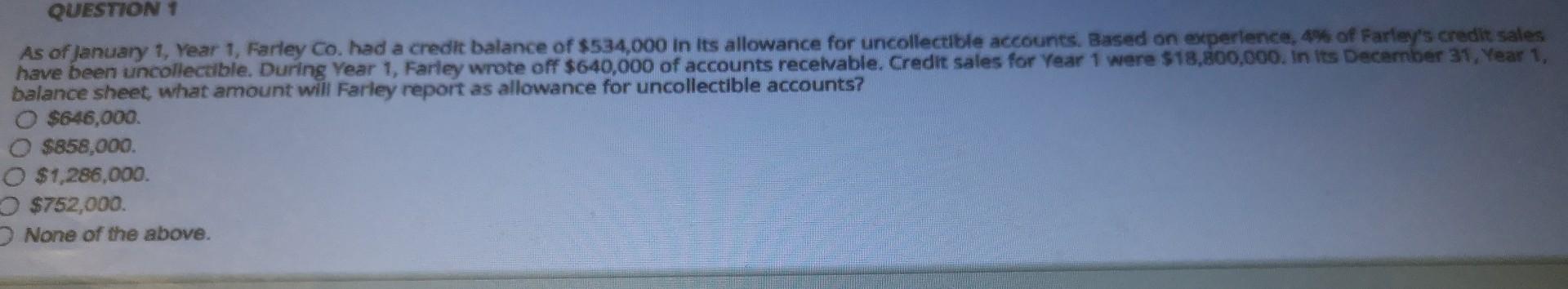

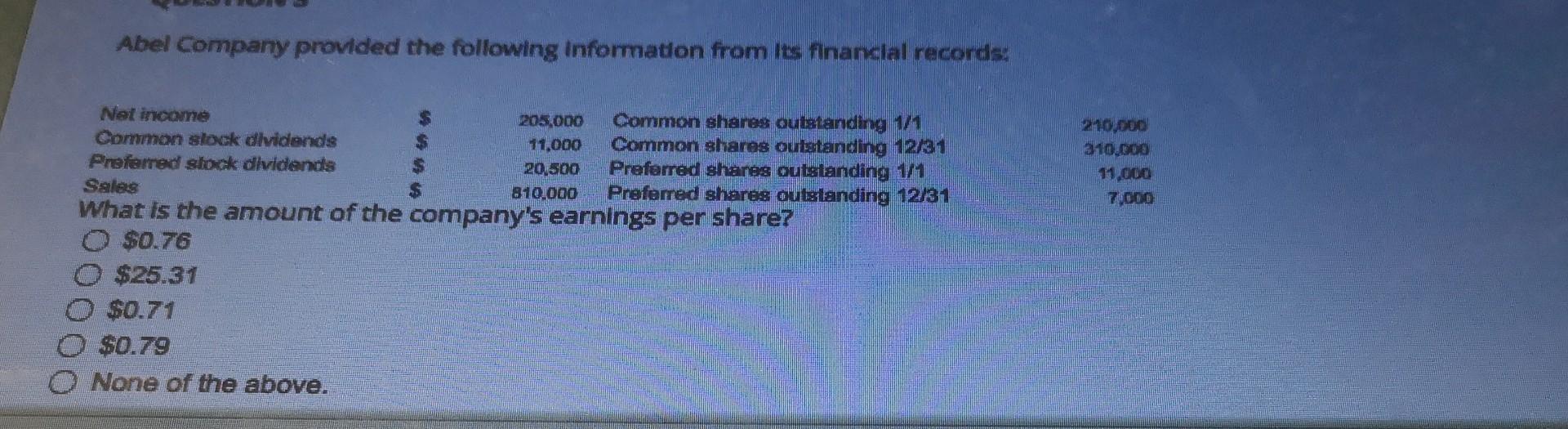

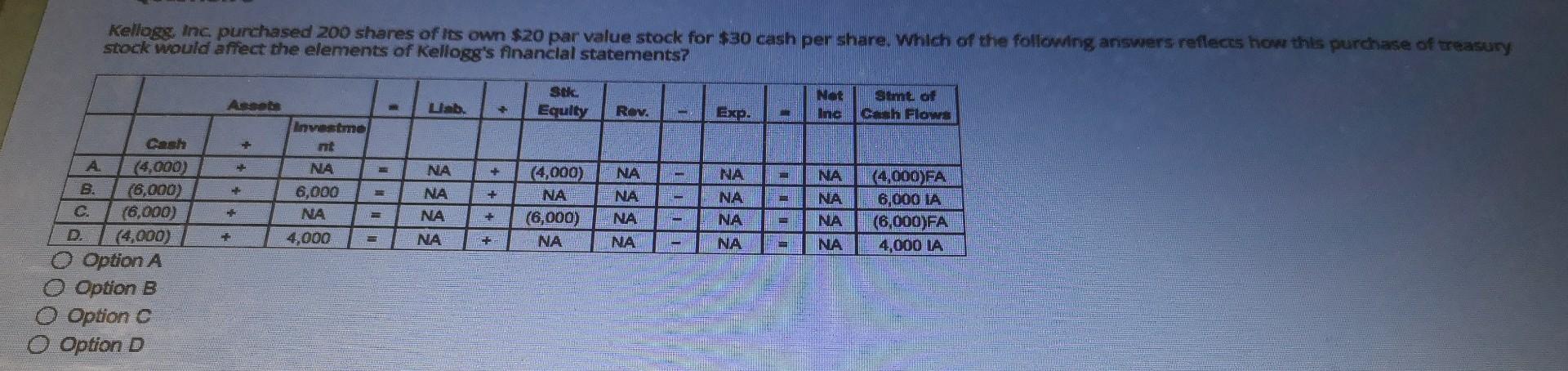

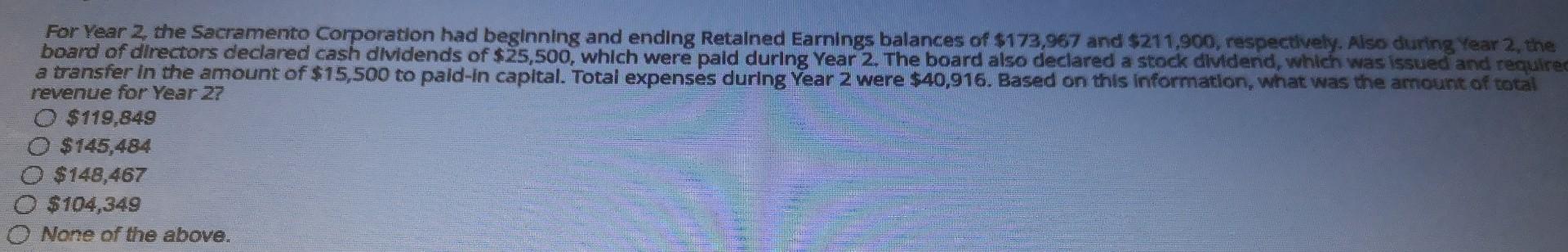

QUESTION 1 As of January 1, Year 1, Farley Co. had a credit balance of $534,000 in Its allowance for uncollectible accounts. Based on experience, 4% of Farley's credit sales have been uncollecdble. During Year 1, Farley wrote off $640,000 of accounts receivable. Credit sales for Year 1 were $18,800,000. In its December 31, Year 1, balance sheet what amount will Farley report as allowance for uncollectible accounts? O $646,000 O $858,000. O $1,286,000. $752,000. None of the above. Abel Company provided the following informaton from its financial records: 210,000 210.000 1.000 2000 Net income 205,000 Common shares outstanding 1/1 Common stock dlvidends 11.000 Common shares outstanding 12/31 Preferred stock dividends 20.500 Preferred shares outstanding 1/1 Sales 810.000 Preferred shares outstanding 12/31 What is the amount of the company's earnings per share? O $0.76 $25.31 $0.71 O $0.79 O None of the above. Kellogg, Inc. purchased 200 shares of its own $20 par value stock for $30 cash per share. Which of the following answers reflects how this purchase of treasury stock would affect the elements of Kellogg's financial statements? Stk. Ascode Lab. Equity Not Inc + Rev. Sent of Ch Flaws Ep. + Investme mt NA + 6,000 NA 4,000 NA NA NA (4,000) NA (6,000) NA NA NA NA NA NA NA NA NA NA (4,000FA 6,000 IA (6,000)FA 4,000 IA NA + NA NA - NA A (4,000) 3. (6,000) (6.000) (4,000) O Option A O Option B O Option c O Option D For Year 2 the Sacramento Corporation had beginning and ending Retained Earnings balances of $173,967 and $211,900, respectively. Also during Year 2, the board of directors declared cash dividends of $25,500, which were paid during Year 2. The board also declared a stock dividend, which was issued and required a transfer in the amount of $15,500 to pald-in capital. Total expenses during Year 2 were $40,916. Based on this information, what was the amount of total revenue for Year 27 $119,849 O $ 145,484 O $148,467 $104,349 None of the above. During Year 1, 6 Paso Company had the following changes in account balances: The Accumulated Depreciation account had a beginning balance of $77,500 and an ending balance of $108,500. The increase was due to depreciation expense. The Long-Tem Notes Payable account had a beginning balance of $124,000 and an ending balance of $63,000. The decrease was due to repayment of debt. The Equipment Account had a beginning balance of $105,000 and an ending balance of $289,500. The increase was due to the purchase of other operational assets. The Long-Term Investments Account (Marketable Securities) had a beginning balance of $75,600 and an ending balance of $52,500. The decrease was due to the sale of investments at cost. The Dividends Payable account had a beginning balance of $50,400 and an ending balance of $42,000. There were $84,000 of dividends declared during the period. - The Interest Payable account had a beginning balance of $9.450 and an ending balance of $5,250. The difference was due to the payment of interest. What is the net cash flow from financing activities? O $153,400 outflow $92,400 inflow $61,000 inflow O $61,000 outfiow O None of the above. The balance sheets of Davidson Corporation reported net fixed assets of $322,000 at the end of year. The fixed asset turnover ratio for Year 2 was 4.0, a sales for the year totaled $1,540,000. Net fixed assets at the end of Year 1 were: O $491,000 $385,000 $438,000 None of these answer choices are correct Sanchez Company engaged in the following transactions during Year 1: 1) Started the business by Issuing $10,700 of common stock for cash. 2) The company paid cash to purchase $6,700 of inventory. 3) The company sold Inventory that cost $4100 for $7,900 cash. 4) Operating expenses incurred and paid during the year, $3,600. Sanchez Company engaged in the following transactions during Year 2: 1) The company paid cash to purchase $9,000 of Inventory. 2) The company sold inventory that cost $8,300 for $14,500 cash. 3) Operating expenses incurred and paid during the year, $4,600. Note: Sanchez uses the perpetual Inventory system. What is the amount of retained earnings that will be shown on the balance sheet at December 31, Year 2? O $6,600 0 $1,600 O $1,800 0 $9,500 None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started