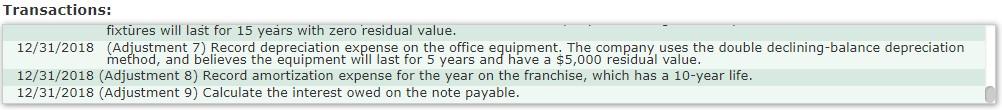

(Only need entries for 08/01/2018 & after ( 08-01-2018 - 12/31/2018( All Adjustments on date of 12-31-2018 / #1-9)))

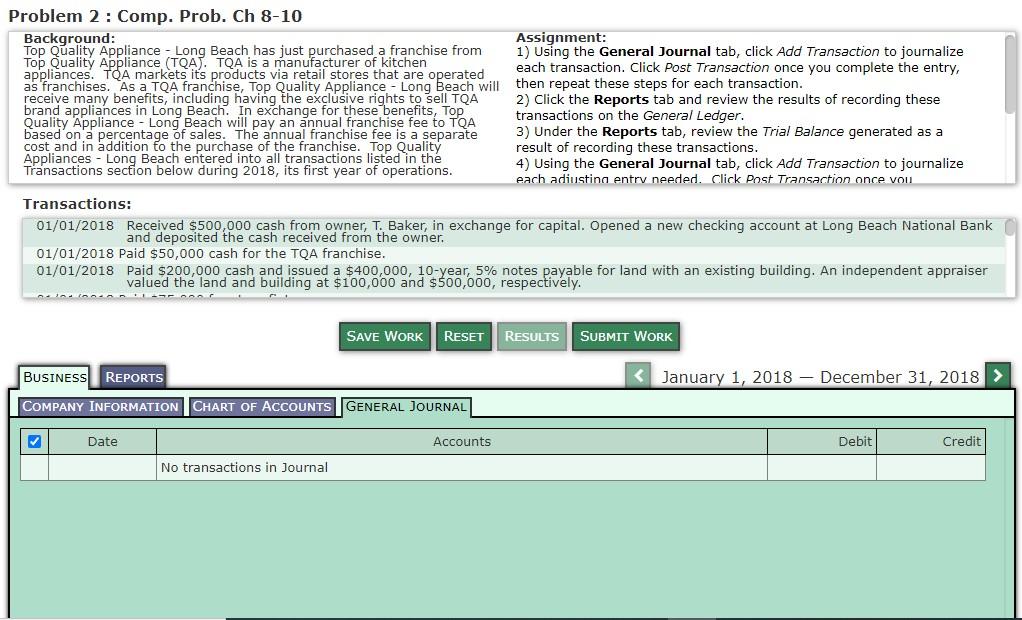

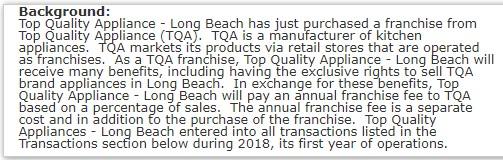

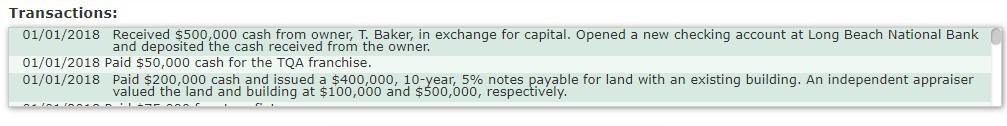

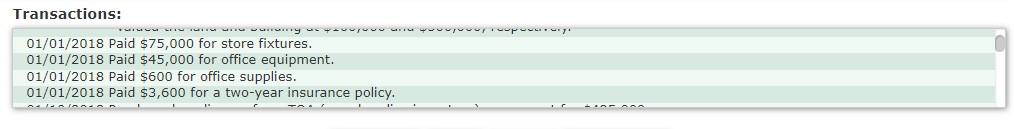

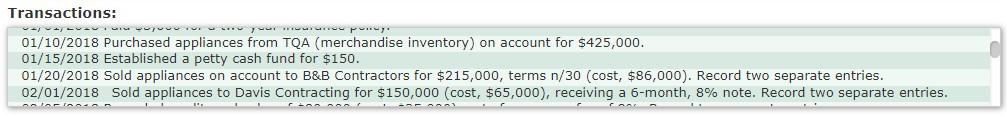

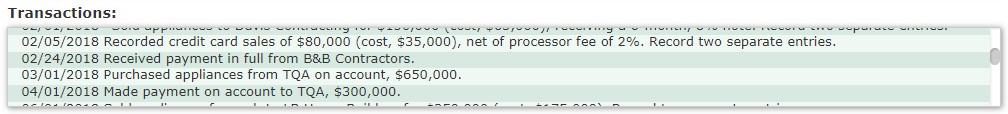

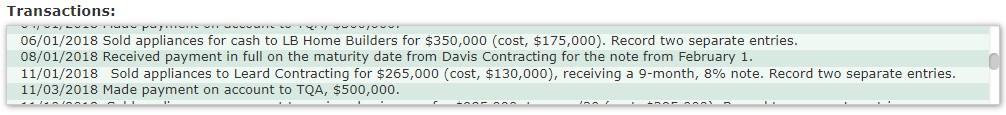

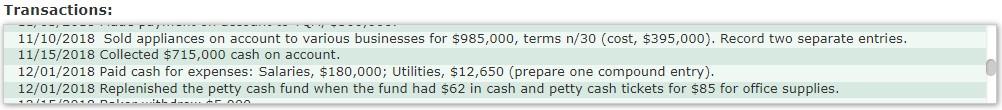

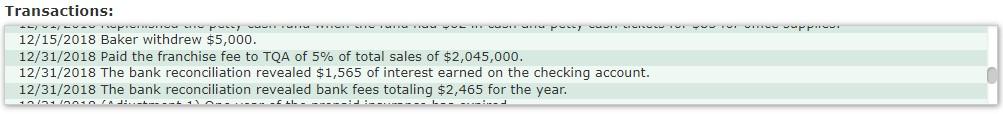

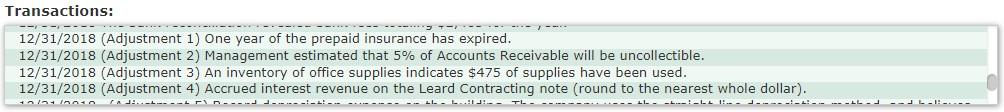

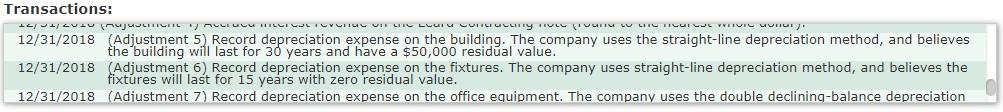

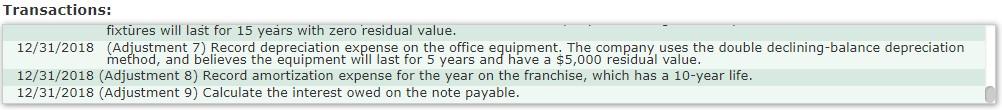

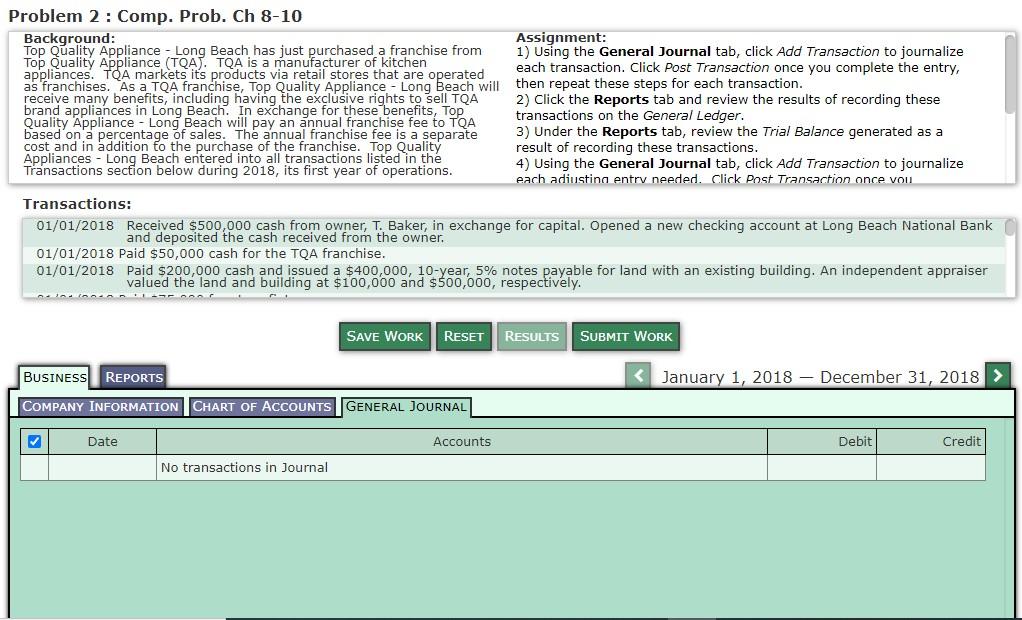

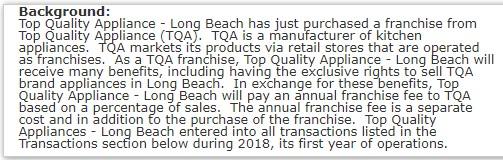

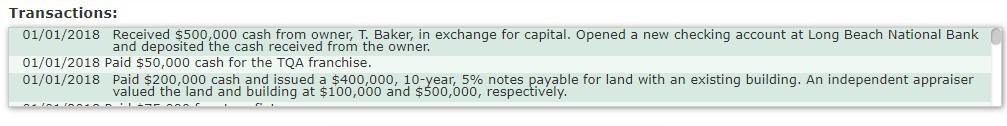

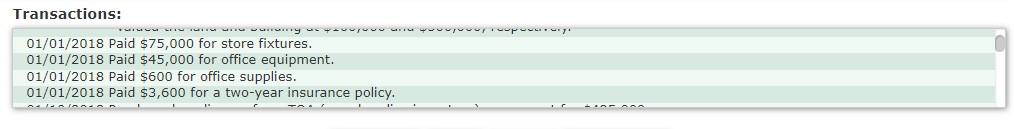

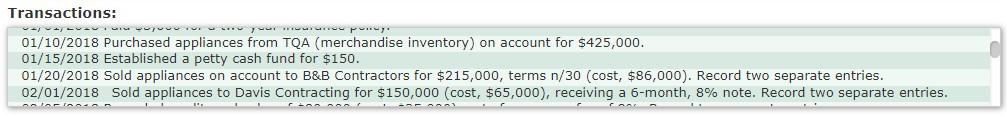

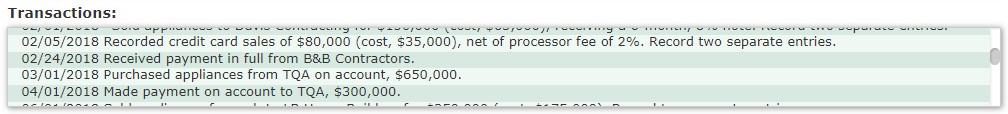

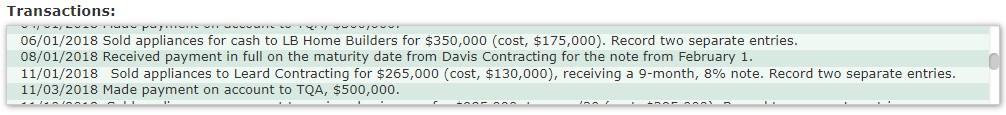

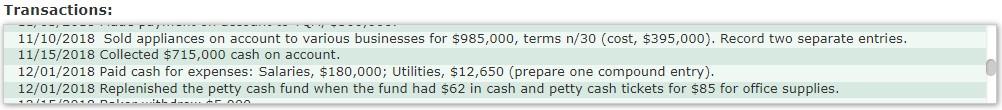

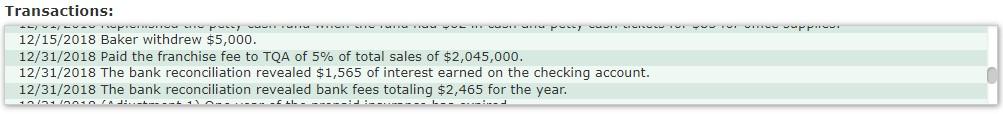

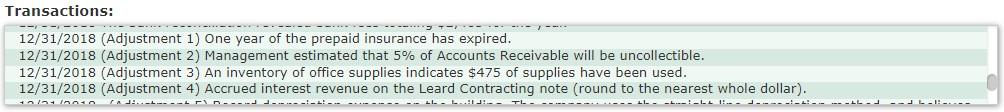

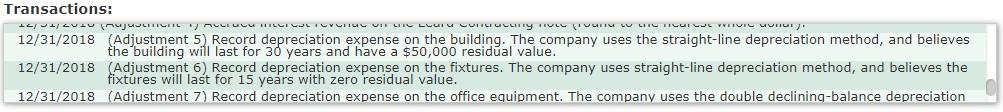

Problem 2: Comp. Prob. Ch 8-10 Background: Assignment: Top Quality Appliance - Long Beach has just purchased a franchise from 1) Using the General Journal tab, click Add Transaction to journalize Top Quality Appliance (TQA). TQA is a manufacturer of kitchen appliances. Toa markets its products via retail stores that are operated each transaction. Click Post Transaction once you complete the entry, as franchises. As a TQA franchise, Top Quality Appliance - Long Beach will then repeat these steps for each transaction. receive many benefits, including having the exclusive rights to sell TQA 2) Click the Reports tab and review the results of recording these brand appliances in Long Beach. In exchange for these benefits, Top Quality Appliance - Long Beach will pay an annual franchise fee to TQA transactions on the General Ledger. based on a percentage of sales. The annual franchise fee is a separate 3) Under the Reports tab, review the Trial Balance generated as a cost and in addition to the purchase of the franchise. Top Quality result of recording these transactions. Appliances - Long Beach entered into all transactions listed in the Transactions section below during 2018, its first year of operations. 4) Using the General Journal tab, click Add Transaction to journalize each adiusting entry needed. Click Post Transaction once vou Transactions: 01/01/2018 Received $500,000 cash from owner, T. Baker, in exchange for capital. Opened a new checking account at Long Beach National Bank and deposited the cash received from the owner. 01/01/2018 Paid $50,000 cash for the TQA franchise. 01/01/2018 Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land with an existing building. An independent appraiser valued the land and building at $100,000 and $500,000, respectively. alcon SAVE WORK RESET RESULTS SUBMIT WORK BUSINESS REPORTS COMPANY INFORMATION CHART OF ACCOUNTS GENERAL JOURNAL Date Accounts Debit Credit No transactions in Journal Background: Top Quality Appliance - Long Beach has just purchased a franchise from Top Quality Appliance (TQA). TQA is a manufacturer of kitchen appliances. TQA markets its products via retail stores that are operated as franchises. As a TQA franchise, Top Quality Appliance - Long Beach will receive many benefits, including having the exclusive rights to sell TQA brand appliances in Long Beach. In exchange for these benefits, Top Quality Appliance - Long Beach will pay an annual franchise fee to TQA based on a percentage of sales. The annual franchise fee is a separate cost and in addition to the purchase of the franchise. Top Quality Appliances - Long Beach entered into all transactions listed in the Transactions section below during 2018, its first year of operations. Transactions: 01/01/2018 Received $500,000 cash from owner, T. Baker, in exchange for capital. Opened a new checking account at Long Beach National Bank and deposited the cash received from the owner. 01/01/2018 Paid $50,000 cash for the TQA franchise. 01/01/2018 Paid $200,000 cash and issued a $400,000, 10-year, 5% notes payable for land with an existing building. An independent appraiser valued the land and building at $100,000 and $500,000, respectively. Transactions: www.myvow-vuvor report 01/01/2018 Paid $75,000 for store fixtures. 01/01/2018 Paid $45,000 for office equipment. 01/01/2018 Paid $600 for office supplies. 01/01/2018 Paid $3,600 for a two-year insurance policy. ILION.O. -A. . wower Power Transactions: 01/10/2018 Purchased appliances from TQA (merchandise inventory) on account for $425,000. 01/15/2018 Established a petty cash fund for $150. 01/20/2018 Sold appliances on account to B&B Contractors for $215,000, terms n/30 (cost, $86,000). Record two separate entries. 02/01/2018 Sold appliances to Davis Contracting for $150,000 (cost, $65,000), receiving a 6-month, 8% note. Record two separate entries. naron LORIA Urong (ouvo.com.ngo.co. Transactions: vavapp- 02/05/2018 Recorded credit card sales of $80,000 (cost, $35,000), net of processor fee of 2%. Record two separate entries. 02/24/2018 Received payment in full from B&B Contractors. 03/01/2018 Purchased appliances from TQA on account, $650,000. 04/01/2018 Made payment on account to TQA, $300,000. - AAA Transactions: YOU 06/01/2018 Sold appliances for cash to LB Home Builders for $350,000 (cost, $175,000). Record two separate entries. 08/01/2018 Received payment in full on the maturity date from Davis Contracting for the note from February 1. 11/01/2018 Sold appliances to Leard Contracting for $265,000 (cost, $130,000), receiving a 9-month, 8% note. Record two separate entries. 11/03/2018 Made payment on account to TQA, $500,000. Transactions: 11/10/2018 Sold appliances on account to various businesses for $985,000, terms n/30 (cost, $395,000). Record two separate entries. 11/15/2018 Collected $715,000 cash on account. 12/01/2018 Paid cash for expenses: Salaries, $180,000; Utilities, $12,650 (prepare one compound entry). 12/01/2018 Replenished the petty cash fund when the fund had $62 in cash and petty cash tickets for $85 for office supplies. Transactions: 12/15/2018 Baker withdrew $5,000. 12/31/2018 Paid the franchise fee to TQA of 5% of total sales of $2,045,000. 12/31/2018 The bank reconciliation revealed $1,565 of interest earned on the checking account. 12/31/2018 The bank reconciliation revealed bank fees totaling $2,465 for the year. IntInnen ..-----11---L-------------------- T- Transactions: 12/31/2018 (Adjustment 1) One year of the prepaid insurance has expired. 12/31/2018 (Adjustment 2) Management estimated that 5% of Accounts Receivable will be uncollectible. 12/31/2018 (Adjustment 3) An inventory of office supplies indicates $475 of supplies have been used. 12/31/2018 (Adjustment 4) Accrued interest revenue on the Leard Contracting note (round to the nearest whole dollar). inn Innen ..----------------------- LIL..!! -- TL ----------------LEI---------- Transactions: 1-11 LUI IUUCHICHI LUCU MICI CLICCHU VITRIC LUIU CURCULITTY FULL KUU LUCHT LICUI VLIVIC WUHU!) 12/31/2018 (Adjustment 5) Record depreciation expense on the building. The company uses the straight-line depreciation method, and believes the building will last for 30 years and have a $50,000 residual value. 12/31/2018 (Adjustment 6) Record depreciation expense on the fixtures. The company uses straight-line depreciation method, and believes the fixtures will last for 15 years with zero residual value. 12/31/2018 (Adjustment 7) Record depreciation expense on the office equipment. The company uses the double declining-balance depreciation Transactions: fixtures will last for 15 years with zero residual value. 12/31/2018 (Adjustment 7) Record depreciation expense on the office equipment. The company uses the double declining-balance depreciation method, and believes the equipment will last for 5 years and have a $5,000 residual value. 12/31/2018 (Adjustment 8) Record amortization expense for the year on the franchise, which has a 10-year life. 12/31/2018 (Adjustment 9) Calculate the interest owed on the note payable. BUSINESS REPORTS