Answered step by step

Verified Expert Solution

Question

1 Approved Answer

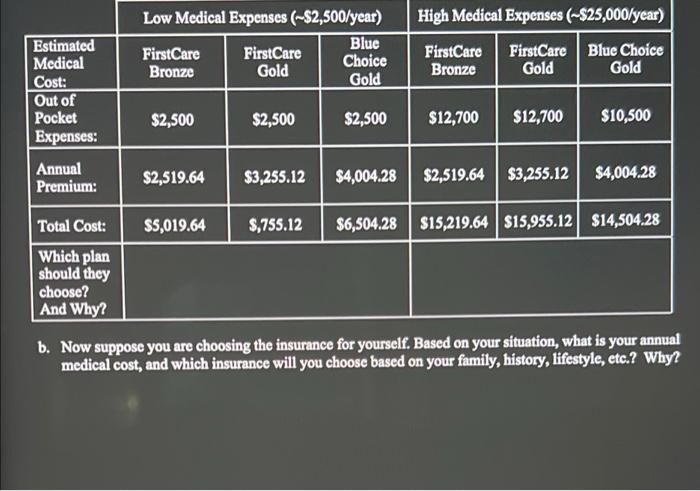

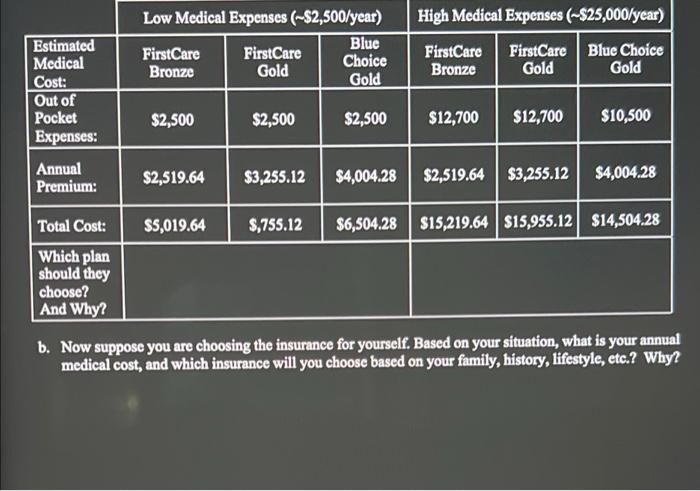

Only need help with B. High Medical Expenses (-$25,000/year) Low Medical Expenses (-$2,500/year) Blue FirstCare FirstCare Choice Bronze Gold Gold FirstCare Bronze FirstCare Blue Choice

Only need help with "B."

High Medical Expenses (-$25,000/year) Low Medical Expenses (-$2,500/year) Blue FirstCare FirstCare Choice Bronze Gold Gold FirstCare Bronze FirstCare Blue Choice Gold Gold Estimated Medical Cost: Out of Pocket Expenses: $2,500 $2,500 $2,500 $12,700 $12,700 $10,500 Annual Premium: $2,519.64 $3,255.12 $4,004.28 $2,519.64 $3,255.12 $4,004.28 $5,019.64 $,755.12 $6,504.28 $15,219.64 $15,955.12 $14,504.28 Total Cost: Which plan should they choose? And Why? b. Now suppose you are choosing the insurance for yourself. Based on your situation, what is your annual medical cost, and which insurance will you choose based on your family, history, lifestyle, etc.? Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started