Only Need Part A

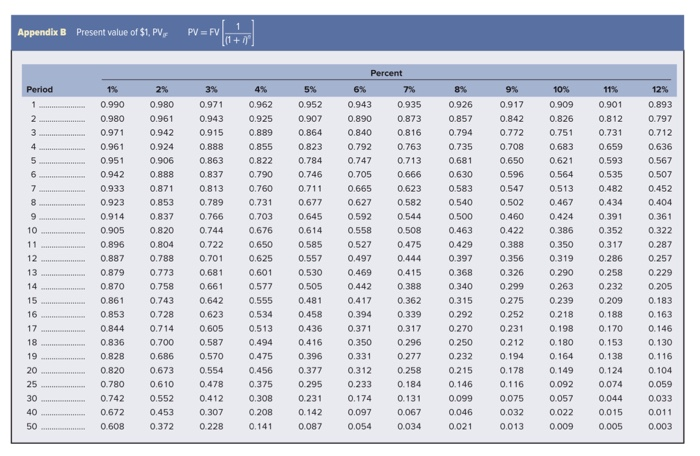

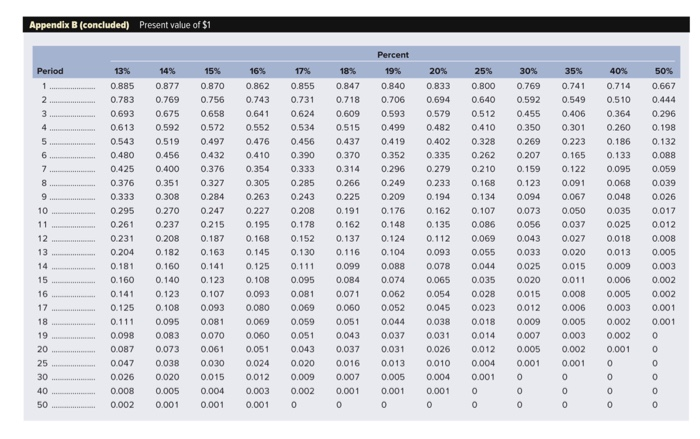

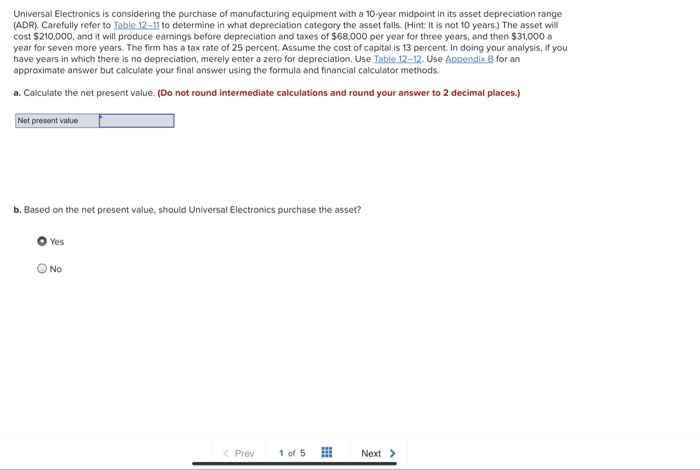

Universal Electronics is considering the purchase of manufacturing equipment with a 10-year midpoint in its asset depreciation range (ADR). Carefully refer to Table 12-11 to determine in what depreciation category the asset falls. (Hint: It is not 10 years.) The asset will cost $210,000, and it will produce earnings before depreciation and taxes of $68,000 per year for three years, and then $31.000 a year for seven more years. The firm has a tax rate of 25 percent. Assume the cost of capital is 13 percent. In doing your analysis, if you have years in which there is no depreciation, merely enter a zero for depreciation. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Calculate the net present value. (Do not round intermediate calculations and round your answer to 2 decimal places.) Net present value b. Based on the net present value, should Universal Electronics purchase the asset? Yes O No Prev 1 of 5 : Next > Next > Appendix B Present value of $1, PV PV=FV 1 +7 9% 12% Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0.339 0.371 0.317 0.350 0.296 0.331 0.277 0.312 0.258 0.233 0.184 0.174 0.131 0.097 0.067 0.054 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 17 18 19 20 25 30 40 50 Appendix B (concluded) Present value of $1 Percent 17 20 Period 1 2 3 4 5 6 7 8 9 138 .885 0.783 .693 0613 0543 0480 0.425 0.376 0.333 0 295 0 261 0 231 0 204 0.181 0.160 0.141 0.125 0.111 0 098 0.087 0047 0026 0008 0.002 10 11 12 13 148 .877 0769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 o 237 0 208 0.182 0.160 0.140 0.123 0.108 0.095 0083 .073 0.038 0.020 0 00s 0 001 15 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 .070 0.061 0,030 0.015 0.004 0.001 16x 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.16B 0.145 0.125 0.10B 0.093 0.000 0.069 0.000 0.051 0,024 0.012 0.003 0.001 0.855 0.731 0.624 0.534 0.456 0,390 0.333 0.285 0.243 0.208 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.043 0,020 0.009 0.002 18 0.847 0.718 0.609 0.515 0.437 0,370 0.314 0.266 0.225 0.191 0, 162 0.137 0.116 0,099 0.04 0.071 0.060 0.051 0.043 0.037 0,016 0.007 0.001 0 19 0.840 0.706 0.593 0.499 0.419 0.352 0 296 0.249 0.209 0.176 0.148 0.124 0, 104 0.088 0.074 0.062 0.052 0.044 0.037 0.031 0.013 0.005 0.001 0 OB33 .694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 . 135 0.112 0.093 0.078 0.065 0.054 0045 0.038 0031 0026 0010 0.004 0.001 25 0.800 0.640 0.512 0.4 10 0.328 0.262 0210 0.168 0.134 0.107 .086 0069 0055 0044 0.035 0028 .023 0.018 0014 0.012 0004 0.001 30 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 .073 0.056 0,043 0.033 0,025 0.020 0.015 0.012 0.009 0007 0.005 0.001 35 0.741 0.549 0.406 0.301 0.223 0.165 0.122 0.091 0.067 0.050 0,037 0.027 0.020 0.015 0.011 0.0 0.006 0.005 0.003 0.002 0,001 40 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.04B 0.035 0,025 0,018 0.013 0,009 0.006 0.005 0.003 0.002 0.002 0.001 50 0.667 0.444 0.296 0, 198 0.132 0.0B8 0.059 0.039 0.026 0.017 0,012 0.008 0.005 0.003 0.002 0.002 0.001 0.001 14 15 16 17 18 19 20 25 30 40 50