Answered step by step

Verified Expert Solution

Question

1 Approved Answer

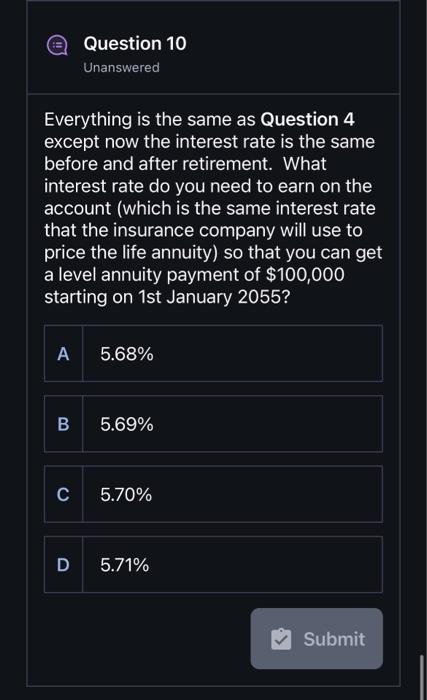

only need Q10 Everything is the same as Question 4 except now the interest rate is the same before and after retirement. What interest rate

only need Q10

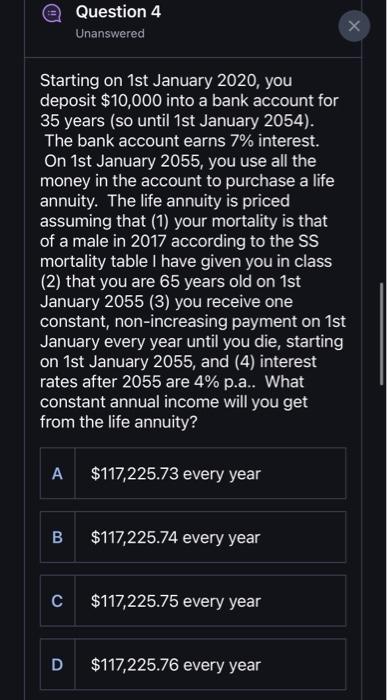

Everything is the same as Question 4 except now the interest rate is the same before and after retirement. What interest rate do you need to earn on the account (which is the same interest rate that the insurance company will use to price the life annuity) so that you can get a level annuity payment of $100,000 starting on 1st January 2055? Starting on 1st January 2020 , you deposit $10,000 into a bank account for 35 years (so until 1st January 2054). The bank account earns 7% interest. On 1st January 2055 , you use all the money in the account to purchase a life annuity. The life annuity is priced assuming that (1) your mortality is that of a male in 2017 according to the SS mortality table I have given you in class (2) that you are 65 years old on 1st January 2055 (3) you receive one constant, non-increasing payment on 1st January every year until you die, starting on 1st January 2055, and (4) interest rates after 2055 are 4% p.a.. What constant annual income will you get from the life annuity? Everything is the same as Question 4 except now the interest rate is the same before and after retirement. What interest rate do you need to earn on the account (which is the same interest rate that the insurance company will use to price the life annuity) so that you can get a level annuity payment of $100,000 starting on 1st January 2055? Starting on 1st January 2020 , you deposit $10,000 into a bank account for 35 years (so until 1st January 2054). The bank account earns 7% interest. On 1st January 2055 , you use all the money in the account to purchase a life annuity. The life annuity is priced assuming that (1) your mortality is that of a male in 2017 according to the SS mortality table I have given you in class (2) that you are 65 years old on 1st January 2055 (3) you receive one constant, non-increasing payment on 1st January every year until you die, starting on 1st January 2055, and (4) interest rates after 2055 are 4% p.a.. What constant annual income will you get from the life annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started