Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need questions #1,2,3,4,5, and 10 please just give short brief answers to questions #1-5 and #10 ating his current retirement portfolio. Ralph, a 78

Only need questions #1,2,3,4,5, and 10

please just give short brief answers to questions #1-5 and #10

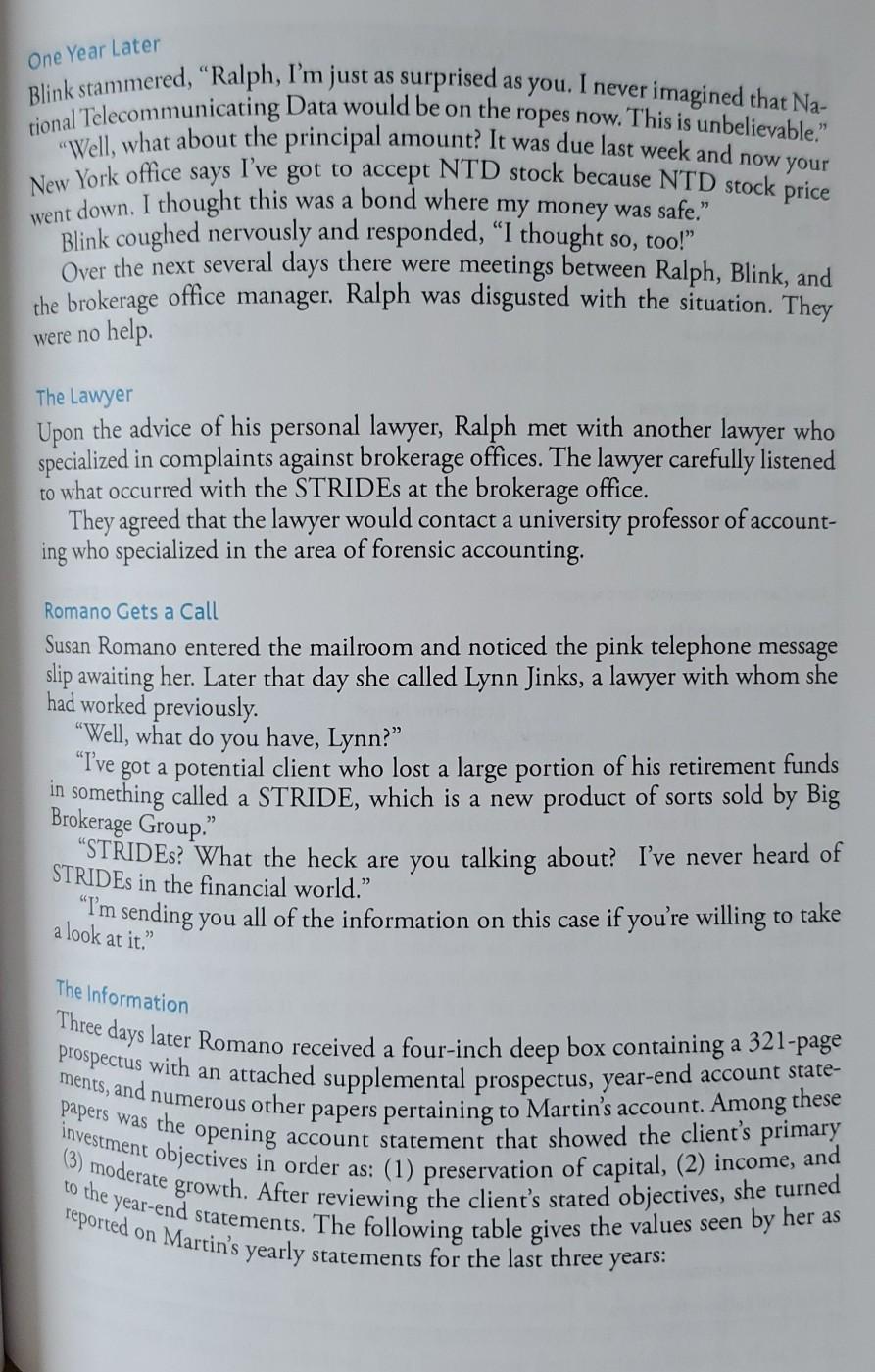

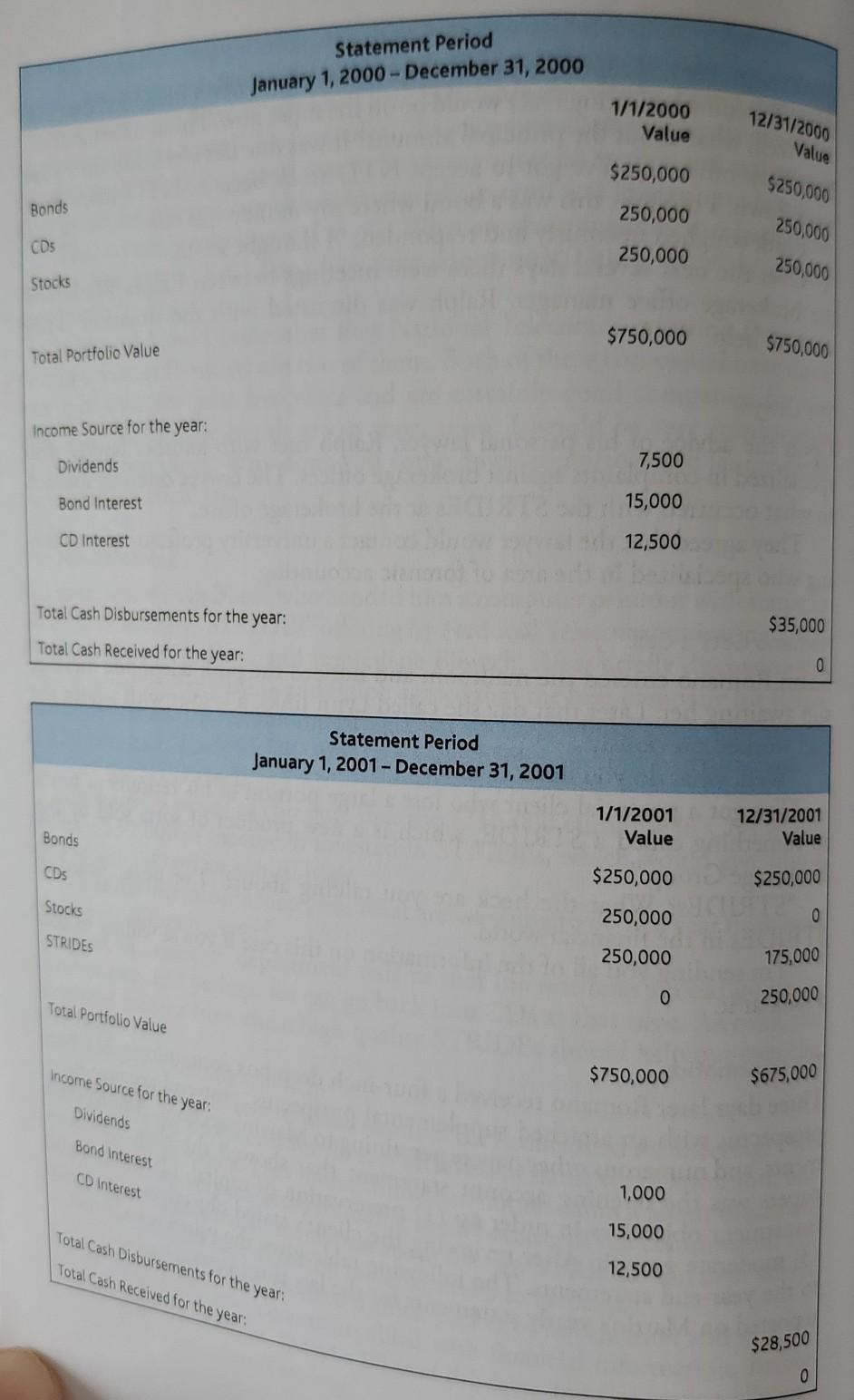

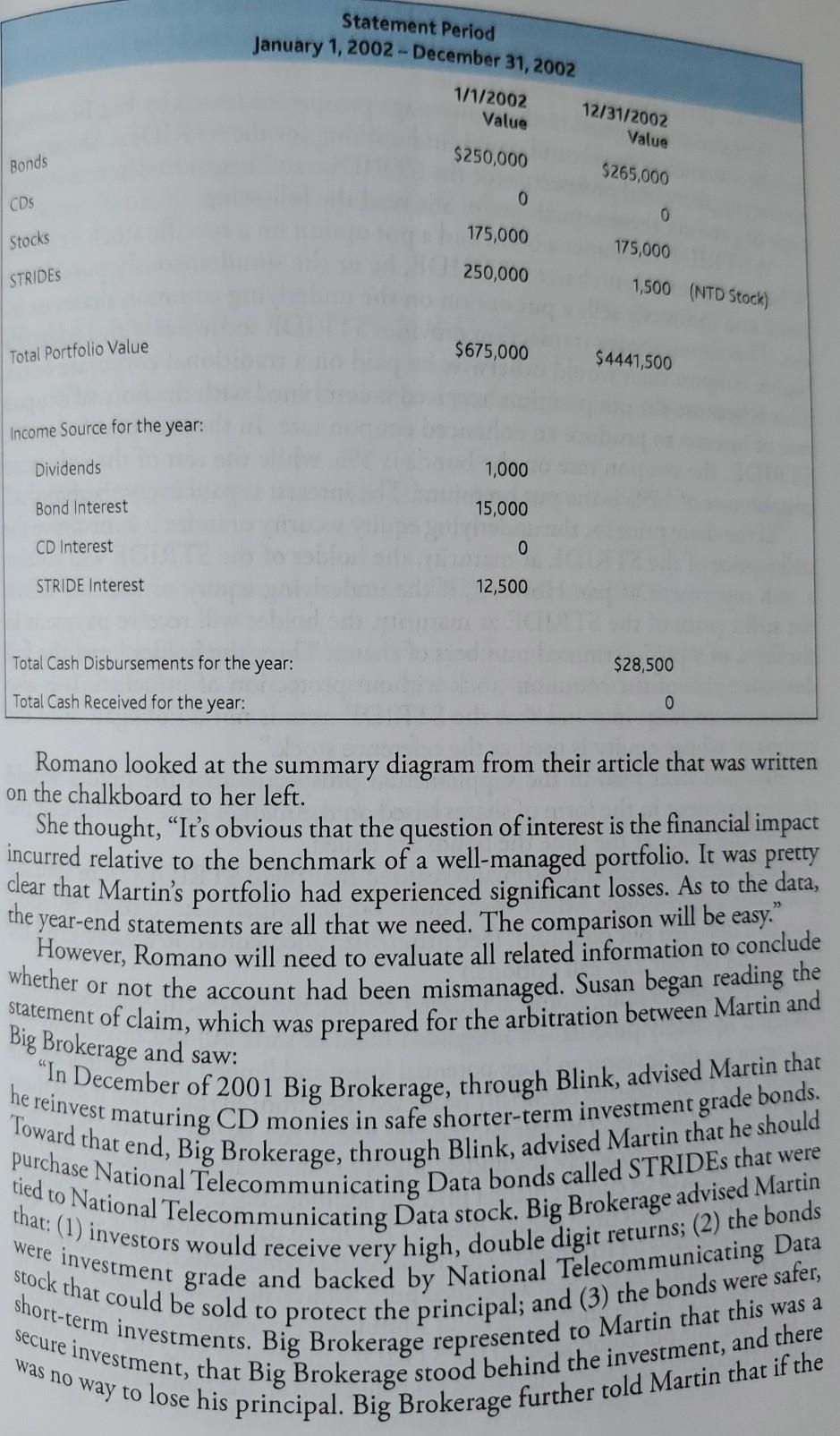

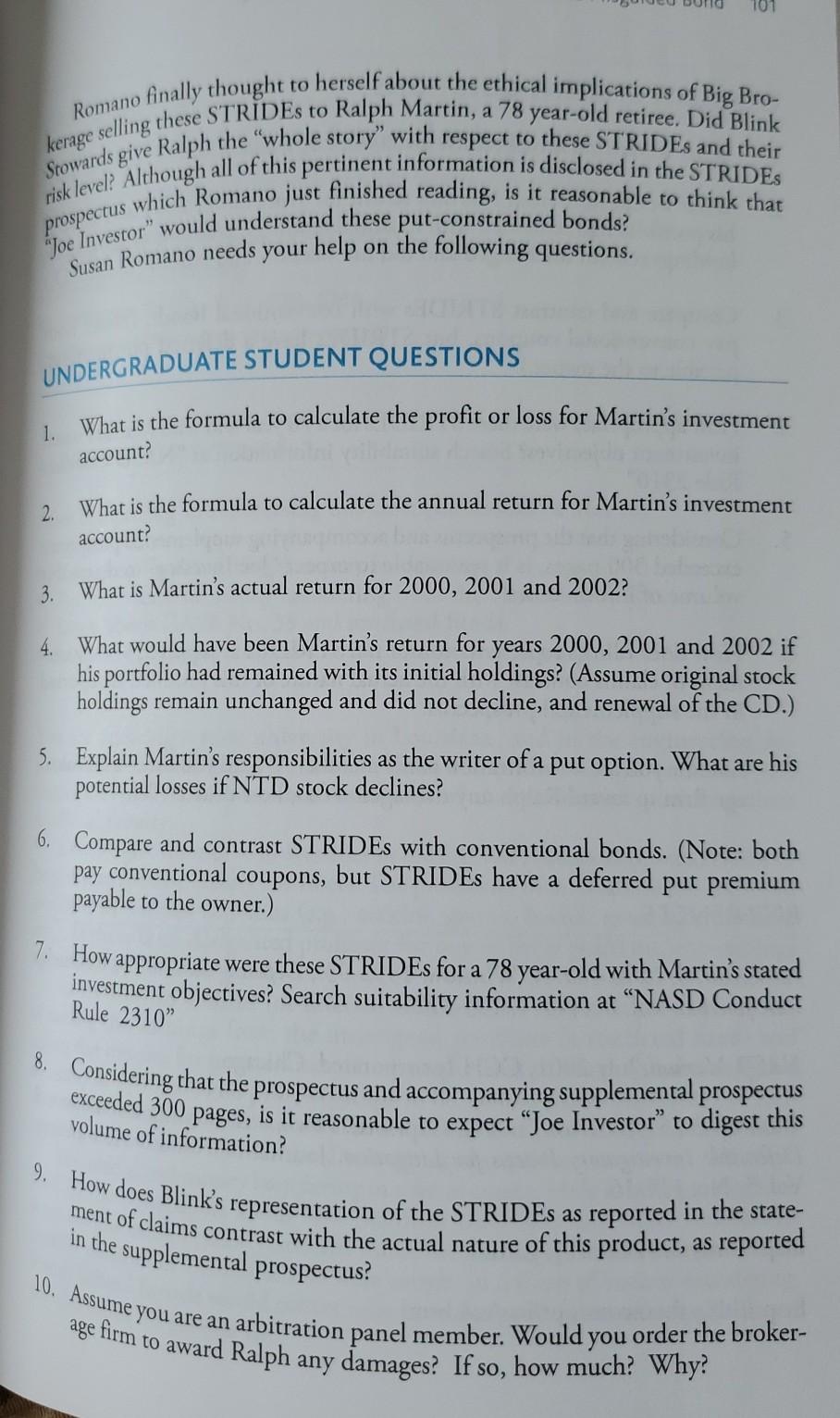

ating his current retirement portfolio. Ralph, a 78 year-old retiree, had little CASE STUDY 11: a financial advisor in the same retail brokerage office who "inherited the ac- count. The new broker advised the client's purchase of a put-constrained bond lost a substantial portion of his assets with the new speculative bond. You are as excerpts from the prospectus. A dialogue format is used to present the issues, provided with the client's yearly summary investment account statements, as well facts, and terminology of the case. Late in 2001, Ralph Martin, a former clothes salesman, sat on his patio evalu- interest in investment and had previously depended on his long-term friend The Misguided Bond Seth C. Anderson, Ph.D., CFA Kim Capriotti, Ph.D. Jacksonville University Vincent Shea, Ph.D., CPA St. John's University LEARNING OBJECTIVES After completing and discussing this case, you should be able to Recognize retail broker account mismanagement. Compare conventional bonds with put-constrained bonds. Learn a five-step forensic accounting process. This case features a 78 year-old married retiree who is seeking to improve the income from a retirement portfolio. Although the client has substantial sav- ings, the client is not a sophisticated investor. He had previously relied on his late financial advisor who had recently passed away, but currently he relies on INTRODUCTION RELEVANT FACTS The five-step process they used in the study entails: s split somewhat and financial advisor for investment advice. However, Fred had died almost two years earlier, and Blink Stowards, another advisor, had worked with Ralph since then. At the time of Fred's death, Ralph's $750,000 portfolio was s equally among intermediate term bonds paying income at approximately 6%, blue chip stocks yielding income of approximately 3%, and CDs paying income of approximately 5%. If it had been up to Ralph all of his money would have been in CDs because he was scared of stocks and bonds. Because of Fred's earlier his wife's teaching pension, allowed them to live comfortably and to lend some guidance, the $35,000 portfolio income, along with their social security and Blink had been attentive of Ralph and had suggested several sells of stodgy" equities such Heinz Foods, SCANA (Electric Utility), General Motors, and three natural gas utilities, in order to hopefully benefit the portfolio corpus, of broker account mismanagement. Earlier in the session she had discussed a generalized model for forensic accounting, which she and two other professors A forensic accountant hired as an expert must segment a broad legal ques- tion into inquiries that can be objectively measured. II. Employing benchmarks that are commonly accepted to address the Commonly accepted standards are selected for measuring the objective assistance to several college-age grandchildren. by investing in AT&T, Cisco, and a few other non-dividend paying telecom- munications related stocks. The high-tech stocks had declined (although the old stodgy equities maintained their market values), but both Ralph and Blink were convinced that their long-term growth potential outweighed any other price risk. However, the CD component would be maturing very soon and then would need to be reinvested. Looking in his local paper's business section, Ralph saw CD rates at 2%, which would generate only $5,000 on the $250,000 principal in CDs. Ralph mulled over the decline in income of their portfolio currently relative to the income generated earlier. He thought to himself that perhaps Blink might be able to make some suggestions which would supplement his annual income. He decided to call Blink the following Monday. Susan Romano, a professor of accounting, was ending her afternoon forensic accounting class with a discussion of how to investigate the possible existence Meanwhile, in the Classroom had earlier presented in an article. 1. Defining the question(s) of interest. question(s). inquiries com/flg/g.html for discussion of bond terminology.) III. Cleaning data in a methodical fashion, which objectively allows the database and unrepresentative observations in order to minimize the effects of data- to be compared to the benchmarks set forth. Data are purged of unreliable entry error and increase the reliability of results. "On Saturday I was looking at my portfolio and figured that my annual income "Yeah, that's right, but as we discussed the last time we talked, the potential growth from the telecommunications and other issues we bought probably IV. Comparing the data to the benchmarks. The forensic accountant compiles observations into a format in order to compare the data set to the commonly accepted standards. V. Providing conclusions that link question(s) to the benchmarks and then to the data. Conclusions are drawn which relate the forensic techniques employed to the questions of interest. (Waldrup et al, 2004). Romano stated, The two primary types of fraud usually involved in broker- age investment accounts include either "churning" (over-trading) of an account, or suitability/disclosure matters for securities in the account. After answering a couple of questions, she continued, In either instance, the forensic accountant needs to use the values on the client's investment ac- count statement to determine the client's account profitability. There are two questions here. First, what calculations are required using these account values to reflect the amount of profits/losses incurred by the client? Second, are these profits/losses appropriate?" A student queried, Is there a formula that we should use to compute the amount of profits/losses?" In fact, there is a formula, and you probably are already familiar with it. Do you remember how you would compute the profit/losses on an investment account for the year? She turned and wrote on the board the following formula: "Total profits/losses = ending account equity value - beginning account equity value + total withdrawals - total deposits." Blink answered the first call of the day and heard Ralph Martin, with whom he hadn't spoken in several months. After a few perfunctory remarks Ralph began, The Following Monday stock income is significantly less than it was... outweighs any loss income. con howy. What do you think about buying more bonds?" (See http://biz.yahoo. D's agere. However, I'm pretty concerned about the extremely low rates on setting it aside, he thought, "Maybe I'll read this later, but I've never really un- short-term, only 12 stocks of several major companies. These bonds are them, out a buy recommendation on some high-yield bonds that are backed by the "It's good that you called at this time. Our research department has just put until maturity, and pay 12% annually. I haven't seen all of the details on but this really might be a good way to increase your total income and at the same time avoid the interest rate risk of intermediate-term and longer-term bonds." "That certainly sounds good to me. What are the companies that back these bonds? You know that I don't like risky companies. This is all of the "Right off hand I remember that National Telecommunicating Data and Glorious Home Products are two of them. Both of these companies have done e years and are certainly good companies for the Blink rose from his desk to shake hands as they concluded the meeting. "We I'll get you one as soon as I get them. Blink had not read much about these new e prospectus for these STRIDEs available for distribution, but securities but was very attracted to selling them because of the commission. He trusted his manager's recommendation about the new STRIDEs and their safety. "Great. You take care of it. You do what needs to be done." flipped through the two documents filled with financial information. Before Two weeks later Ralph received a thick packet of information and quickly past five long pull . Since these bonds are so short-term, I would be for you to own them. Why don't you come down tomorrow and let me show you some information." money that I have." very well over the very comfortable at $20 The Next Morning Ralph sat across from Blink, who handed him a computer printout with statistics on three of the new "STRIDEs offering by National Telecommunicating Data, Glorious Home Products, and Immediate Biotech. After briefly discussing the three companies, both Blink and Ralph agreed that the best company for Ralph would be National Telecommunicating Data (NTD), whose stock was trading per share. Each $1,000 unit face value of the offering had attached 50 shares of the NTD stock. Ralph used a pencil to compute that the $250,000 currently in CDs would generate $30,000 of income, if invested in STRIDEs, which would give him a total of $46,000 on an annual basis. I like the increased income, but what are we going to do in a from now when these things mature?" "Well, our research department tells us that interest rates should go up in a year or two, and perhaps we can go back into CDs at that time. Anyway, the year additional income from these high quality STRIDEs should help next year." "Yeah, that certainly will help." out over the don't yet have the derstood this financial stuff anyway? One Year Later were no help Blink stammered, Ralph, I'm just as surprised as you. I never imagined that Na- tional Telecommunicating Data would be on the ropes now. This is unbelievable." "Well, what about the principal amount? It was due last week and now your New York office says I've got to accept NTD stock because NTD stock price Three days later Romano received a four-inch deep box containing a 321-page ments, and numerous other papers pertaining to Martin's account. Among these investment objectives in order as: (1) preservation of capital, (2) income, and (3) moderate growth. After reviewing the client's stated objectives, she turned to the year-end statements. The following table gives the values seen by her as went down. I thought this was a bond where my money was safe." Blink coughed nervously and responded, I thought so, too!" Over the next several days there were meetings between Ralph, Blink, and the brokerage office manager. Ralph was disgusted with the situation. They The Lawyer Upon the advice of his personal lawyer , Ralph met with another lawyer who specialized in complaints against brokerage offices. The lawyer carefully listened to what occurred with the STRIDEs at the brokerage office. They agreed that the lawyer would contact a university professor of account- ing who specialized in the area of forensic accounting. Romano Gets a Call Susan Romano entered the mailroom and noticed the pink telephone message slip awaiting her. Later that day she called Lynn Jinks, a lawyer with whom she had worked previously. "Well, what do you have, Lynn?" "I've got a potential client who lost a large portion of his retirement funds in something called a STRIDE, which is a new product of sorts sold by Big STRIDES? What the heck are you talking about? I've never heard of STRIDEs in the financial world. I'm sending you all of the information on this case if you're willing to take neppectus with an attached supplemental prospectus, year-end account state statement that showed the client's statements for the last three years: Brokerage Group." a look at it. The Information was reported on Martin's yearly Statement Period January 1, 2000 - December 31, 2000 1/1/2000 Value 12/31/2000 Value $250,000 $250,000 Bonds 250,000 250,000 CDS 250,000 250,000 Stocks $750,000 $750,000 Total Portfolio Value Income Source for the year: Dividends 7,500 Bond Interest 15,000 CD Interest 12,500 Total Cash Disbursements for the year: $35,000 Total Cash Received for the year: Statement Period January 1, 2001 - December 31, 2001 1/1/2001 Value 12/31/2001 Value Bonds CDs $250,000 $250,000 Stocks 250,000 0 STRIDES 250,000 175,000 0 250,000 Total Portfolio Value $750,000 $675,000 Income Source for the year. Dividends Bond Interest CD Interest 1,000 Total Cash Disbursements for the year: 15,000 Total Cash Received for the year 12,500 $28,500 0 Statement Period January 1, 2002-December 31, 2002 1/1/2002 Value 12/31/2002 Value $250,000 Bonds $265,000 CDS 0 0 175,000 Stocks 175,000 STRIDES 250,000 1,500 (NTD Stock) Total Portfolio Value $4441,500 Dividends 1,000 Bond Interest 15,000 "In December of 2001 Big Brokerage, through Blink, advised Martin that he reinvest maturing CD monies in safe shorter-term investment grade bonds. Toward that end, Big Brokerage, through Blink, advised Martin that he should purchase National Telecommunicating Data bonds called STRIDEs that were tied to National Telecommunicating Data stock. Big Brokerage advised Martin were investment grade and backed by National Telecommunicating Data that: (1) investors would receive very high, double digit returns; (2) the bonds stock that could be sold to protect the principal; and (3) the bonds were safer, secure investment, that Big Brokerage stood behind the investment, and there was no way to lose his principal. Big Brokerage further told Martin that if the short-term investments. Big Brokerage represented to Martin that this was a $675,000 Income Source for the year: Total Cash Disbursements for the year: Total Cash Received for the year: Romano looked at the summary diagram from their article that was written on the chalkboard to her left. She thought, It's obvious that the question of interest is the financial impact incurred relative to the benchmark of a well-managed portfolio. It was pretty clear that Martin's portfolio had experienced significant losses. As to the data, the year-end statements are all that we need. The comparison will be easy." However, Romano will need to evaluate all related information to conclude whether or not the account had been mismanaged. Susan began reading the Bilement of claim, which was prepared for the arbitration between Martin and CD Interest 0 STRIDE Interest 12,500 $28,500 0 Big Brokerage and saw: repay the principal." value of National Telecommunicating Data stock linked to the bonds fell to the value of the principal of the bonds, then the stock could be liquidated to Romano then turned to the many-page prospectus issued by Big Brokerage for the issuance of bonds and could find nothing for the STRIDEs. She turned ately use the proceeds from issuing these STRIDEs to pay for operating costs. She thought about how STRIDEs differ from convertible bonds, which can be exchanged for a given number of shares at a specified price. Convertibles would allow people to have protection of the underlying bond while having potential stock appreciation. put component of the STRIDEs might well force the bond owner to the supplemental prospectus for the STRIDEs and began to determine what type of product these actually were. She read the following: "A STRIDE combines a bond and a put option on a specific stock or index. When an investor purchases a STRIDE, he or she simultaneously purchases a bond and indirectly sells a put option on the underlying common shares or in- dex. This simultaneous transaction provides STRIDE securities with a relatively higher coupon than would otherwise be paid on a traditional corporate bond. This is because the put premium received is combined with the normal coupon rate of interest to produce an enhanced coupon rate. In the case of this specific STRIDE, the coupon rate on the bonds is 5%, while the rest of the enhanced coupon rate of 12% is the put premium. The interest is paid every six months. If the share price for the underlying equity security or index is at or above the strike price of the STRIDE at maturity, the holder of the STRIDE will receive a cash repayment at par. However, if the underlying equity or index is below the strike price of the STRIDE at maturity, the holder will receive payment in the form of a predetermined numbers of shares. Thus, the holder bears the full downside risk of the common stock without protection of principal. It is also important to keep in mind that the STRIDE note is not an obligation of the company whose equity is used as the reference stock." Romano later read in the supplemental prospectus that the holder would receive payment in the form of shares based on the market price per share of the underlying stock at the time the bonds are issued. After reflecting on this, Romano realized that these STRIDEs were actually put-constrained bonds , which were quasi bonds, which paid interest in addi- tion to a deferred put premium. (See http://biz.yahoo.com/opt/basics4.html for discussion on put and call options.) After about an hour, Romano finished reading the prospectus and concluded "What a squirrelly product a misguided bond of sorts. All this investment did the investor to huge potential losses and limited the potential on the upside. Big Brokerage has essentially protected itself from all risks when it sells these required the owner to accept the underlying NTD shares at approximately $200. was open up share regardless of its current market price. In addition, Big Brokerage In contrast, the Romano finally thought to herself about the ethical implications of Big Bro- Stowards give Ralph the "whole story with respect to these STRIDEs and their kerage selling these STRIDEs to Ralph Martin, a 78 year-old retiree. Did Blink prospectus which Romano just finished reading, is it reasonable to think that risk level? Although all of this pertinent information is disclosed in the STRIDES "Joe Investor would understand these put-constrained bonds? 10. Assume you are an arbitration panel member. Would you order the broker- age firm to award Ralph any damages? If so, how much? Why? Susan Romano needs your help on the following questions. UNDERGRADUATE STUDENT QUESTIONS What is the formula to calculate the profit or loss for Martin's investment 1. account? What is the formula to calculate the annual return for Martin's investment 2. account? 3. What is Martin's actual return for 2000, 2001 and 2002? 4. What would have been Martin's return for years 2000, 2001 and 2002 if his portfolio had remained with its initial holdings? (Assume original stock holdings remain unchanged and did not decline, and renewal of the CD.) 5. Explain Martin's responsibilities as the writer of a put option. What are his potential losses if NTD stock declines? 6. Compare and contrast STRIDEs with conventional bonds. (Note: both pay conventional coupons, but STRIDEs have a deferred put premium payable to the owner.) 7. How appropriate were these STRIDEs for a 78 year-old with Martin's stated investment objectives? Search suitability information at NASD Conduct Rule 2310" volume of information? 8. Considering that the prospectus and accompanying supplemental prospectus exceeded 300 pages , is it reasonable to expect Joe Investor to digest this " How does Blink's representation of the STRIDEs as reported in the state- inent of claims contrast with the actual nature of this product , as reported in the supplemental prospectus? ating his current retirement portfolio. Ralph, a 78 year-old retiree, had little CASE STUDY 11: a financial advisor in the same retail brokerage office who "inherited the ac- count. The new broker advised the client's purchase of a put-constrained bond lost a substantial portion of his assets with the new speculative bond. You are as excerpts from the prospectus. A dialogue format is used to present the issues, provided with the client's yearly summary investment account statements, as well facts, and terminology of the case. Late in 2001, Ralph Martin, a former clothes salesman, sat on his patio evalu- interest in investment and had previously depended on his long-term friend The Misguided Bond Seth C. Anderson, Ph.D., CFA Kim Capriotti, Ph.D. Jacksonville University Vincent Shea, Ph.D., CPA St. John's University LEARNING OBJECTIVES After completing and discussing this case, you should be able to Recognize retail broker account mismanagement. Compare conventional bonds with put-constrained bonds. Learn a five-step forensic accounting process. This case features a 78 year-old married retiree who is seeking to improve the income from a retirement portfolio. Although the client has substantial sav- ings, the client is not a sophisticated investor. He had previously relied on his late financial advisor who had recently passed away, but currently he relies on INTRODUCTION RELEVANT FACTS The five-step process they used in the study entails: s split somewhat and financial advisor for investment advice. However, Fred had died almost two years earlier, and Blink Stowards, another advisor, had worked with Ralph since then. At the time of Fred's death, Ralph's $750,000 portfolio was s equally among intermediate term bonds paying income at approximately 6%, blue chip stocks yielding income of approximately 3%, and CDs paying income of approximately 5%. If it had been up to Ralph all of his money would have been in CDs because he was scared of stocks and bonds. Because of Fred's earlier his wife's teaching pension, allowed them to live comfortably and to lend some guidance, the $35,000 portfolio income, along with their social security and Blink had been attentive of Ralph and had suggested several sells of stodgy" equities such Heinz Foods, SCANA (Electric Utility), General Motors, and three natural gas utilities, in order to hopefully benefit the portfolio corpus, of broker account mismanagement. Earlier in the session she had discussed a generalized model for forensic accounting, which she and two other professors A forensic accountant hired as an expert must segment a broad legal ques- tion into inquiries that can be objectively measured. II. Employing benchmarks that are commonly accepted to address the Commonly accepted standards are selected for measuring the objective assistance to several college-age grandchildren. by investing in AT&T, Cisco, and a few other non-dividend paying telecom- munications related stocks. The high-tech stocks had declined (although the old stodgy equities maintained their market values), but both Ralph and Blink were convinced that their long-term growth potential outweighed any other price risk. However, the CD component would be maturing very soon and then would need to be reinvested. Looking in his local paper's business section, Ralph saw CD rates at 2%, which would generate only $5,000 on the $250,000 principal in CDs. Ralph mulled over the decline in income of their portfolio currently relative to the income generated earlier. He thought to himself that perhaps Blink might be able to make some suggestions which would supplement his annual income. He decided to call Blink the following Monday. Susan Romano, a professor of accounting, was ending her afternoon forensic accounting class with a discussion of how to investigate the possible existence Meanwhile, in the Classroom had earlier presented in an article. 1. Defining the question(s) of interest. question(s). inquiries com/flg/g.html for discussion of bond terminology.) III. Cleaning data in a methodical fashion, which objectively allows the database and unrepresentative observations in order to minimize the effects of data- to be compared to the benchmarks set forth. Data are purged of unreliable entry error and increase the reliability of results. "On Saturday I was looking at my portfolio and figured that my annual income "Yeah, that's right, but as we discussed the last time we talked, the potential growth from the telecommunications and other issues we bought probably IV. Comparing the data to the benchmarks. The forensic accountant compiles observations into a format in order to compare the data set to the commonly accepted standards. V. Providing conclusions that link question(s) to the benchmarks and then to the data. Conclusions are drawn which relate the forensic techniques employed to the questions of interest. (Waldrup et al, 2004). Romano stated, The two primary types of fraud usually involved in broker- age investment accounts include either "churning" (over-trading) of an account, or suitability/disclosure matters for securities in the account. After answering a couple of questions, she continued, In either instance, the forensic accountant needs to use the values on the client's investment ac- count statement to determine the client's account profitability. There are two questions here. First, what calculations are required using these account values to reflect the amount of profits/losses incurred by the client? Second, are these profits/losses appropriate?" A student queried, Is there a formula that we should use to compute the amount of profits/losses?" In fact, there is a formula, and you probably are already familiar with it. Do you remember how you would compute the profit/losses on an investment account for the year? She turned and wrote on the board the following formula: "Total profits/losses = ending account equity value - beginning account equity value + total withdrawals - total deposits." Blink answered the first call of the day and heard Ralph Martin, with whom he hadn't spoken in several months. After a few perfunctory remarks Ralph began, The Following Monday stock income is significantly less than it was... outweighs any loss income. con howy. What do you think about buying more bonds?" (See http://biz.yahoo. D's agere. However, I'm pretty concerned about the extremely low rates on setting it aside, he thought, "Maybe I'll read this later, but I've never really un- short-term, only 12 stocks of several major companies. These bonds are them, out a buy recommendation on some high-yield bonds that are backed by the "It's good that you called at this time. Our research department has just put until maturity, and pay 12% annually. I haven't seen all of the details on but this really might be a good way to increase your total income and at the same time avoid the interest rate risk of intermediate-term and longer-term bonds." "That certainly sounds good to me. What are the companies that back these bonds? You know that I don't like risky companies. This is all of the "Right off hand I remember that National Telecommunicating Data and Glorious Home Products are two of them. Both of these companies have done e years and are certainly good companies for the Blink rose from his desk to shake hands as they concluded the meeting. "We I'll get you one as soon as I get them. Blink had not read much about these new e prospectus for these STRIDEs available for distribution, but securities but was very attracted to selling them because of the commission. He trusted his manager's recommendation about the new STRIDEs and their safety. "Great. You take care of it. You do what needs to be done." flipped through the two documents filled with financial information. Before Two weeks later Ralph received a thick packet of information and quickly past five long pull . Since these bonds are so short-term, I would be for you to own them. Why don't you come down tomorrow and let me show you some information." money that I have." very well over the very comfortable at $20 The Next Morning Ralph sat across from Blink, who handed him a computer printout with statistics on three of the new "STRIDEs offering by National Telecommunicating Data, Glorious Home Products, and Immediate Biotech. After briefly discussing the three companies, both Blink and Ralph agreed that the best company for Ralph would be National Telecommunicating Data (NTD), whose stock was trading per share. Each $1,000 unit face value of the offering had attached 50 shares of the NTD stock. Ralph used a pencil to compute that the $250,000 currently in CDs would generate $30,000 of income, if invested in STRIDEs, which would give him a total of $46,000 on an annual basis. I like the increased income, but what are we going to do in a from now when these things mature?" "Well, our research department tells us that interest rates should go up in a year or two, and perhaps we can go back into CDs at that time. Anyway, the year additional income from these high quality STRIDEs should help next year." "Yeah, that certainly will help." out over the don't yet have the derstood this financial stuff anyway? One Year Later were no help Blink stammered, Ralph, I'm just as surprised as you. I never imagined that Na- tional Telecommunicating Data would be on the ropes now. This is unbelievable." "Well, what about the principal amount? It was due last week and now your New York office says I've got to accept NTD stock because NTD stock price Three days later Romano received a four-inch deep box containing a 321-page ments, and numerous other papers pertaining to Martin's account. Among these investment objectives in order as: (1) preservation of capital, (2) income, and (3) moderate growth. After reviewing the client's stated objectives, she turned to the year-end statements. The following table gives the values seen by her as went down. I thought this was a bond where my money was safe." Blink coughed nervously and responded, I thought so, too!" Over the next several days there were meetings between Ralph, Blink, and the brokerage office manager. Ralph was disgusted with the situation. They The Lawyer Upon the advice of his personal lawyer , Ralph met with another lawyer who specialized in complaints against brokerage offices. The lawyer carefully listened to what occurred with the STRIDEs at the brokerage office. They agreed that the lawyer would contact a university professor of account- ing who specialized in the area of forensic accounting. Romano Gets a Call Susan Romano entered the mailroom and noticed the pink telephone message slip awaiting her. Later that day she called Lynn Jinks, a lawyer with whom she had worked previously. "Well, what do you have, Lynn?" "I've got a potential client who lost a large portion of his retirement funds in something called a STRIDE, which is a new product of sorts sold by Big STRIDES? What the heck are you talking about? I've never heard of STRIDEs in the financial world. I'm sending you all of the information on this case if you're willing to take neppectus with an attached supplemental prospectus, year-end account state statement that showed the client's statements for the last three years: Brokerage Group." a look at it. The Information was reported on Martin's yearly Statement Period January 1, 2000 - December 31, 2000 1/1/2000 Value 12/31/2000 Value $250,000 $250,000 Bonds 250,000 250,000 CDS 250,000 250,000 Stocks $750,000 $750,000 Total Portfolio Value Income Source for the year: Dividends 7,500 Bond Interest 15,000 CD Interest 12,500 Total Cash Disbursements for the year: $35,000 Total Cash Received for the year: Statement Period January 1, 2001 - December 31, 2001 1/1/2001 Value 12/31/2001 Value Bonds CDs $250,000 $250,000 Stocks 250,000 0 STRIDES 250,000 175,000 0 250,000 Total Portfolio Value $750,000 $675,000 Income Source for the year. Dividends Bond Interest CD Interest 1,000 Total Cash Disbursements for the year: 15,000 Total Cash Received for the year 12,500 $28,500 0 Statement Period January 1, 2002-December 31, 2002 1/1/2002 Value 12/31/2002 Value $250,000 Bonds $265,000 CDS 0 0 175,000 Stocks 175,000 STRIDES 250,000 1,500 (NTD Stock) Total Portfolio Value $4441,500 Dividends 1,000 Bond Interest 15,000 "In December of 2001 Big Brokerage, through Blink, advised Martin that he reinvest maturing CD monies in safe shorter-term investment grade bonds. Toward that end, Big Brokerage, through Blink, advised Martin that he should purchase National Telecommunicating Data bonds called STRIDEs that were tied to National Telecommunicating Data stock. Big Brokerage advised Martin were investment grade and backed by National Telecommunicating Data that: (1) investors would receive very high, double digit returns; (2) the bonds stock that could be sold to protect the principal; and (3) the bonds were safer, secure investment, that Big Brokerage stood behind the investment, and there was no way to lose his principal. Big Brokerage further told Martin that if the short-term investments. Big Brokerage represented to Martin that this was a $675,000 Income Source for the year: Total Cash Disbursements for the year: Total Cash Received for the year: Romano looked at the summary diagram from their article that was written on the chalkboard to her left. She thought, It's obvious that the question of interest is the financial impact incurred relative to the benchmark of a well-managed portfolio. It was pretty clear that Martin's portfolio had experienced significant losses. As to the data, the year-end statements are all that we need. The comparison will be easy." However, Romano will need to evaluate all related information to conclude whether or not the account had been mismanaged. Susan began reading the Bilement of claim, which was prepared for the arbitration between Martin and CD Interest 0 STRIDE Interest 12,500 $28,500 0 Big Brokerage and saw: repay the principal." value of National Telecommunicating Data stock linked to the bonds fell to the value of the principal of the bonds, then the stock could be liquidated to Romano then turned to the many-page prospectus issued by Big Brokerage for the issuance of bonds and could find nothing for the STRIDEs. She turned ately use the proceeds from issuing these STRIDEs to pay for operating costs. She thought about how STRIDEs differ from convertible bonds, which can be exchanged for a given number of shares at a specified price. Convertibles would allow people to have protection of the underlying bond while having potential stock appreciation. put component of the STRIDEs might well force the bond owner to the supplemental prospectus for the STRIDEs and began to determine what type of product these actually were. She read the following: "A STRIDE combines a bond and a put option on a specific stock or index. When an investor purchases a STRIDE, he or she simultaneously purchases a bond and indirectly sells a put option on the underlying common shares or in- dex. This simultaneous transaction provides STRIDE securities with a relatively higher coupon than would otherwise be paid on a traditional corporate bond. This is because the put premium received is combined with the normal coupon rate of interest to produce an enhanced coupon rate. In the case of this specific STRIDE, the coupon rate on the bonds is 5%, while the rest of the enhanced coupon rate of 12% is the put premium. The interest is paid every six months. If the share price for the underlying equity security or index is at or above the strike price of the STRIDE at maturity, the holder of the STRIDE will receive a cash repayment at par. However, if the underlying equity or index is below the strike price of the STRIDE at maturity, the holder will receive payment in the form of a predetermined numbers of shares. Thus, the holder bears the full downside risk of the common stock without protection of principal. It is also important to keep in mind that the STRIDE note is not an obligation of the company whose equity is used as the reference stock." Romano later read in the supplemental prospectus that the holder would receive payment in the form of shares based on the market price per share of the underlying stock at the time the bonds are issued. After reflecting on this, Romano realized that these STRIDEs were actually put-constrained bonds , which were quasi bonds, which paid interest in addi- tion to a deferred put premium. (See http://biz.yahoo.com/opt/basics4.html for discussion on put and call options.) After about an hour, Romano finished reading the prospectus and concluded "What a squirrelly product a misguided bond of sorts. All this investment did the investor to huge potential losses and limited the potential on the upside. Big Brokerage has essentially protected itself from all risks when it sells these required the owner to accept the underlying NTD shares at approximately $200. was open up share regardless of its current market price. In addition, Big Brokerage In contrast, the Romano finally thought to herself about the ethical implications of Big Bro- Stowards give Ralph the "whole story with respect to these STRIDEs and their kerage selling these STRIDEs to Ralph Martin, a 78 year-old retiree. Did Blink prospectus which Romano just finished reading, is it reasonable to think that risk level? Although all of this pertinent information is disclosed in the STRIDES "Joe Investor would understand these put-constrained bonds? 10. Assume you are an arbitration panel member. Would you order the broker- age firm to award Ralph any damages? If so, how much? Why? Susan Romano needs your help on the following questions. UNDERGRADUATE STUDENT QUESTIONS What is the formula to calculate the profit or loss for Martin's investment 1. account? What is the formula to calculate the annual return for Martin's investment 2. account? 3. What is Martin's actual return for 2000, 2001 and 2002? 4. What would have been Martin's return for years 2000, 2001 and 2002 if his portfolio had remained with its initial holdings? (Assume original stock holdings remain unchanged and did not decline, and renewal of the CD.) 5. Explain Martin's responsibilities as the writer of a put option. What are his potential losses if NTD stock declines? 6. Compare and contrast STRIDEs with conventional bonds. (Note: both pay conventional coupons, but STRIDEs have a deferred put premium payable to the owner.) 7. How appropriate were these STRIDEs for a 78 year-old with Martin's stated investment objectives? Search suitability information at NASD Conduct Rule 2310" volume of information? 8. Considering that the prospectus and accompanying supplemental prospectus exceeded 300 pages , is it reasonable to expect Joe Investor to digest this " How does Blink's representation of the STRIDEs as reported in the state- inent of claims contrast with the actual nature of this product , as reported in the supplemental prospectusStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started