only need requirements 5-9 done. WILL like if it is correct

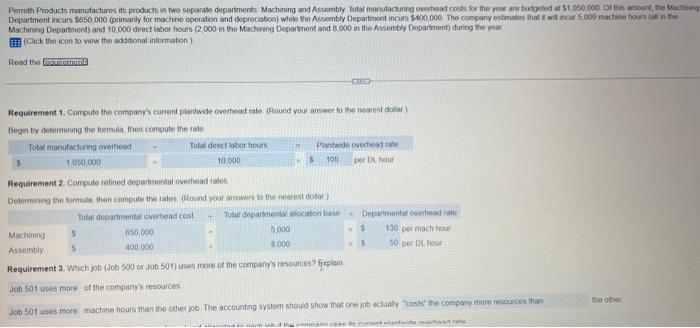

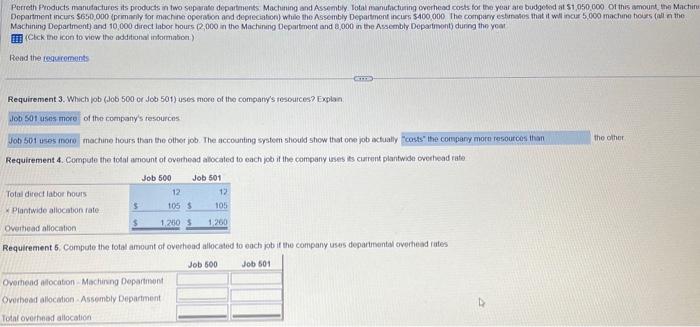

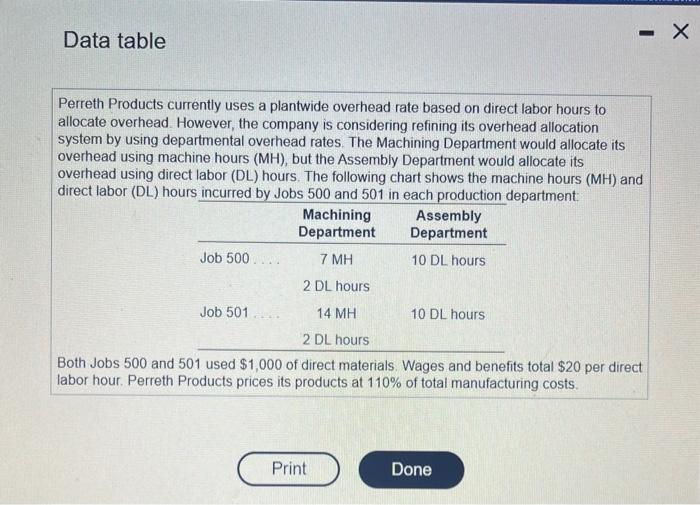

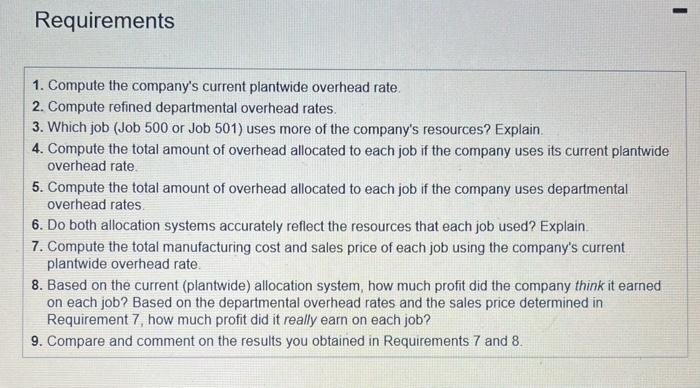

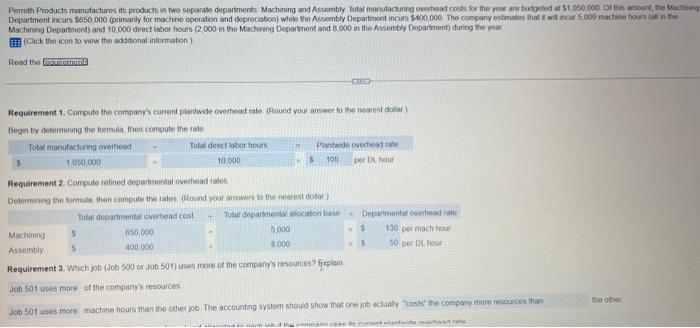

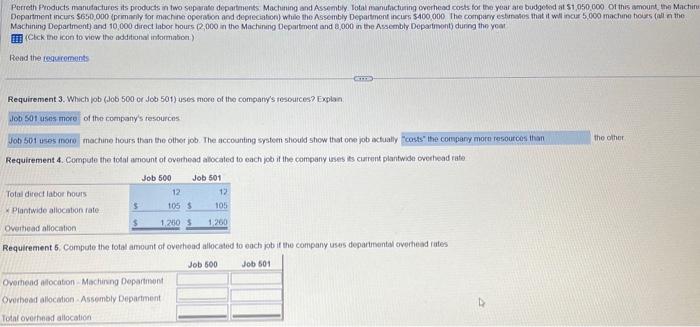

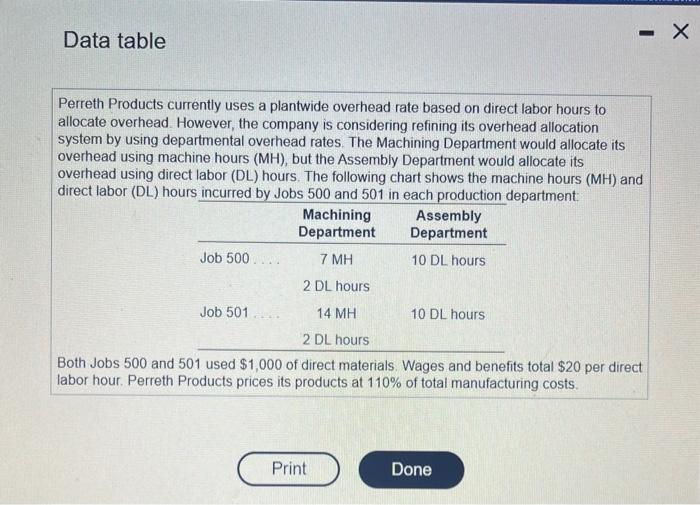

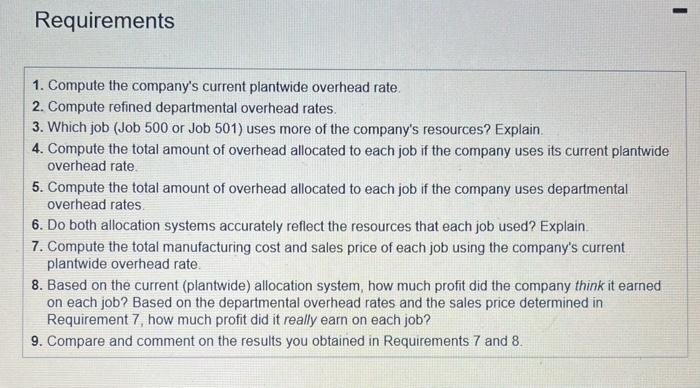

Data table Perreth Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department: Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benefits total $20 per direct labor hour. Perreth Products prices its products at 110% of total manufacturing costs. Requirements 1. Compute the company's current plantwide overhead rate. 2. Compute refined departmental overhead rates. 3. Which job (Job 500 or Job 501) uses more of the company's resources? Explain. 4. Compute the total amount of overhead allocated to each job if the company uses its current plantwide overhead rate. 5. Compute the total amount of overhead allocated to each job if the company uses departmental overhead rates. 6. Do both allocation systems accurately reflect the resources that each job used? Explain 7. Compute the total manufacturing cost and sales price of each job using the company's current plantwide overhead rate. 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Based on the departmental overhead rates and the sales price determined in Requirement 7 , how much profit did it really earn on each job? 9. Compare and comment on the results you obtained in Requirements 7 and 8. Mschining Department) and 10,000 direct labor bours, (2,000 in the Machining Depaitment and B,000 in the Assembly Depatinont) during the yeat (Clek me icon to view tho additional informabioer) Read the regurements Requirement 3. Which job (Job 500 or Job 501) uses more of tho company/s resoutces? Explan of the company's tesourcos machine hours than the other job. The accounting systeen should show that one job actually the other Requirement 4. Compule the todal amount of owerhead atocaled to each job if the company irsers is caurent plantwide oreshead rate (Cick tho icon to view the additonal information) Reasd the Bega by docormining the focmula, tron comsute the rate Requirement 2 Compute refined dopartmental overtwad robs Requiremeat 3 . Which job (job 500 or job 501) uses more of the compary's resounces? firplen. of the companys resources machine hours than the other job. The accotenteng system shoud show that one job actualy "costs" the company more resouices than Eo othet