Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only need to check answers for 6,7 and 8. ACCT 215 (CT) Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to

only need to check answers for 6,7 and 8.

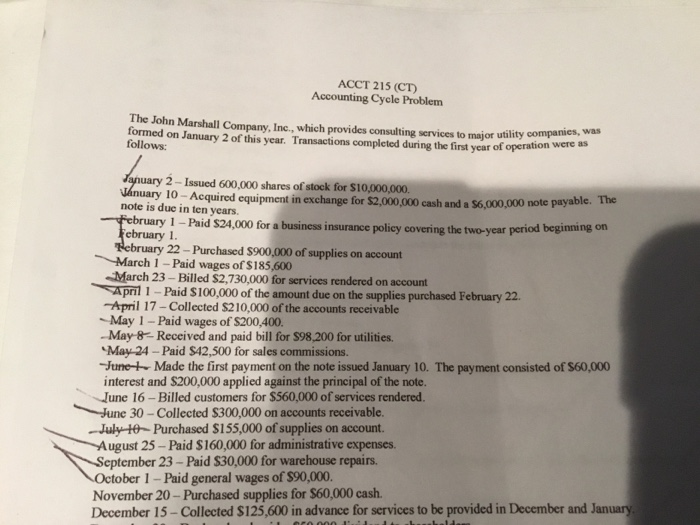

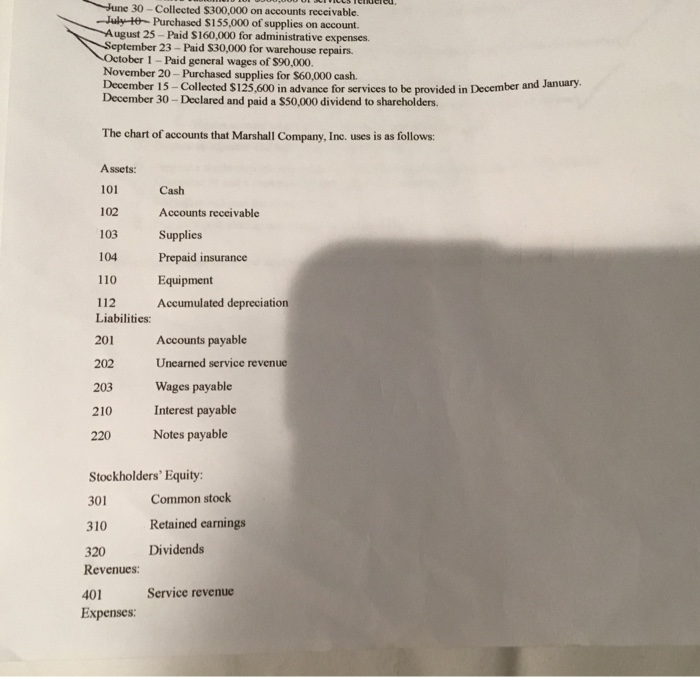

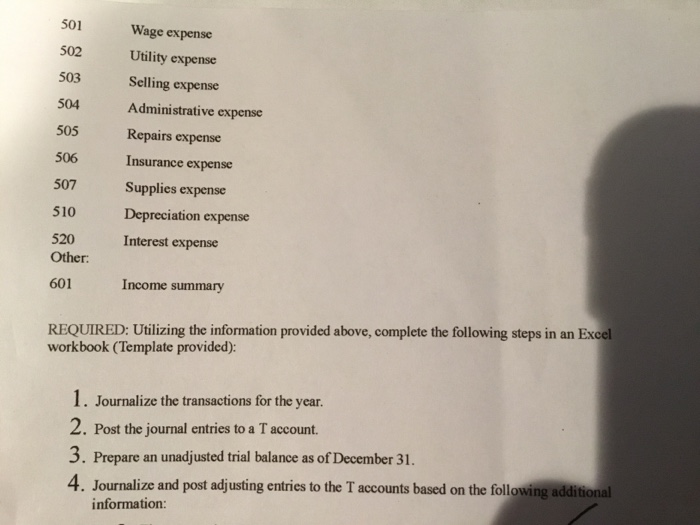

ACCT 215 (CT) Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: Paypwarya January 2 - Issued 600,000 shares of stock for $10,000,000 January 10 - Acquired equipment in exchange for $2,000,000 cash and a $6,000,000 note payable. The February 1 - Paid $24,000 for a business insurance policy covering the two-year period beginning on February 1. February 22 - Purchased $900,000 of supplies on account March 1 - Paid wages of $185,600 March 23 - Billed $2,730,000 for services rendered on account April 1 - Paid $100,000 of the amount due on the supplies purchased February 22. April 17 - Collected $210,000 of the accounts receivable May 1 - Paid wages of $200,400 - May 8 - Received and paid bill for $98,200 for utilities. "May 24 - Paid $42,500 for sales commissions. June to Made the first payment on the note issued January 10. The payment consisted of $60,000 interest and $200,000 applied against the principal of the note. June 16 - Billed customers for $560,000 of services rendered. June 30 - Collected $300,000 on accounts receivable. - July 10- Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000. November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $125,600 in advance for services to provided in December and January June 30 - Collected $300,000 on accounts receivable. --July-to-Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000 November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $125,600 in advance for services to be provided in December and January December 30 - Declared and paid a $50,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows: Assets: 101 Cash 102 Accounts receivable 103 Supplies 104 Prepaid insurance 110 Equipment 112 Accumulated depreciation Liabilities: 201 Accounts payable 202 Unearned service revenue 203 Wages payable 210 Interest payable 220 Notes payable Stockholders' Equity: 301 Common stock 310 Retained earnings 320 Dividends Revenues: 401 Service revenue Expenses: 501 502 503 504 505 Wage expense Utility expense Selling expense Administrative expense Repairs expense Insurance expense Supplies expense Depreciation expense Interest expense 506 507 510 520 Other: 601 Income summary REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31. 4. Journalize and post adjusting entries to the T accounts based on the following additional information: year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31. 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is $400,000. C. The company provided $70,000 of services related to the advance collection of December 15. d. There are $500,000 of supplies on hand at the end of the year. e. An additional S170,000 of interest has accrued on the note by the end of the yean f. Wilson accrued wages of S200,000 at the end of the car. 5. Prepare an adjusted trial balance as of December 31. 6. Prepare a single-step income statement and statement of retained carnings for the year ended December 31 and a classified balance sheet as of December 31. 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31. Submit your completed Excel workbook in Black Board under assignments by the due date. ACCT 215 (CT) Accounting Cycle Problem The John Marshall Company, Inc., which provides consulting services to major utility companies, was formed on January 2 of this year. Transactions completed during the first year of operation were as follows: Paypwarya January 2 - Issued 600,000 shares of stock for $10,000,000 January 10 - Acquired equipment in exchange for $2,000,000 cash and a $6,000,000 note payable. The February 1 - Paid $24,000 for a business insurance policy covering the two-year period beginning on February 1. February 22 - Purchased $900,000 of supplies on account March 1 - Paid wages of $185,600 March 23 - Billed $2,730,000 for services rendered on account April 1 - Paid $100,000 of the amount due on the supplies purchased February 22. April 17 - Collected $210,000 of the accounts receivable May 1 - Paid wages of $200,400 - May 8 - Received and paid bill for $98,200 for utilities. "May 24 - Paid $42,500 for sales commissions. June to Made the first payment on the note issued January 10. The payment consisted of $60,000 interest and $200,000 applied against the principal of the note. June 16 - Billed customers for $560,000 of services rendered. June 30 - Collected $300,000 on accounts receivable. - July 10- Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000. November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $125,600 in advance for services to provided in December and January June 30 - Collected $300,000 on accounts receivable. --July-to-Purchased $155,000 of supplies on account. August 25 - Paid $160,000 for administrative expenses. September 23 - Paid $30,000 for warehouse repairs. October 1 - Paid general wages of $90,000 November 20 - Purchased supplies for $60,000 cash. December 15 - Collected $125,600 in advance for services to be provided in December and January December 30 - Declared and paid a $50,000 dividend to shareholders. The chart of accounts that Marshall Company, Inc. uses is as follows: Assets: 101 Cash 102 Accounts receivable 103 Supplies 104 Prepaid insurance 110 Equipment 112 Accumulated depreciation Liabilities: 201 Accounts payable 202 Unearned service revenue 203 Wages payable 210 Interest payable 220 Notes payable Stockholders' Equity: 301 Common stock 310 Retained earnings 320 Dividends Revenues: 401 Service revenue Expenses: 501 502 503 504 505 Wage expense Utility expense Selling expense Administrative expense Repairs expense Insurance expense Supplies expense Depreciation expense Interest expense 506 507 510 520 Other: 601 Income summary REQUIRED: Utilizing the information provided above, complete the following steps in an Excel workbook (Template provided): 1. Journalize the transactions for the year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31. 4. Journalize and post adjusting entries to the T accounts based on the following additional information: year. 2. Post the journal entries to a T account. 3. Prepare an unadjusted trial balance as of December 31. 4. Journalize and post adjusting entries to the T accounts based on the following additional information: a. Eleven months of the insurance policy expired by the end of the year. b. Depreciation for equipment is $400,000. C. The company provided $70,000 of services related to the advance collection of December 15. d. There are $500,000 of supplies on hand at the end of the year. e. An additional S170,000 of interest has accrued on the note by the end of the yean f. Wilson accrued wages of S200,000 at the end of the car. 5. Prepare an adjusted trial balance as of December 31. 6. Prepare a single-step income statement and statement of retained carnings for the year ended December 31 and a classified balance sheet as of December 31. 7. Journalize and post the closing entries 8. Prepare a post-closing trial balance as of December 31. Submit your completed Excel workbook in Black Board under assignments by the due date Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started