Only part A thanx

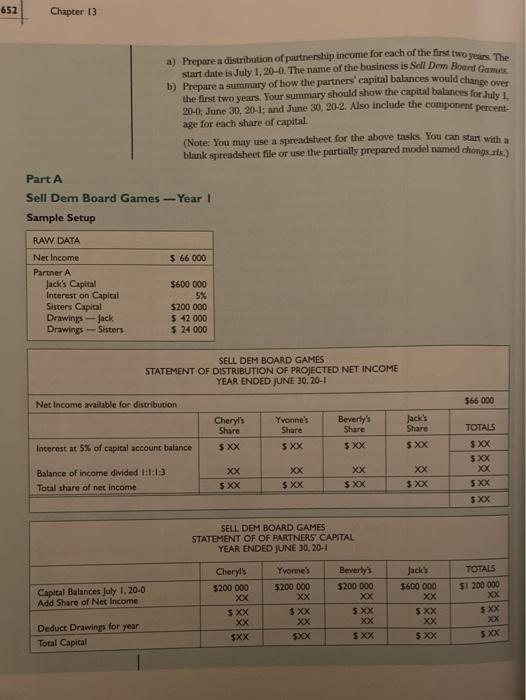

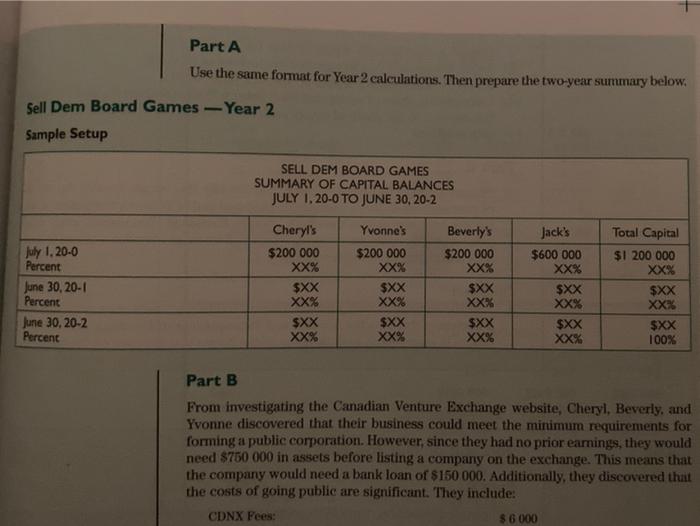

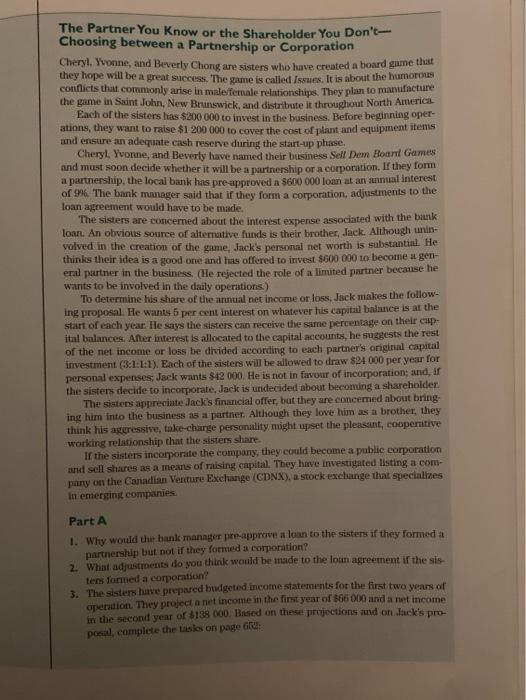

The Partner You Know or the Shareholder You Don't Choosing between a Partnership or Corporation Cheryl. Yvonne, and Beverly Chong are sisters who have created a board game that they hope will be a great success. The game is called Issues. It is about the humoros conflicts that commonly arise in male/female relationships. They plan to manufacture the game in Saint John, New Brunswick, and distribute it throughout North America Each of the sisters has $200 000 to invest in the business. Before beginning oper- ations, they want to raise $1 200 000 to cover the cost of plant and equipment items and ensure an adequate cash reserve during the start-up phase. Cheryl, Yvonne, and Beverly have named their business Sell Dem Board Games and must soon decide whether it will be a partnership or a corporation. If they form a partnership, the local bank has pre-approved a 5600 000 loan at an annual interest of 9. The bank manager said that if they form a corporation, adjustments to the loan agreement would have to be made. The sisters are concerned about the interest expense associated with the bank loan. An obvious source of alternative funds is their brother, Jack. Although unin- volved in the creation of the game, Jack's personal net worth is substantial. He thinks their idea is a good one and has offered to invest $600 000 to become a gen- eral partner in the business. (He rejected the role of a limited partner because he wants to be involved in the daily operations.) To determine his share of the annual net income or loss, Jack makes the follow ing proposal. He wants 5 per cent interest on whatever his capital balance is at the start of each year. He says the sisters can receive the same percentage on their cap- ital balances. After interest is allocated to the capital accounts, he suggests the rest of the net income or loss be divided according to each partner's original capital investment (3:1:1:1). Each of the sisters will be allowed to draw 824 000 per year for personal expenses: Jack wants $42 000. He is not in favour of incorporation; and, if the sisters decide to incorporate, Jack is undecided about becoming a shareholder The sisters appreciate Jack's financial offer, but they are concerned about bring. ing him into the business as a partner. Although they love him as a brother, they think his agressive, take-charge personality might upset the pleasant, cooperative working relationship that the sisters share If the sisters incorporate the company, they could become a public corporation and sell shares as a means of raising capital. They have investigated listing a com- pany on the Canadian Venture Exchange (CDNX), a stock exchange that specializes in emerging companies Part A 1. Why would the bank manager pre-approve a loan to the sisters if they formed a partnership but not if they formed a corporation? 2. What adjustments do you think would be made to the loan agreement if the sis ters formed a corporation? 3. The sisters have prepared budgeted income statements for the first two years of operation. They project a net income in the first year of 685 000 and a net income in the second year of 6138 000. Based on these projections and on Jack's pro posal, complete the takes on page 2 652 Chapter 13 a) Prepare a distribution of partnership income for each of the first two years. The start date is July 1, 20-0. The name of the business is Sell Dem Board Games b) Prepare a summary of how the partners capital balances would change over the first two years Your summary should show the capital balances for July 1. 20-0, June 30, 20-1; and June 30, 20-2. Also include the component percent age for each share of capital (Note: You may use a spreadsheet for the above tasks. You can start with a blank spreadsheet file or use the partially prepared model named chongs etc.) Part A Sell Dem Board Games Year Sample Setup $ 66 000 RAW DATA Net Income Partner A Jack's Capital Interest on Capital Sisters Capital Drawings - Jack Drawings --Sisters $600 000 5% $200 000 $ 42 000 $ 24 000 SELL DEM BOARD GAMES STATEMENT OF DISTRIBUTION OF PROJECTED NET INCOME YEAR ENDED JUNE 30, 20-1 Net Income available for distribution 566 000 Cheryls Share $ XX Yvonne's Share $ XX Beverly's Share $XX Jack's Share $XX Interest at 5% of capital account balance TOTALS $XX $ XX XOX $XX $XX XX Balance of income divided lil:13 Total share of net income XX $XX XX $XOX $ XX $ XX SELL DEM BOARD GAMES STATEMENT OF OF PARTNERS' CAPITAL YEAR ENDED JUNE 30,20-1 Jacks $600 000 Capital Balances July 1, 20-0 Add Share of Net Income Cheryl's $200 000 XX $ XX Yvonne) $200 000 XX $XX XX $XX Beverly's $200 000 5 XX TOTALS $1 200 000 5 X XOX 5xx $XX XX Deduct Drawings for year Total Capital SXX $ XX $ XX Part A Use the same format for Year 2 calculations. Then prepare the two-year summary below. Sell Dem Board Games -Year 2 Sample Setup SELL DEM BOARD GAMES SUMMARY OF CAPITAL BALANCES JULY 1, 20-0 TO JUNE 30, 20-2 July 1, 20-0 Percent June 30, 20-1 Percent June 30, 20-2 Percent Cheryl's $200 000 XX% $XX XX% $XX XX% Yvonne's $200 000 XX% $XX XX% $XX XX% Beverly's $200 000 XX% $XX XX% $XX XX% Jack's $600 000 XX% $XX XX% $XX XX% Total Capital $1 200 000 XX% $XX XX $XX 100% Part B From investigating the Canadian Venture Exchange website, Cheryl, Beverly, and Yvonne discovered that their business could meet the minimum requirements for forming a public corporation. However, since they had no prior earnings, they would need $750 000 in assets before listing a company on the exchange. This means that the company would need a bank loan of $150 000. Additionally, they discovered that the costs of going public are significant. They include: CDNX Fees: $ 6000