Question

***Only Part B needs to be answered thanks!!*** (Part A only there for reference) Marin Inc. follows IFRS and has adopted the policy of classifying

***Only Part B needs to be answered thanks!!*** (Part A only there for reference)

Marin Inc. follows IFRS and has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities. Comparative SFP accounts of Marin Inc., and its statement of income for the year ending December 31, 2020, follow:

| December 31 | ||||||||||||

| 2020 | 2019 | Change | ||||||||||

| Cash | $41,000 | $47,000 | $(6,000 | ) | ||||||||

| Cash equivalents (Note 1) | 31,000 | 41,400 | (10,400 | ) | ||||||||

| Accounts receivable | 347,000 | 284,000 | 63,000 | |||||||||

| Prepaid insurance | 17,200 | 34,200 | (17,000 | ) | ||||||||

| Inventory | 404,000 | 368,000 | 36,000 | |||||||||

| Supplies | 13,000 | 17,000 | (4,000 | ) | ||||||||

| Long-term investment, at equity (Note 7) | 420,000 | 409,800 | 10,200 | |||||||||

| Land (Note 6) | 637,000 | 513,000 | 124,000 | |||||||||

| Buildings (Note 3) | 1,310,000 | 1,280,000 | 30,000 | |||||||||

| Accumulated depreciationbuildings | (400,000 | ) | (360,000 | ) | (40,000 | ) | ||||||

| Equipment (Note 4) | 633,000 | 641,400 | (8,400 | ) | ||||||||

| Accumulated depreciationequipment | (160,000 | ) | (135,000 | ) | (25,000 | ) | ||||||

| Patent | 100,000 | 100,000 | 0 | |||||||||

| Accumulated amortization | (40,000 | ) | (35,000 | ) | (5,000 | ) | ||||||

| $3,353,200 | $3,205,800 | $147,400 | ||||||||||

| Bank overdrafts (temporary) | $0 | $80,400 | $(80,400 | ) | ||||||||

| Accounts payable | 163,000 | 157,000 | 6,000 | |||||||||

| Income tax payable | 26,000 | 35,000 | (9,000 | ) | ||||||||

| Accrued liabilities | 55,000 | 42,000 | 13,000 | |||||||||

| Dividends payable | 21,000 | 53,000 | (32,000 | ) | ||||||||

| Long-term notes payable | 420,000 | 460,000 | (40,000 | ) | ||||||||

| Bonds payable | 999,000 | 995,000 | 4,000 | |||||||||

| Preferred shares (Note 2) | 486,000 | 380,000 | 106,000 | |||||||||

| Common shares | 744,000 | 677,000 | 67,000 | |||||||||

| Retained earnings | 439,200 | 326,400 | 112,800 | |||||||||

| $3,353,200 | $3,205,800 | $147,400 | ||||||||||

Income Statement

| Revenues | |||||

| Sales revenue | $986,000 | ||||

| Investment income | 90,000 | $1,076,000 | |||

| Expenses and Losses | |||||

| Cost of goods sold | 310,000 | ||||

| Sales commissions expense | 105,000 | ||||

| Operating expenses (Note 5) | 166,000 | ||||

| Salaries and wages expense | 103,000 | ||||

| Interest expense | 91,000 | ||||

| Loss on disposal of equipment (Note 4) | 11,000 | ||||

| Income tax expense | 96,000 | 882,000 | |||

| Net Income | $194,000 | ||||

The following is additional information about Marins transactions during the year ended December 31, 2020.

| 1. | The cash equivalents are typically term deposits that are very liquid and mature on average in 60 days. The bank overdrafts are temporary and reverse within a few days. Marin has opted to show these as cash and cash equivalents on its statement of cash flows. | |

| 2. | During the year, preferred shares with a carrying amount of $18,000 were converted to common shares. | |

| 3. | There were no disposals of buildings during the year 2020. | |

| 4. | Equipment with an original cost of $46,000 and carrying amount of $14,000 was sold at a loss during the year. | |

| 5. | All depreciation and amortization expense is included in operating expenses. | |

| 6. | During the year, Marin obtained land with a fair value of $100,000 in exchange for its preferred shares. | |

| 7. | Investment income includes the equity earnings of $62,000 from a long-term investment accounted for using the equity method and from interest revenue on the short-term investments referred to in note 1 above. |

A. Prepare the statement of cash flows for the year ended December 31, 2020, for Marin Inc. using the indirect method. Prepare any additional disclosure notes that are required, including a table that shows the details of the cash and cash equivalents accounts at the end of each period.

B. Prepare the operating activities section of the statement using the direct format.

***Only Part B needs to be answered thanks!!***

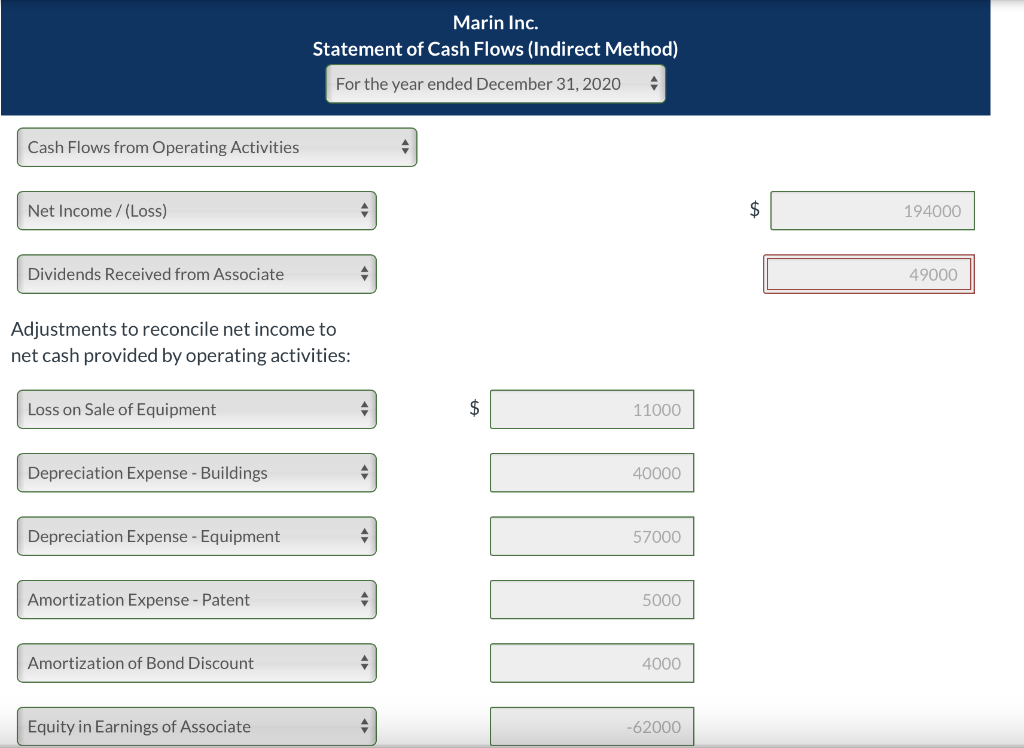

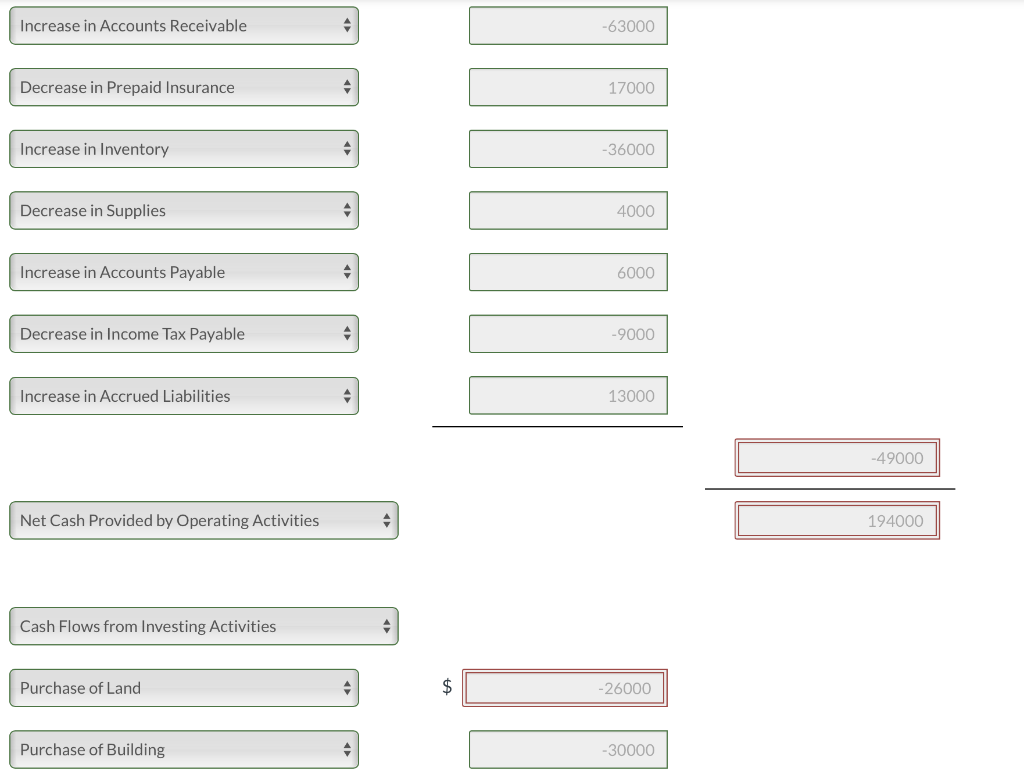

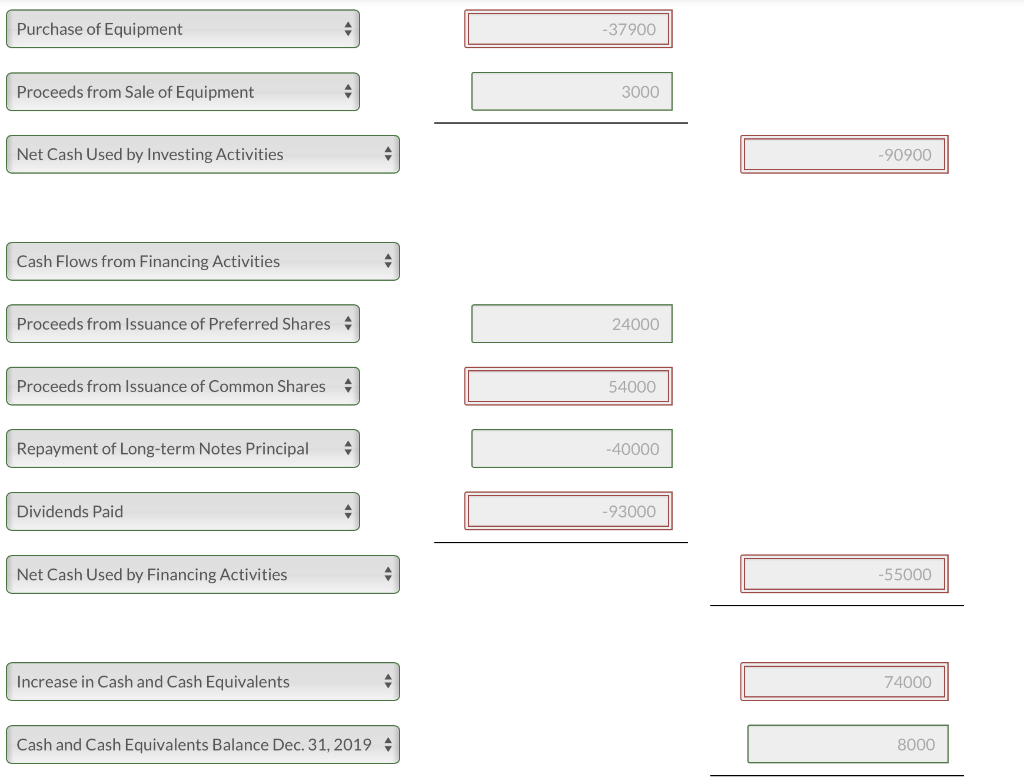

Marin Inc. Statement of Cash Flows (Indirect Method) For the year ended December 31, 2020 Cash Flows from Operating Activities Net Income /(Loss) $ 194000 Dividends Received from Associate 49000 Adjustments to reconcile net income to net cash provided by operating activities: Loss on Sale of Equipment $ 11000 Depreciation Expense - Buildings 40000 Depreciation Expense - Equipment 57000 Amortization Expense - Patent 5000 Amortization of Bond Discount 4000 Equity in Earnings of Associate -62000 Increase in Accounts Receivable -63000 Decrease in Prepaid Insurance 17000 Increase in Inventory -36000 Decrease in Supplies 4000 Increase in Accounts Payable 6000 Decrease in Income Tax Payable 2 -9000 Increase in Accrued Liabilities 13000 -49000 Net Cash Provided by Operating Activities 194000 Cash Flows from Investing Activities Purchase of Land $ -26000 Purchase of Building -30000 Purchase of Equipment a -37900 Proceeds from Sale of Equipment 3000 Net Cash Used by Investing Activities -90900 Cash Flows from Financing Activities Proceeds from Issuance of Preferred Shares 24000 Proceeds from Issuance of Common Shares 54000 Repayment of Long-term Notes Principal -40000 Dividends Paid -93000 Net Cash Used by Financing Activities -55000 IN Increase in Cash and Cash Equivalents 74000 Cash and Cash Equivalents Balance Dec. 31, 2019 8000 Cash and Cash Equivalents Balance Dec. 31, 2020 $ 82000 Non-cash investing and financing activities Land Obtained for Preferred Shares $ 100000 Additional disclosures: Interest Paid $ 95000 Income Taxes Paid $ 105000 Cash and Cash Equivalents: 2020 2019 Cash 4 $ 41000 $ 47000 Cash Equivalents 31000 41400 Temporary Bank Overdrafts O 80400 $ 72000 $ 8000 Marin Inc. Statement of Cash Flows (Direct Method) December 31, 2020 $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started