Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only Q2 urgently required Q1 true or False with reason (a) Econimic recession may affect on financial leveral (b) trivestor's awareness about repurchasinu implication is

Only Q2 urgently required

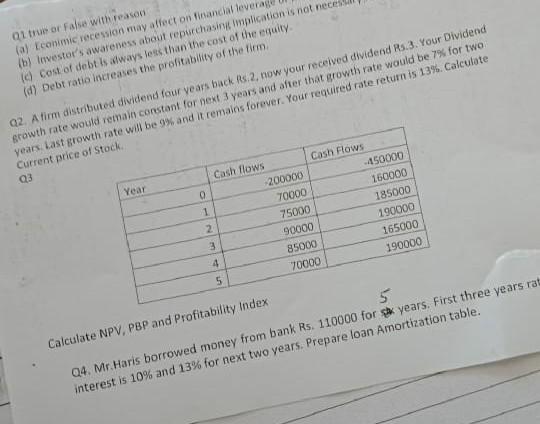

Q1 true or False with reason (a) Econimic recession may affect on financial leveral (b) trivestor's awareness about repurchasinu implication is not neces a) Cost of debt is always less than the cost of the equity (d) Debt ratio increases the profitability of the firm 02. Afirm distributed dividend four years back Rs 2, now your received dividend Rs.3. Your Dividend growth rate would remain constant for next 3 years and after that growth rate would be 79 for two years. Last growth rate will be 9% and it remains forever. Your required rate return is 13%. Calculate Current price of Stock Q3 Year 0 1 2 Cash flows 200000 70000 75000 90000 85000 70000 Cash Flows -450000 160000 185000 190000 165000 190000 3 4 5 Calculate NPV, PBP and Profitability Index 5 Q4. Mr.Haris borrowed money from bank Rs. 110000 for stor years. First three years rat interest is 10% and 13% for next two years. Prepare loan Amortization tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started