Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only question 1 & 3 At one time, Boeing closed a giant deal to acquire another manutacturer, Mcbonnell Douglas. Boeing paid for the acquisition by

Only question 1 & 3

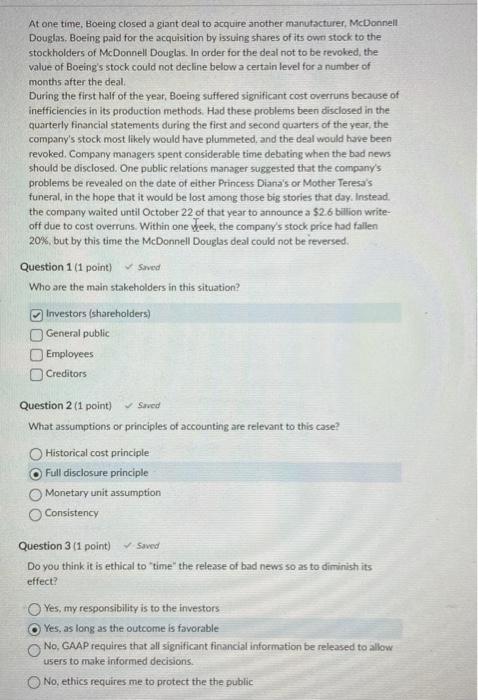

At one time, Boeing closed a giant deal to acquire another manutacturer, Mcbonnell Douglas. Boeing paid for the acquisition by issuing shares of its own stock to the stockholders of McDonnell Douglis. In order for the deal not to be revoked, the value of Boeing's stock could not decline below a certain level for a number of months after the deal. During the first half of the year, Boeing suffered significant cost overruns because of inefficiencies in its production methods. Had these problems been disclosed in the quarterly financial statements during the first and second quarters of the year, the company's stock most likely would have plummeted, and the deal would have been revoked. Company managers spent considerable time debating when the bad news should be disclosed. One public relations manager sugzested that the company's. problems be revealed on the date of either Princess Diana's or Mother Teresa's funeral, in the hope that it would be lost among those big stories that day, Instead. the company waited until October 22 of that year to announce a 52.6 billion writeoff due to cost overruns. Within one week, the company's stock price had fallen 20%, but by this time the MeDonnell Douglas deal could not be reversed. Question 1 (1 point) sived Who are the main stakeholders in this situation? Investors (shareholders) General public Employees Creditors Question 2 (1 point) Srved What assumptions or principles of accounting are relevant to this case? Historical cost princlple Full disclosure principle Monetary unit assumption Consistency Question 3 (1 point) Saved Do you think it is ethical to "time" the release of bad news so as to diminish its effect? Yes, my responsibility is to the investors Yes, as long as the outcome is favorable No, GAAP requires that all significant financial information be released to allow users to make informed decisions. No, ethics requires me to protect the the public

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started