Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only questions 2,3,4 PS3-2.pdf PS3-2.pdf G 1 3 Question 2 D > A Q , 7 07:37 bed them for the new one Spply mat

Only questions 2,3,4

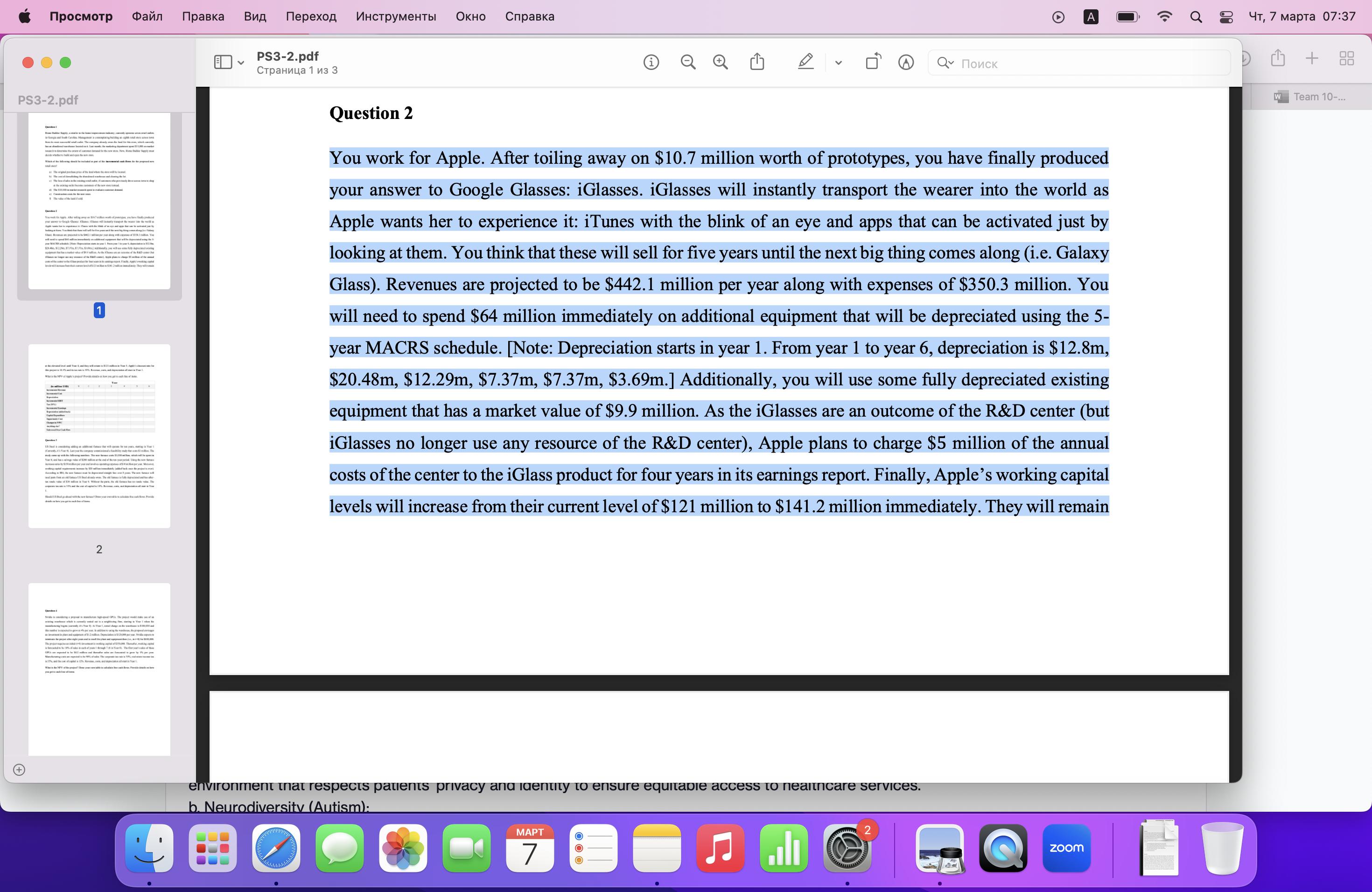

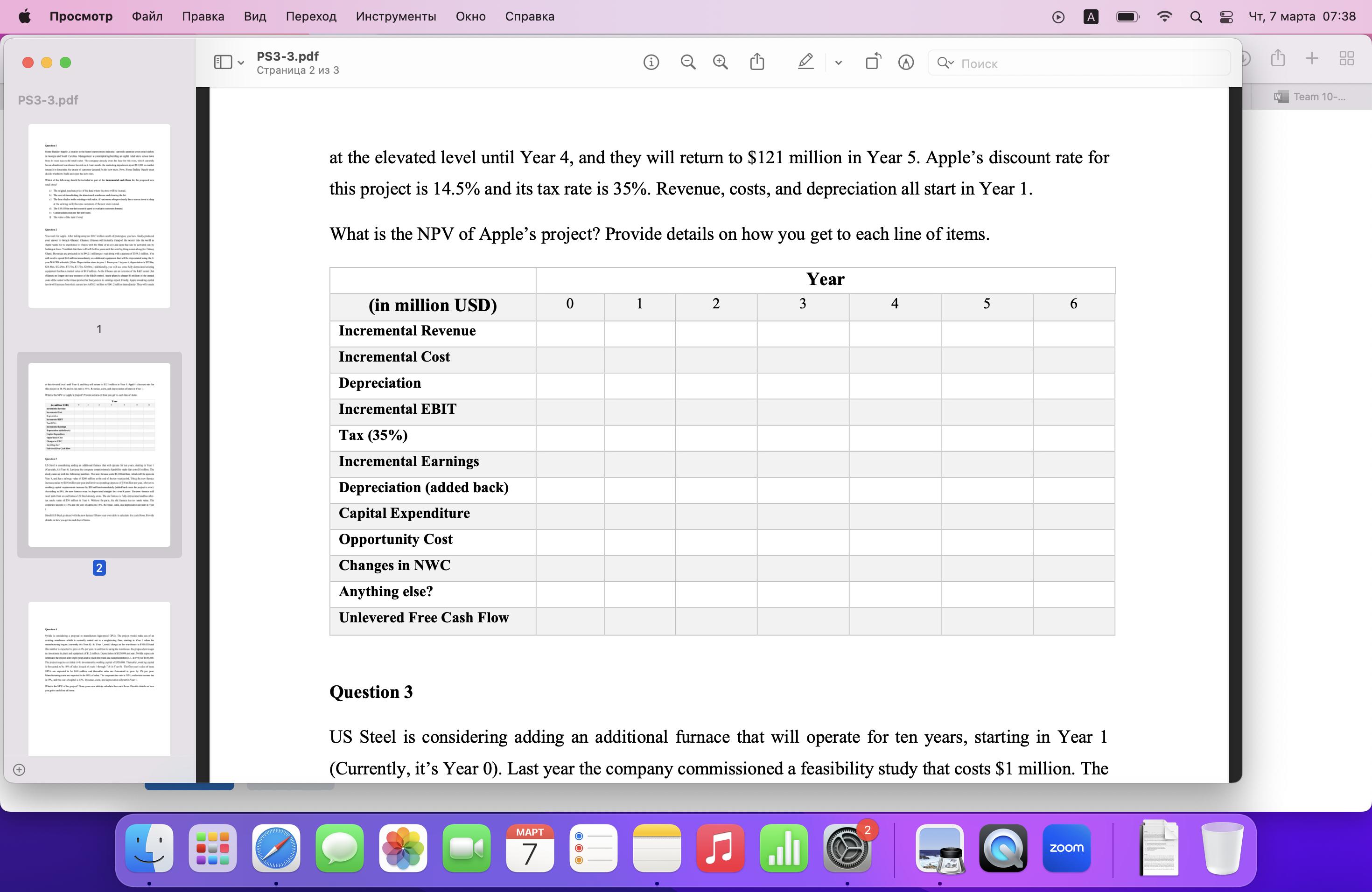

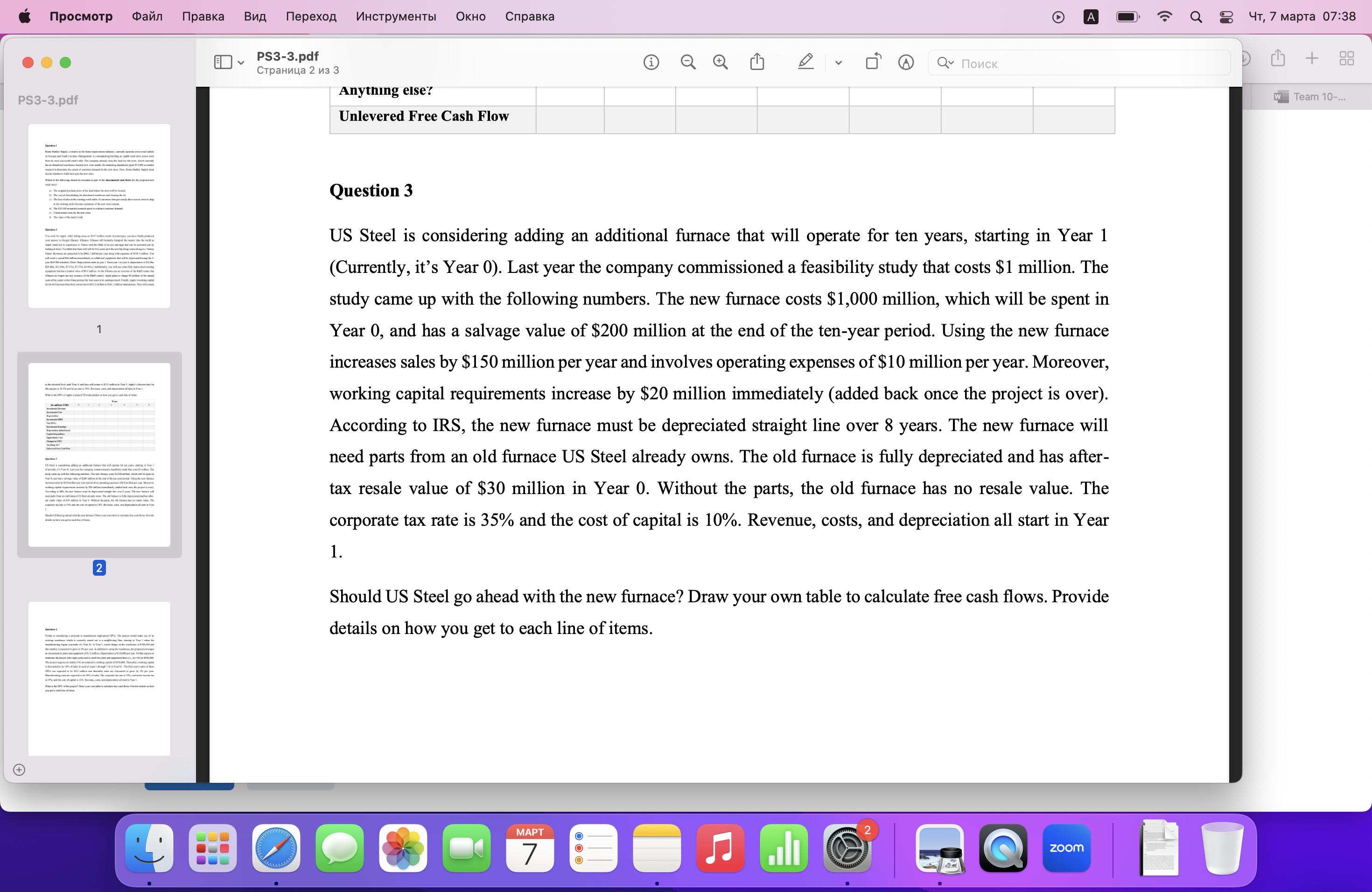

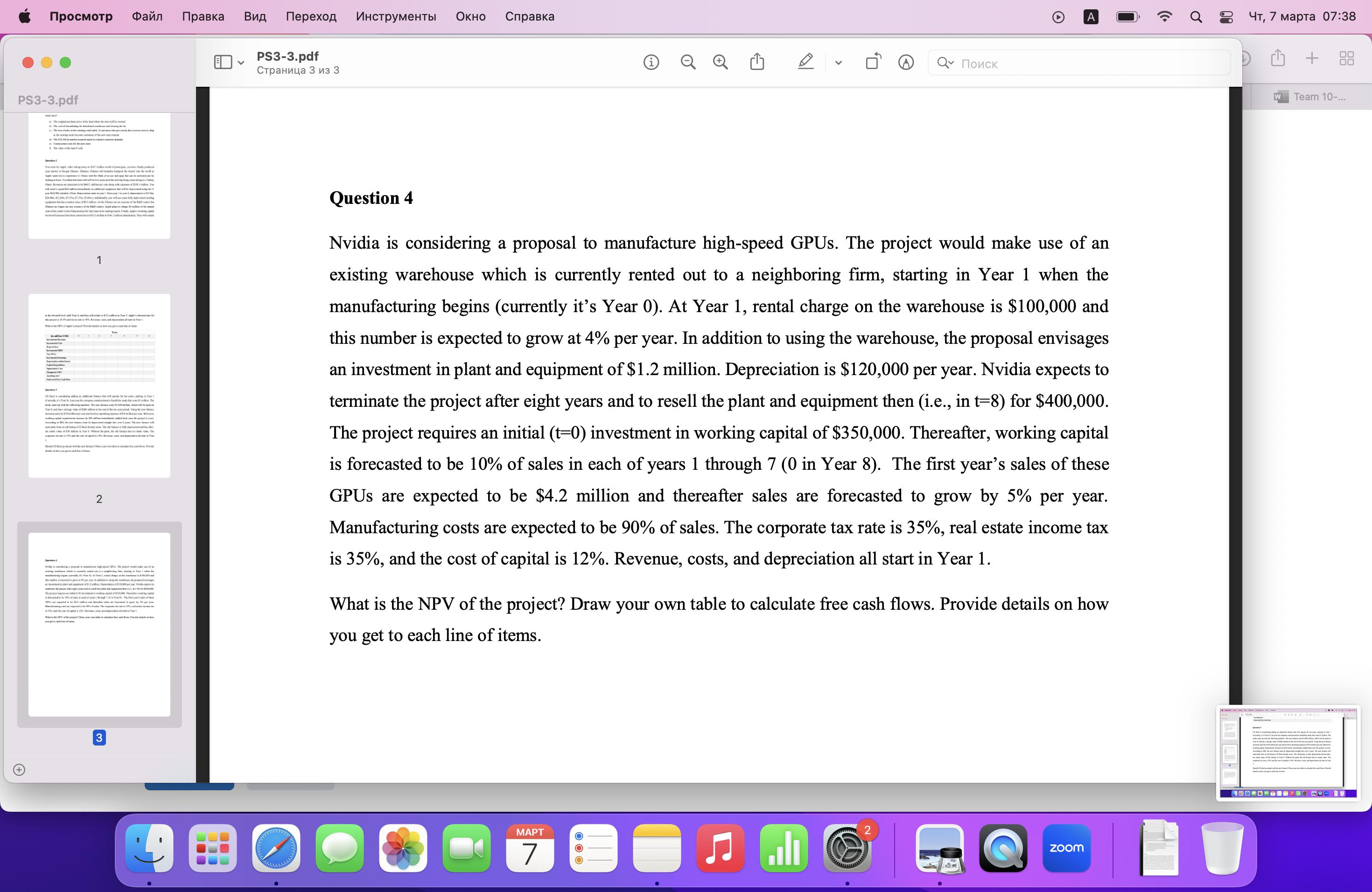

PS3-2.pdf PS3-2.pdf G 1 3 Question 2 D > A Q , 7 07:37 bed them for the new one Spply mat The pop when wi Thegandong la The 10 sp in a 1. That the bad if th Chad RSL Y 22 SURU wil ne vom fily processing 1 wwws of Ankowy go of They will 15 feet will be in Yor is Late then the The wist the path fra The L You work for Apple. After toiling away on $10.7 million worth of prototypes, you have finally produced your answer to Google Glasses: iGlasses. iGlasses will instantly transport the wearer into the world as Apple wants her to experience it: iTunes with the blink of an eye and apps that can be activated just by looking at them. You think that these will sell for five years until the next big thing comes along (i.e. Galaxy Glass). Revenues are projected to be $442.1 million per year along with expenses of $350.3 million. You will need to spend $64 million immediately on additional equipment that will be depreciated using the 5- year MACRS schedule. [Note: Depreciation starts in year 1. From year 1 to year 6, depreciation is $12.8m, $20.48m, $12.29m, $7.37m, $7.37m, $3.69m.] Additionally, you will use some fully depreciated existing equipment that has a market value of $9.9 million. As the iGlasses are an outcome of the R&D center (but iGlasses no longer use any resource of the R&D center), Apple plans to charge $5 million of the annual costs of the center to the iGlass product for four years in its earnings report. Finally, Apple's working capital levels will increase from their current level of $121 million to $141.2 million immediately. They will remain 2 Ship The The Th The of t % of op 1% Road in Sal Wh environment that respects patients privacy and identity to ensure equitable access to healthcare services. b. Neurodiversity (Autism): MAPT 7 2 ZOOM 00 Team 10-...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started