only solve question 2 there's the answer of question 1 if needed

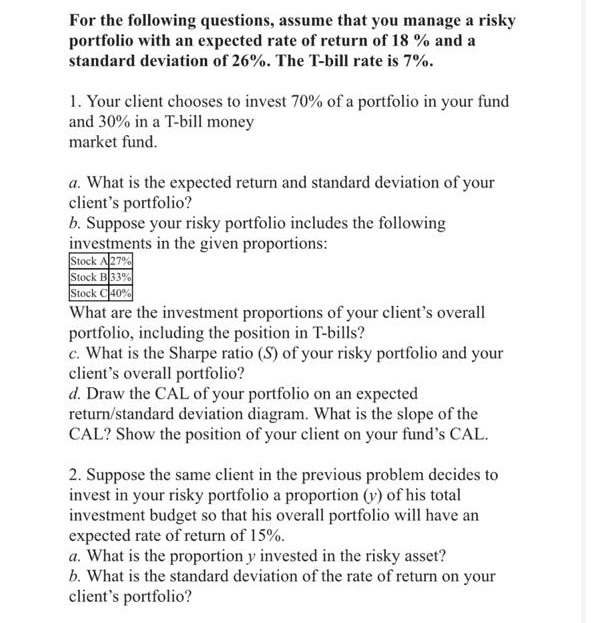

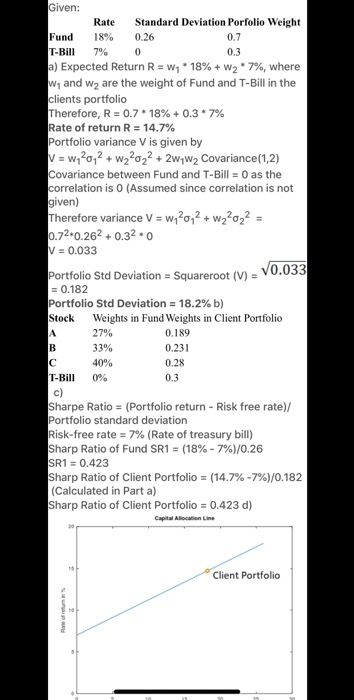

For the following questions, assume that you manage a risky portfolio with an expected rate of return of 18 % and a standard deviation of 26%. The T-bill rate is 7%. 1. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A 27% Stock B 33% Stock 90% What are the investment proportions of your client's overall portfolio, including the position in T-bills? c. What is the Sharpe ratio (S) of your risky portfolio and your client's overall portfolio? d. Draw the CAL of your portfolio on an expected return/standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL. 2. Suppose the same client in the previous problem decides to invest in your risky portfolio a proportion (y) of his total investment budget so that his overall portfolio will have an expected rate of return of 15%. a. What is the proportion y invested in the risky asset? b. What is the standard deviation of the rate of return on your client's portfolio? Given: Rate Standard Deviation Porfolio Weight Fund 18% 0.26 0.7 T-BIL 7% 0 0.3 a) Expected Return R = W18% + W27%, where W, and W2 are the weight of Fund and T-Bill in the clients portfolio Therefore, R = 0.7 * 18% +0.3 * 7% Rate of return R = 14.7% Portfolio variance V is given by V = W202 + W22022 +2w7W2 Covariance(1,2) Covariance between Fund and T-Bill = 0 as the correlation is 0 (Assumed since correlation is not given) Therefore variance V = w 20,2 + w22022 = 0.72*0.262 +0.320 V = 0.033 Portfolio Std Deviation = Squareroot (V) = V0.033 = 0.182 Portfolio Std Deviation = 18.2% b) Stock Weights in Fund Weights in Client Portfolio A 27% B 33% 0.231 C 40% 0.28 T-Bill 0% 0.3 0.189 c) Sharpe Ratio = (Portfolio return - Risk free rate) Portfolio standard deviation Risk-free rate = 7% (Rate of treasury bill) Sharp Ratio of Fund SR1 = (18% - 7%)/0.26 SR1 = 0.423 Sharp Ratio of Client Portfolio = (14.7%-7%)/0.182 (Calculated in Parta) Sharp Ratio of Client Portfolio = 0.423 d) Capital Allocation Line Client Portfolio