Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only the information in yellow fields is needed. Thank you. Obj. 1, 2 H ||||| PR 7-2A Income statements under absorption costing and variable costing

Only the information in yellow fields is needed. Thank you.

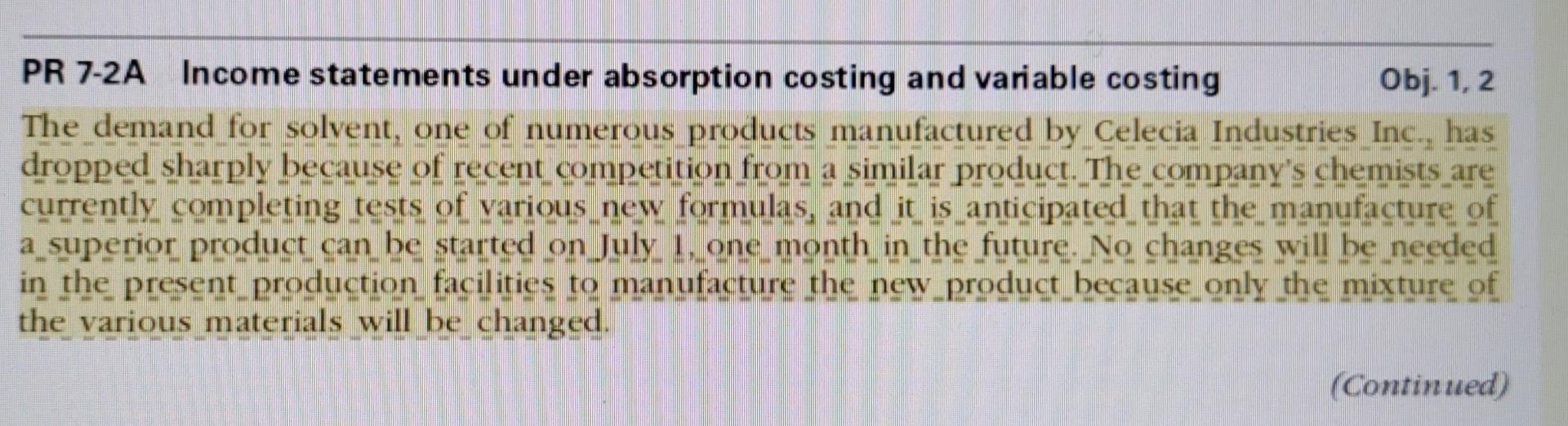

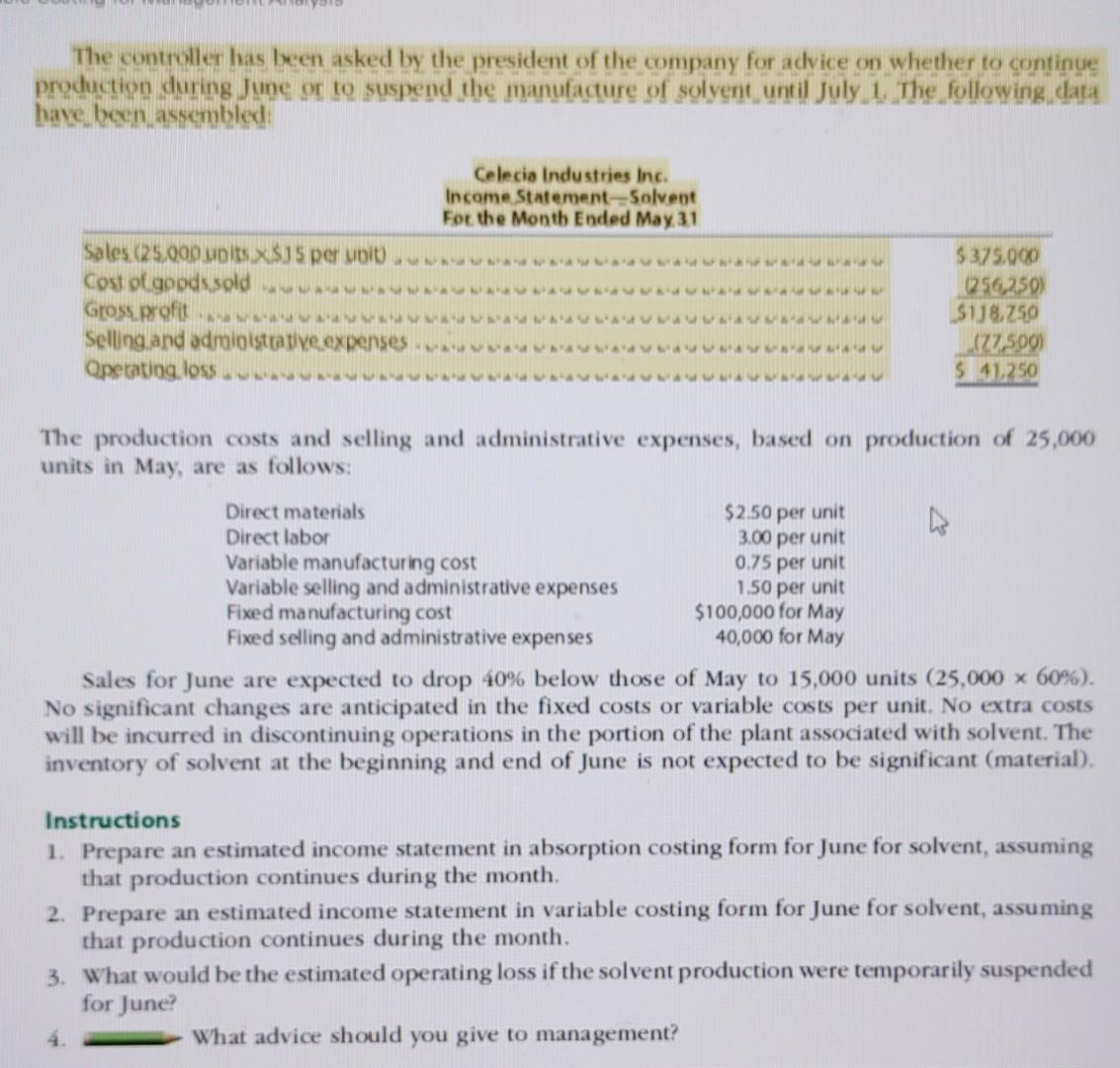

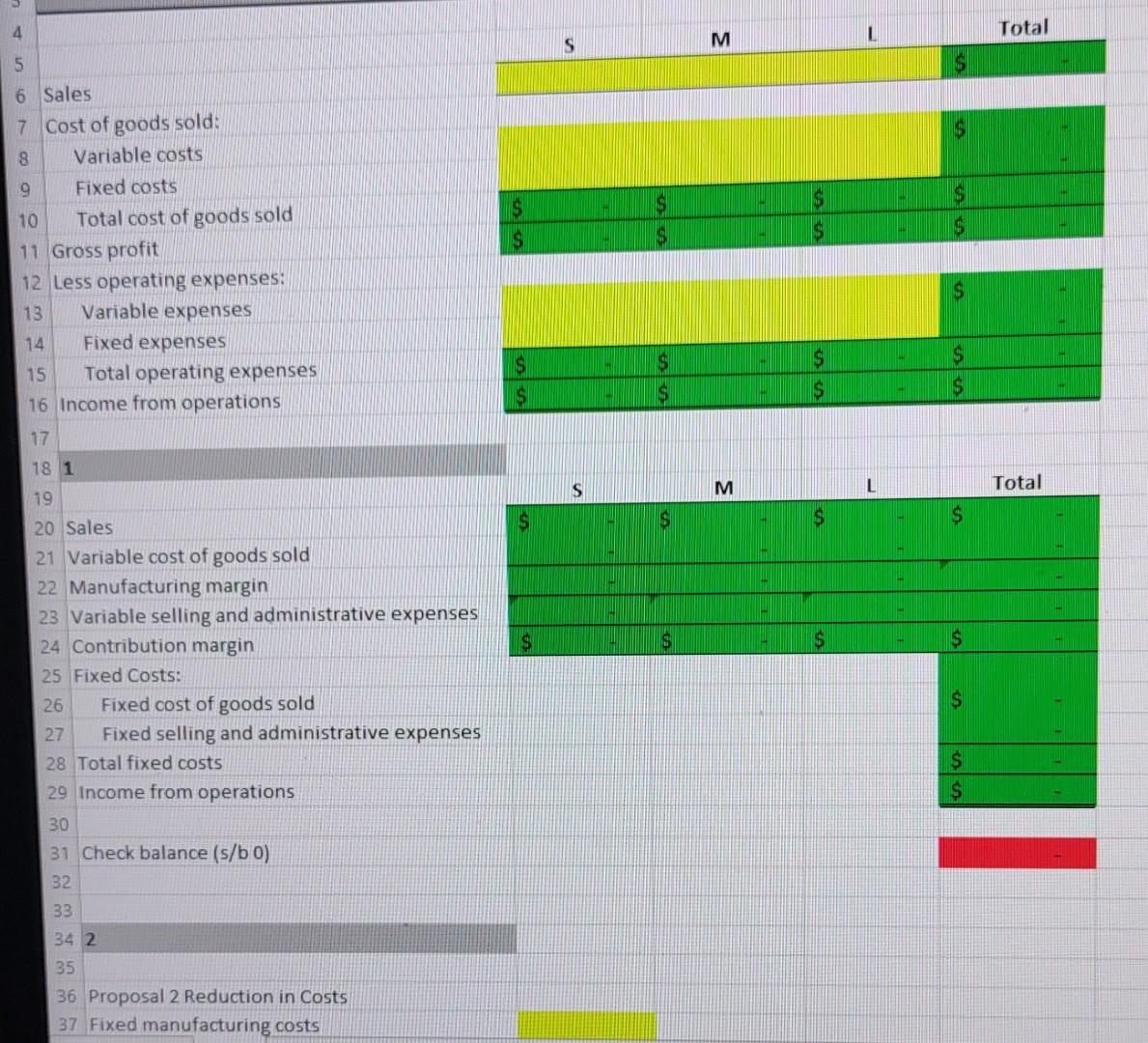

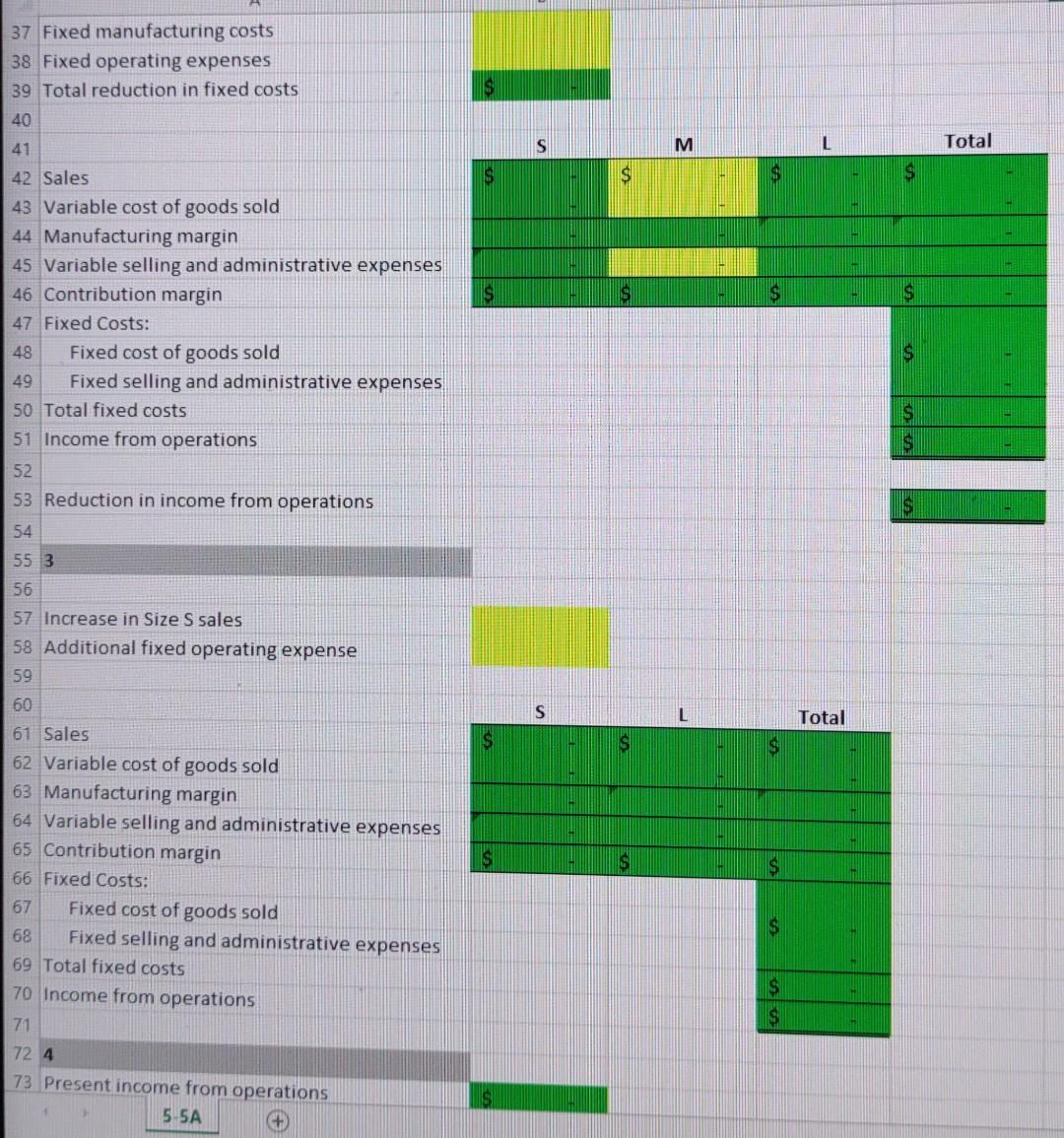

Obj. 1, 2 H ||||| PR 7-2A Income statements under absorption costing and variable costing The demand for solvent, one of numerous products manufactured by Celecia Industries Inc., has dropped sharply because of recent competition from a similar product. The company's chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on July 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed. H [ H (Continued) The controller has been asked by the president of the company for advice on whether to continue production during June or to suspend the manufacture of solvent until July 1. The following data have been assembled: Celecia Industries Inc. Income Statement-Solvent For the Month Ended May 31 Sales (25.000 units X$35 per voit $375.000 *45*45 (256,250) 344 Cost of goods sold 54533 Gross profit $118.750 www333 (77,500) 35337 Selling and administrative expenses Operating loss $ 41.250 *** The production costs and selling and administrative expenses, based on production of 25,000 units in May, are as follows: Direct materials Direct labor 4 Variable manufacturing cost $2.50 per unit 3.00 per unit 0.75 per unit 1.50 per unit $100,000 for May 40,000 for May Variable selling and administrative expenses Fixed manufacturing cost Fixed selling and administrative expenses Sales for June are expected to drop 40 % below those of May to 15,000 units (25,000 60%). No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of June is not expected to be significant (material). Instructions 1. Prepare an estimated income statement in absorption costing form for June for solvent, assuming that production continues during the month. 2. Prepare an estimated income statement in variable costing form for June for solvent, assuming that production continues during the month. 3. What would be the estimated operating loss if the solvent production were temporarily suspended for June? What advice should you give to management? MASSNANAMA 4 5 6 Sales 7 Cost of goods sold: 8 Variable costs 9 Fixed costs 10 Total cost of goods sold 11 Gross profit 12 Less operating expenses: 13 Variable expenses 14 Fixed expenses 15 Total operating expenses 16 Income from operations 17 18 1 19 20 Sales 21 Variable cost of goods sold 22 Manufacturing margin 23 Variable selling and administrative expenses 24 Contribution margin 25 Fixed Costs: 26 Fixed cost of goods sold 27 Fixed selling and administrative expenses 28 Total fixed costs 29 Income from operations 30 31 Check balance (s/b 0) 32 33 34 2 35 36 Proposal 2 Reduction in Costs 37 Fixed manufacturing costs $ S $ $ S S $ $ M 3 H H $ $ $ $ $ L L H H H $ $ $ $ $ $ $ $ Total Total 37 Fixed manufacturing costs 38 Fixed operating expenses 39 Total reduction in fixed costs 40 41 42 Sales 43 Variable cost of goods sold 44 Manufacturing margin 45 Variable selling and administrative expenses 46 Contribution margin 47 Fixed Costs: 48 Fixed cost of goods sold 49 Fixed selling and administrative expenses 50 Total fixed costs 51 Income from operations 52 53 Reduction in income from operations 54 55 3 56 57 Increase in Size S sales 58 Additional fixed operating expense 59 60 61 Sales 62 Variable cost of goods sold 63 Manufacturing margin 64 Variable selling and administrative expenses 65 Contribution margin 66 Fixed Costs: 67 Fixed cost of goods sold 68 Fixed selling and administrative expenses 69 Total fixed costs 70 Income from operations 71 72 4 73 Present income from operations 5-5A $ S $ S S HIT $ M S $ $ L Total $ $ $ $ TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started