Only the last question,

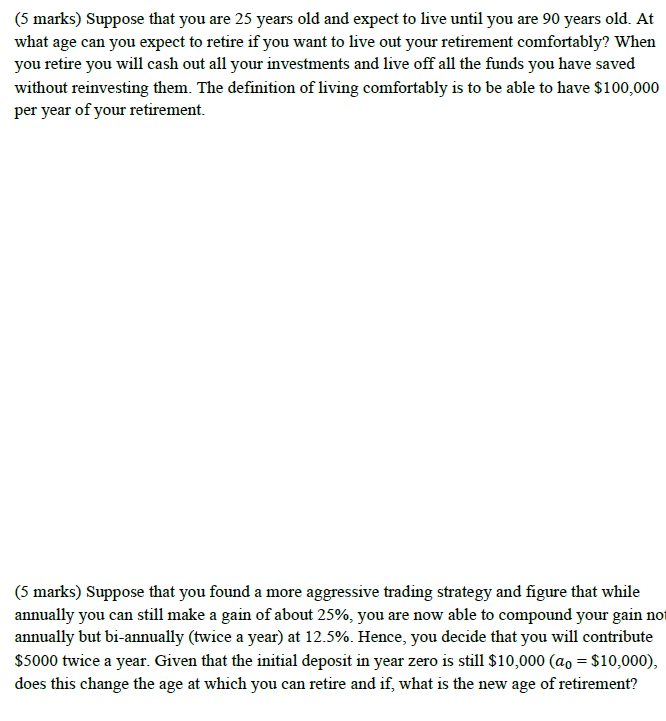

You successfully completed your computer science degree a year ago and have been working at a large tech company. Being a responsible high income earning adult, you of course have thought about your retirement already. For years you have been doing paper trades on the stock market and you are confident that your strategy will make you a net gain of 25% per year that is reinvested back into the account. After doing your budget you decided that you can contribute $10,000 in your trading account once a year. A. (5 marks) Write a recurrence relation that represents the value of your investment account where do= $10,000 (year zero where you just deposited the first $10,000) and az is the value of the account after k years. Assume the compounding period is yearly. B. (10 marks) Solve for the above recurrence relation by finding the analytical formula anwhere n is the number of years that you have been trading. (5 marks) Suppose that you are 25 years old and expect to live until you are 90 years old. At what age can you expect to retire if you want to live out your retirement comfortably? When you retire you will cash out all your investments and live off all the funds you have saved without reinvesting them. The definition of living comfortably is to be able to have $100,000 per year of your retirement. (5 marks) Suppose that you found a more aggressive trading strategy and figure that while annually you can still make a gain of about 25%, you are now able to compound your gain no annually but bi-annually (twice a year) at 12.5%. Hence, you decide that you will contribute $5000 twice a year. Given that the initial deposit in year zero is still $10,000 (ao = $10,000), does this change the age at which you can retire and if, what is the new age of retirement? You successfully completed your computer science degree a year ago and have been working at a large tech company. Being a responsible high income earning adult, you of course have thought about your retirement already. For years you have been doing paper trades on the stock market and you are confident that your strategy will make you a net gain of 25% per year that is reinvested back into the account. After doing your budget you decided that you can contribute $10,000 in your trading account once a year. A. (5 marks) Write a recurrence relation that represents the value of your investment account where do= $10,000 (year zero where you just deposited the first $10,000) and az is the value of the account after k years. Assume the compounding period is yearly. B. (10 marks) Solve for the above recurrence relation by finding the analytical formula anwhere n is the number of years that you have been trading. (5 marks) Suppose that you are 25 years old and expect to live until you are 90 years old. At what age can you expect to retire if you want to live out your retirement comfortably? When you retire you will cash out all your investments and live off all the funds you have saved without reinvesting them. The definition of living comfortably is to be able to have $100,000 per year of your retirement. (5 marks) Suppose that you found a more aggressive trading strategy and figure that while annually you can still make a gain of about 25%, you are now able to compound your gain no annually but bi-annually (twice a year) at 12.5%. Hence, you decide that you will contribute $5000 twice a year. Given that the initial deposit in year zero is still $10,000 (ao = $10,000), does this change the age at which you can retire and if, what is the new age of retirement