Answered step by step

Verified Expert Solution

Question

1 Approved Answer

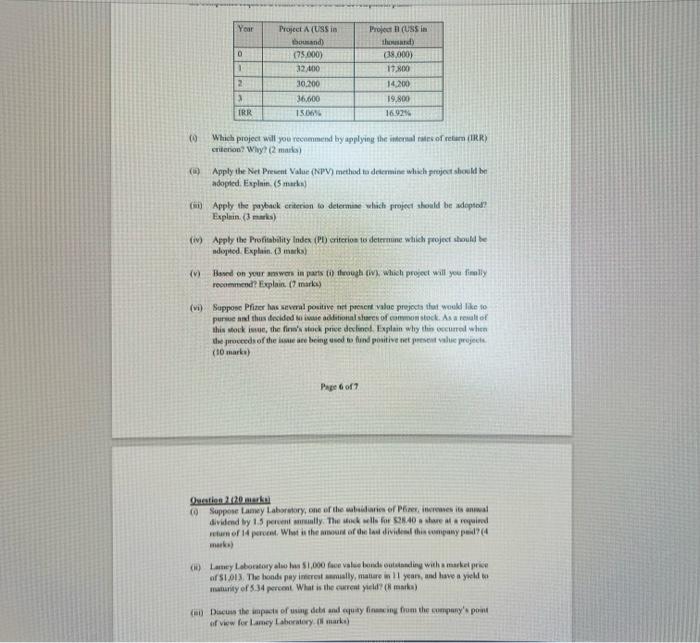

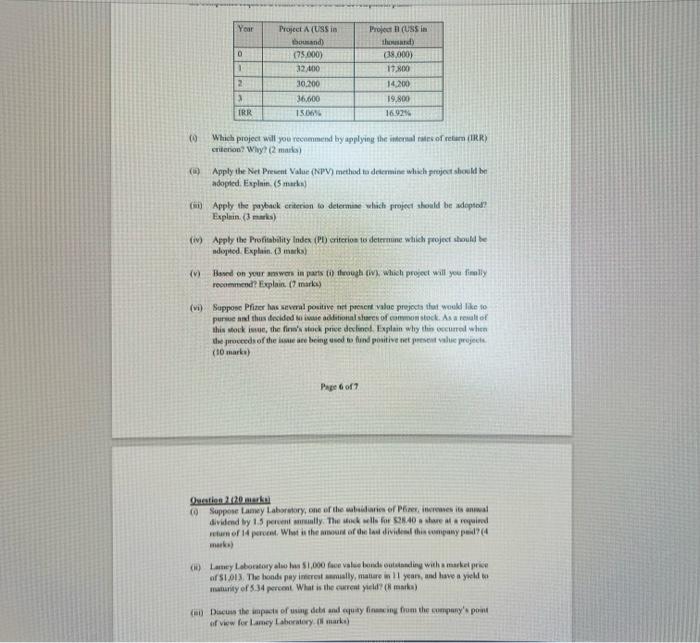

only the question 2(20marks) pls help!!!!! Your D 1 2 3 TRR Project AYUSS in bound) (75.000) 32,400 30.200 36,600 15.06% Project (USS in thousand

only the question 2(20marks)

Your D 1 2 3 TRR Project AYUSS in bound) (75.000) 32,400 30.200 36,600 15.06% Project (USS in thousand (38.000) 17.800 14.200 19.800 16.925 CO Which project will you recommend by applying the internal of retam (IRR) criterion? Why? (2 mi) Apply the Net Present Value (NPV) method to determine which project should be adopted. Explnin. (5 marka (0) Apply the payback criterion to determine which project should be adapted? Explain. (3 marks) $$$ (iv) Apply the Profitability Index (PD) criterion to determine which project should be adopted. Explain. maka) (v) Hard on your wen in parts to through (i), which project will you finally recommend? Explain. (1 mark) (vi) Suppose Primeras several positive et prenent value projects that would like to pure and thus decided to collecs of common stock. As a result of this mock issue, the fin' wock price dell. Explain why this occurred when the proceeds of these are being used to find positive rest value projects (10 marks) Page 6 of 7 Owestie 120 mm Suppose Laney Laboratory, one of the war of Permesinewal dividend by 15 percentily. The ockwell for $2840 are required return of 14 rWhat is the run of the individe this company pil?(4 mark) CIO Laney Laboratory S1,000 face value bonds outstanding with a market price of S1013. The honde pay interest misly, mature in 11 years, and have a yield to maturity of 5.34 percent What is the current yield(maka) ( Dacus the impact of using debt and quay financing from the company's powe of view for Laney Laboratory i mark) pls help!!!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started