Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only use group 3 numbers Question 1: If you borrowed $x1 at x2% annual interest. You agreed to repay the loan with five equal annual

only use group 3 numbers

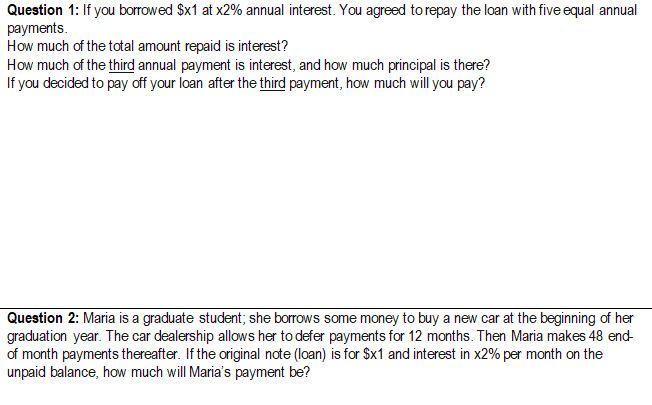

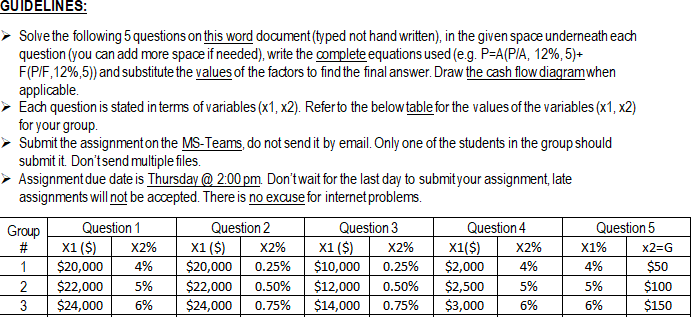

Question 1: If you borrowed $x1 at x2% annual interest. You agreed to repay the loan with five equal annual payments. How much of the total amount repaid is interest? How much of the third annual payment is interest, and how much principal is there? If you decided to pay off your loan after the third payment, how much will you pay? Question 2: Maria is a graduate student; she borrows some money to buy a new car at the beginning of her graduation year. The car dealership allows her to defer payments for 12 months. Then Maria makes 48 end of month payments thereafter. If the original note (loan) is for $x1 and interest in X2% per month on the unpaid balance, how much will Maria's payment be? GUIDELINES: Solve the following 5 questions on this word document (typed not hand written), in the given space underneath each question (you can add more space if needed), write the complete equations used (e.g. P=A(PIA, 12%,5)+ F(P/F,12%,5)) and substitute the values of the factors to find the final answer. Draw the cash flow diagram when applicable. Each question is stated in terms of variables (x1, x2). Refer to the below table for the values of the variables (x1, x2) for your group Submit the assignmenton the MS-Teams, do not send it by email. Only one of the students in the group should submit it. Don'tsend multiple files. Assignment due date is Thursday @ 2:00 pm. Don't wait for the last day to submityour assignment, late assignments will not be accepted. There is no excuse for internet problems. Group Question 1 Question 2 Question 3 Question 4 Question 5 # X1 ($) X2% X1 ($) X1 ($) X1($) X2% X1% $20,000 $20,000 0.25% $10,000 0.25% $2,000 4% $50 2 $22,000 5% $22,000 0.50% $12,000 0.50% $2,500 5% 5% $100 3 $24,000 6% $24,000 0.75% $14,000 0.75% $3,000 6% 6% $150 X2% X2% X2=G 1 4% 4% Question 1: If you borrowed $x1 at x2% annual interest. You agreed to repay the loan with five equal annual payments. How much of the total amount repaid is interest? How much of the third annual payment is interest, and how much principal is there? If you decided to pay off your loan after the third payment, how much will you pay? Question 2: Maria is a graduate student; she borrows some money to buy a new car at the beginning of her graduation year. The car dealership allows her to defer payments for 12 months. Then Maria makes 48 end of month payments thereafter. If the original note (loan) is for $x1 and interest in X2% per month on the unpaid balance, how much will Maria's payment be? GUIDELINES: Solve the following 5 questions on this word document (typed not hand written), in the given space underneath each question (you can add more space if needed), write the complete equations used (e.g. P=A(PIA, 12%,5)+ F(P/F,12%,5)) and substitute the values of the factors to find the final answer. Draw the cash flow diagram when applicable. Each question is stated in terms of variables (x1, x2). Refer to the below table for the values of the variables (x1, x2) for your group Submit the assignmenton the MS-Teams, do not send it by email. Only one of the students in the group should submit it. Don'tsend multiple files. Assignment due date is Thursday @ 2:00 pm. Don't wait for the last day to submityour assignment, late assignments will not be accepted. There is no excuse for internet problems. Group Question 1 Question 2 Question 3 Question 4 Question 5 # X1 ($) X2% X1 ($) X1 ($) X1($) X2% X1% $20,000 $20,000 0.25% $10,000 0.25% $2,000 4% $50 2 $22,000 5% $22,000 0.50% $12,000 0.50% $2,500 5% 5% $100 3 $24,000 6% $24,000 0.75% $14,000 0.75% $3,000 6% 6% $150 X2% X2% X2=G 1 4% 4%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started