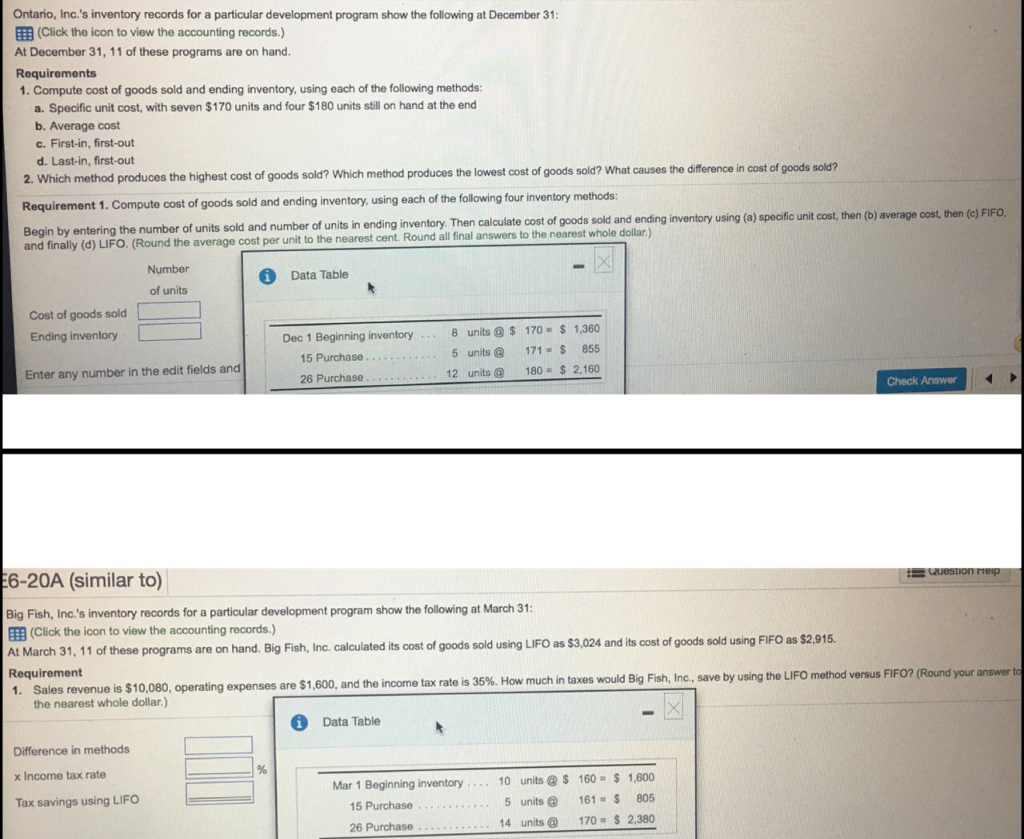

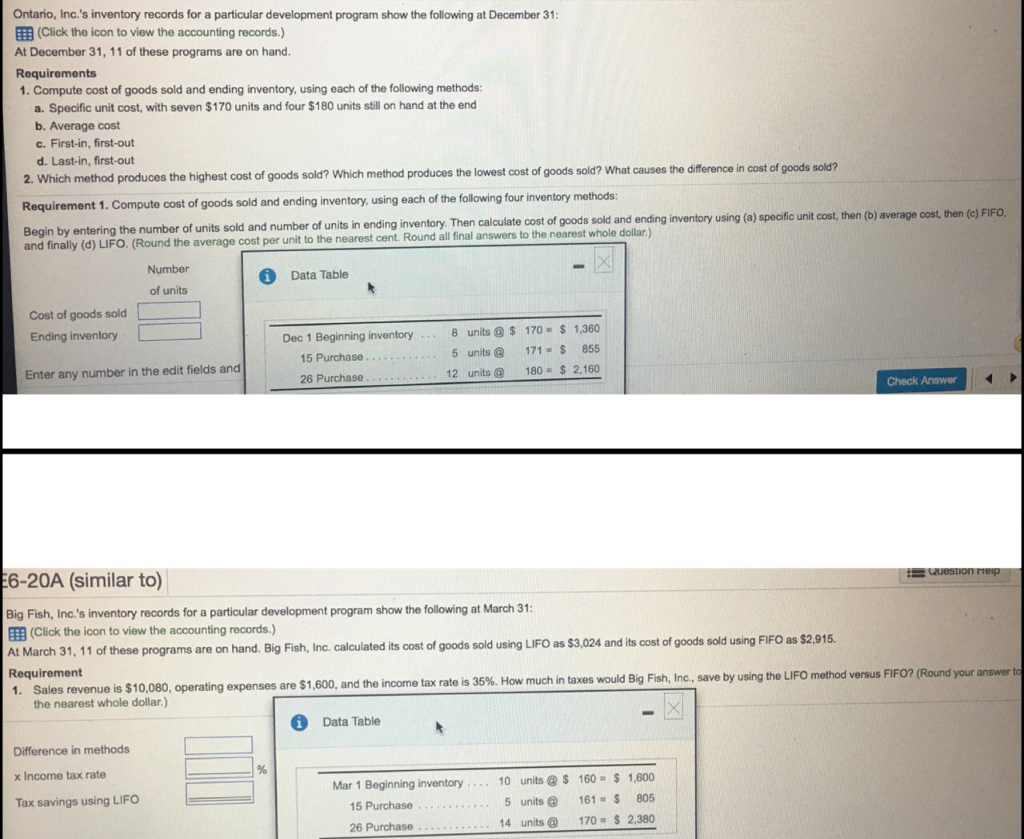

Ontario, Inc.'s inventory records for a particular development program show the following at December 31 ?(Click the icon to view the accounting records.) At December 31, 11 of these programs are on hand Requirements 1. Compute cost of goods sold and ending inventory, using each of the following methods: a. Specific unit cost, with seven $170 units and four $180 units still on hand at the end b. Average cost c. First-in,first-out d. Last-in, first-out 2. Which method produces the highest cost of goods sold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods: its sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round all final Round all final answers to the nearest whole dollar) answers t Number Data Table of units Cost of goods sold Ending inventory Enter any number in the edit fields and Dec 1 Beginning inventory8 units $170 $ 1,360 5 units @ 171 855 12 units 180 S 2.160 15 Purchase 26 Purchase Check Answer 6-20A (similar to) Big Fish, Inc.'s inventory records for a particular development program ?(Click the icon to view the accounting records.) show the following at March 31: A March 31, 11 of these programs are on hand. Big Fish, Inc. calculatoed its cost of goods sold using LIFO as $3,024 and its cost of goods sold using FIFO as $2,915 Requirement 1. Sales revenue is $10.080, operating expenses are $1,600, and the income tax rate is 35%. How much in taxes would Big Fish, Inc., save by using the LIFO method versus FIFO? (Round your answer t the nearest whole dollar.) Data Table Difference in methods x Income tax rate Tax savings using LIFO Mar 1 Beginning inventory10 units@s 160 $ 1,600 .. 5 units @ 161 = $ 805 14 units 170S 2,380 15 Purchase 26 Purchase Ontario, Inc.'s inventory records for a particular development program show the following at December 31 ?(Click the icon to view the accounting records.) At December 31, 11 of these programs are on hand Requirements 1. Compute cost of goods sold and ending inventory, using each of the following methods: a. Specific unit cost, with seven $170 units and four $180 units still on hand at the end b. Average cost c. First-in,first-out d. Last-in, first-out 2. Which method produces the highest cost of goods sold? Which method produces the lowest cost of goods sold? What causes the difference in cost of goods sold? Requirement 1. Compute cost of goods sold and ending inventory, using each of the following four inventory methods: its sold and number of units in ending inventory. Then calculate cost of goods sold and ending inventory using (a) and finally (d) LIFO. (Round the average cost per unit to the nearest cent. Round all final Round all final answers to the nearest whole dollar) answers t Number Data Table of units Cost of goods sold Ending inventory Enter any number in the edit fields and Dec 1 Beginning inventory8 units $170 $ 1,360 5 units @ 171 855 12 units 180 S 2.160 15 Purchase 26 Purchase Check Answer 6-20A (similar to) Big Fish, Inc.'s inventory records for a particular development program ?(Click the icon to view the accounting records.) show the following at March 31: A March 31, 11 of these programs are on hand. Big Fish, Inc. calculatoed its cost of goods sold using LIFO as $3,024 and its cost of goods sold using FIFO as $2,915 Requirement 1. Sales revenue is $10.080, operating expenses are $1,600, and the income tax rate is 35%. How much in taxes would Big Fish, Inc., save by using the LIFO method versus FIFO? (Round your answer t the nearest whole dollar.) Data Table Difference in methods x Income tax rate Tax savings using LIFO Mar 1 Beginning inventory10 units@s 160 $ 1,600 .. 5 units @ 161 = $ 805 14 units 170S 2,380 15 Purchase 26 Purchase