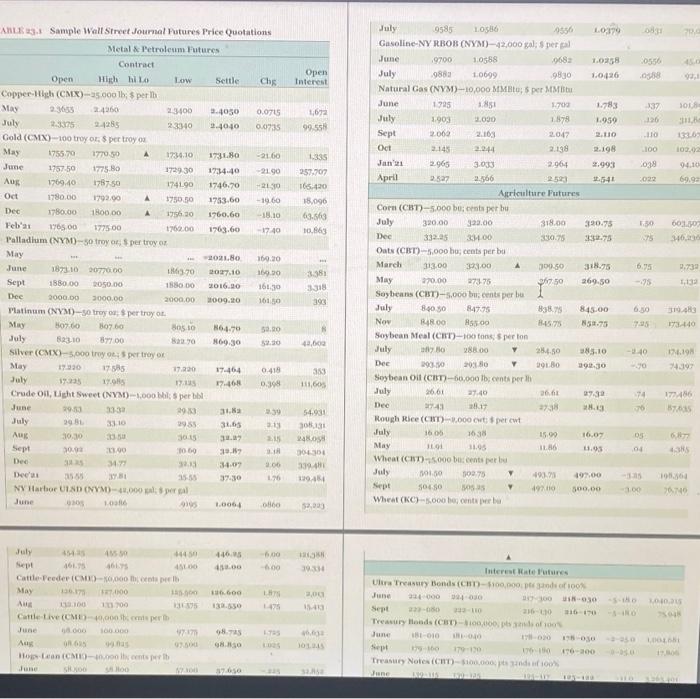

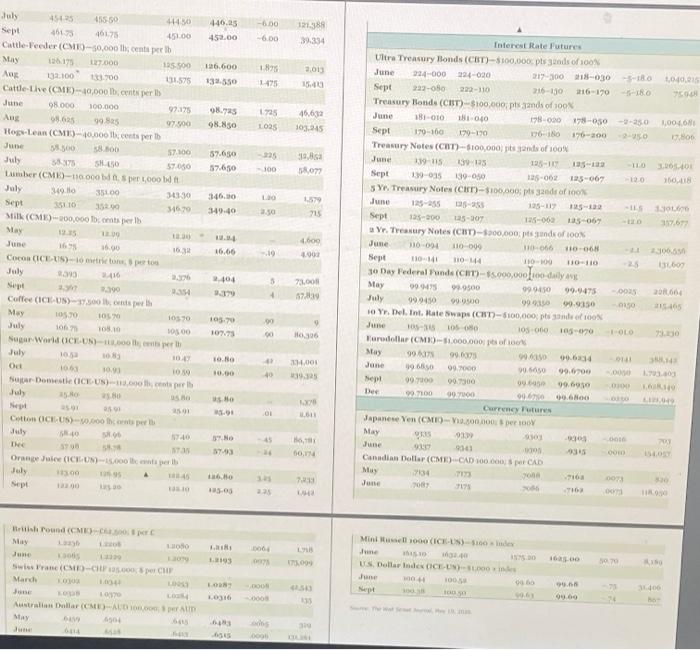

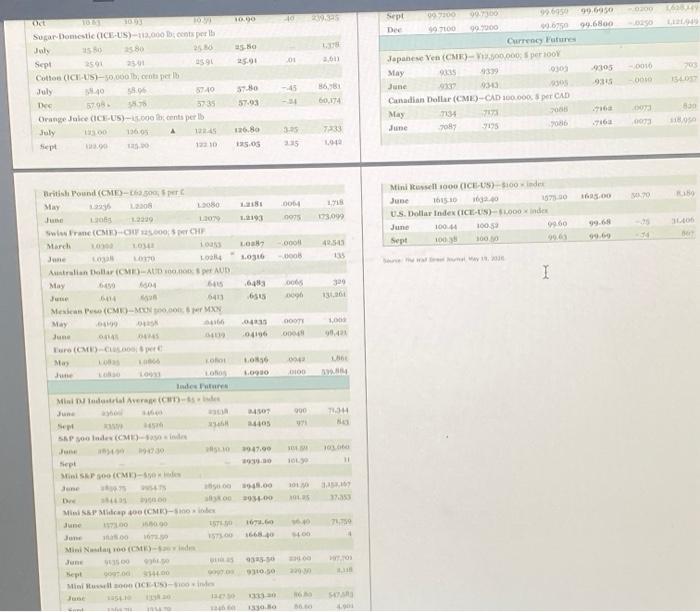

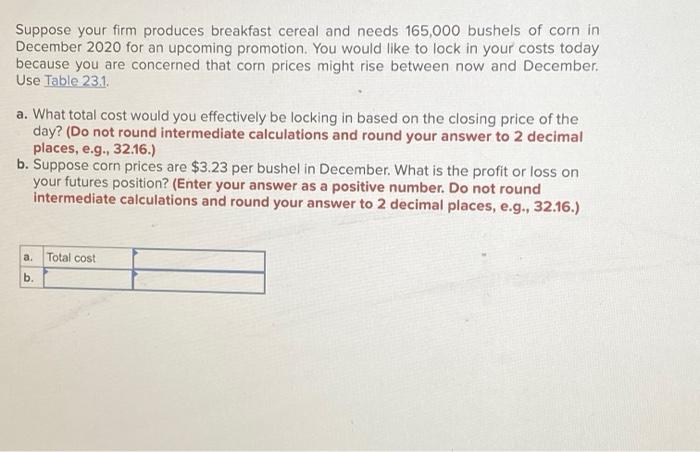

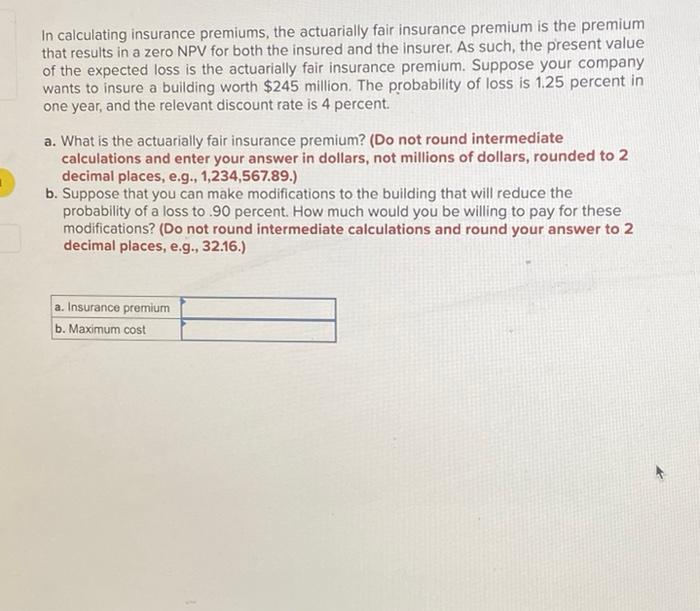

Open Interest 15 1672 99.55 102 1335 257.707 165.420 18.090 63.663 10.863 -1960 33400 19.30 ALE Sample Wall Street Journal Futures Price Quotations Metal & Petroleum Futures Contract Open High hilo Low Settle Ch Copper-High (CMR)-5.000 lb, 5 per lh May 27035 2.4260 23400 2.4050 0.075 July 2.375 2255 23340 9.4040 0.0235 Gold (CMX)-100 troy or per troyo May 1755.70 17700 A 1734.10 17380 -21.60 June 1757.50 1775.80 1729.30 1734-40 -21.90 Aug 1769.40 1787 50 174190 1746,70 -21.30 Oct 1780.00 1792.00 A 5750.50 1753.60 Dec 1780.00 1800.00 1756.30 1960.60 -16.10 Feb's 1965.00 177500 1760.00 1763.60 1749 Palladium (NYM) - 50 troy os per troy on May 2018 June 1873.10 0770.00 116370027.10 169.00 1880200 2050.00 15000 2016.30 Dec 2000.00 3000.00 2000.00 2009.10 16150 Platinum (NYM)-50 troy os pertray. May 307.60 307.60 05.10 M670 July 823.10 377.00 169.30 52.0 Silver (CMX)-5.000 tryo: 5 perroyo May 17.30 1785 17.20 17464 0.418 July 19235 17.95 17. 17.461 0.394 Crude Oil, Light Sweet (NYM) -1.000 hl per bal June 29.00 3330 293 31.3 2.39 July 310 29.85 31.05 31 Aus 30.10 JU 2 Sept GO 6.90 10.60 19.12 Dee 323 34.09 3:06 Deca 155 1.76 NY Harbor UND NYM) - 10.000 persal June 10 930 1.0064 oo July 9585 1056 9556 L0379 0831 Gasoline NYRBOB (NYM)-42.000 gali per al June 9700 10588 0683 1.0258 0556 July 9883 1.0699 9830 1.0426 . Natural Gas (NYM)-10,000 MMB; per MM June 1995 1.700 1.78 137 301 July 1903 1090 1878 1.950 126 Sept 2002 22.103 2.042 2.110 110 1330 Oct 2.145 2.244 2.138 22.198 100 Jan 21 2.965 3.033 2.96+ 039 04.10 April 27 2.566 03 69.92 Agriculture Futures Corn (CBT)-5.000 bucents per bu July 320.00 323.00 318.00 390.75 1:30 601.30 Dec 332.95 30.78 3.75 340.00 Oats (CBT)-5.000 hascents per bu March 313.00 23.00 A 309-50 318.75 6.95 2.732 May 270.00 27375 17.50 269.50 1.1 Soybeans (CWT)-5.000 bucents per bu July 840 30 84775 838.75 845.00 6.30 Nov 348.00 853.00 145.75 N5.75 735 17349 Soybean Meal (CRT)-100 ton perton July 288.00 24.50 05.10 -240 124.198 Dec 1930 2010 91.80 29.30 0 4397 Soybean Oil (CBT)-60,000 tbcents per July 26.01 27:40 26.01 27.30 74 172486 Dec 2741 17 22:38 . 7 5705 Rough Rice (CH).000 cu percut July 1606 15.00 16.00 os May LO 31.05 IL 11.95 3 Wheat (CRT)-5.000 bucents July 1.50 10270 4973 900 10.04 Sept 50680 492.0 500.00 100 7070 Wheat (KC)-5.000 bocent Sept 1610 3:38 3:38 393 42.000 353 111.605 3638 54.931 3131 24 30450 339.480 -- 055 52.000 6.00 00 13 3336 4.00 1600 3,00 2003 19 4350 1445 Sept 46175 45200 Cattle-Feeder (CM-000 The May 136.17 17000 A 1.100 1000 Cattle Live (CM) 10,000 per June 8000 27 AR Hoan CMO 0.00 entsperit June Interest Rate Futures Ultra Treasury Bond (HD)-$100.000 100 2200001400 10W-30 Sept -060 116- Treasury Honda (CBT) -100,00 Jung 180-010 Sept 7910 176 6-200 Treasury Notes (CRT) $100.000 euro June SOL. 325 440.as 452.00 -6.00 -6.00 121388 39.334 126,600 2013 132.350 8.925 98.830 1725 toas 46,632 103.945 SIL 57.650 37.650 225 100 som LO 346.00 349:40 250 July 45425 455.50 4430 Sept 46175 45100 Cattle-Feeder (CMT)-50,000 cent per May 1961 127.000 125 500 A 12.100 13.700 111.575 Cattle-tive (CMK-10,000 lb, perb June 98.000 100.000 97.175 Aug 0.625 99.85 Hoge-Lean (CM)-10.000 certs per 38.500 58.500 57.100 July 3875 57.050 Lumber (CME)-110 000 per LOO July 349.0 35100 Sept 3510 3520 34679 Silk (CM) -100,000 per May 120 ta 1693 16.00 16:33 Cocos (ICE-US-1 meetop July 2416 2. 2 2854 Coffee (ICE-US). Onts per May 105.70 10570 10570 100 10.10 VOS 00 Sugar World (ICE ON July 10. 1041 106 1059 Sur Domestic (ICE-US). center July . 25.01 20 Cotton (ICEUS)-50.000 sconto per il July 4600 16.66 10 Interest Rate Futures Ultra Treasury Bonds (CBT)-$100,000 ps 32nd of 100% June 24-000 224-020 21-3008-030 -- 140215 Sept 222-00 32-110 216-130 216170 7500 Treasury Bonds (CBT)$100,000ptsands of 100% June 181-010 1040 08.020 18-050-250 1,004 Sept 170-100 179-170 1761 176-200 Treasury Notes (CWT) -100,000 pitsands of 100% June 139-115 139-15 195-HT Sept 19-as 199.00 125-06% 125-06% 20 160418 s Y Treasury Notes (CUT)-$100,000 ps 32 of 100% June 5.255 - 150 Sept 135.000 25-30 135 067 Yr. Treasury Notes (CNT)-$100.000 do 100 June 110-094 110-09 066 T10-06 1180065 Sept 10:41 HO 110-100 110110 137.600 30 Day Federal Pande (CRT)-$5.000.000 dalys May 0904529500 999450 99.9475 0035 999450 99.9900 990 30.9350 2465 10 Y Del. Int. Hate Swaps (CHT)-$100,000 pendet 105-16 1050 105 00 103070 OLO Nurodollar (CMX)-1.000.000 May 9987 96003 0.63 011 June 19.6850 09.000 99.60 99.000 sep 99 100 097900 99.695 19 Der 20.7100 99,700 90.600.6 . No Currency Future Japanese Yen (CM) -2.400.000 per 100 May OS 910 93 0903 June 000 Canadian Dollar (CME) CAD 1000 CAD May 7134 DO June 7173 TO 2.104 3 + 71.00 57.839 July 10775 90 No.36 10.B 14.000 10.00 40 . 1511 No 45 Dhe H. Orange Juice (CUN) - 16.00 bent per Joly 13.00 Sept 1200 30 4 7,23 L. Bets Pound (ME) May June 10 Swiss Franc (CHE-CHOCH Mardi LO Mini (ICES)-100 Je . US Dollar Index ICE UNO OH 07 ATKO 070 10 100 HUN 000 . 000 000 250 400 Australian Dollar (CMA. AUD My . 00 200 10.00 25 0 2011 250 - 0010 Spl 907300 De TOD 90.000 90.675094.6800 Currency Future Japanese Yen (CME)-.300.000,00 May 93 0303 9105 June 30 9 Canadian Dollar (CME)-CAD 100.000 per CAD May 7734 707 June 7087 9195 7163 20 1340 CE Sugar Bonetic (ICE-US)-113.000 cents per Jul 250 Sept 25.01 3590 Cotton (ICUS-50.000 h, tapet July 10 SO 5720 Tec 375 Orange Juice (ICE-US)-1.000 cents per lb July 196/03 sept 12210 380 868 60.174 57.03 07 10 26. 720 3:35 135 15.05 V70 1918 June 0064 0975 1.2.193 173,09 Mini Rossell 1000 (CE-US)-100 index 161510 20 30 US Dollar Index (ICE-US)-1000X index June 100 Sept 100 100 9060 10 British Pound (CME), May LO 1.2919 10 Sirane CM) CH00 SCHE March 1034 100 LO Australian Dollar (CME-AUDAUD May 4 960 99.00 LON 1036 0001 - www. I 30 6483 6505 Mexican Peso (CMO)-MON.COM MXN 66 June Euro (OME) May Roho 000 000 04196 . 1090 Mial Industries MOT 900 TH SAP de CME) 1970 1947.00 HOLY Min SAP (CM)- 101 18.00 393400 17.353 Mini SAP Midcap 40 CME)-sino June ISTO 157.00 1 Mini Nusa CM) - Side 932. 10.50 Sept SHO Suppose your firm produces breakfast cereal and needs 165,000 bushels of corn in December 2020 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might rise between now and December. Use Table 23.1. a. What total cost would you effectively be locking in based on the closing price of the day? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Suppose corn prices are $3.23 per bushel in December. What is the profit or loss on your futures position? (Enter your answer as a positive number. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Total cost b. In calculating insurance premiums, the actuarially fair insurance premium is the premium that results in a zero NPV for both the insured and the insurer. As such, the present value of the expected loss is the actuarially fair insurance premium. Suppose your company wants to insure a building worth $245 million. The probability of loss is 1.25 percent in one year, and the relevant discount rate is 4 percent. a. What is the actuarially fair insurance premium? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) b. Suppose that you can make modifications to the building that will reduce the probability of a loss to .90 percent. How much would you be willing to pay for these modifications? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Insurance premium b. Maximum cost