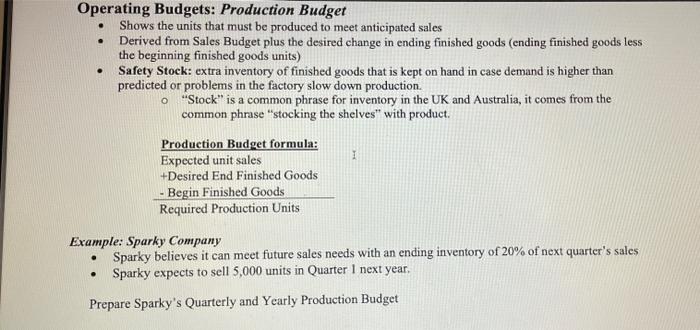

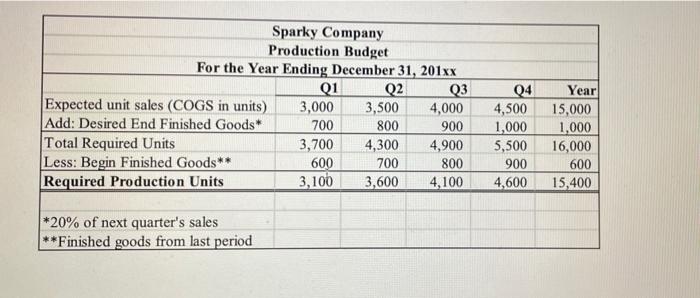

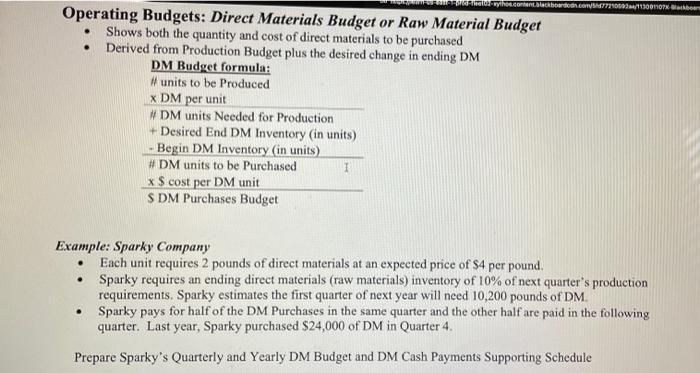

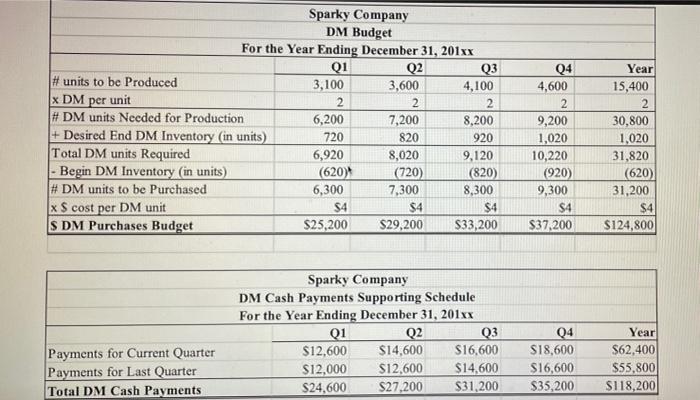

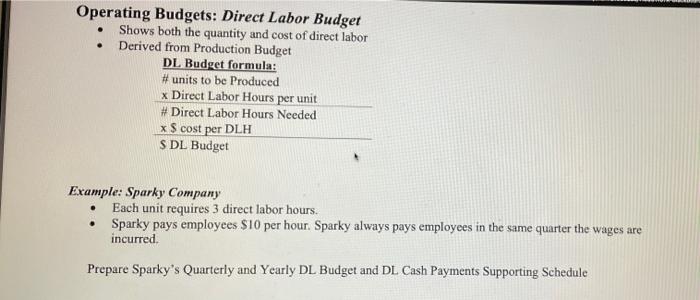

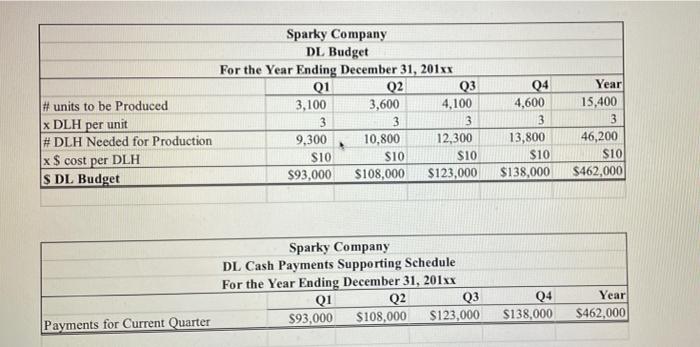

. . Operating Budgets: Production Budget Shows the units that must be produced to meet anticipated sales Derived from Sales Budget plus the desired change in ending finished goods (ending finished goods less the beginning finished goods units) Safety Stock: extra inventory of finished goods that is kept on hand in case demand is higher than predicted or problems in the factory slow down production o "Stock is a common phrase for inventory in the UK and Australia, it comes from the common phrase "stocking the shelves" with product. 1 Production Budget formula: Expected unit sales +Desired End Finished Goods - Begin Finished Goods Required Production Units Example: Sparky Company Sparky believes it can meet future sales needs with an ending inventory of 20% of next quarter's sales Sparky expects to sell 5,000 units in Quarter I next year. . Prepare Sparky's Quarterly and Yearly Production Budget h.corelackboard TVS772/113000TX Beer . Operating Budgets: Direct Materials Budget or Raw Material Budget Shows both the quantity and cost of direct materials to be purchased Derived from Production Budget plus the desired change in ending DM DM Budget formula: #units to be Produced X DM per unit WDM units Needed for Production + Desired End DM Inventory (in units) - Begin DM Inventory (in units) # DM units to be purchased I x $ cost per DM unit SDM Purchases Budget Example: Sparky Company Each unit requires 2 pounds of direct materials at an expected price of $4 per pound. Sparky requires an ending direct materials (raw materials) inventory of 10% of next quarter's production requirements. Sparky estimates the first quarter of next year will need 10,200 pounds of DM. Sparky pays for half of the DM Purchases in the same quarter and the other half are paid in the following quarter. Last year, Sparky purchased $24,000 of DM in Quarter 4. Prepare Sparky's Quarterly and Yearly DM Budget and DM Cash Payments Supporting Schedule . Q4 4,600 Sparky Company DM Budget For the Year Ending December 31, 201xx Q1 Q2 Q3 #units to be Produced 3,100 3,600 4,100 x DM per unit 2 2 2 # DM units Needed for Production 6,200 7,200 8,200 + Desired End DM Inventory (in units) 720 820 920 Total DM units Required 6,920 8,020 9,120 Begin DM Inventory (in units) (620) (720) (820) # DM units to be purchased 6,300 7,300 8,300 x S cost per DM unit $4 $4 $4 SDM Purchases Budget $25,200 $29,200 $33,200 9,200 1,020 10,220 (920) 9,300 $4 $37,200 Year 15,400 2 30,800 1,020 31,820 (620) 31,200 $4 S124,800 Sparky Company DM Cash Payments Supporting Schedule For the Year Ending December 31, 201xx Q1 Q2 Q3 $12,600 $14,600 $16,600 $12,000 $12,600 $14,600 $24,600 S27,200 $31,200 Payments for Current Quarter Payments for Last Quarter Total DM Cash Payments 04 $18,600 $16,600 $35,200 Year $62,400 $55,800 $118,200 Operating Budgets: Direct Labor Budget Shows both the quantity and cost of direct labor Derived from Production Budget DL Budget formula: #units to be Produced x Direct Labor Hours per unit # Direct Labor Hours Needed XS cost per DLH SDL Budget Example: Sparky Company Each unit requires 3 direct labor hours. Sparky pays employees $10 per hour. Sparky always pays employees in the same quarter the wages are incurred. Prepare Sparky's Quarterly and Yearly DL Budget and DL Cash Payments Supporting Schedule # units to be produced x DLH per unit # DLH Needed for Production x $ cost per DLH SDL Budget Sparky Company DL Budget For the Year Ending December 31, 201xx Q1 02 Q3 3,100 3,600 4,100 3 3 3 9,300 10.800 12,300 S10 S10 S10 $93,000 $108,000 $123,000 04 4,600 3 13,800 $10 $138,000 Year 15,400 3 46,200 $10 $462,000 Sparky Company DL Cash Payments Supporting Schedule For the Year Ending December 31, 201xx Q1 Q2 Q3 $93,000 $108,000 $123,000 Q4 $138,000 Year $462,000 Payments for Current Quarter