Q1: You bought a small cap, illiquid stock 6 months ago, paying $1,734.55 per share. Two weeks ago, due to some unexpected financial pressures,

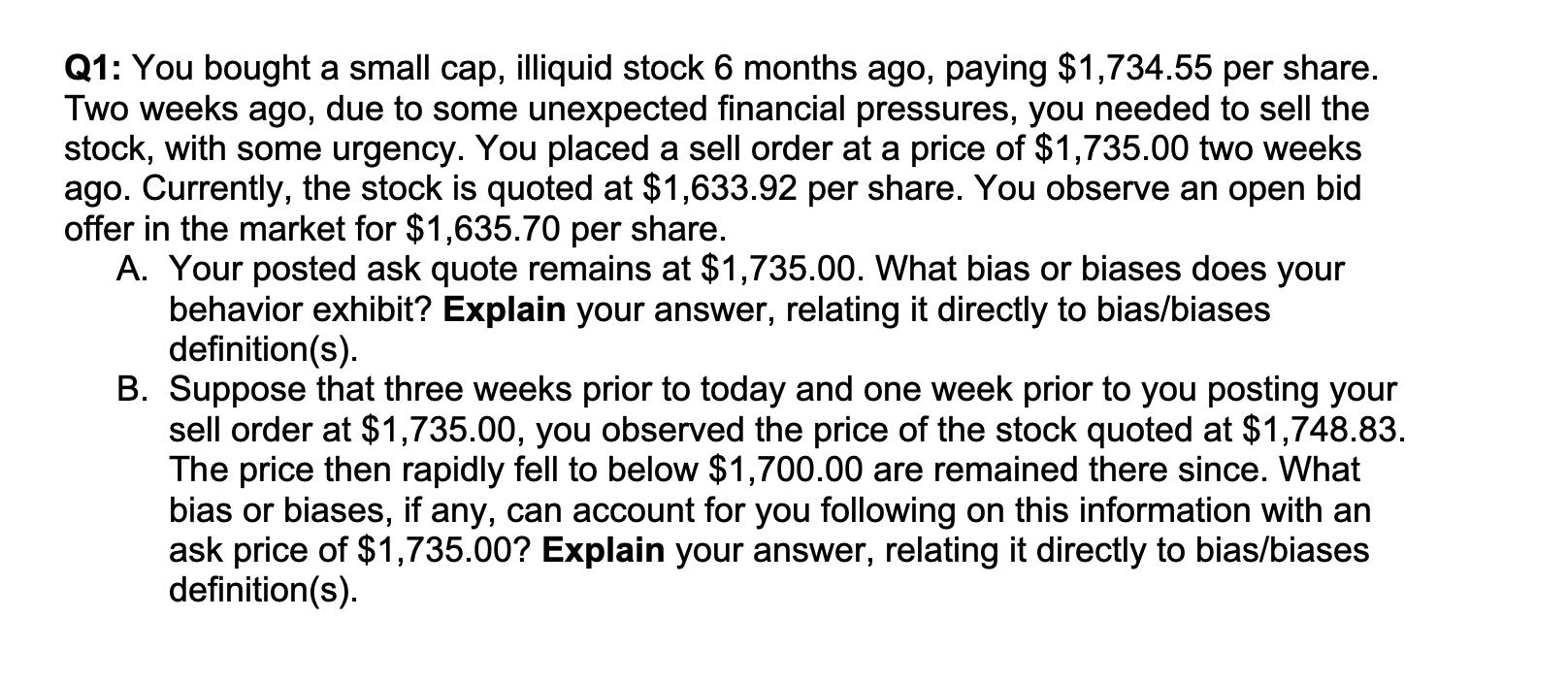

Q1: You bought a small cap, illiquid stock 6 months ago, paying $1,734.55 per share. Two weeks ago, due to some unexpected financial pressures, you needed to sell the stock, with some urgency. You placed a sell order at a price of $1,735.00 two weeks ago. Currently, the stock is quoted at $1,633.92 per share. You observe an open bid offer in the market for $1,635.70 per share. A. Your posted ask quote remains at $1,735.00. What bias or biases does your behavior exhibit? Explain your answer, relating it directly to bias/biases definition(s). B. Suppose that three weeks prior to today and one week prior to you posting your sell order at $1,735.00, you observed the price of the stock quoted at $1,748.83. The price then rapidly fell to below $1,700.00 are remained there since. What bias or biases, if any, can account for you following on this information with an ask price of $1,735.00? Explain your answer, relating it directly to bias/biases definition(s).

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a There are a few different biases at play here The first is the sunk cost fallacy which is when in...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started