Answered step by step

Verified Expert Solution

Question

1 Approved Answer

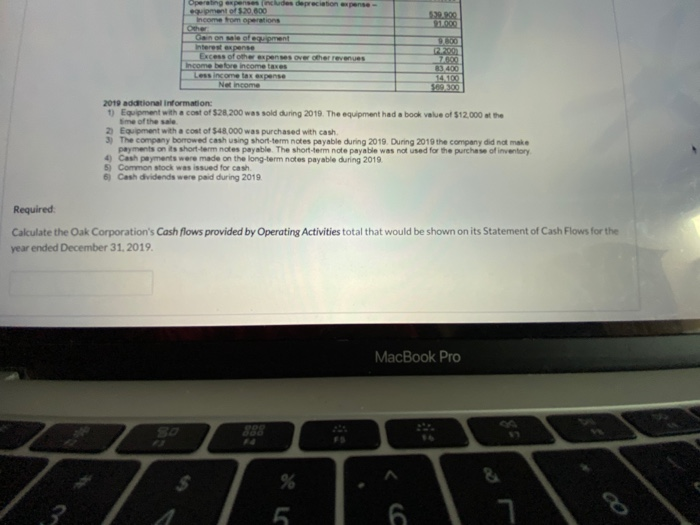

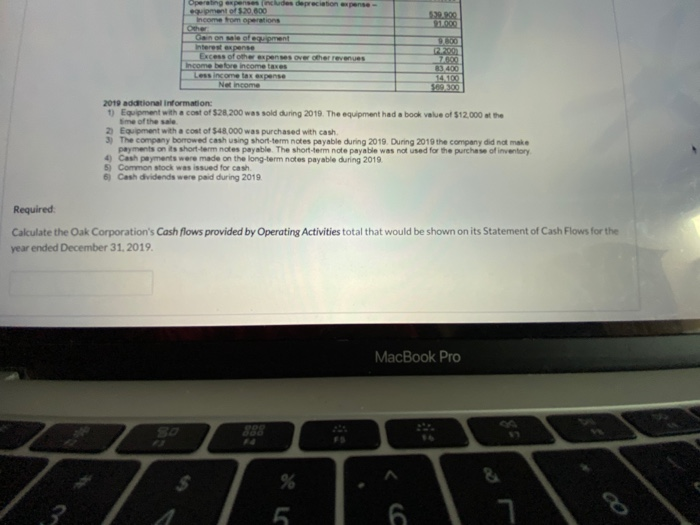

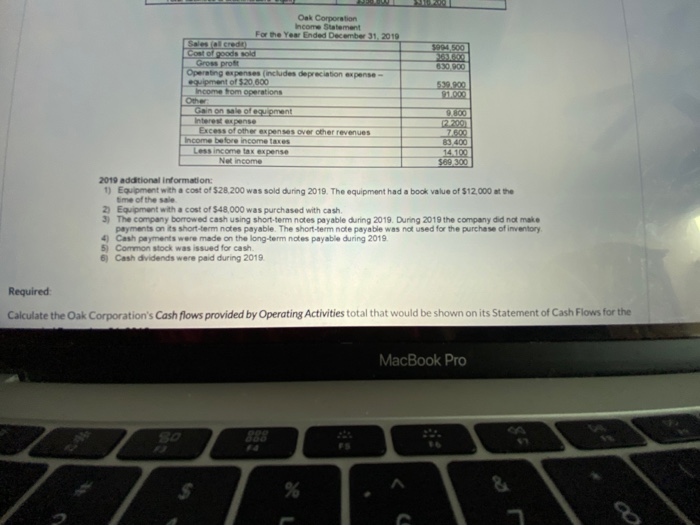

Operating expenses includes depreciation expense equipment of $20.800 income from operations $39.000 9100 Gonon le ofequent Interest expense Excess of other expenses over other revenu

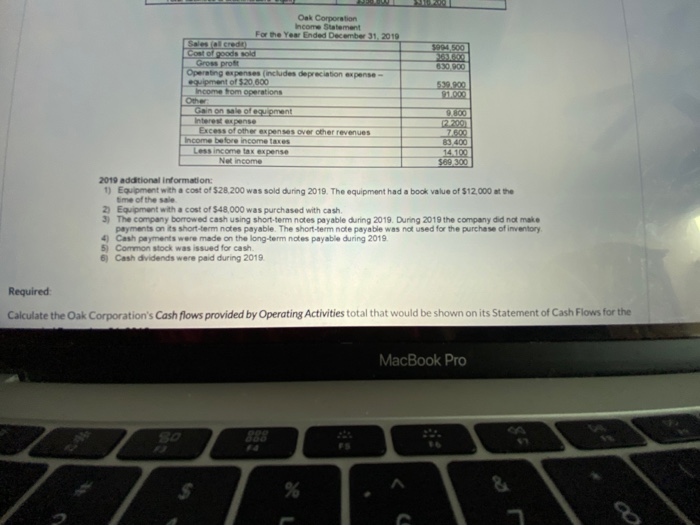

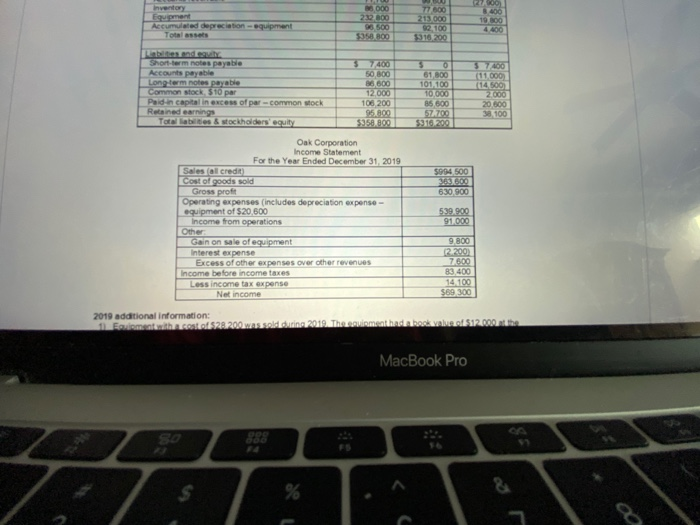

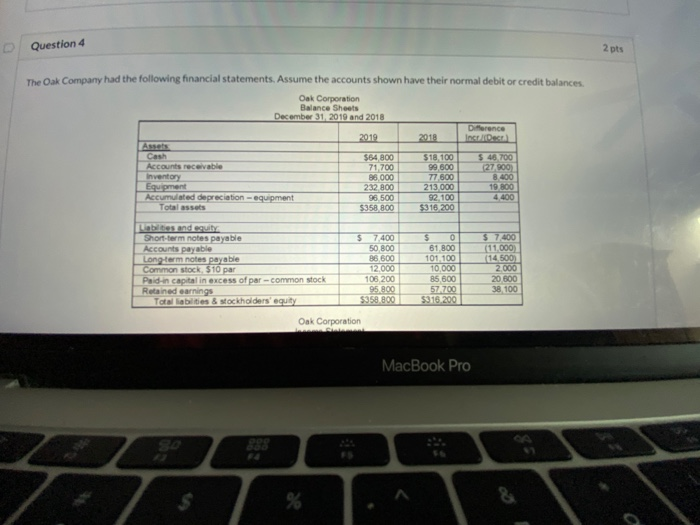

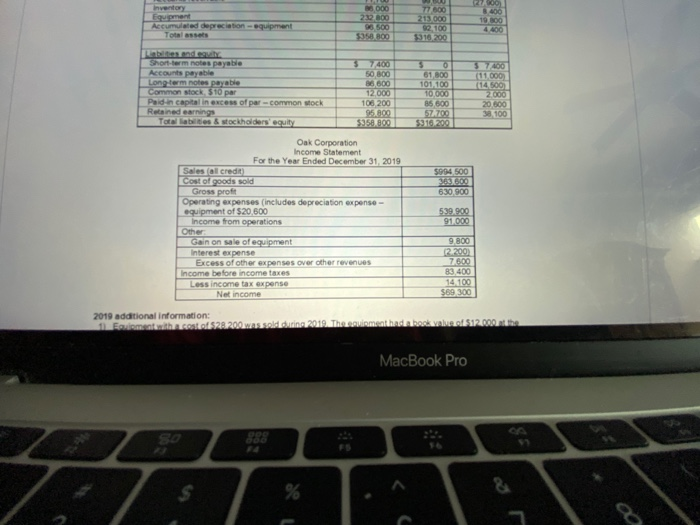

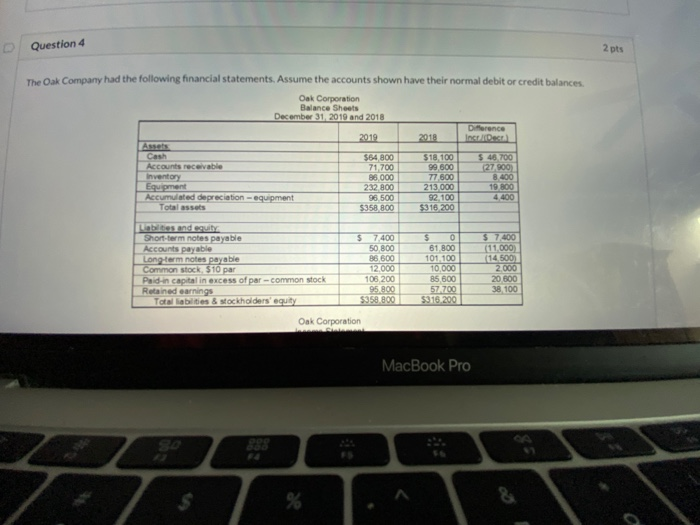

Operating expenses includes depreciation expense equipment of $20.800 income from operations $39.000 9100 Gonon le ofequent Interest expense Excess of other expenses over other revenu Income before income taxes Less income tax expense Nec income 7800 83 400 14.100 SH300 2019 additional information: 1) Equipment with a cost of $28. 200 was sold during 2019. The equipment had a book value of $12.000 at the time of the sale 2 Equipment with a cost of $48.000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019 5) Common stock was issued for cash 5) Cash dividends were paid during 2019 Required Calculate the Oak Corporation's Cash flows provided by Operating Activities total that would be shown on its Statement of Cash Flows for the year ended December 31, 2019. MacBook Pro 1 100 Oak Corporation Income Statement For the Year Ended December 31, 2019 Se all credit Cost of goods sold Gross proft Operating expenses includes depreciation expense- equipment of $20.000 income from operations Other Gain on sale of equipment Interest expense Excess of other expenses over other reven Income before income taxes Less income tax expense Not income 91.000 9800 22001 83.400 14.100 $69, 300 2019 additional information: 1) Equipment with a cost of $28.200 was sold during 2019. The equipment had a book value of $12.000 at the time of the sale 2) Equipment with a cost of $48.000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019 5) Common stock was issued for cash 6) Cash dividends were paid during 2019 Required Calculate the Oak Corporation's Cash flows provided by Operating Activities total that would be shown on its Statement of Cash Flows for the MacBook Pro Accumulated depreciation Total assets 000 232 BDO 0500 $350.800 77600 213.000 52100 3310 200 Liten de Short-term notes payable Accounts payable Long-term notes payable Common stock, $10 par Paid in capital in excess of par common stock Retained earnings Tob ie & stockholders' equity 37200 50.800 86 500 12.000 106 200 95.800 $350.800 $ 0 51.300 101 100 107000 85 600 57700 $3107001 $984,500 3637800 630.900 Oak Corporation Income Statement For the Year Ended December 31, 2019 Sales (all credit) Cost of goods sold Gross proft Operating expenses includes depreciation expense- equipment of $20,600 income from operations Other Gain on sale of equipment Interest expense Excess of other expenses over other revenues Income before income taxes Less income tax expense Net income 539.900 91.000 9800 2200 7600 83.400 14100 $69 300 2019 additional information: Rematado 220m in 2019. Thenimenthan herkvakes312.000 MacBook Pro Question 4 2 pts The Oak Company had the following financial statements. Assume the accounts shown have their normal debitor credit balances Oak Corporation Balance Sheets December 31, 2019 and 2018 2019 2018 Derence Ince Accounts receivable Inventory Equipment Accumulated depreciation Total assets $64.800 71,700 88 000 232 800 96.500 5358,800 S18100 99 300 77500 213.000 92.100 $316 200 $ 46.700 27.900) 8.400 19,800 4,400 equipment lates and cavit Short-term notes payable Accounts payable Long-term notes payable Common stock, $10 par Paid in capital in excess of par-common stock Retained earnings Total abilities & stockholders' equity $ 7.400 50.800 86.600 12,000 106 200 95.800 $358,800 $ 0 61 800 101.100 10.000 85.600 57700 $316.200 $ 1700 (11.000 14.500 2,000 20 800 38 100 Oak Corporation MacBook Pro

Operating expenses includes depreciation expense equipment of $20.800 income from operations $39.000 9100 Gonon le ofequent Interest expense Excess of other expenses over other revenu Income before income taxes Less income tax expense Nec income 7800 83 400 14.100 SH300 2019 additional information: 1) Equipment with a cost of $28. 200 was sold during 2019. The equipment had a book value of $12.000 at the time of the sale 2 Equipment with a cost of $48.000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019 5) Common stock was issued for cash 5) Cash dividends were paid during 2019 Required Calculate the Oak Corporation's Cash flows provided by Operating Activities total that would be shown on its Statement of Cash Flows for the year ended December 31, 2019. MacBook Pro 1 100 Oak Corporation Income Statement For the Year Ended December 31, 2019 Se all credit Cost of goods sold Gross proft Operating expenses includes depreciation expense- equipment of $20.000 income from operations Other Gain on sale of equipment Interest expense Excess of other expenses over other reven Income before income taxes Less income tax expense Not income 91.000 9800 22001 83.400 14.100 $69, 300 2019 additional information: 1) Equipment with a cost of $28.200 was sold during 2019. The equipment had a book value of $12.000 at the time of the sale 2) Equipment with a cost of $48.000 was purchased with cash 3) The company borrowed cash using short-term notes payable during 2019. During 2019 the company did not make payments on its short-term notes payable. The short-term note payable was not used for the purchase of inventory 4) Cash payments were made on the long-term notes payable during 2019 5) Common stock was issued for cash 6) Cash dividends were paid during 2019 Required Calculate the Oak Corporation's Cash flows provided by Operating Activities total that would be shown on its Statement of Cash Flows for the MacBook Pro Accumulated depreciation Total assets 000 232 BDO 0500 $350.800 77600 213.000 52100 3310 200 Liten de Short-term notes payable Accounts payable Long-term notes payable Common stock, $10 par Paid in capital in excess of par common stock Retained earnings Tob ie & stockholders' equity 37200 50.800 86 500 12.000 106 200 95.800 $350.800 $ 0 51.300 101 100 107000 85 600 57700 $3107001 $984,500 3637800 630.900 Oak Corporation Income Statement For the Year Ended December 31, 2019 Sales (all credit) Cost of goods sold Gross proft Operating expenses includes depreciation expense- equipment of $20,600 income from operations Other Gain on sale of equipment Interest expense Excess of other expenses over other revenues Income before income taxes Less income tax expense Net income 539.900 91.000 9800 2200 7600 83.400 14100 $69 300 2019 additional information: Rematado 220m in 2019. Thenimenthan herkvakes312.000 MacBook Pro Question 4 2 pts The Oak Company had the following financial statements. Assume the accounts shown have their normal debitor credit balances Oak Corporation Balance Sheets December 31, 2019 and 2018 2019 2018 Derence Ince Accounts receivable Inventory Equipment Accumulated depreciation Total assets $64.800 71,700 88 000 232 800 96.500 5358,800 S18100 99 300 77500 213.000 92.100 $316 200 $ 46.700 27.900) 8.400 19,800 4,400 equipment lates and cavit Short-term notes payable Accounts payable Long-term notes payable Common stock, $10 par Paid in capital in excess of par-common stock Retained earnings Total abilities & stockholders' equity $ 7.400 50.800 86.600 12,000 106 200 95.800 $358,800 $ 0 61 800 101.100 10.000 85.600 57700 $316.200 $ 1700 (11.000 14.500 2,000 20 800 38 100 Oak Corporation MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started