Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are going to take out a one-year $15,000 loan to purchase a car. The loan company believes there are three possible outcomes: a

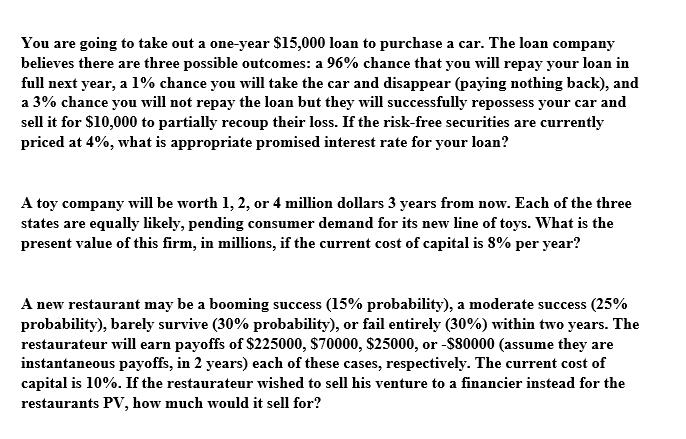

You are going to take out a one-year $15,000 loan to purchase a car. The loan company believes there are three possible outcomes: a 96% chance that you will repay your loan in full next year, a 1% chance you will take the car and disappear (paying nothing back), and a 3% chance you will not repay the loan but they will successfully repossess your car and sell it for $10,000 to partially recoup their loss. If the risk-free securities are currently priced at 4%, what is appropriate promised interest rate for your loan? A toy company will be worth 1, 2, or 4 million dollars 3 years from now. Each of the three states are equally likely, pending consumer demand for its new line of toys. What is the present value of this firm, in millions, if the current cost of capital is 8% per year? A new restaurant may be a booming success (15% probability), a moderate success (25% probability), barely survive (30% probability), or fail entirely (30%) within two years. The restaurateur will earn payoffs of $225000, $70000, $25000, or -$80000 (assume they are instantaneous payoffs, in 2 years) each of these cases, respectively. The current cost of capital is 10%. If the restaurateur wished to sell his venture to a financier instead for the restaurants PV, how much would it sell for?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 The appropriate promised interest rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started