Answered step by step

Verified Expert Solution

Question

1 Approved Answer

However, CEO of Mill Export Co. is worried about the impact on stock price due to an increase in debt ratio. As a financial

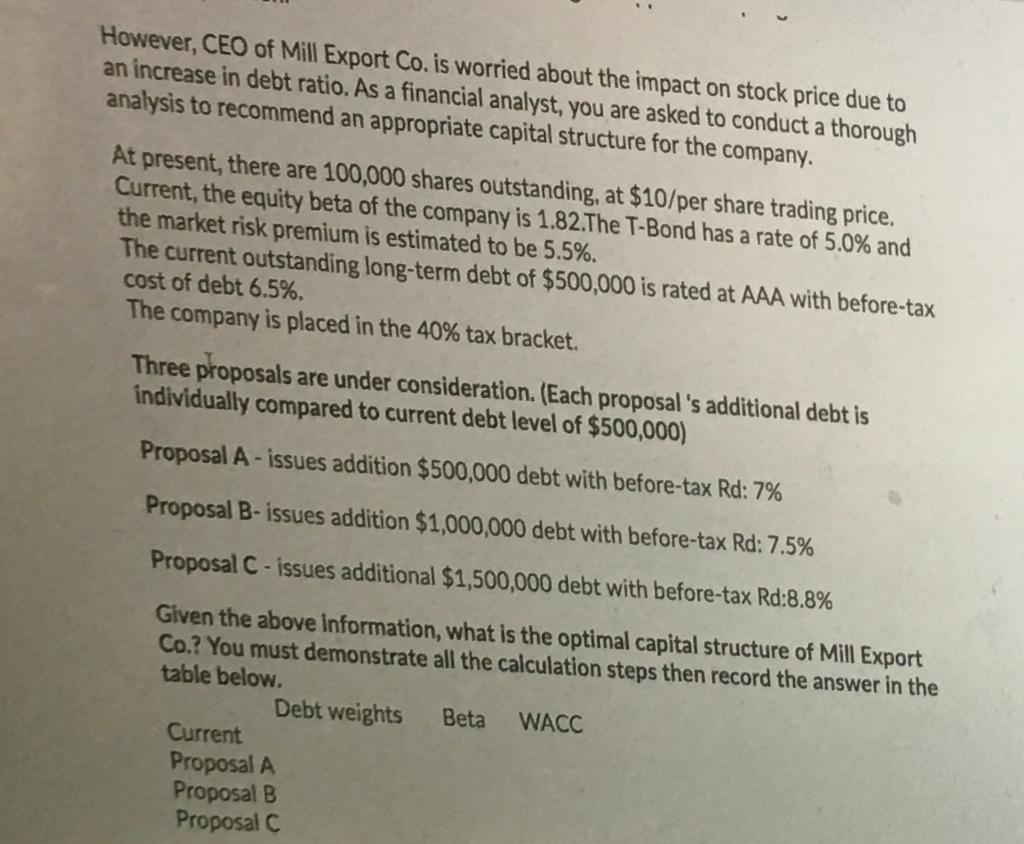

However, CEO of Mill Export Co. is worried about the impact on stock price due to an increase in debt ratio. As a financial analyst, you are asked to conduct a thorough analysis to recommend an appropriate capital structure for the company. At present, there are 100,000 shares outstanding, at $10/per share trading price. Current, the equity beta of the company is 1.82.The T-Bond has a rate of 5.0% and the market risk premium is estimated to be 5.5%. The current outstanding long-term debt of $500,000 is rated at AAA with before-tax cost of debt 6.5%. The company is placed in the 40% tax bracket. Three proposals are under consideration. (Each proposal 's additional debt is individually compared to current debt level of $500,000) Proposal A-issues addition $500,000 debt with before-tax Rd: 7% Proposal B-issues addition $1,000,000 debt with before-tax Rd: 7.5% Proposal C-issues additional $1,500,000 debt with before-tax Rd:8.8% Given the above Information, what is the optimal capital structure of Mill Export Co.? You must demonstrate all the calculation steps then record the answer in the table below. Debt weights Beta WACC Current Proposal A Proposal B Proposal C

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Share Price 1000 No of Shares 10000000 Share Capital Share Price x No of Share...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started