Answered step by step

Verified Expert Solution

Question

1 Approved Answer

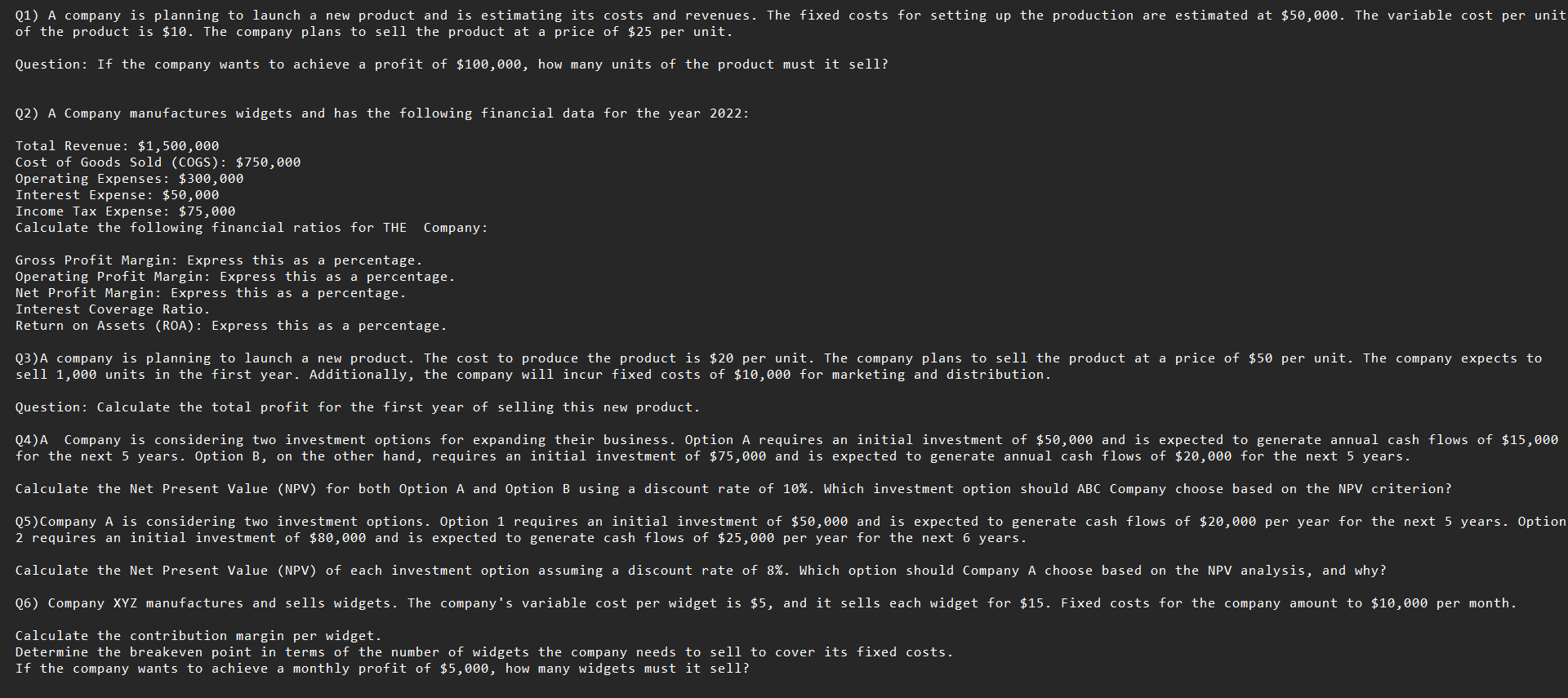

operation management QI) A company is planning to launch a new product and is estimating its costs and revenues. The fixed costs for setting up

operation management

QI) A company is planning to launch a new product and is estimating its costs and revenues. The fixed costs for setting up the production are estimated at $5,. of the product is $10. The company plans to sell the product at a price of $25 per unit. Question: If the company wants to achieve a profit of $100, , how many units of the product must it sell? Q2) A Company manufactures widgets and has the following financial data for the year 2022: Total Revenue: $1, 500, cost of Goods sold (COGS): $750, Operating Expenses: $300, Interest Expense: $50, Income Tax Expense: $75, Calculate the following financial ratios for THE Company: Gross Profit Margin: Express this as a percentage. Operating Profit Margin: Express this as a percentage. Net Profit Margin: Express this as a percentage. Interest Coverage Ratio. Return on Assets (ROA): Express this as a percentage. Q3)A company is planning to launch a new product. The cost to produce the product is $20 per unit. The company plans to sell the product at a price of $50 per unit. sell I, units in the first year. Additionally, the company will incur fixed costs of $1, for marketing and distribution. Question: Calculate the total profit for the first year of selling this new product. The variable cost per unit The company expects to Q4)A Company is considering two investment options for expanding their business. Option A requires an initial investment of $50, and is expected to generate annual cash flows of $15, for the next 5 years. Option B, on the other hand, requires an initial investment of $75, and is expected to generate annual cash flows of $2, for the next 5 years. Calculate the Net Present Value (NPV) for both Option A and Option B using a discount rate of 10%. Which investment option should ABC Company choose based on the NPV criterion? Q5)Company A is considering two investment options. Option 1 requires an initial investment of $5, and is expected to generate cash flows of $2, per year for the next 5 years. 2 requires an initial investment of $8, and is expected to generate cash flows of $25, per year for the next 6 years. Calculate the Net Present Value (NPV) of each investment option assuming a discount rate of 8%. Which option should Company A choose based on the NPV analysis, and why? Q6) Company XYZ manufactures and sells widgets. The company's variable cost per widget is $5, and it sells each widget for $15. Fixed costs for the company amount to $1, per month. Calculate the contribution margin per widget. Determine the breakeven point in terms of the number of widgets the company needs to sell to cover its fixed costs. If the company wants to achieve a monthly profit of $5, , how many widgets must it sell? Option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started