Answered step by step

Verified Expert Solution

Question

1 Approved Answer

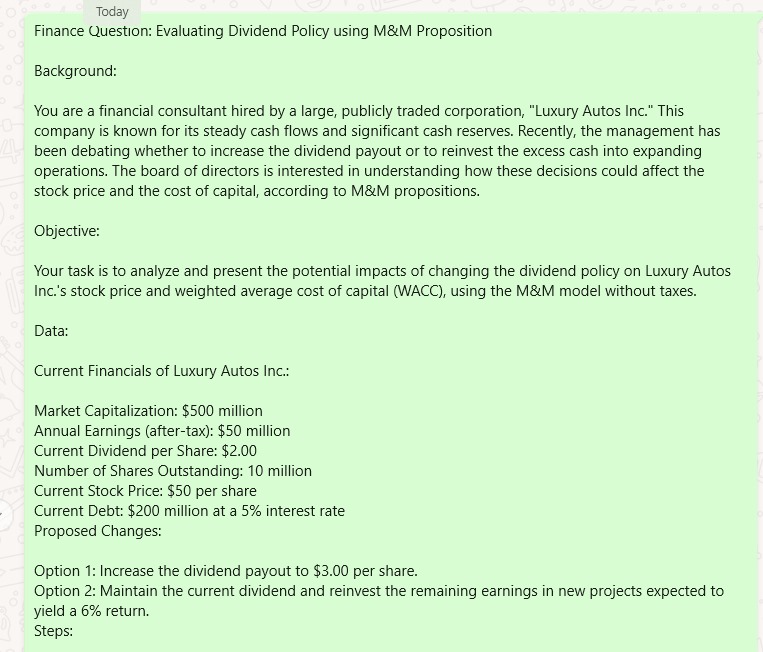

OPERATION MANAGEMENT Quest on: Evaluating Dividend Policy using M&M Proposition Background: You are a financial consultant hired by a large, publicly traded corporation, Luxury Autos

OPERATION MANAGEMENT Queston: Evaluating Dividend Policy using M&M Proposition

Background:

You are a financial consultant hired by a large, publicly traded corporation, "Luxury Autos Inc." This

company is known for its steady cash flows and significant cash reserves. Recently, the management has

been debating whether to increase the dividend payout or to reinvest the excess cash into expanding

operations. The board of directors is interested in understanding how these decisions could affect the

stock price and the cost of capital, according to M&M propositions.

Objective:

Your task is to analyze and present the potential impacts of changing the dividend policy on Luxury Autos

Inc.s stock price and weighted average cost of capital WACC using the M&M model without taxes.

Data:

Current Financials of Luxury Autos Inc.:

Market Capitalization: $ million

Annual Earnings aftertax: $ million

Current Dividend per Share: $

Number of Shares Outstanding: million

Current Stock Price: $ per share

Current Debt: $ million at a interest rate

Proposed Changes:

Option : Increase the dividend payout to $ per share.

Option : Maintain the current dividend and reinvest the remaining earnings in new projects expected to

yield a return.

Steps: Option : Increase the dividend payout to $ per share.

Option : Maintain the current dividend and reinvest the remaining earnings in new projects expected to

yield a return.

Steps:

Current WACC Calculation:

Calculate the current cost of equity using the dividend discount model DDM

Calculate the current WACC for Luxury Autos Inc.

Impact of Increased Dividend:

Calculate the new stock price using the revised dividend on the DDM model.

Discuss the potential impact on the company's stock price according to M&M theorem.

Reinvestment Analysis:

Estimate the new earnings and stock price if the retained earnings are reinvested.

Calculate the new WACC.

Comparison and Recommendation:

Compare the financial outcomes of increasing the dividend versus reinvesting the earnings.

Make a recommendation based on your analysis regarding the optimal dividend policy for maximizing

shareholder value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started