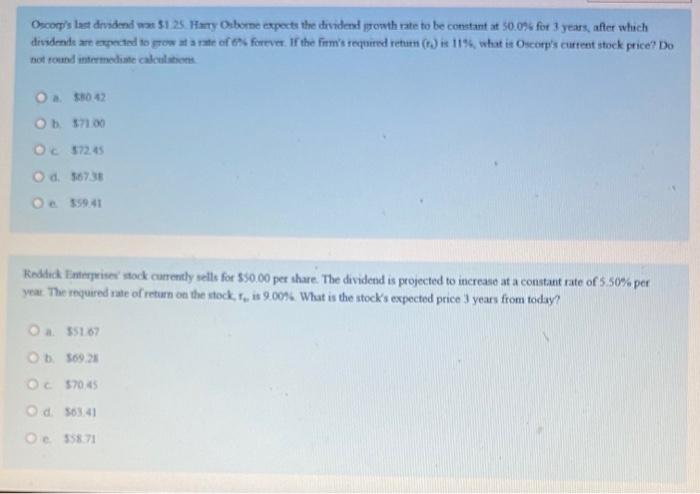

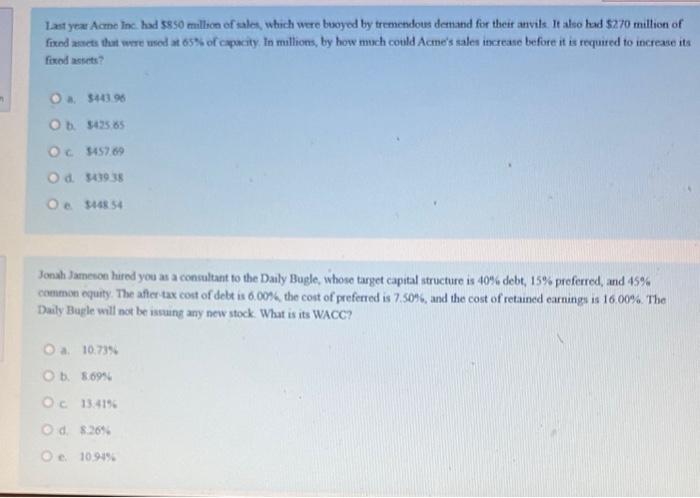

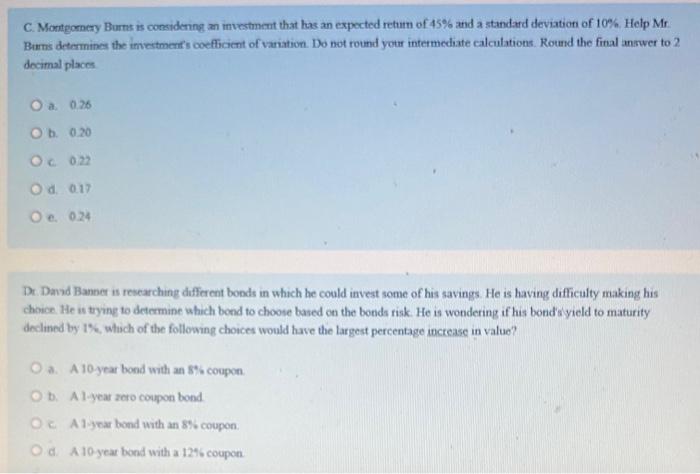

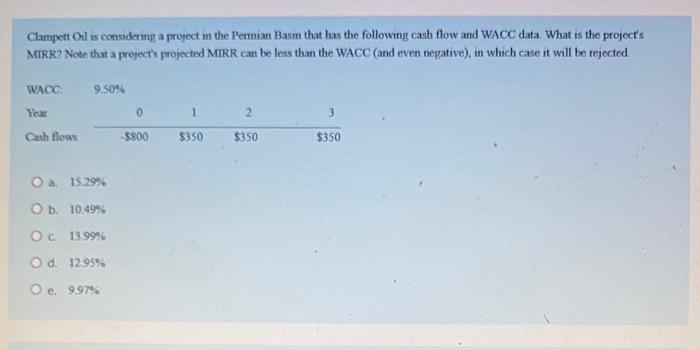

Opoop's last dividmd mat 51.25 . Hart Osborne expects the dividesd jrowth rate to be censtant at 50.0 . for 3 years, after which divdende ar expected to grow at a rate of 6 . forrerr. If the firm's required return (h) is 11%, what it Oscorp's current stock price? Do bot tound imstrmodiste calculatione a. 50042 b. 57100 c. 47245 a. 9.6738 e 559.41 Keddick Iinterprises' stock currently sells for 550.00 per share. The dividend is projected to increase at a constant rate of 5.50% per year. The required rate of retum on the stock, rk is 9.00%. What is the stocks expected price 3 years from today? a. 55167 b. 36921 c 57045 d 563.41 c. 558.71 Last yea Aame inc had 5850 millon of sales which were buoyed by tremendous denand for their anvils. It also had 5270 million of fixnd acecs that wre wsed at 65% of capwity, in mallioms, by how much could Acme's sales increase before it is required to increase its ferod astets? 3. 544396 b. 542565 c. 545769 d. 543938 e. 1445.54 Jonah Jameson hired you as a consultant to the Daily Bugle, whose target capital structure is 40% debt, 15% preferred, and 45% common equity. The affertax cost of debt is 6.00%, the cost of preferred is 7.50%6, and the cost of retained earnings is 16.00%. The Daily Bugle will not be issung any new stock. What is its WACC? a. 10.73% b. 8.69% c. 13.4196 d. $20% c. 1094% C. Montgornery Burns is considenng an investment that has an expocted return of 45% and a standard deviation of 10%. Help Mr Burns deterninas the imecimerif's coefficient of variation. Do not round your intermediate calculations. Round the firal answer to 2 docimal places a. 0.26 b. 0.20 c. 022 d. 0.17 e. 024 Dr. Dand Banner is researching different bonds in which he could invest some of his savings. He is having difficulty making his choice. He is trying to determine which bond to choose based on the bonds risk. He is wondering if his bond s yield to maturity dnclined by 1%, which of the following choices would have the largest percentage increase in value? 3. A 10 year bond with an 8% coupon b. A l-year zero coupon bond c. A 1 year bend with an 8\% coupon. d. A 10 year bond with a 1246 coupon Clampett Oil is considering a project in the Permian Basm that has the following cach flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected a. 1529% b. 10.49% c. 1399% d. 1295% e. 9.9756