Answered step by step

Verified Expert Solution

Question

1 Approved Answer

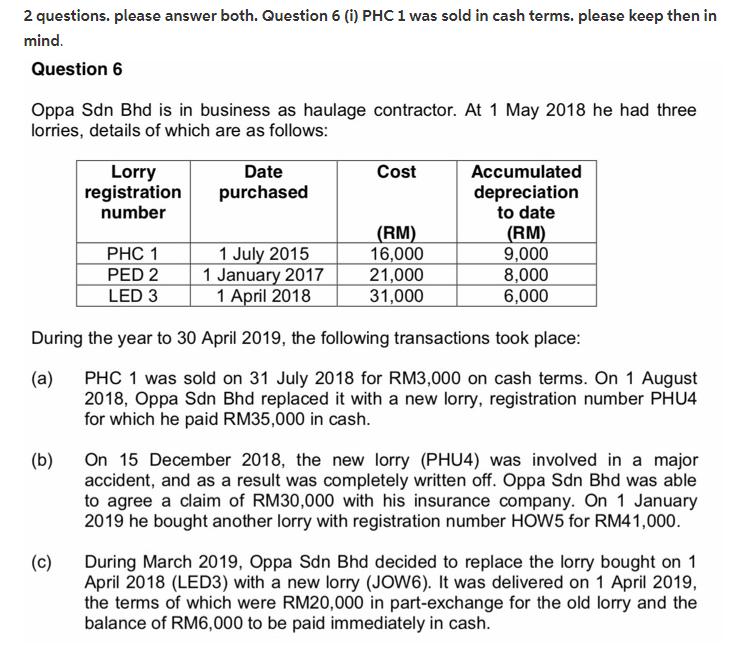

Oppa Sdn Bhd is in business as haulage contractor. At 1 May 2018 he had three lorries, details of which are as follows: (b)

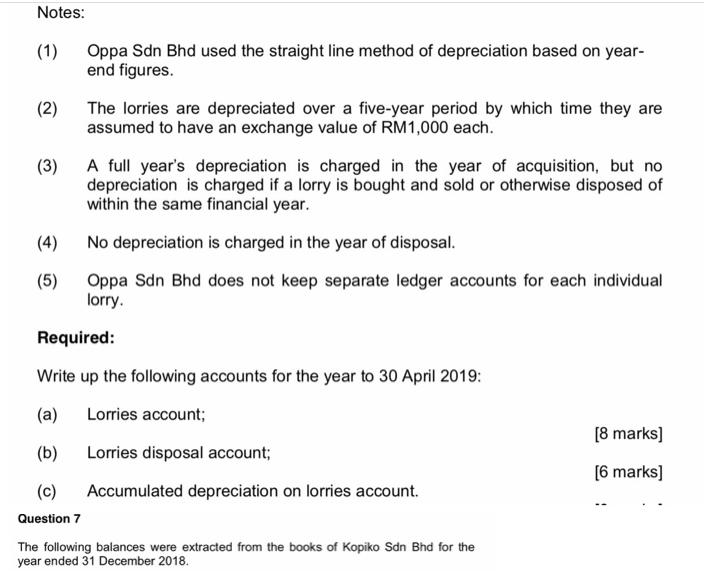

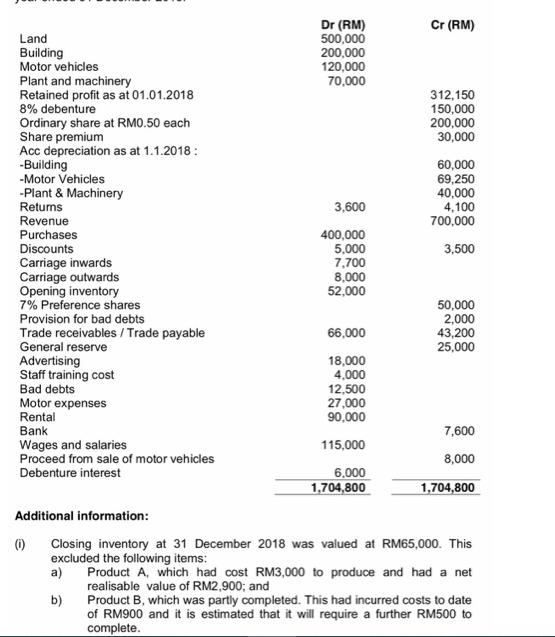

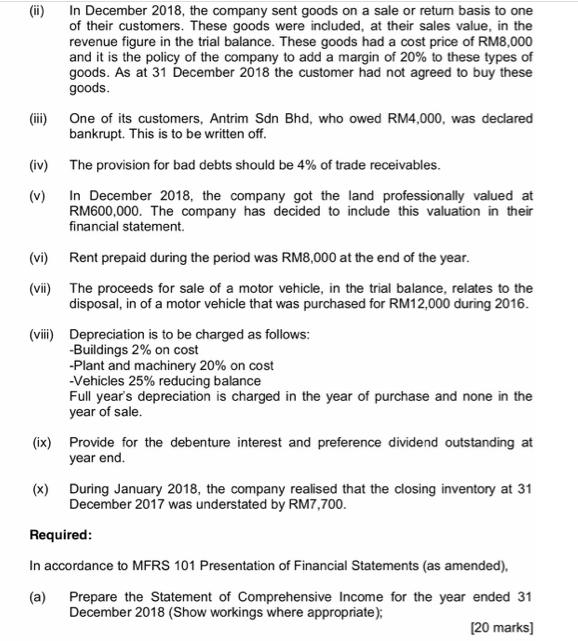

Oppa Sdn Bhd is in business as haulage contractor. At 1 May 2018 he had three lorries, details of which are as follows: (b) Lorry registration number (c) PHC 1 PED 2 LED 3 Date purchased Cost (RM) 16,000 1 July 2015 1 January 2017 1 April 2018 During the year to 30 April 2019, the following transactions took place: (a) PHC 1 was sold on 31 July 2018 for RM3,000 on cash terms. On 1 August 2018, Oppa Sdn Bhd replaced it with a new lorry, registration number PHU4 for which he paid RM35,000 in cash. Accumulated depreciation to date 21,000 31,000 (RM) 9,000 8,000 6,000 On 15 December 2018, the new lorry (PHU4) was involved in a major accident, and as a result was completely written off. Oppa Sdn Bhd was able to agree a claim of RM30,000 with his insurance company. On 1 January 2019 he bought another lorry with registration number HOW5 for RM41,000. During March 2019, Oppa Sdn Bhd decided to replace the lorry bought on 1 April 2018 (LED3) with a new lorry (JOW6). It was delivered on 1 April 2019, the terms of which were RM20,000 in part-exchange for the old lorry and the balance of RM6,000 to be paid immediately in cash. Notes: (1) (2) Oppa Sdn Bhd used the straight line method of depreciation based on year- end figures. (4) (5) The lorries are depreciated over a five-year period by which time they are assumed to have an exchange value of RM1,000 each. (3) A full year's depreciation is charged in the year of acquisition, but no depreciation is charged if a lorry is bought and sold or otherwise disposed of within the same financial year. No depreciation is charged in the year of disposal. Oppa Sdn Bhd does not keep separate ledger accounts for each individual lorry. Required: Write up the following accounts for the year to 30 April 2019: (a) Lorries account; (b) Lorries disposal account; (c) Accumulated depreciation on lorries account. Question 7 The following balances were extracted from the books of Kopiko Sdn Bhd for the year ended 31 December 2018. [8 marks] [6 marks] Land Building Motor vehicles Plant and machinery Retained profit as at 01.01.2018 8% debenture Ordinary share at RM0.50 each Share premium Acc depreciation as at 1.1.2018: -Building -Motor Vehicles -Plant & Machinery Returns Revenue Purchases Discounts Carriage inwards Carriage outwards Opening inventory 7% Preference shares Provision for bad debts Trade receivables / Trade payable General reserve Advertising Staff training cost Bad debts Motor expenses Rental Bank Wages and salaries Proceed from sale of motor vehicles Debenture interest Dr (RM) 500,000 200,000 120,000 70,000 (1) 3,600 400,000 5,000 7,700 8,000 52,000 66,000 18,000 4,000 12,500 27,000 90,000 115,000 6,000 1,704,800 Cr (RM) 312,150 150,000 200,000 30,000 60,000 69,250 40,000 4,100 700,000 3,500 50,000 2,000 43,200 25,000 7,600 8,000 1,704,800 Additional information: Closing inventory at 31 December 2018 was valued at RM65,000. This excluded the following items: a) Product A, which had cost RM3,000 to produce and had a net realisable value of RM2,900; and b) Product B, which was partly completed. This had incurred costs to date of RM900 and it is estimated that it will require a further RM500 to complete. (ii) In December 2018, the company sent goods on a sale or return basis to one of their customers. These goods were included, at their sales value, in the revenue figure in the trial balance. These goods had a cost price of RM8,000 and it is the policy of the company to add a margin of 20% to these types of goods. As at 31 December 2018 the customer had not agreed to buy these goods. (iii) (iv) (v) (vi) (vii) One of its customers, Antrim Sdn Bhd, who owed RM4,000, was declared bankrupt. This is to be written off. The provision for bad debts should be 4% of trade receivables. In December 2018, the company got the land professionally valued at RM600,000. The company has decided to include this valuation in their financial statement. Rent prepaid during the period was RM8,000 at the end of the year. The proceeds for sale of a motor vehicle, in the trial balance, relates to the disposal, in of a motor vehicle that was purchased for RM12,000 during 2016. (viii) Depreciation is to be charged as follows: -Buildings 2% on cost -Plant and machinery 20% on cost -Vehicles 25% reducing balance Full year's depreciation is charged in the year of purchase and none in the year of sale. (ix) Provide for the debenture interest and preference dividend outstanding at year end. (x) During January 2018, the company realised that the closing inventory at 31 December 2017 was understated by RM7,700. Required: In accordance to MFRS 101 Presentation of Financial Statements (as amended), (a) Prepare the Statement of Comprehensive Income for the year ended 31 December 2018 (Show workings where appropriate); [20 marks] (b) Prepare the Statement of Financial Position for the year ended 31 December 2018 (Show workings where appropriate). please answer q6 and ignore q7 thanks. just answer the q6 and ignore q7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started