Answered step by step

Verified Expert Solution

Question

1 Approved Answer

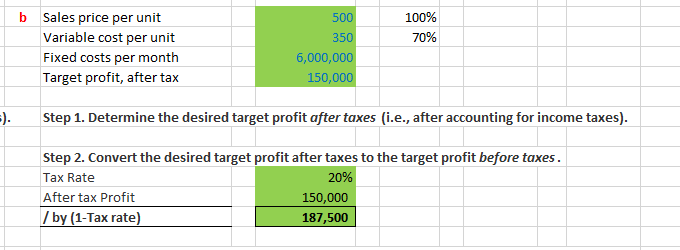

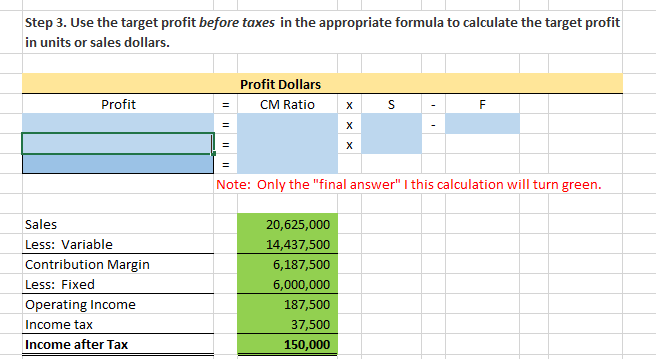

Optical Incorporated has annual fixed costs totaling $6,000,000 and variable costs of $350 per unit. Each unit of product is sold for $500. Assume a

Optical Incorporated has annual fixed costs totaling $6,000,000 and variable costs of $350 per unit. Each unit of product is sold for $500. Assume a tax rate of 20 percent.

Use the three steps described in the chapter to determine the sales dollars required to earn an annual profit of $150,000 after taxes Support the calculation in requirement b, by constructing a contribution income statement

JUST NEED BLUE AREAS PLEASE

b Sales price per unit Variable cost per unit Fixed costs per month Target profit, after tax 100% 70% 500 6,000,000 150,000 Siope. Determine h Step 2. Convert the desired target profit after taxes to the target profit before taxes. 2096 150,000 187,500 late After tax Profit /by (1-Tax rate) Step 3. Use the target profit before taxes in the appropriate formula to calculate the target profit in units or sales dollars. Profit Dollars CM Ratio Preiii ic Note: Only the "final answer" I this calculation will turn green Sales Less: Variable Contribution Margin Less: Fixed Operating Income Income tax Income after Tax 20,625,000 14,437,500 6,187,500 6,000,000 187,500 37,500 150,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started