Question

OptiLux is considering investing in an automated manufacturing system. The system requires an initial investment of $6.0 million, has a 20-year life, and will have

OptiLux is considering investing in an automated manufacturing system. The system requires an initial investment of $6.0 million, has a 20-year life, and will have zero salvage value. If the system is implemented, the company will save $740,000 per year in direct labor costs. The company requires a 10% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) a. Compute the proposed investments net present value.

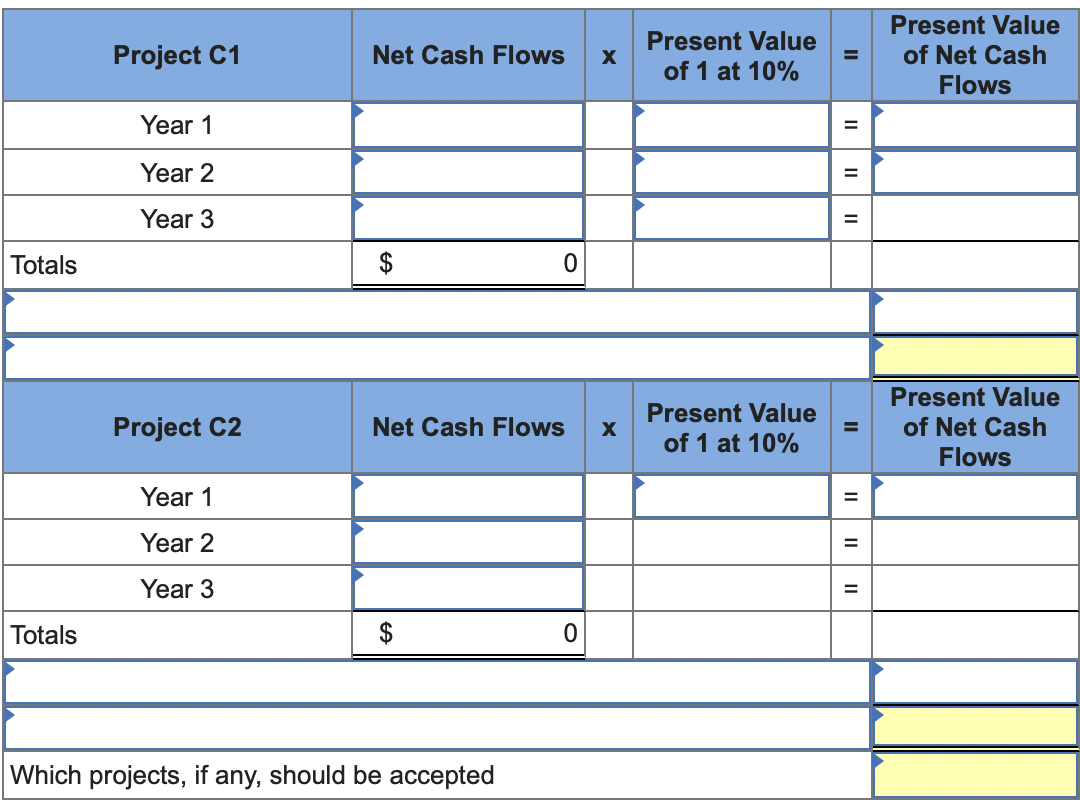

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $234,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Net cash flows | Project C1 | Project C2 |

|---|---|---|

| Year 1 | $ 14,000 | $ 98,000 |

| Year 2 | 110,000 | 98,000 |

| Year 3 | 170,000 | 98,000 |

| Totals | $ 294,000 | $ 294,000 |

a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted.

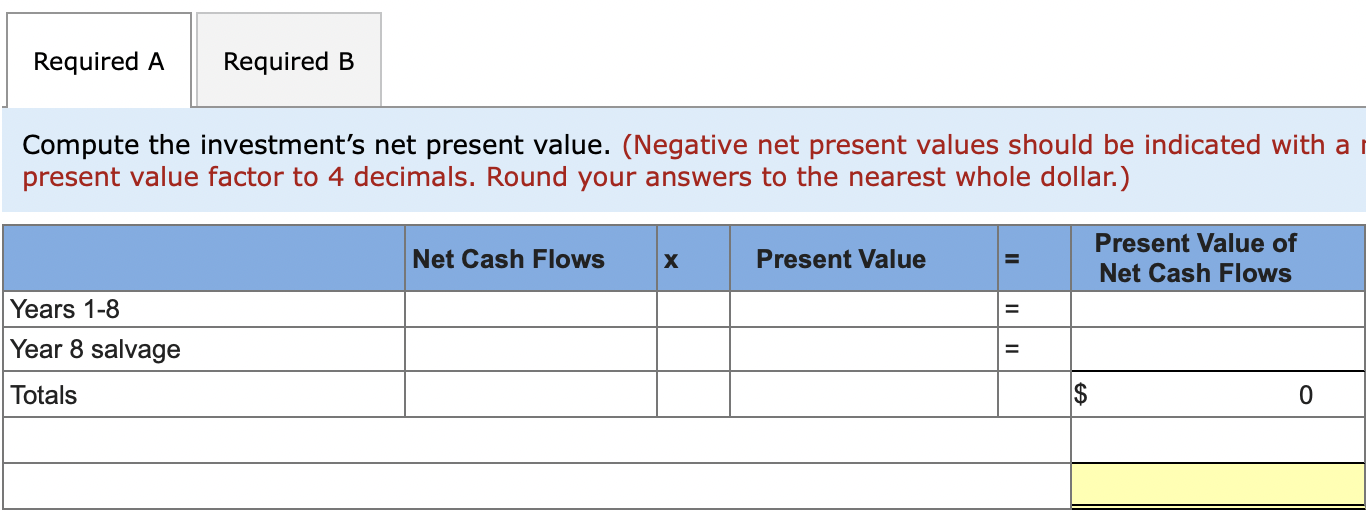

Quary Company is considering an investment in machinery with the following information. The companys required rate of return is 12%. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Initial investment | $ 256,000 | Materials, labor, and overhead (except depreciation) | $ 48,000 | |

| Useful life | 8 | years | DepreciationMachinery | 25,600 |

| Salvage value | $ 25,600 | Selling, general, and administrative expenses | 8,000 | |

| Expected sales per year | 10,000 | units | Selling price per unit | $ 12 |

a. Compute the investments net present value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started