Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Optima Bhd is considering a project in replacing an existing machine that would increase sales and reduce costs. This project called Project A requires

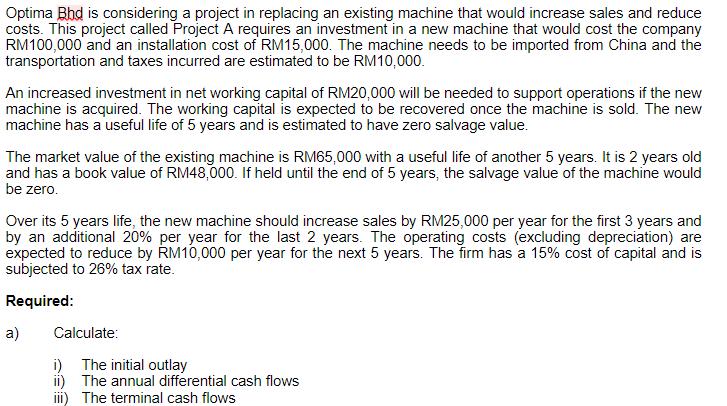

Optima Bhd is considering a project in replacing an existing machine that would increase sales and reduce costs. This project called Project A requires an investment in a new machine that would cost the company RM100,000 and an installation cost of RM15,000. The machine needs to be imported from China and the transportation and taxes incurred are estimated to be RM10,000. An increased investment in net working capital of RM20,000 will be needed to support operations if the new machine is acquired. The working capital is expected to be recovered once the machine is sold. The new machine has a useful life of 5 years and is estimated to have zero salvage value. The market value of the existing machine is RM65,000 with a useful life of another 5 years. It is 2 years old and has a book value of RM48,000. If held until the end of 5 years, the salvage value of the machine would be zero. Over its 5 years life, the new machine should increase sales by RM25,000 per year for the first 3 years and by an additional 20% per year for the last 2 years. The operating costs (excluding depreciation) are expected to reduce by RM10,000 per year for the next 5 years. The firm has a 15% cost of capital and is subjected to 26% tax rate. Required: a) Calculate: i) ii) iii) The initial outlay The annual differential cash flows The terminal cash flows

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the financial viability of Project A we need to calculate the initial outlay annual differential cash flows and terminal cash flows Lets break down the calculations step by step a i The ini...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started