Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Optimization Correction!! Hint: In each periodt= 1, . . . , T, we have constraints cash inflow = cash outflow '=' not '- A company

Optimization

Correction!!

Hint: In each periodt= 1, . . . , T, we have constraints cash inflow = cash outflow

'=' not '-

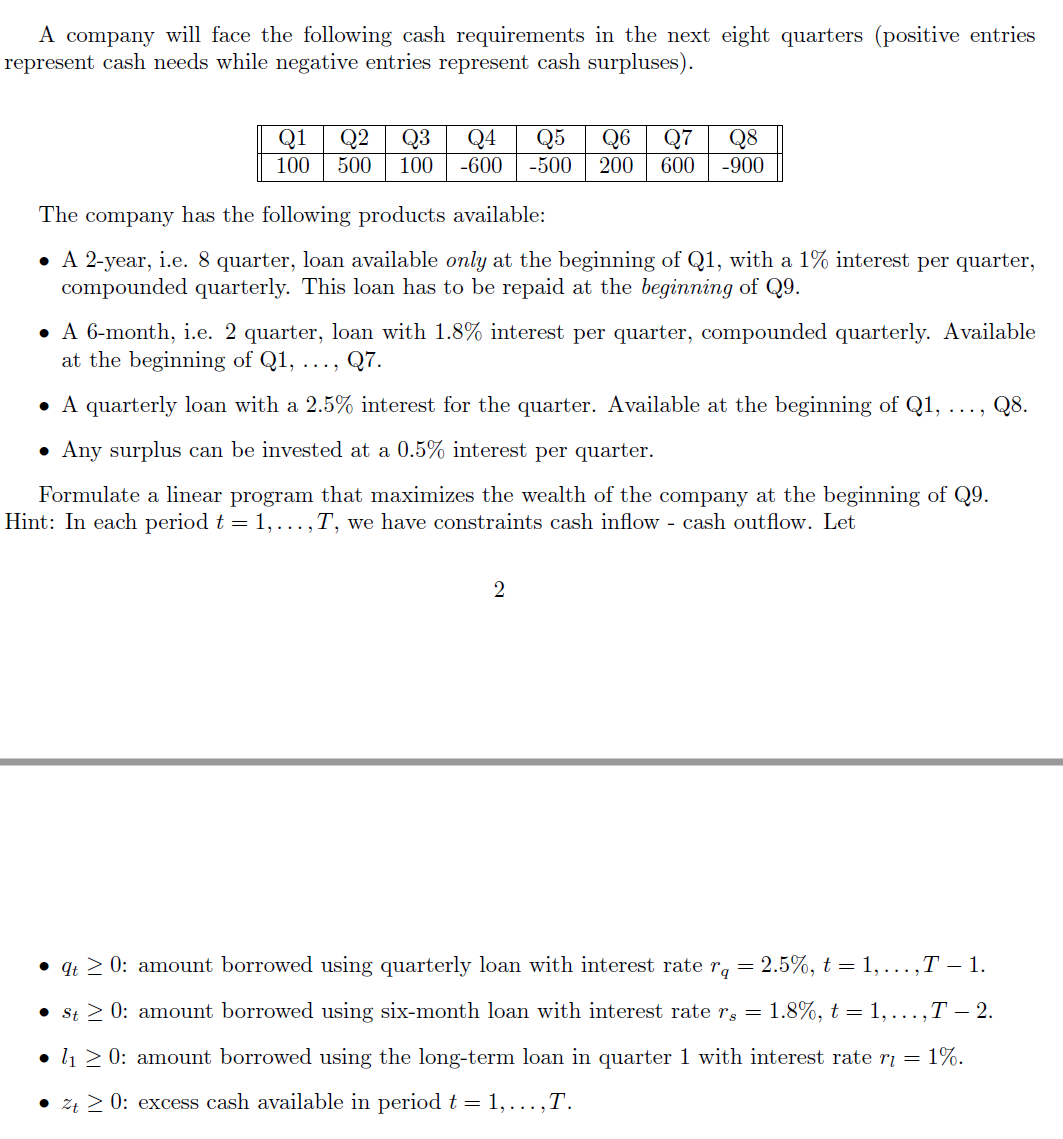

A company will face the following cash requirements in the next eight quarters (positive entries represent cash needs while negative entries represent cash surpluses). Q1 100 Q2 500 Q3 100 Q4 -600 Q5 -500 Q6 200 Q7 600 Q8 -900 The company has the following products available: A 2-year, i.e. 8 quarter, loan available only at the beginning of Q1, with a 1% interest per quarter, compounded quarterly. This loan has to be repaid at the beginning of Q9. A 6-month, i.e. 2 quarter, loan with 1.8% interest per quarter, compounded quarterly. Available at the beginning of Q1, ..., Q7. A quarterly loan with a 2.5% interest for the quarter. Available at the beginning of Qi, Q8. Any surplus can be invested at a 0.5% interest per quarter. Formulate a linear program that maximizes the wealth of the company at the beginning of Q9. Hint: In each period t = 1,...,T, we have constraints cash inflow - cash outflow. Let 2 qt > 0: amount borrowed using quarterly loan with interest rate ra = 2.5%, t = 1, ...,T 1. St > 0: amount borrowed using six-month loan with interest rate rs = 1.8%, t= 1, ...,T 2. li > 0: amount borrowed using the long-term loan in quarter 1 with interest rate ri = 1%. zt > 0: excess cash available in period t = 1,...,T. A company will face the following cash requirements in the next eight quarters (positive entries represent cash needs while negative entries represent cash surpluses). Q1 100 Q2 500 Q3 100 Q4 -600 Q5 -500 Q6 200 Q7 600 Q8 -900 The company has the following products available: A 2-year, i.e. 8 quarter, loan available only at the beginning of Q1, with a 1% interest per quarter, compounded quarterly. This loan has to be repaid at the beginning of Q9. A 6-month, i.e. 2 quarter, loan with 1.8% interest per quarter, compounded quarterly. Available at the beginning of Q1, ..., Q7. A quarterly loan with a 2.5% interest for the quarter. Available at the beginning of Qi, Q8. Any surplus can be invested at a 0.5% interest per quarter. Formulate a linear program that maximizes the wealth of the company at the beginning of Q9. Hint: In each period t = 1,...,T, we have constraints cash inflow - cash outflow. Let 2 qt > 0: amount borrowed using quarterly loan with interest rate ra = 2.5%, t = 1, ...,T 1. St > 0: amount borrowed using six-month loan with interest rate rs = 1.8%, t= 1, ...,T 2. li > 0: amount borrowed using the long-term loan in quarter 1 with interest rate ri = 1%. zt > 0: excess cash available in period t = 1,...,TStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started