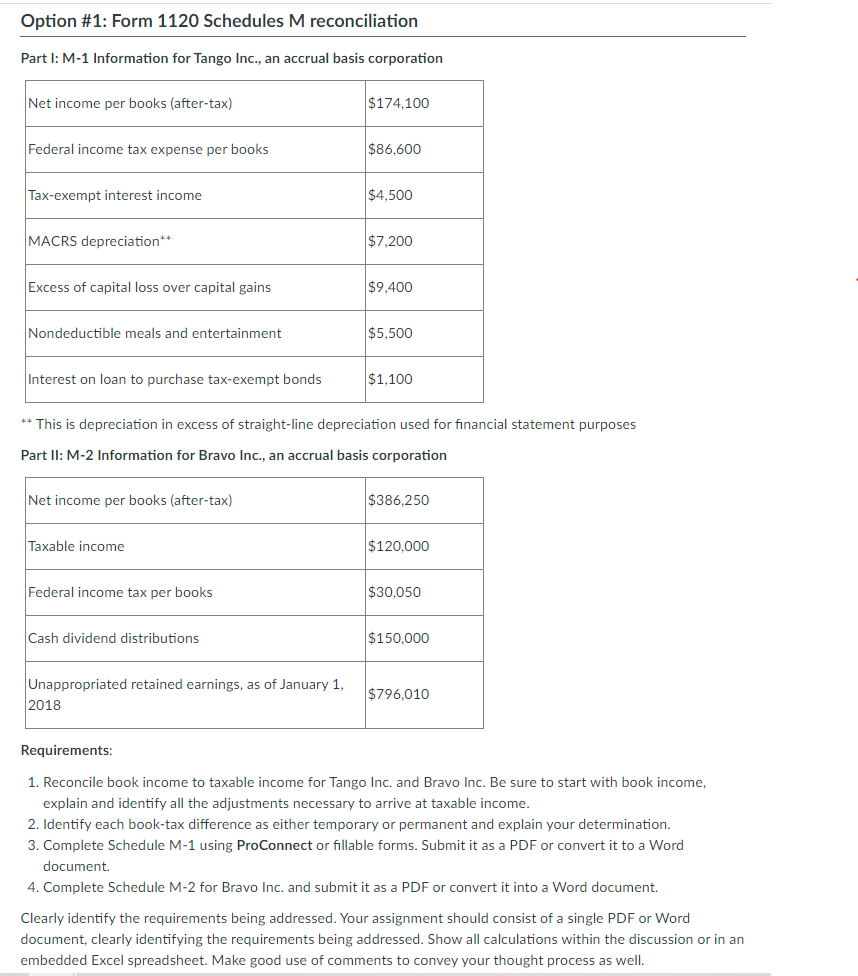

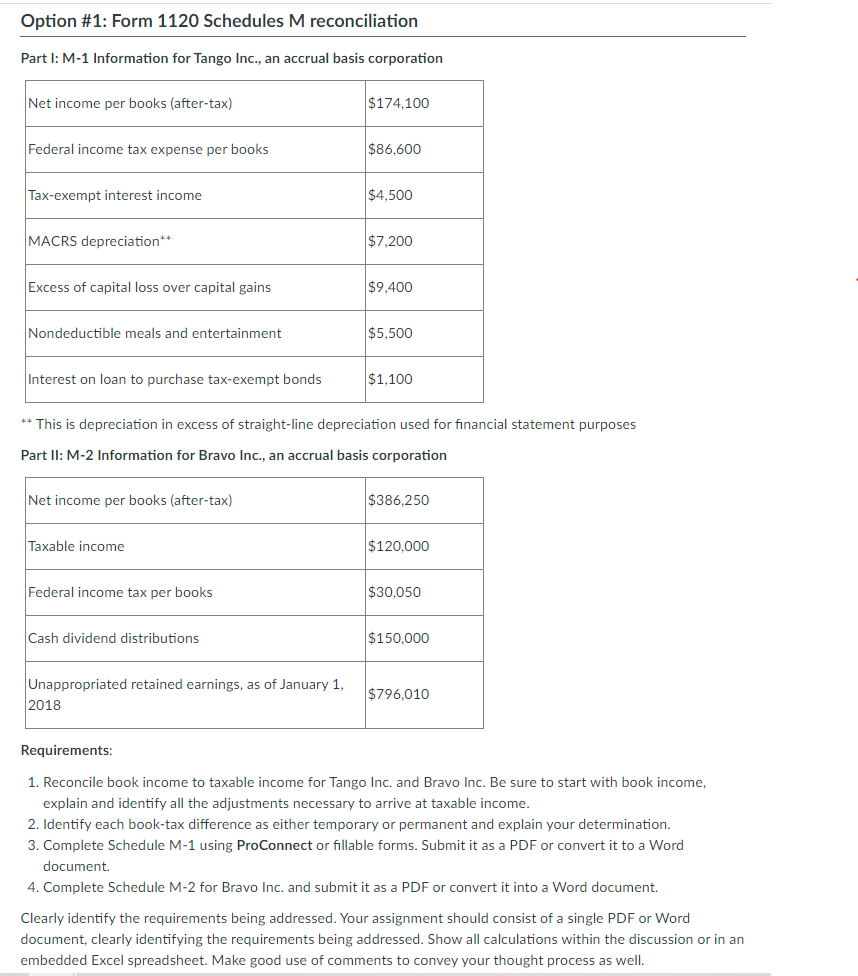

Option #1: Form 1120 Schedules M reconciliation Part 1: M-1 Information for Tango Inc., an accrual basis corporation Net income per books (after-tax) $174.100 Federal income tax expense per books $86,600 Tax-exempt interest income $4,500 MACRS depreciation** $7,200 Excess of capital loss over capital gains $9,400 Nondeductible meals and entertainment $5.500 Interest on loan to purchase tax-exempt bonds $1,100 ** This is depreciation in excess of straight-line depreciation used for financial statement purposes Part II: M-2 Information for Bravo Inc., an accrual basis corporation Net income per books (after-tax) $386,250 Taxable income $120,000 Federal income tax per books $30,050 Cash dividend distributions $150,000 Unappropriated retained earnings, as of January 1, 2018 $796.010 Requirements: 1. Reconcile book income to taxable income for Tango Inc. and Bravo Inc. Be sure to start with book income, explain and identify all the adjustments necessary to arrive at taxable income. 2. Identify each book-tax difference as either temporary or permanent and explain your determination. 3. Complete Schedule M-1 using ProConnect or fillable forms. Submit it as a PDF or convert it to a Word document. 4. Complete Schedule M-2 for Bravo Inc. and submit it as a PDF or convert it into a Word document. Clearly identify the requirements being addressed. Your assignment should consist of a single PDF or Word document, clearly identifying the requirements being addressed. Show all calculations within the discussion or in an embedded Excel spreadsheet. Make good use of comments to convey your thought process as well. Option #1: Form 1120 Schedules M reconciliation Part 1: M-1 Information for Tango Inc., an accrual basis corporation Net income per books (after-tax) $174.100 Federal income tax expense per books $86,600 Tax-exempt interest income $4,500 MACRS depreciation** $7,200 Excess of capital loss over capital gains $9,400 Nondeductible meals and entertainment $5.500 Interest on loan to purchase tax-exempt bonds $1,100 ** This is depreciation in excess of straight-line depreciation used for financial statement purposes Part II: M-2 Information for Bravo Inc., an accrual basis corporation Net income per books (after-tax) $386,250 Taxable income $120,000 Federal income tax per books $30,050 Cash dividend distributions $150,000 Unappropriated retained earnings, as of January 1, 2018 $796.010 Requirements: 1. Reconcile book income to taxable income for Tango Inc. and Bravo Inc. Be sure to start with book income, explain and identify all the adjustments necessary to arrive at taxable income. 2. Identify each book-tax difference as either temporary or permanent and explain your determination. 3. Complete Schedule M-1 using ProConnect or fillable forms. Submit it as a PDF or convert it to a Word document. 4. Complete Schedule M-2 for Bravo Inc. and submit it as a PDF or convert it into a Word document. Clearly identify the requirements being addressed. Your assignment should consist of a single PDF or Word document, clearly identifying the requirements being addressed. Show all calculations within the discussion or in an embedded Excel spreadsheet. Make good use of comments to convey your thought process as well