Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Option 1 : Purchasing my dream car Go to the car dealer near your house and search for your dream car. You can also search

Option : Purchasing my dream car

Go to the car dealer near your house and search for your dream car. You can also search for

your dream car through

autotrader.com and go to your bank's website Bank of America, Well

Fargo, Chase, Citi, credit union, etc... and get the interest rate for your car.

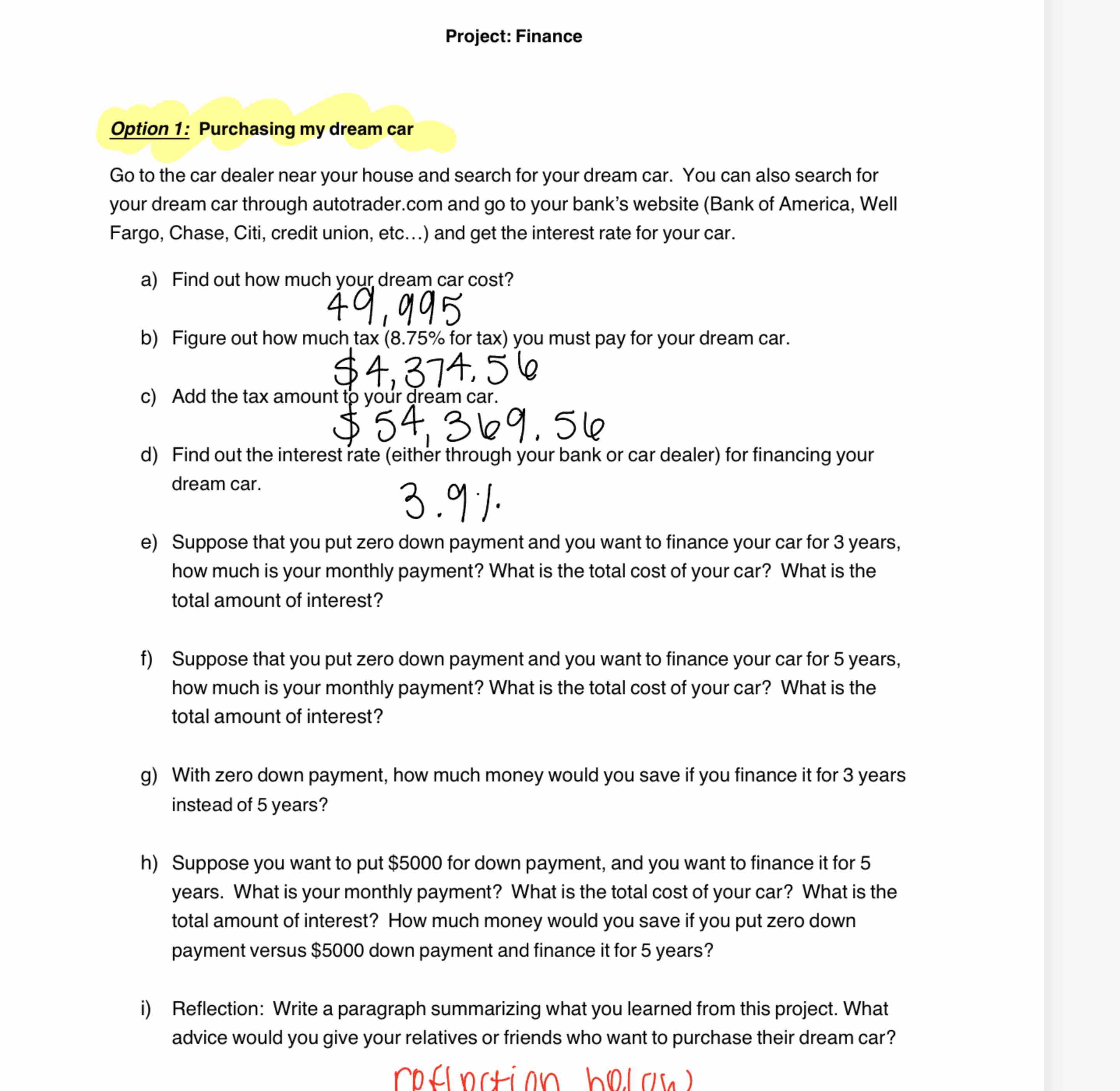

a Find out how much your dream car cost?

b Figure out how much tax for tax you must pay for your dream car.

$

c Add the tax amount to your dream car.

$

d Find out the interest rate either through your bank or car dealer for financing your

dream car.

e Suppose that you put zero down payment and you want to finance your car for years,

how much is your monthly payment? What is the total cost of your car? What is the

total amount of interest?

f Suppose that you put zero down payment and you want to finance your car for years,

how much is your monthly payment? What is the total cost of your car? What is the

total amount of interest?

g With zero down payment, how much money would you save if you finance it for years

instead of years?

h Suppose you want to put $ for down payment, and you want to finance it for

years. What is your monthly payment? What is the total cost of your car? What is the

total amount of interest? How much money would you save if you put zero down

payment versus $ down payment and finance it for years?

i Reflection: Write a paragraph summarizing what you learned from this project. What

advice would you give your relatives or friends who want to purchase their dream car?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started