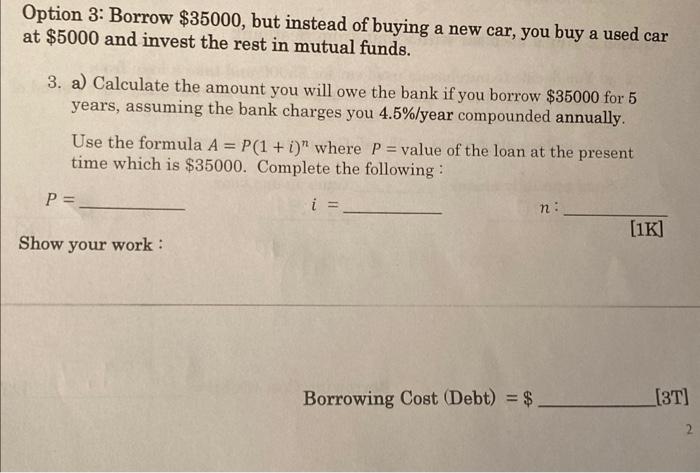

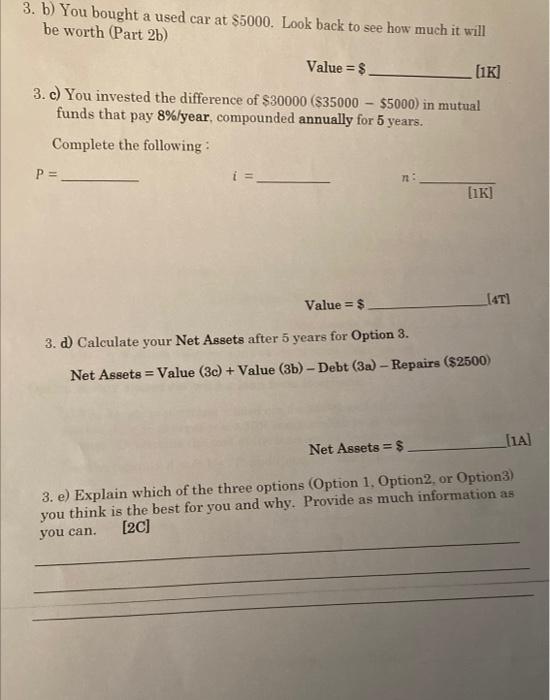

Option 3: Borrow $35000, but instead of buying a new car, you buy a used car at $5000 and invest the rest in mutual funds. 3. a) Calculate the amount you will owe the bank if you borrow $35000 for 5 years, assuming the bank charges you 4.5%/year compounded annually. Use the formula A = P(1 + i)" where P = value of the loan at the present time which is $35000. Complete the following: P = i = n: [1K] Show your work : Borrowing Cost (Debt) = $. [3T] 2 3. b) You bought a used car at $5000. Look back to see how much it will be worth (Part 2b) Value = $_ [1K] 3. c) You invested the difference of $30000 ($35000 $5000) in mutual funds that pay 8%/year, compounded annually for 5 years. Complete the following: P=. n: [IK] Value = $ __[47] 3. d) Calculate your Net Assets after 5 years for Option 3. Net Assets Value (3c) + Value (3b)-Debt (3a) - Repairs ($2500) [14] Net Assets = $ 3. e) Explain which of the three options (Option 1. Option2, or Option3) you think is the best for you and why. Provide as much information as you can. [2C] Option 3: Borrow $35000, but instead of buying a new car, you buy a used car at $5000 and invest the rest in mutual funds. 3. a) Calculate the amount you will owe the bank if you borrow $35000 for 5 years, assuming the bank charges you 4.5%/year compounded annually. Use the formula A = P(1 + i)" where P = value of the loan at the present time which is $35000. Complete the following: P = i = n: [1K] Show your work : Borrowing Cost (Debt) = $. [3T] 2 3. b) You bought a used car at $5000. Look back to see how much it will be worth (Part 2b) Value = $_ [1K] 3. c) You invested the difference of $30000 ($35000 $5000) in mutual funds that pay 8%/year, compounded annually for 5 years. Complete the following: P=. n: [IK] Value = $ __[47] 3. d) Calculate your Net Assets after 5 years for Option 3. Net Assets Value (3c) + Value (3b)-Debt (3a) - Repairs ($2500) [14] Net Assets = $ 3. e) Explain which of the three options (Option 1. Option2, or Option3) you think is the best for you and why. Provide as much information as you can. [2C]