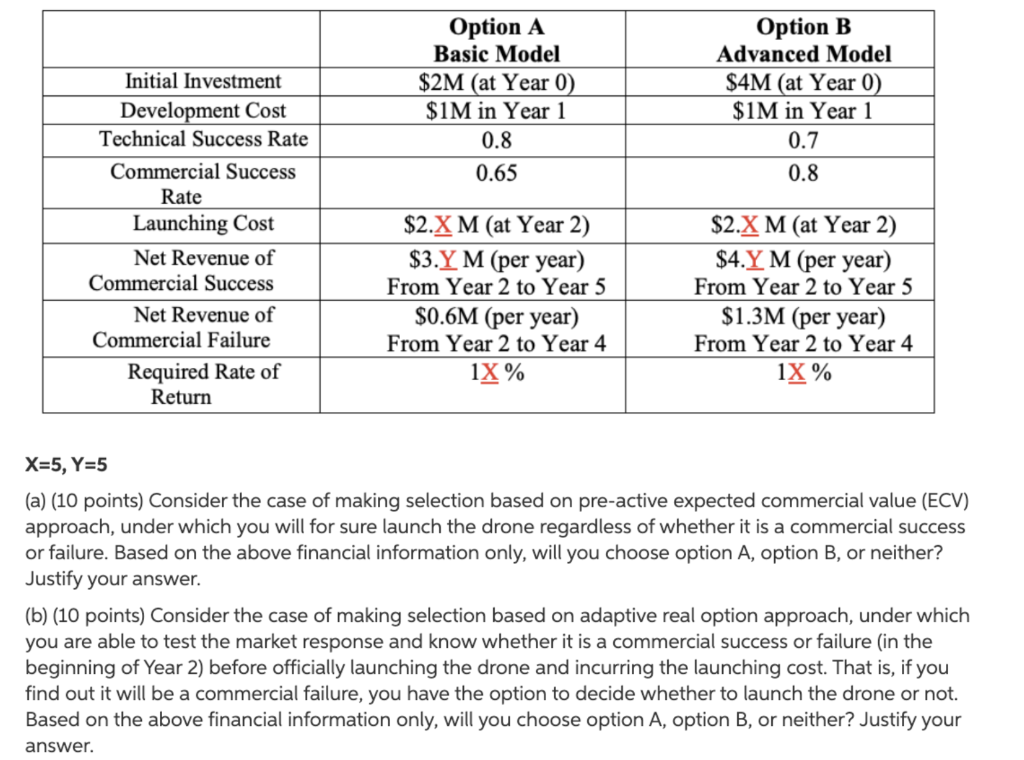

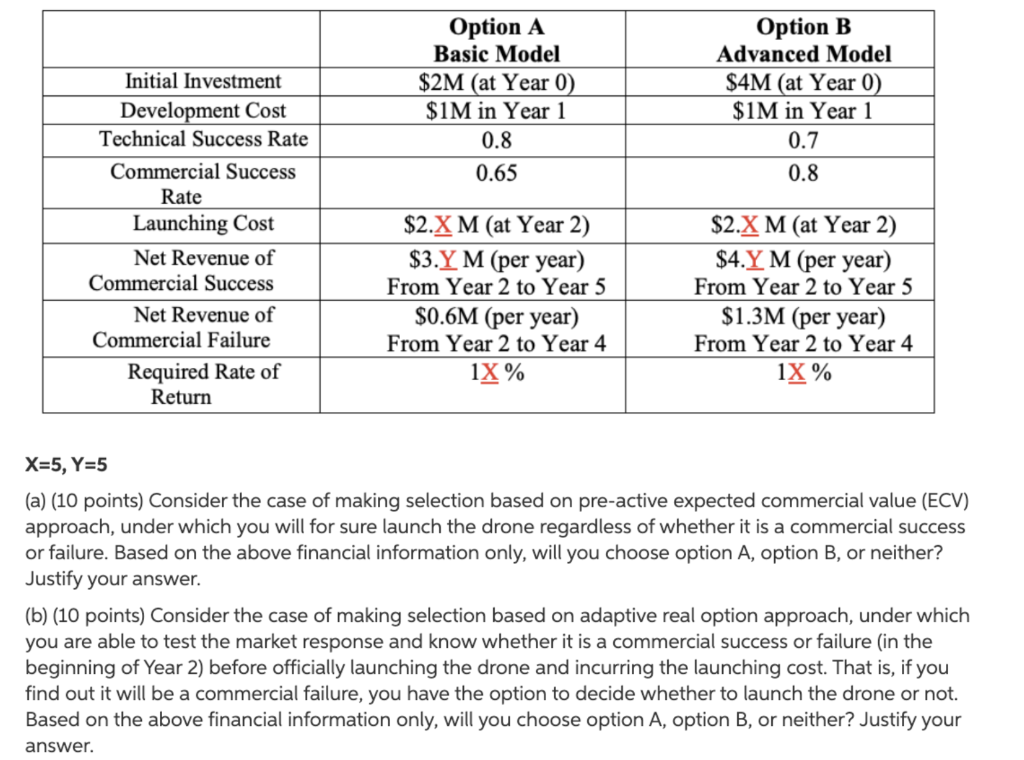

Option A Basic Model $2M (at Year 0) $1M in Year 1 Option B Advanced Model $4M (at Year 0) $1M in Year 1 Initial Investment Development Cost Technical Success Rate 0.8 0.7 Commercial Success 0.65 0.8 Rate Launching Cost $2.X M (at Year 2) $2.X M (at Year 2) $3.Y M (per year) From Year 2 to Year 5 $4.Y M (per year) From Year 2 to Year 5 Net Revenue of Commercial Success Net Revenue of Commercial Failure $0.6M (per year) From Year 2 to Year 4 1X% $1.3M (per year) From Year 2 to Year 4 1X% Required Rate of Return X=5, Y=5 (a) (10 points) Consider the case of making selection based on pre-active expected commercial value (ECV) approach, under which you will for sure launch the drone regardless of whether it is a commercial success or failure. Based on the above financial information only, will you choose option A, option B, or neither? Justify your answer. (b) (10 points) Consider the case of making selection based on adaptive real option approach, under which you are able to test the market response and know whether it is a commercial success or failure (in the beginning of Year 2) before officially launching the drone and incurring the launching cost. That is, if you find out it will be a commercial failure, you have the option to decide whether to launch the drone or not. Based on the above financial information only, will you choose option A, option B, or neither? Justify your answer. Option A Basic Model $2M (at Year 0) $1M in Year 1 Option B Advanced Model $4M (at Year 0) $1M in Year 1 Initial Investment Development Cost Technical Success Rate 0.8 0.7 Commercial Success 0.65 0.8 Rate Launching Cost $2.X M (at Year 2) $2.X M (at Year 2) $3.Y M (per year) From Year 2 to Year 5 $4.Y M (per year) From Year 2 to Year 5 Net Revenue of Commercial Success Net Revenue of Commercial Failure $0.6M (per year) From Year 2 to Year 4 1X% $1.3M (per year) From Year 2 to Year 4 1X% Required Rate of Return X=5, Y=5 (a) (10 points) Consider the case of making selection based on pre-active expected commercial value (ECV) approach, under which you will for sure launch the drone regardless of whether it is a commercial success or failure. Based on the above financial information only, will you choose option A, option B, or neither? Justify your answer. (b) (10 points) Consider the case of making selection based on adaptive real option approach, under which you are able to test the market response and know whether it is a commercial success or failure (in the beginning of Year 2) before officially launching the drone and incurring the launching cost. That is, if you find out it will be a commercial failure, you have the option to decide whether to launch the drone or not. Based on the above financial information only, will you choose option A, option B, or neither? Justify your