Answered step by step

Verified Expert Solution

Question

1 Approved Answer

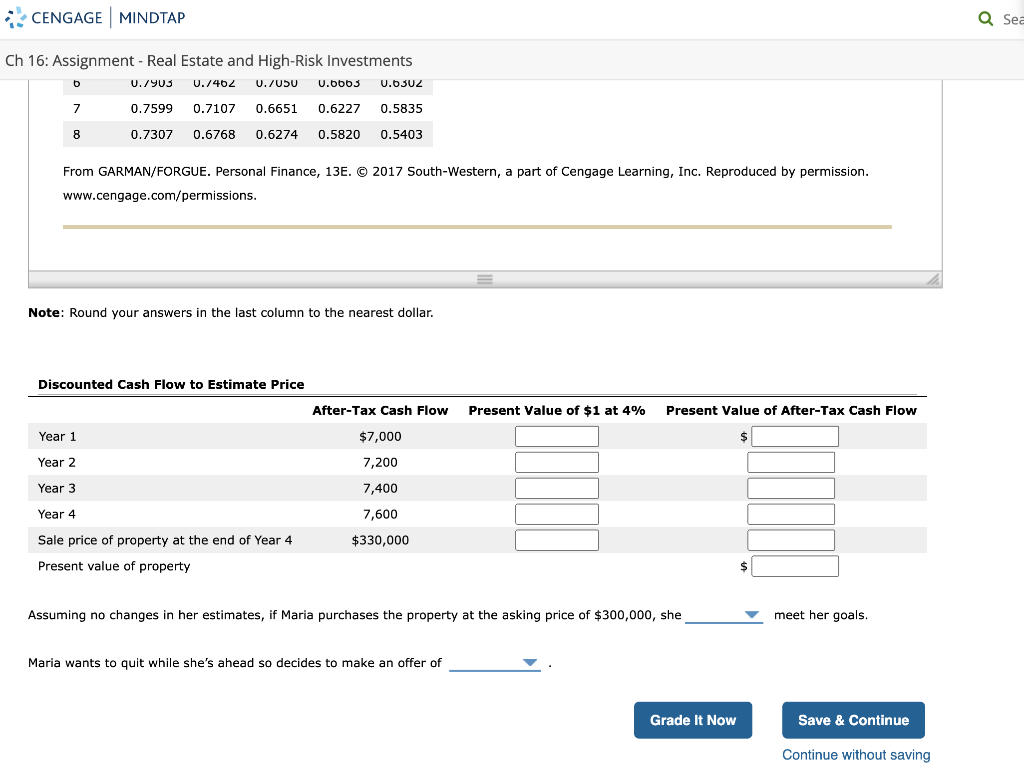

Option Blanks A. Will, will not B. 300,000, 308,547 Ch 16: Assignment - Real Estate and High-Risk Investments 8. Using the discounted cash-flow method to

Option Blanks

A. Will, will not

B. 300,000, 308,547

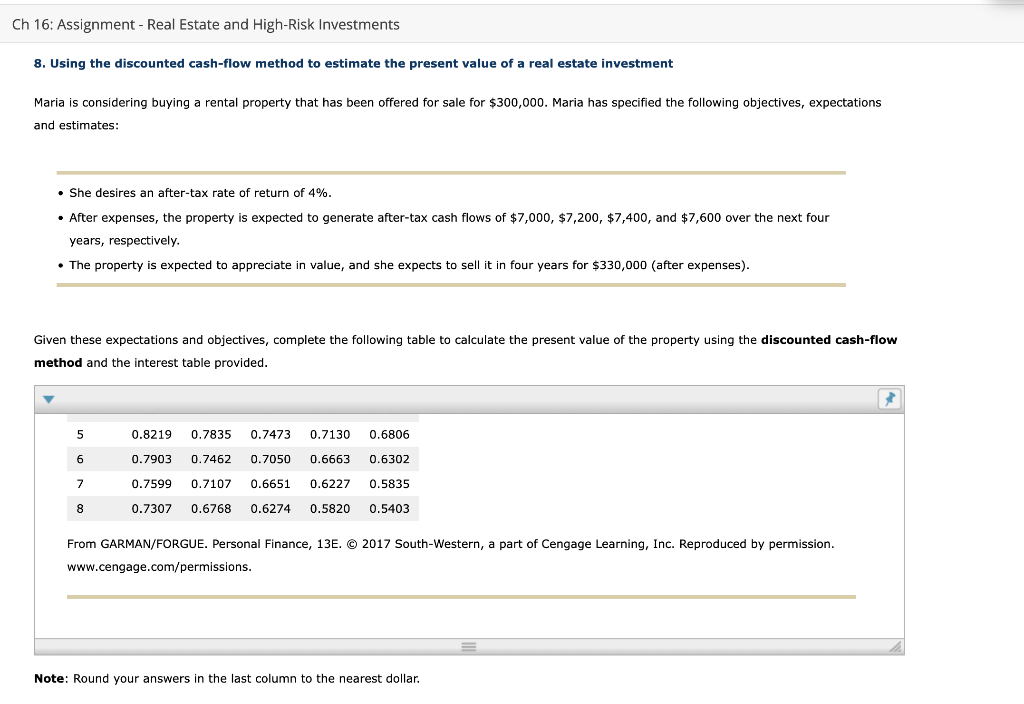

Ch 16: Assignment - Real Estate and High-Risk Investments 8. Using the discounted cash-flow method to estimate the present value of a real estate investment Maria is considering buying a rental property that has been offered for sale for $300,000. Maria has specified the following objectives, expectations and estimates: She desires an after-tax rate of return of 4%. After expenses, the property is expected to generate after-tax cash flows of $7,000, $7,200, $7,400, and $7,600 over the next four years, respectively. The property is expected to appreciate in value, and she expects to sell it in four years for $330,000 (after expenses). Given these expectations and objectives, complete the following table to calculate the present value of the property using the discounted cash-flow method and the interest table provided. 5 0.8219 0.7835 0.7473 0.7130 0.6806 0.7903 0.7462 0.7050 0.6663 0.6302 6 7 0.7599 0.7107 0.6651 0.6227 0.5835 0.7307 0.6768 0.6274 0.5820 0.5403 8 From GARMAN/FORGUE. Personal Finance, 13E. 2017 South-Western, a part of Cengage Learning, Inc. Reproduced by permission. www.cengage.com/permissions. Note: Round your answers in the last column to the nearest dollar. CENGAGE MINDTAP Ch 16: Assignment - Real Estate and High-Risk Investments b 0.7903 U./402 U./050 0.0003 0.6302 7 0.7599 0.7107 0.6651 0.6227 0.5835 8 0.7307 0.6768 0.6274 0.5820 0.5403 From GARMAN/FORGUE. Personal Finance, 13E. 2017 South-Western, a part of Cengage Learning, Inc. Reproduced by permission. www.cengage.com/permissions. Note: Round your answers in the last column to the nearest dollar. Discounted Cash Flow to Estimate Price After-Tax Cash Flow Present Value of $1 at 4% Present Value of After-Tax Cash Flow Year 1 $7,000 $ Year 2 7,200 Year 3 7,400 Year 4 7,600 Sale price of property at the end of Year 4 $330,000 Present value of property $ Assuming no changes in her estimates, if Maria purchases the property at the asking price of $300,000, she meet her goals. Maria wants to quit while she's ahead so decides to make an offer of Grade It Now Save & Continue Continue without saving Q Sea

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started