Answered step by step

Verified Expert Solution

Question

1 Approved Answer

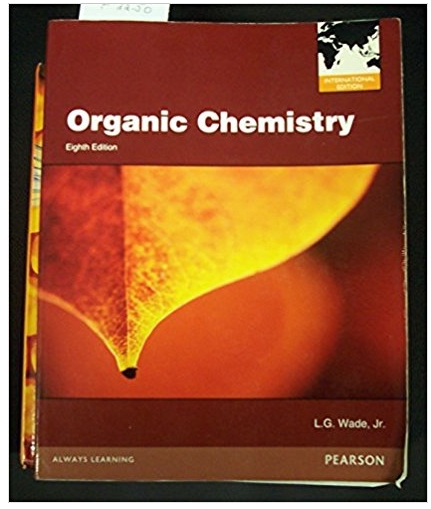

Option Payoffs. Consider the following two butterfly spreads (Spread A and Spread B) with the following payoffs: payoff 12 10 8 (0 A 2

Option Payoffs. Consider the following two butterfly spreads (Spread A and Spread B) with the following payoffs: payoff 12 10 8 (0 A 2 Spread-A Spread-B 10 20 30 40 50 ST 1 60 70 Both spreads are based on the same underlying stock and payoff at T = 80 90 1 year. 100 (a) (5 points) Find portfolios using calls, puts, stocks, and/or bonds to replicate the payoffs of Spread A and Spread B. Solution: (b) (5 points) On the graph below, draw the payoff when you go long B and short spread A. Do not include the upfront premiums, only the terminal payoffs at T = 2. Solution: If follod 20 15 10 5 0 -5 -10 0 10 20 30 40 50 ST 60 70 80 90 100 :) (5 points) Suppose that the price of spread B is lower than the price of spread A. Explain how you can construct an arbitrage. Solution:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To Replicate the above mentioned strategies we need to take following positions Spread A Buy a Call at Strike Price of 40 Sell 2 Calls at Strike Pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started