Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Option risk parameters, June Bund Options 121.00 Put 121.50 Put 122.00 Put 122.50 Put 123.00 Put 123.50 Put 124.00 Put 124.50 Put 125.00 Put

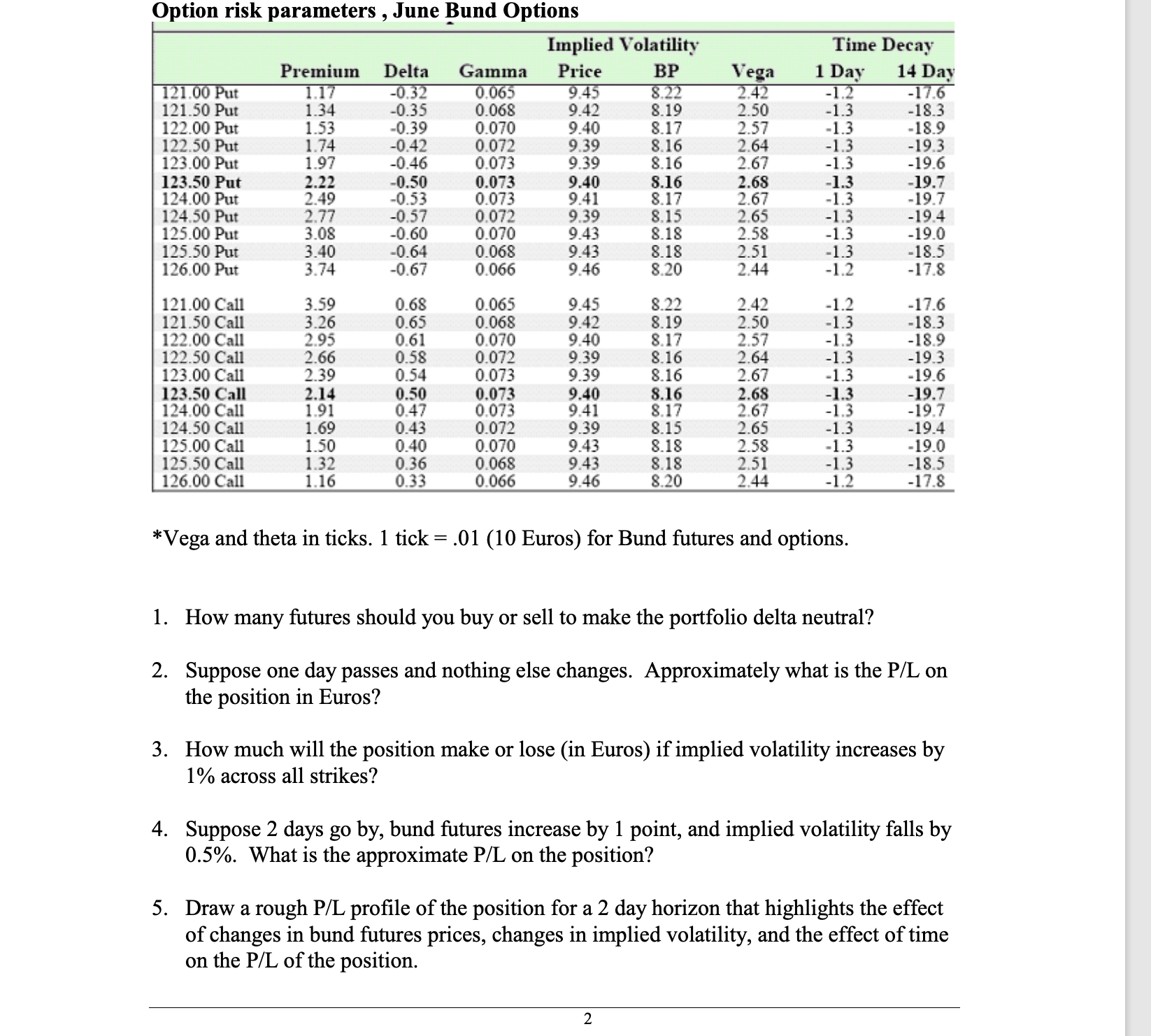

Option risk parameters, June Bund Options 121.00 Put 121.50 Put 122.00 Put 122.50 Put 123.00 Put 123.50 Put 124.00 Put 124.50 Put 125.00 Put 125.50 Put 126.00 Put 121.00 Call 121.50 Call 122.00 Call 122.50 Call 123.00 Call 123.50 Call 124.00 Call 124.50 Call 125.00 Call 125.50 Call 126.00 Call Premium Delta 1.17 -0.32 1.34 -0.35 1.53 -0.39 1.74 -0.42 1.97 -0.46 2.22 2.49 2.77 3.08 3.40 3.74 3.59 3.26 2.95 2.66 2.39 2.14 1.91 1.69 1.50 1.32 1.16 -0.50 -0.53 -0.57 -0.60 -0.64 -0.67 0.68 0.65 0.61 0.58 0.54 0.50 0.47 0.43 0.40 0.36 0.33 Gamma 0.065 0.068 0.070 0.072 0.073 0.073 0.073 0.072 0.070 0.068 0.066 0.065 0.068 0.070 0.072 0.073 0.073 0.073 0.072 0.070 0.068 0.066 Implied Volatility Price 9.45 9.42 9.40 9.39 9.39 9.40 9.41 9.39 9.43 9.43 9.46 9.45 9.42 9.40 9.39 9.39 9.40 9.41 9.39 9.43 9.43 9.46 BP 8.22 8.19 8.17 8.16 8.16 8.16 8.17 8.15 8.18 8.18 8.20 8.22 8.19 8.17 8.16 8.16 8.16 8.17 8.15 8.18 8.18 8.20 Vega 2.42 2.50 2.57 2.64 2.67 2 2.68 2.67 2.65 2.58 2.51 2.44 2.42 2.50 2.57 2.64 2.67 2.68 2.67 2.65 2.58 2.51 2.44 Time Decay 1 Day -1.2 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.2 -1.2 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.3 -1.2 *Vega and theta in ticks. 1 tick = .01 (10 Euros) for Bund futures and options. 14 Day -17.6 -18.3 -18.9 -19.3 -19.6 -19.7 -19.7 -19.4 -19.0 -18.5 -17.8 -17.6 -18.3 -18.9 -19.3 -19.6 -19.7 -19.7 -19.4 -19.0 -18.5 -17.8 1. How many futures should you buy or sell to make the portfolio delta neutral? 2. Suppose one day passes and nothing else changes. Approximately what is the P/L on the position in Euros? 3. How much will the position make or lose (in Euros) if implied volatility increases by 1% across all strikes? 4. Suppose 2 days go by, bund futures increase by 1 point, and implied volatility falls by 0.5%. What is the approximate P/L on the position? 5. Draw a rough P/L profile of the position for a 2 day horizon that highlights the effect of changes in bund futures prices, changes in implied volatility, and the effect of time on the P/L of the position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started