Answered step by step

Verified Expert Solution

Question

1 Approved Answer

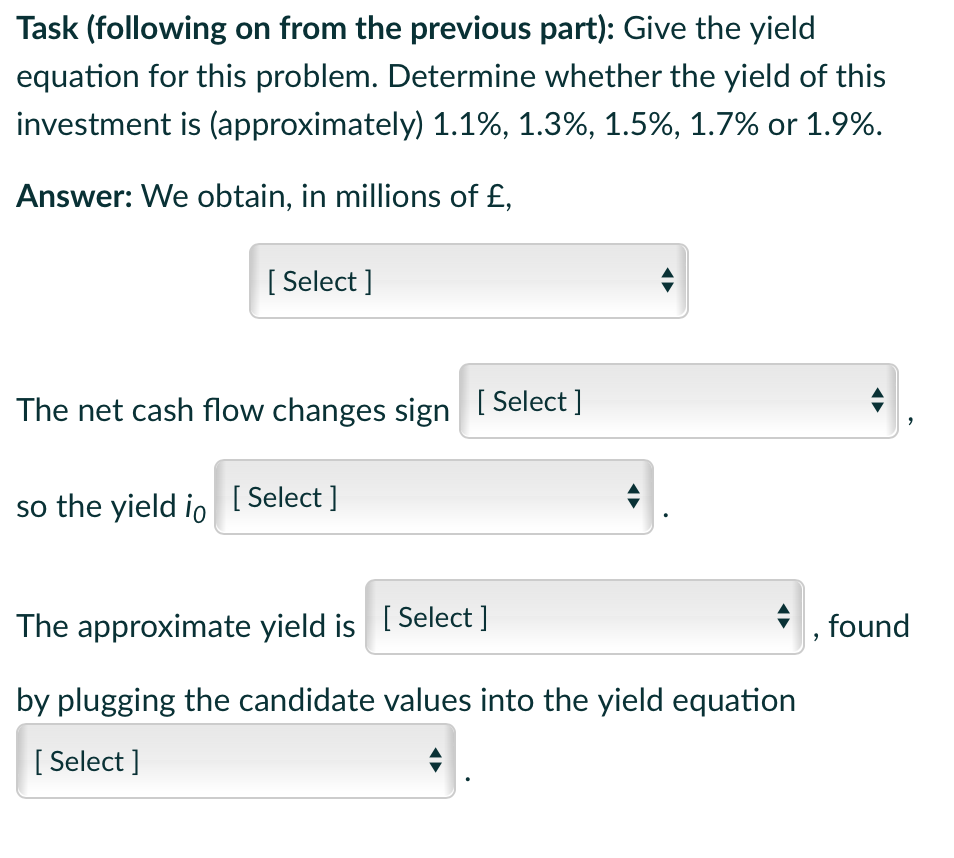

Options: 1: 2: 3: 4: 5: Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of

Options:

1:

2:

3:

4:

5:

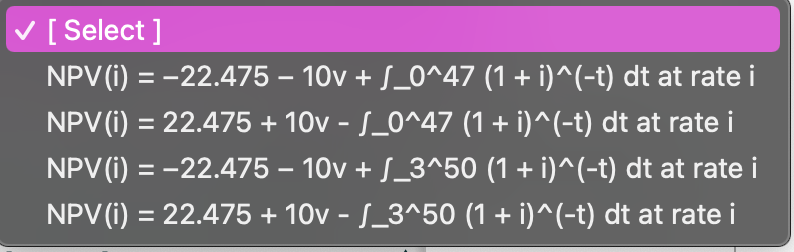

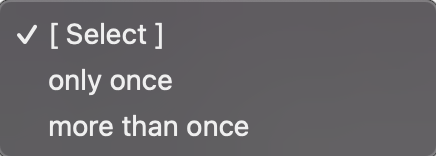

Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [ Select] The net cash flow changes sign [ Select ] so the yield io [ Select ] The approximate yield is [ Select ] , found by plugging the candidate values into the yield equation [ Select ] [Select ] NPV(i) = -22.475 - 10v + S_0^47 (1 + i)^(-t) dt at rate i NPV (i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 10v + S_3450 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i = - + [Select ] only once more than once [ Select ] exists does not exist [ Select ] 1.1% 1.3% 1.5% 1.7% 1.9% [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [ Select] The net cash flow changes sign [ Select ] so the yield io [ Select ] The approximate yield is [ Select ] , found by plugging the candidate values into the yield equation [ Select ] [Select ] NPV(i) = -22.475 - 10v + S_0^47 (1 + i)^(-t) dt at rate i NPV (i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 10v + S_3450 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i = - + [Select ] only once more than once [ Select ] exists does not exist [ Select ] 1.1% 1.3% 1.5% 1.7% 1.9% [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started