Question

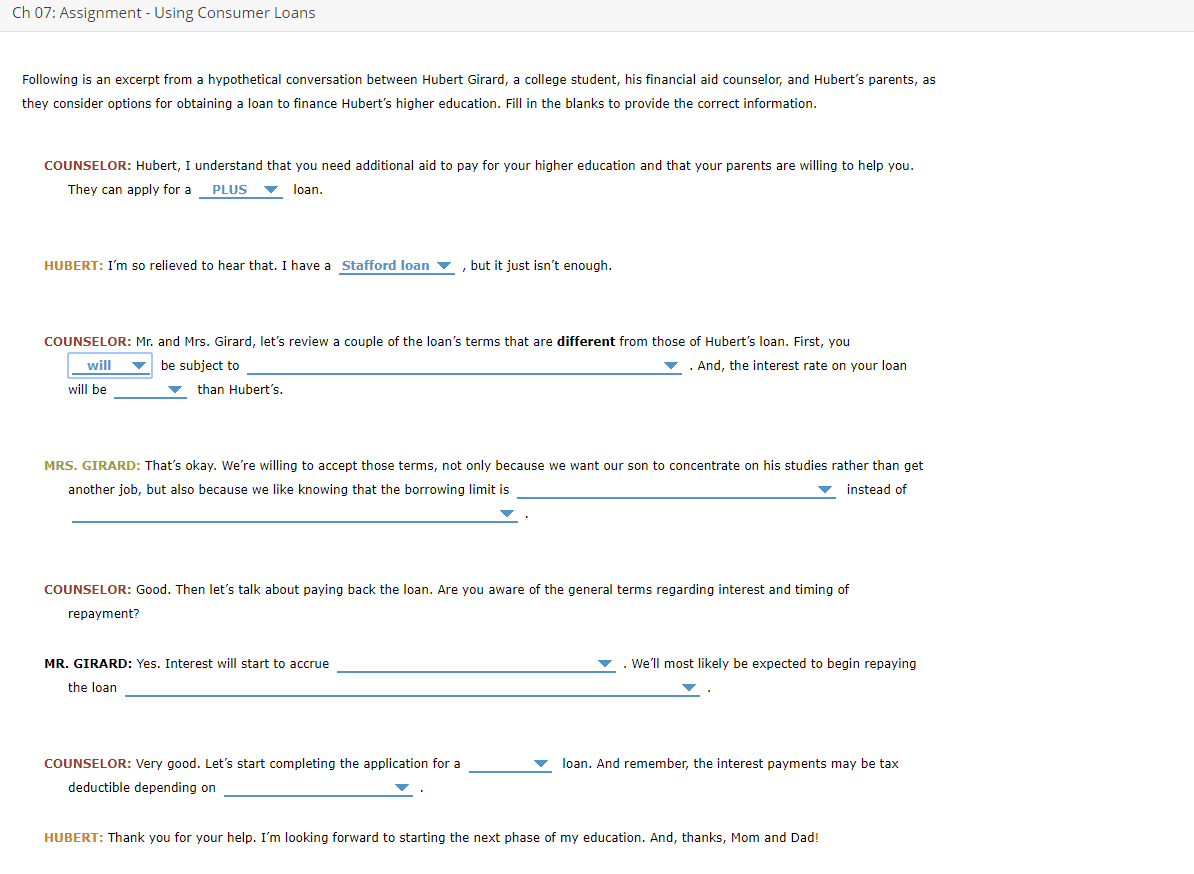

Options 1. PLUS / Stafford / Perkins 2. Stafford loan / Parent Loan 3. WIll / will not 4. an origination fee / opening a

Options

Options

1. PLUS / Stafford / Perkins

2. Stafford loan / Parent Loan

3. WIll / will not

4. an origination fee / opening a checking account at the bank that makes the loan / providing collateral

5. lower / higher

6. a set percentage of our gross income / the cost of attendance less his current loan

7. a set dollar amount / the cost of attendance less other financial aid Hubert receives

8. Immediately / when hubert earns his degree / after hubert's first semester of study

9. When hubert declares his major, but no later than the end of his sophomore year / Within 60 days of receiving the funds / after hubert's first semester of study

10. Parent / Perkins / Stafford

11. the equity in your home / your income / your credit score

Thank you!

Ch 07: Assignment - Using Consumer Loans Following is an excerpt from a hypothetical conversation between Hubert Girard, a college student, his financial aid counselor, and Hubert's parents, as they consider options for obtaining a loan to finance Hubert's higher education. Fill in the blanks to provide the correct information. COUNSELOR: Hubert, I understand that you need additional aid to pay for your higher education and that your parents are willing to help you. They can apply for a PLUS loan. HUBERT: I'm so relieved to hear that. I have a Stafford loan , but it just isn't enough. COUNSELOR: Mr. and Mrs. Girard, let's review a couple of the loan's terms that are different from those of Hubert's loan. First, you will be subject to . And, the interest rate on your loan will be than Hubert's. MRS. GIRARD: That's okay. We're willing to accept those terms, not only because we want our son to concentrate on his studies rather than get another job, but also because we like knowing that the borrowing limit is instead of COUNSELOR: Good. Then let's talk about paying back the loan. Are you aware of the general terms regarding interest and timing of repayment? MR. GIRARD: Yes. Interest will start to accrue . We'll most likely be expected to begin repaying the loan loan. And remember, the interest payments may be tax COUNSELOR: Very good. Let's start completing the application for a deductible depending on HUBERT: Thank you for your help. I'm looking forward to starting the next phase of my education. And, thanks, Mom and DadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started