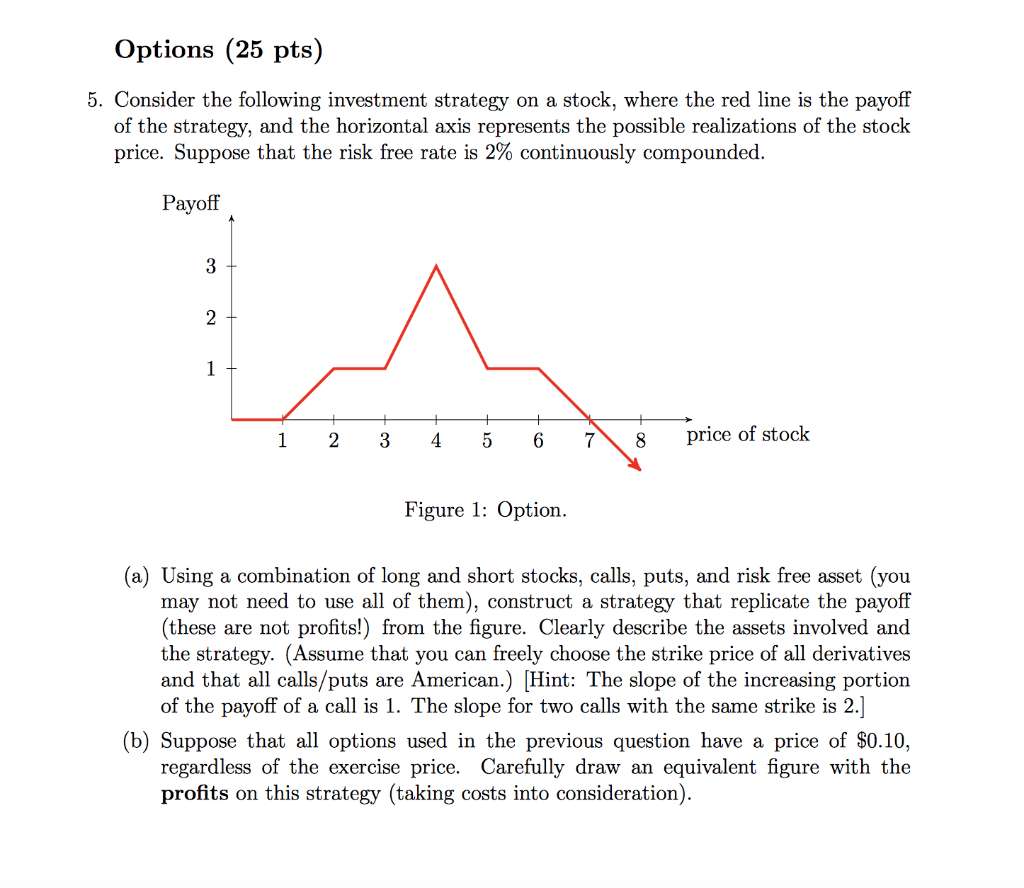

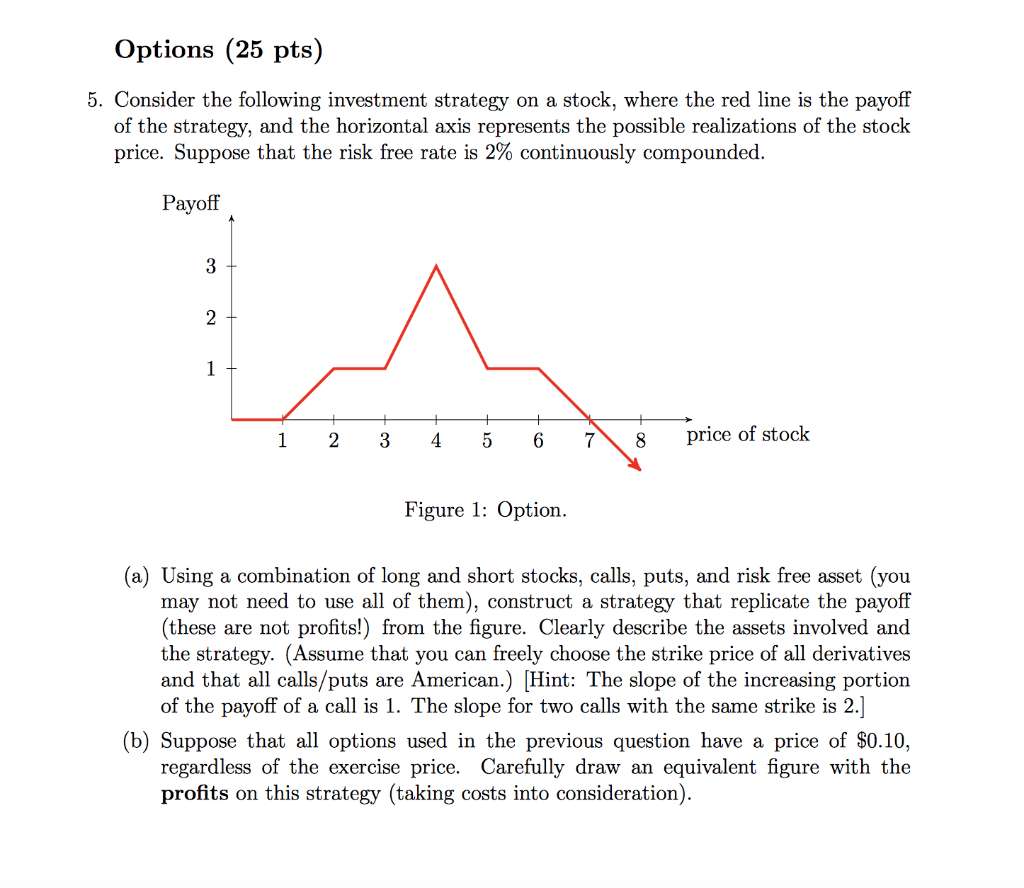

Options (25 pts) 5. Consider the following investment strategy on a stock, where the red line is the payoff of the strategy, and the horizontal axis represents the possible realizations of the stock price. Suppose that the risk free rate is 2% continuously compounded. Payoff 3 2 1 1 2 3 4 5 6 7 8 price of stock Figure 1: Option. (a) Using a combination of long and short stocks, calls, puts, and risk free asset (you may not need to use all of them), construct a strategy that replicate the payoff (these are not profits!) from the figure. Clearly describe the assets involved and the strategy. (Assume that you can freely choose the strike price of all derivatives and that all calls/puts are American.) [Hint: The slope of the increasing portion of the payoff of a call is 1. The slope for two calls with the same strike is 2.] (b) Suppose that all options used in the previous question have a price of $0.10, regardless of the exercise price. Carefully draw an equivalent figure with the profits on this strategy (taking costs into consideration). Options (25 pts) 5. Consider the following investment strategy on a stock, where the red line is the payoff of the strategy, and the horizontal axis represents the possible realizations of the stock price. Suppose that the risk free rate is 2% continuously compounded. Payoff 3 2 1 1 2 3 4 5 6 7 8 price of stock Figure 1: Option. (a) Using a combination of long and short stocks, calls, puts, and risk free asset (you may not need to use all of them), construct a strategy that replicate the payoff (these are not profits!) from the figure. Clearly describe the assets involved and the strategy. (Assume that you can freely choose the strike price of all derivatives and that all calls/puts are American.) [Hint: The slope of the increasing portion of the payoff of a call is 1. The slope for two calls with the same strike is 2.] (b) Suppose that all options used in the previous question have a price of $0.10, regardless of the exercise price. Carefully draw an equivalent figure with the profits on this strategy (taking costs into consideration)