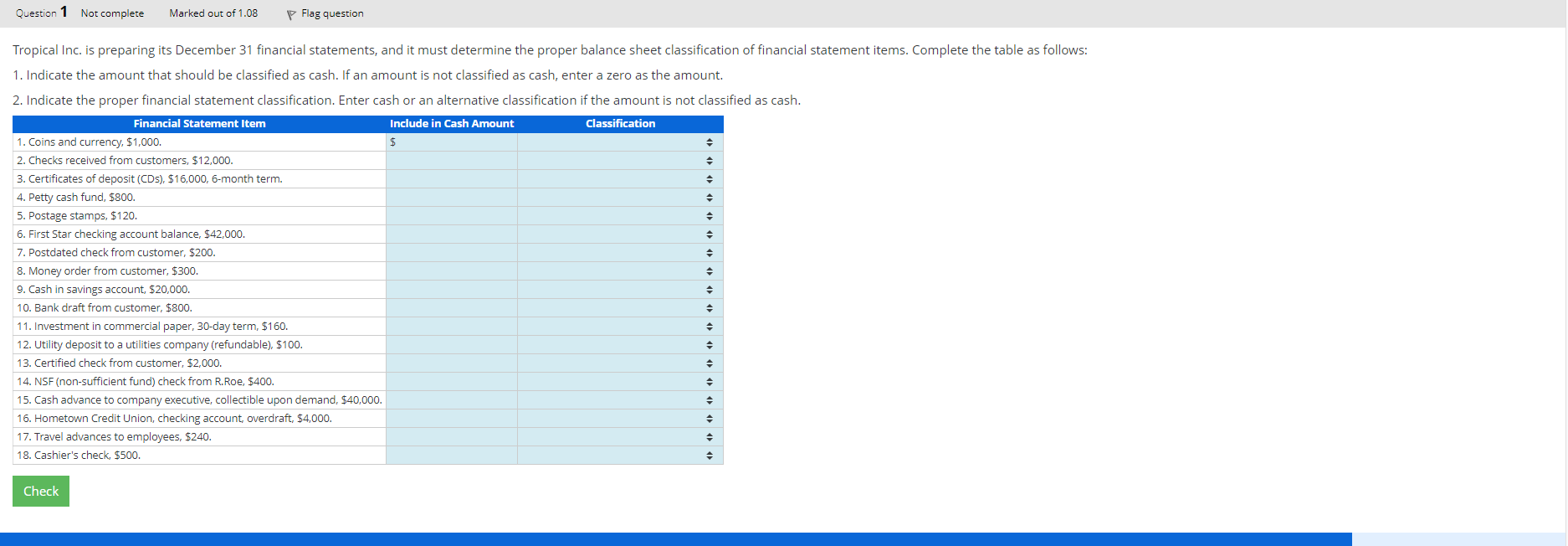

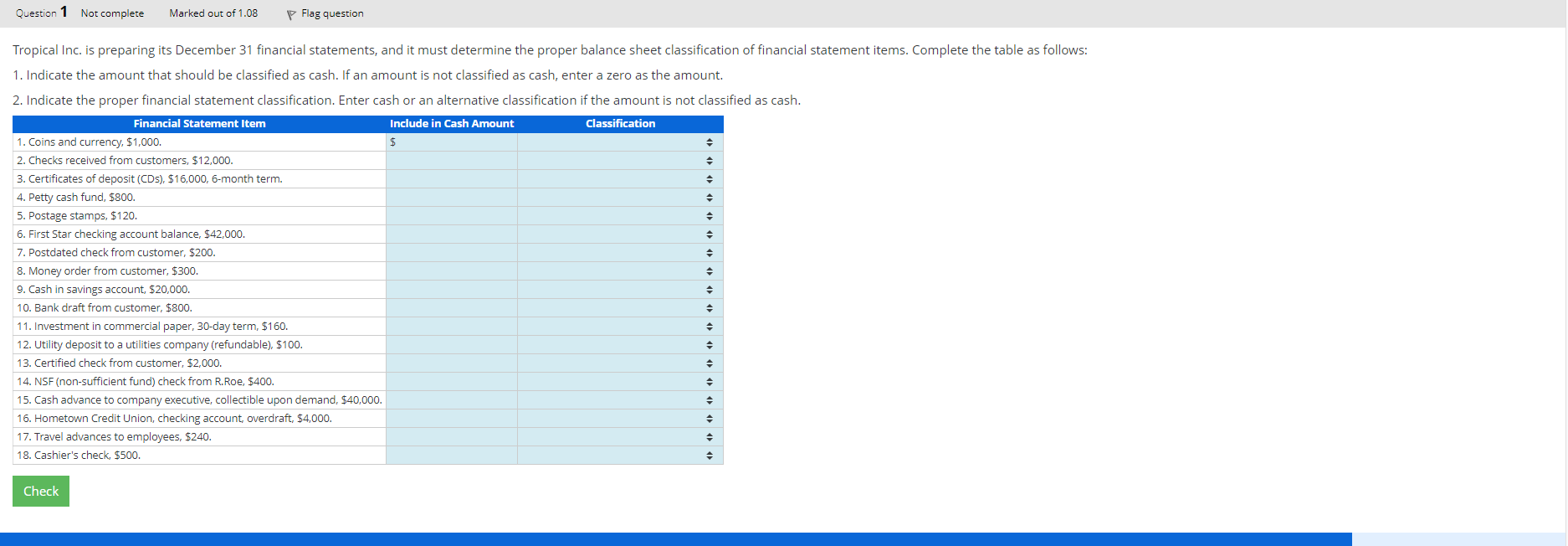

Options are

AR, AP, Cash, Cash Equivalent, Other Receivable, Prepaid Expense, Refundable Deposit (Current Asset), Refundable Deposit (Current Liability), Short-Term Investment, Note Receivable, Restricted Cash, NA

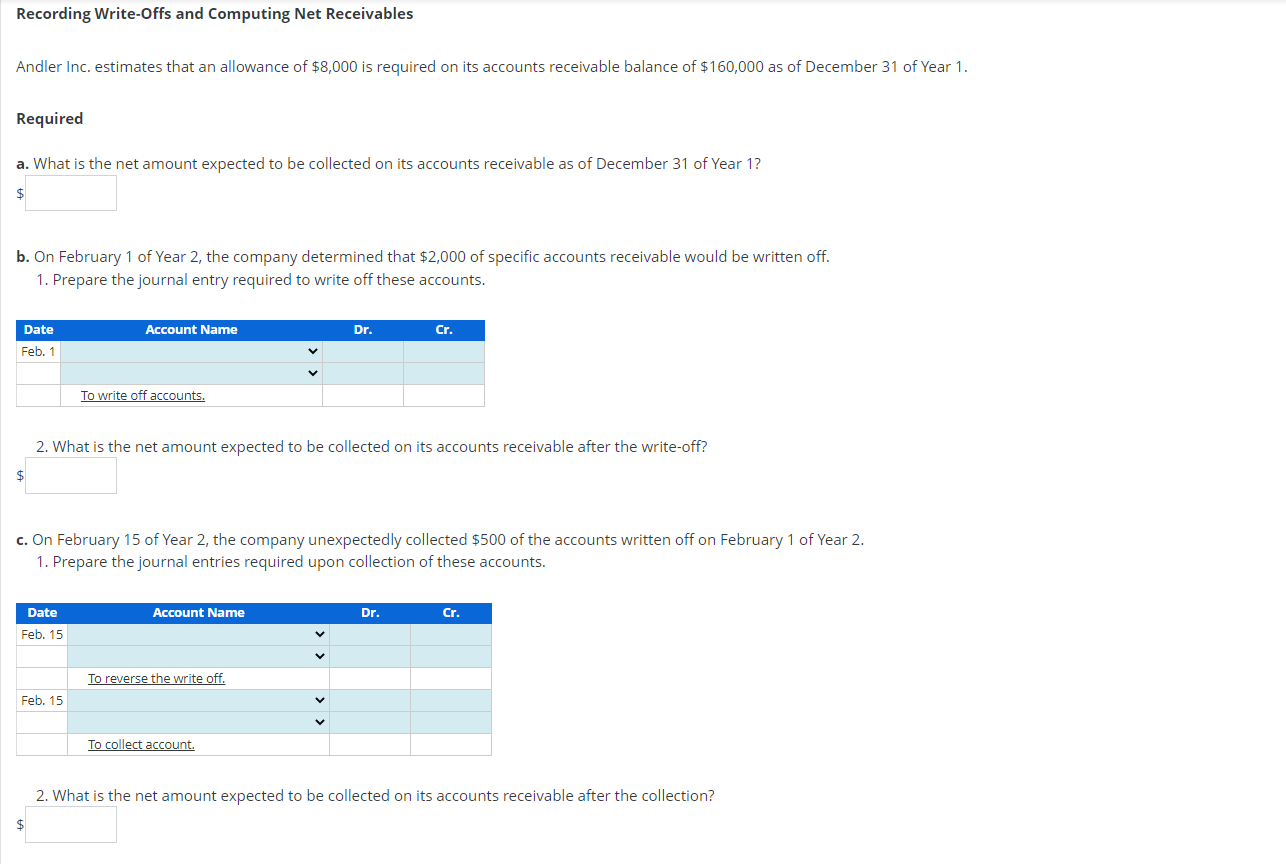

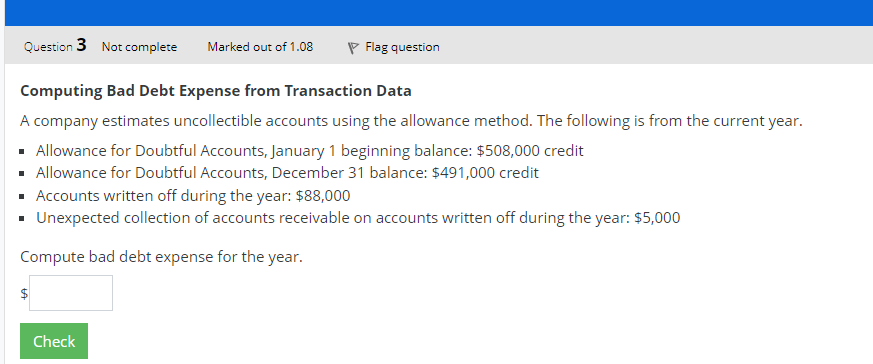

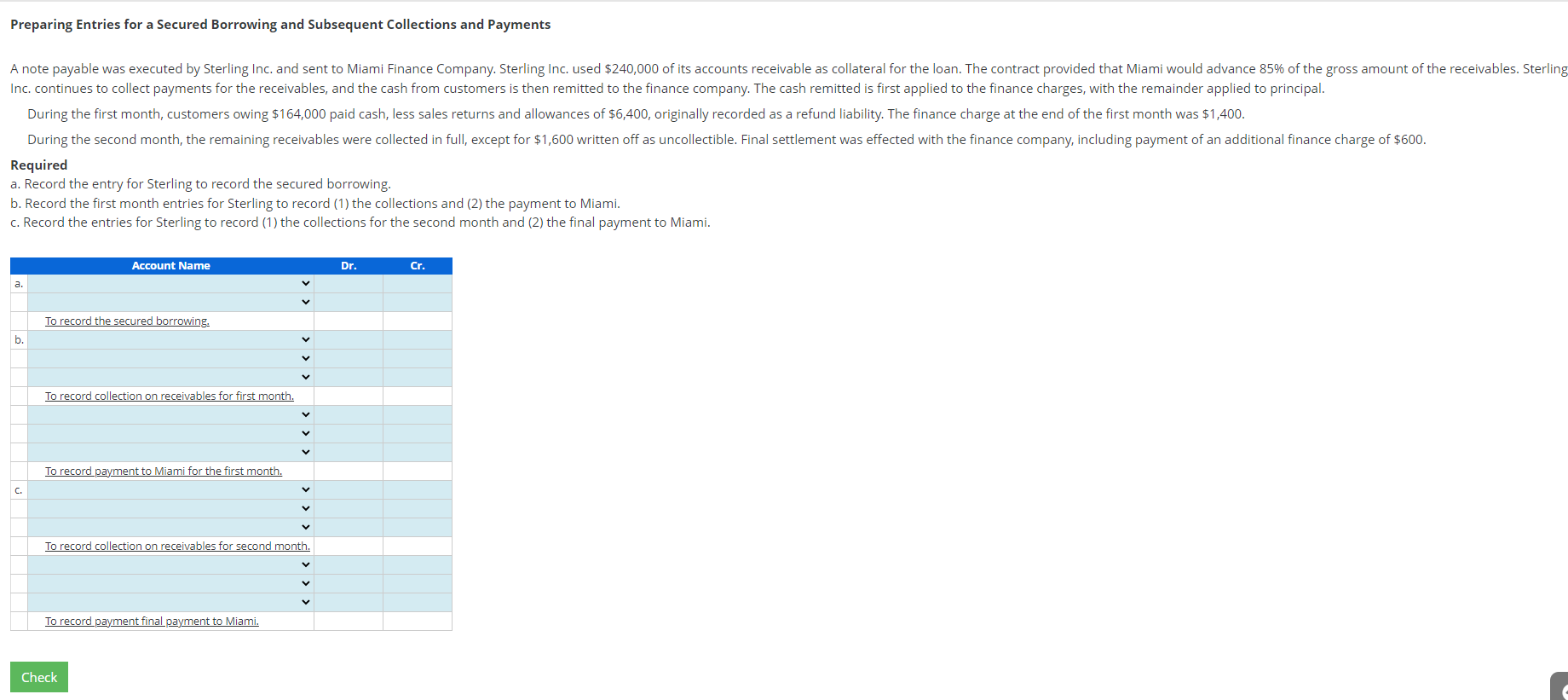

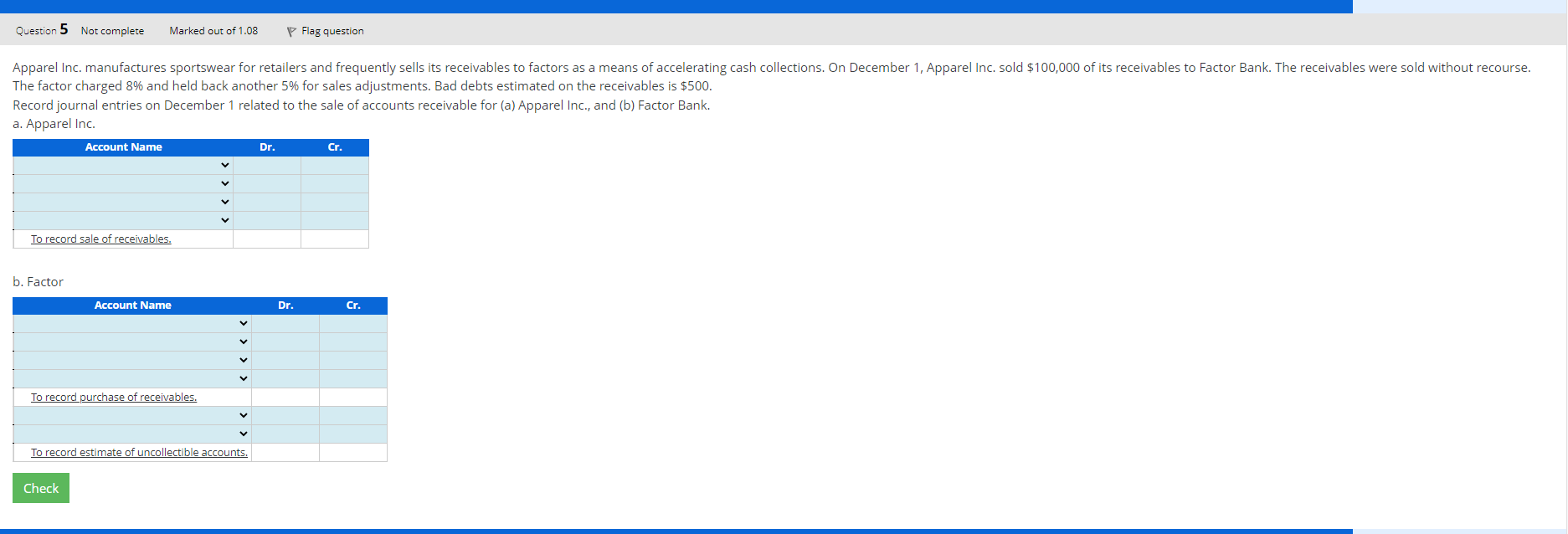

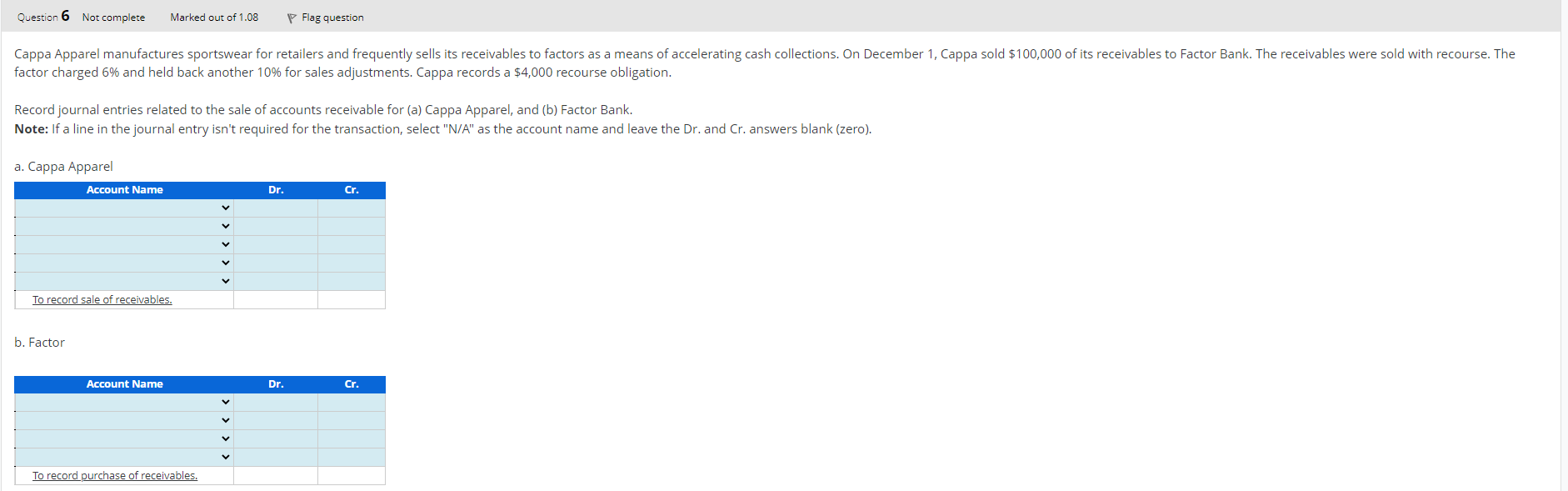

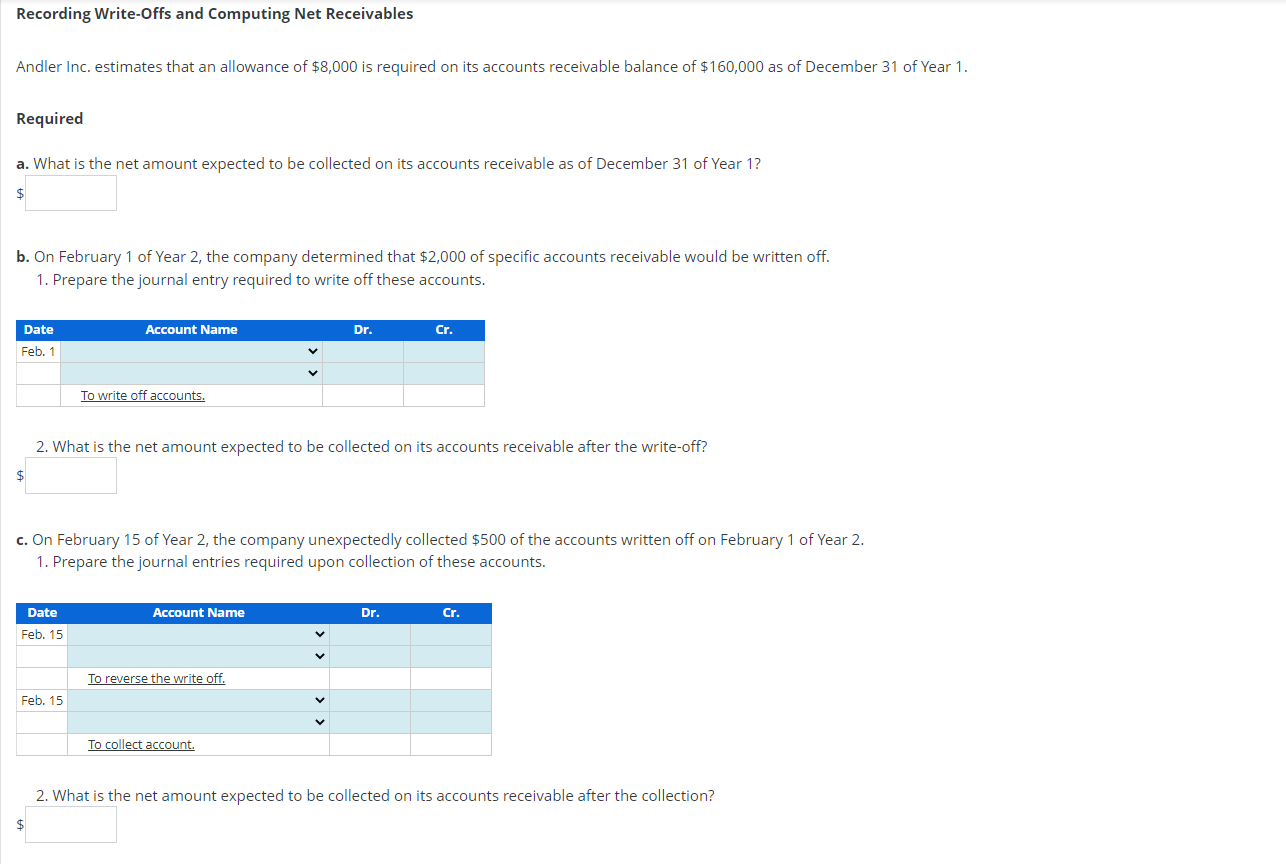

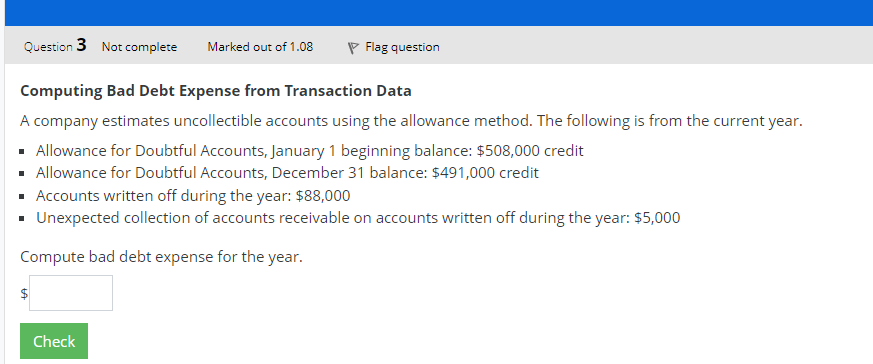

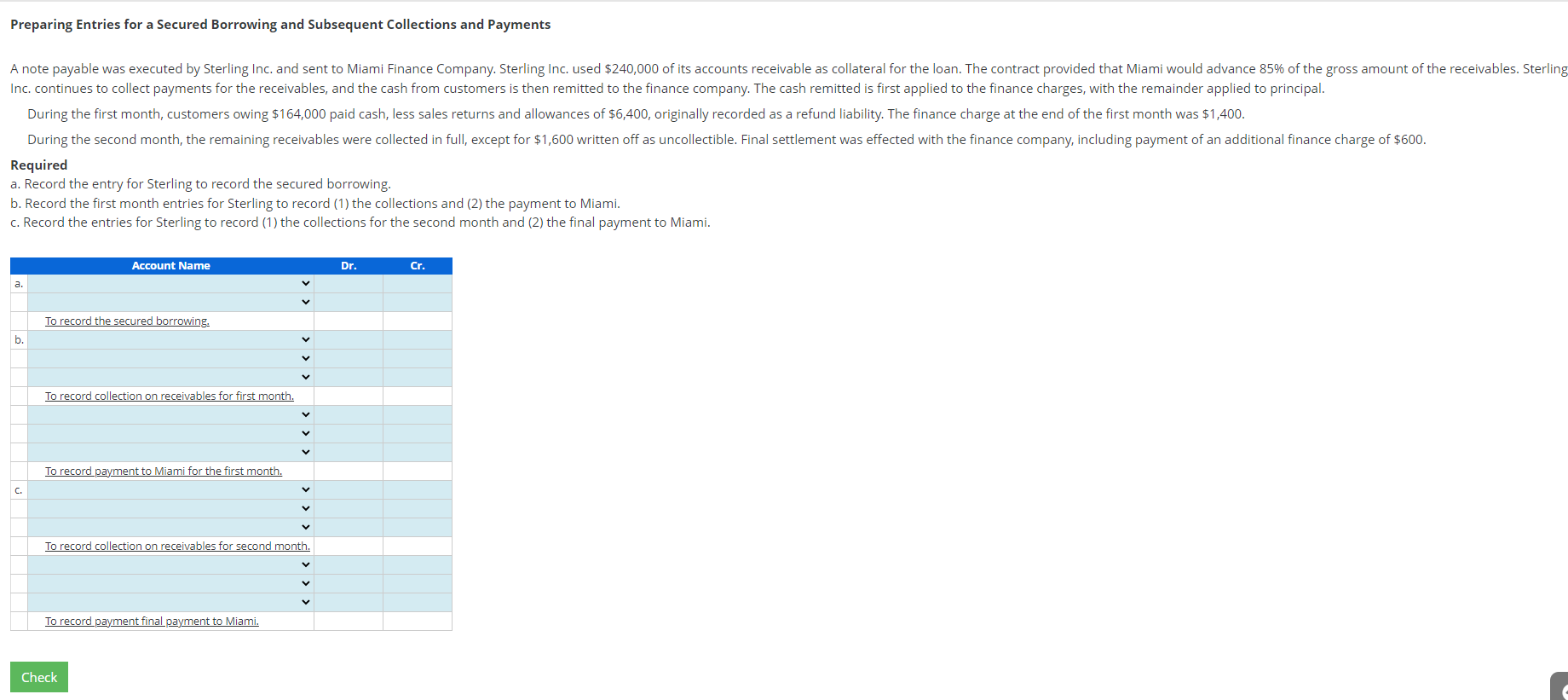

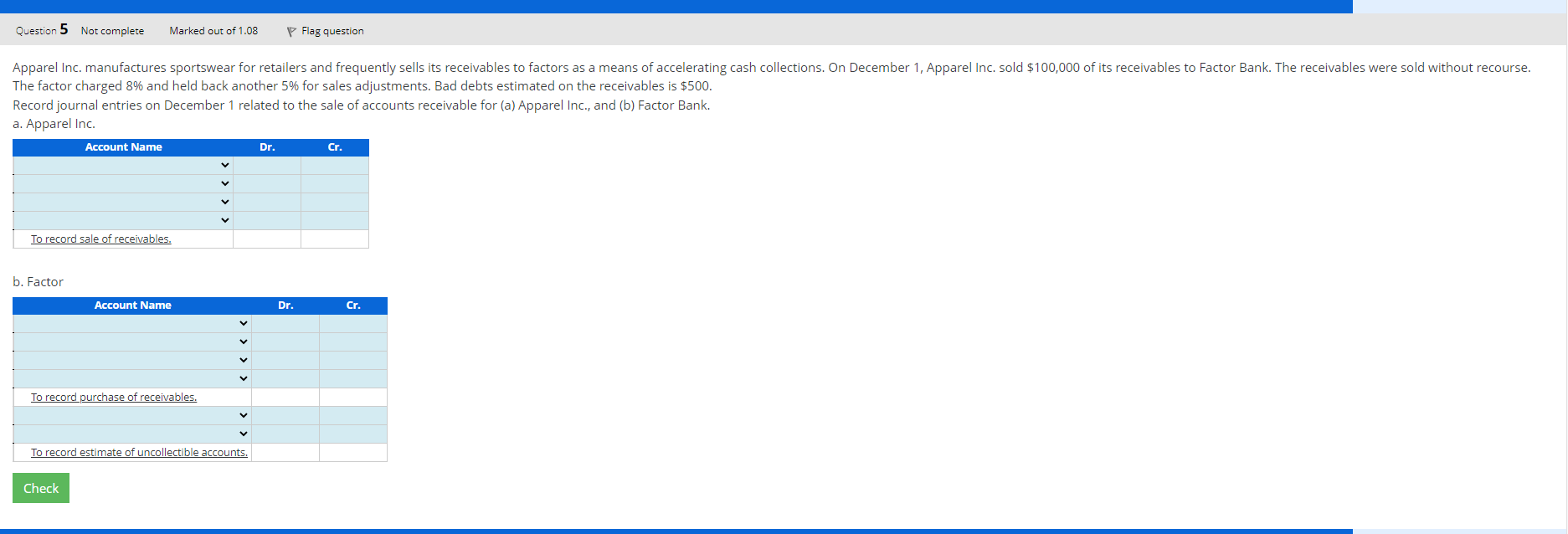

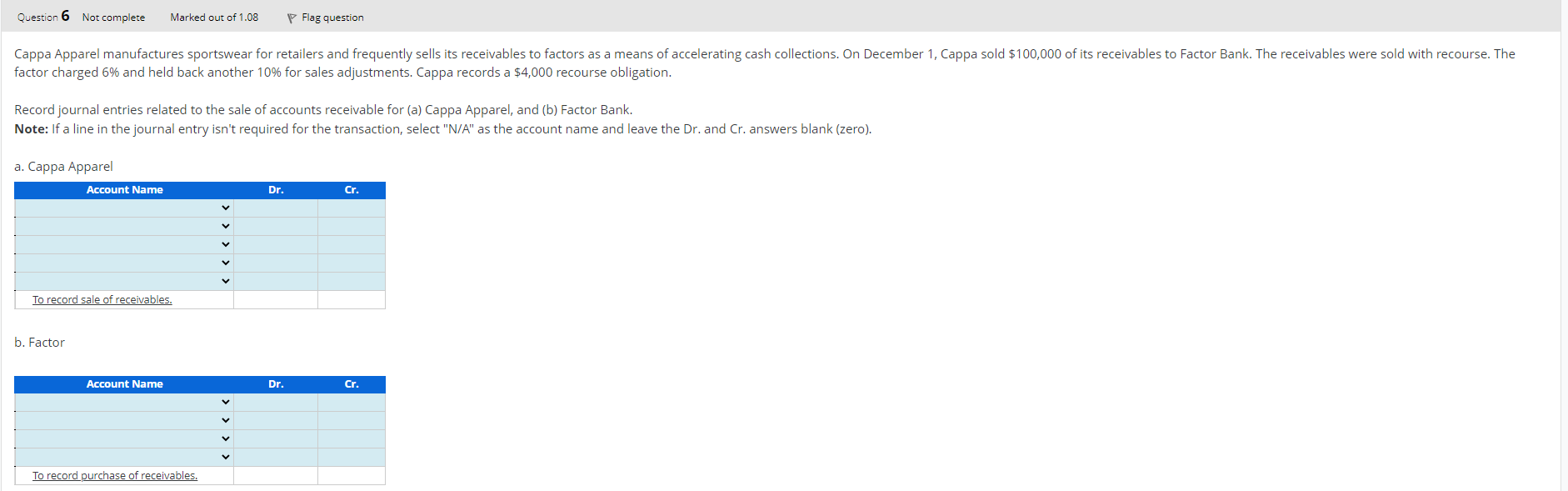

Tropical Inc. is preparing its December 31 financial statements, and it must determine the proper balance sheet classification of financial statement items. Complete the table as follows: 1. Indicate the amount that should be classified as cash. If an amount is not classified as cash, enter a zero as the amount. 2. Indicate the proper financial statement classification. Enter cash or an alternative classification if the amount is not classified as cash. b. On February 1 of Year 2, the company determined that $2,000 of specific accounts receivable would be written off. 1. Prepare the journal entry required to write off these accounts. 2. What is the net amount expected to be collected on its accounts receivable after the write-off? $ c. On February 15 of Year 2, the company unexpectedly collected $500 of the accounts written off on February 1 of Year 2. 1. Prepare the journal entries required upon collection of these accounts. 2. What is the net amount expected to be collected on its accounts receivable after the collection? Computing Bad Debt Expense from Transaction Data A company estimates uncollectible accounts using the allowance method. The following is from the current year. - Allowance for Doubtful Accounts, January 1 beginning balance: $508,000 credit - Allowance for Doubtful Accounts, December 31 balance: $491,000 credit - Accounts written off during the year: $88,000 - Unexpected collection of accounts receivable on accounts written off during the year: $5,000 Compute bad debt expense for the year. $ Preparing Entries for a Secured Borrowing and Subsequent Collections and Payments Required a. Record the entry for Sterling to record the secured borrowing. b. Record the first month entries for Sterling to record (1) the collections and (2) the payment to Miami. c. Record the entries for Sterling to record (1) the collections for the second month and (2) the final payment to Miami. The factor charged 8% and held back another 5% for sales adjustments. Bad debts estimated on the receivables is $500. Record journal entries on December 1 related to the sale of accounts receivable for (a) Apparel Inc., and (b) Factor Bank. a. Apparel Inc. b. Factor factor charged 6% and held back another 10% for sales adjustments. Cappa records a $4,000 recourse obligation. Record journal entries related to the sale of accounts receivable for (a) Cappa Apparel, and (b) Factor Bank. Note: If a line in the journal entry isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Cappa Apparel b. Factor