Answered step by step

Verified Expert Solution

Question

1 Approved Answer

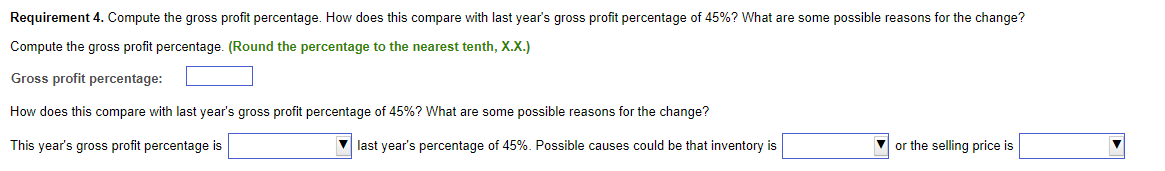

Options for the long answer questions are (in order from left): 1. (exactly the same as, higher than, lower than) 2, (Costing too little, costing

Options for the long answer questions are (in order from left): 1. (exactly the same as, higher than, lower than) 2, (Costing too little, costing too much, priced just right) 3. (now low enough, not high enough, just right) ty.

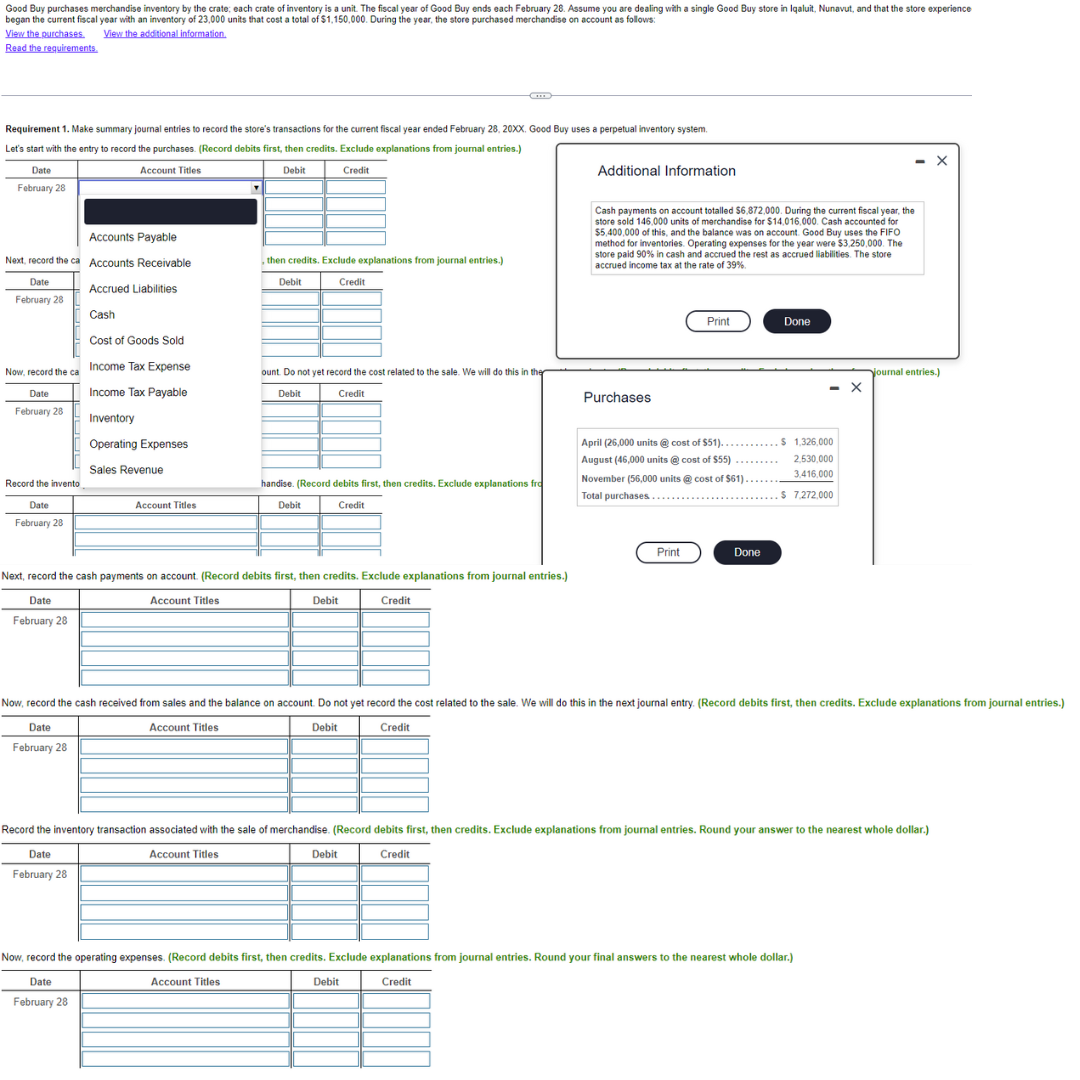

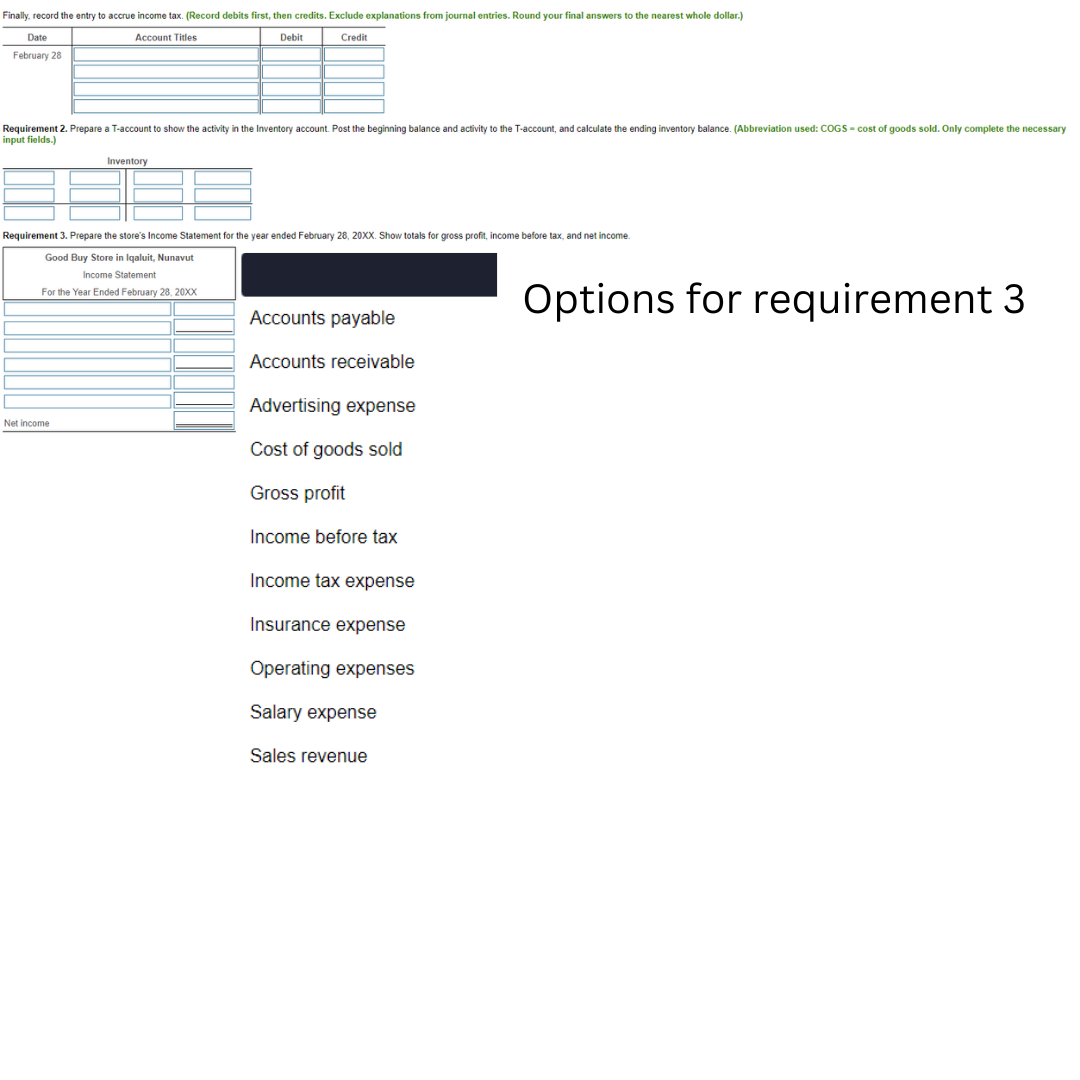

Options for requirement 3 Requirement 4 . Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: View the purchases. Read the reguirements. Requirement 1. Make summary journal entrles to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.) Options for requirement 3 Requirement 4 . Compute the gross profit percentage. How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? Compute the gross profit percentage. (Round the percentage to the nearest tenth, X.X.) Gross profit percentage: How does this compare with last year's gross profit percentage of 45% ? What are some possible reasons for the change? This year's gross profit percentage is last year's percentage of 45%. Possible causes could be that inventory is or the selling price is began the current fiscal year with an inventory of 23,000 units that cost a total of $1,150,000. During the year, the store purchased merchandise on account as follows: View the purchases. Read the reguirements. Requirement 1. Make summary journal entrles to record the store's transactions for the current fiscal year ended February 28, 20XX. Good Buy uses a perpetual inventory system. Let's start with the entry to record the purchases. (Record debits first, then credits. Exclude explanations from journal entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started